Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

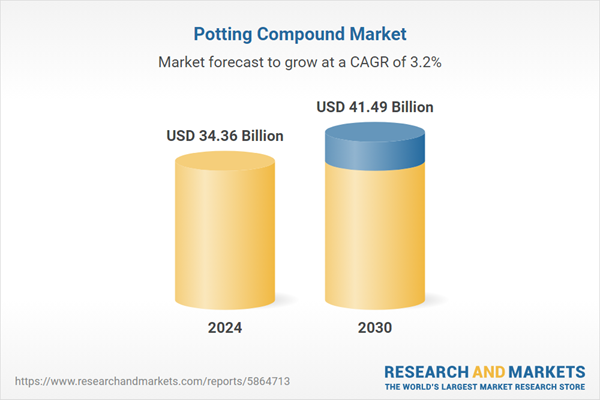

Despite challenges like rising raw material costs and stricter environmental regulations, continuous innovation in sustainable formulations and multifunctional compounds, alongside the adoption of Industry 4.0 manufacturing technologies, is strengthening market resilience. These strategic developments are positioning the global potting compound industry for sustained growth, as industries place greater emphasis on durability, operational efficiency, and regulatory compliance in their electronic and electrical systems.

Key Market Drivers

Rising Demand for Electronic Miniaturization and Reliability

The rising demand for electronic miniaturization and enhanced reliability is a pivotal driver fueling growth in the global potting compound market. As consumer and industrial electronics evolve toward smaller, more compact form factors, manufacturers face increasing challenges in protecting highly sensitive components within limited spatial constraints. Potting compounds provide critical solutions by offering effective insulation, mechanical stability, and environmental protection key factors that ensure the optimal performance and longevity of miniaturized devices.Miniaturization often leads to increased component density, which heightens the risk of heat buildup, mechanical stress, and electrical interference. Advanced potting materials help mitigate these risks by dissipating heat efficiently and cushioning components against vibrations and shocks, thus preventing damage and failure. This is particularly essential in sectors such as consumer electronics, telecommunications, aerospace, and medical devices, where product reliability directly impacts user safety and satisfaction. As electronic devices incorporate more complex functionalities, the tolerance for defects decreases, increasing the need for robust encapsulation techniques. Potting compounds enable manufacturers to meet stringent quality and durability standards, ensuring that devices maintain consistent performance throughout their operational lifecycle, even under harsh environmental conditions such as humidity, dust, and temperature fluctuations.

In addition, the demand for faster production cycles and cost-effective manufacturing intensifies the need for potting compounds that cure rapidly and adapt to automated assembly lines without compromising protective qualities. These dynamic drives innovation in potting formulations, further expanding their adoption. The convergence of miniaturization trends with stringent reliability requirements makes potting compounds indispensable in modern electronics manufacturing, thereby significantly contributing to the accelerated growth of the global potting compound market.

Key Market Challenges

High Material and Production Costs

Potting compounds, particularly those formulated with advanced resins or specialized additives, can be costly to manufacture. The expenses associated with raw materials, stringent quality controls, and complex curing processes translate into higher overall production costs. For price-sensitive markets or applications with tight cost constraints, this can limit adoption or encourage substitution with less expensive, though potentially less effective, alternatives. Additionally, the requirement for specialized equipment and skilled labor to handle potting processes adds to operational expenses, creating barriers for smaller manufacturers and new entrants.Key Market Trends

Integration of Advanced Functionalities in Potting Materials

Beyond basic protection, potting compounds are increasingly being engineered with multifunctional properties such as enhanced thermal conductivity, flame retardancy, and electromagnetic interference (EMI) shielding. This trend responds to the evolving demands of high-performance electronics, where heat dissipation and signal integrity are critical. Innovations such as nano-filled epoxy resins and hybrid silicone formulations enable manufacturers to deliver tailored solutions that improve device efficiency and safety, opening new markets in sectors like by the end of 2023, global 5G connections exceeded 1.5 billion just four years after the technology’s commercial launch establishing 5G as the fastest-adopted mobile broadband technology in history, electric vehicles, and aerospace.Key Market Players

- Henkel AG & Co. KGaA

- 3M

- The Dow Chemical Company

- MG Chemicals

- Huntsman International LLC

- Hitachi High-Tech Corporation

- ELANTAS GmbH

- H.B. Fuller Company

- Dymax Corporation

- CHT Group

Report Scope:

In this report, the Global Potting Compound Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Potting Compound Market, By Product:

- Epoxy Resin

- Polyurethane Resin

- Silicone Resin

- Polyester System

- Polyamide

- Other

Potting Compound Market, By Technology:

- Room Temperature

- High Temperature or Thermally Cured

- UV Cured

Potting Compound Market, By Application:

- Electronics

- Electrical

- Other

Potting Compound Market, By End Use:

- Transportation

- Energy & Power

- Solar Power

- Other

Potting Compound Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Potting Compound Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The leading companies profiled in this Potting Compound market report include:- Henkel AG & Co. KGaA

- 3M

- The Dow Chemical Company

- MG Chemicals

- Huntsman International LLC

- Hitachi High-Tech Corporation

- ELANTAS GmbH

- H.B. Fuller Company

- Dymax Corporation

- CHT Group

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | September 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 34.36 Billion |

| Forecasted Market Value ( USD | $ 41.49 Billion |

| Compound Annual Growth Rate | 3.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |