Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Increasing Demand for Real-Time, High-Throughput Analysis in Drug Discovery

The rising need for real-time, high-throughput screening technologies in pharmaceutical and biotechnological research is a major driver of the label-free array systems market. Traditional labeled assays are time-intensive and susceptible to inaccuracies due to interference from the labels themselves. Label-free array systems overcome these limitations by allowing direct observation of biomolecular interactions without tagging, providing valuable kinetic data. This is especially critical in early drug discovery stages where understanding drug-target affinities and interaction profiles can guide lead compound selection and optimization, significantly accelerating the development pipeline.Key Market Challenges

High Cost of Equipment and Infrastructure Requirements

Despite offering cutting-edge capabilities, label-free array systems come with high capital and operational costs. The instruments often require specialized detection components - optical, acoustic, or electrochemical - which demand substantial financial investment and maintenance. Moreover, these systems frequently need controlled lab environments such as clean rooms or vibration-free setups, further increasing infrastructure costs. These financial constraints can hinder adoption in small- to mid-sized research facilities and institutions, particularly in low- and middle-income regions. Even in developed countries, funding limitations pose challenges for academia and SMEs unless supported by grants or partnerships, which remain competitive and limited in availability.Key Market Trends

Integration with Artificial Intelligence and Machine Learning for Data Interpretation

The incorporation of artificial intelligence (AI) and machine learning (ML) technologies into label-free array systems is transforming how large-scale biological data is analyzed. These systems produce vast and complex datasets, particularly in proteomics and biomarker discovery. AI-driven analytics streamline data processing by detecting subtle patterns, improving signal clarity, and reducing background noise. This trend enhances both the accuracy and speed of research outputs. Globally, regulatory and research bodies are promoting AI integration in healthcare. The FDA’s Digital Health Center of Excellence and the European Commission’s Digital Europe Programme - with a €7.5 billion allocation - are key initiatives advancing AI-based biomedical innovation, supporting broader adoption of intelligent data analytics in label-free platforms.Key Market Players

- Illumina, Inc.

- Thermo Fisher Scientific, Inc.

- Agilent Technologies, Inc.

- PerkinElmer, Inc.

- Merck KGaA

- Danaher Corporation

- Bio-Rad Laboratories, Inc.

- F. Hoffmann-La Roche Ltd.

- Becton, Dickinson and Company

- Sartorius AG

Report Scope:

In this report, the Global Label-free Array Systems Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Label-free Array Systems Market, By Type:

- Surface Plasmon Resonance

- Bio-layer Interferometry

- Cellular Dielectric Spectroscopy

- Others

Label-free Array Systems Market, By Application:

- Drug Discovery

- Protein Interface Analysis

- Antibody Characterization

- Others

Label-free Array Systems Market, By End User:

- Pharmaceutical and Biotechnology Companies

- Academic and Research Institute

- Contract Research Organization

- Others

- Ambulatory Care Centers

- Others

Label-free Array Systems Market, By Region:

- North America

- United States

- Mexico

- Canada

- Europe

- France

- Germany

- United Kingdom

- Italy

- Spain

- Asia-Pacific

- China

- India

- South Korea

- Japan

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Label-free Array Systems Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Illumina, Inc.

- Thermo Fisher Scientific, Inc.

- Agilent Technologies, Inc.

- PerkinElmer, Inc.

- Merck KGaA

- Danaher Corporation

- Bio-Rad Laboratories, Inc.

- F. Hoffmann-La Roche Ltd.

- Becton, Dickinson and Company

- Sartorius AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | July 2025 |

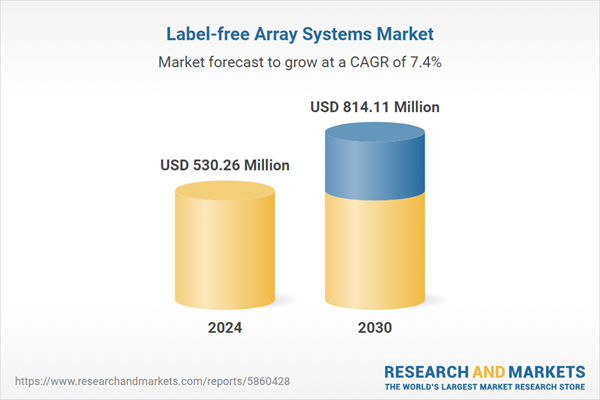

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 530.26 Million |

| Forecasted Market Value ( USD | $ 814.11 Million |

| Compound Annual Growth Rate | 7.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |