Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Technological advancements in enzyme engineering and delivery systems are also fueling market expansion. Companies are investing heavily in R&D to develop thermostable and pH-resistant enzymes that remain effective during feed processing and digestion. This is particularly crucial for monogastric animals such as poultry and swine, where targeted enzyme action can significantly enhance feed efficiency. In addition, tailored enzyme blends designed for specific animal species and feed compositions are gaining popularity.

Key Market Drivers

Growing demand and consumption of livestock-based products

The rising consumption of livestock-based products continues to be a major driver for the global feed enzymes market. As global diets shift toward higher protein intake, poultry meat has seen significant growth. According to the U.S. Department of Agriculture, chicken retail sales volumes in the United States increased by 3% year-over-year in 2024, outpacing other meat categories like beef and pork. Globally, chicken meat production is estimated to increase by an additional 1.1 million tonnes in 2024, reaching a total of 146 million tonnes. This growing demand places emphasis on feed efficiency, where enzymes such as phytases and proteases are being increasingly incorporated to improve nutrient utilization and lower feeding costs.In Asia, meat production has seen a dramatic surge, with the region becoming a key growth center. Since the 1960s, Asia’s total meat production has grown more than fifteen-fold. At the same time, per capita meat consumption in developing nations in the region rose from 41.4 kg in 2012 to 44.5 kg in 2022, as reported by international sources. This rise is largely attributed to rapid urbanization, changing dietary preferences, and an expanding middle class. The increased focus on efficient and sustainable animal farming in these countries has led to greater uptake of feed enzymes, which enable producers to maximize output while managing resource constraints.

Economic considerations are also contributing to this trend. As inflation and input costs continue to pressure food supply chains, many consumers are shifting towards more affordable meat options such as poultry. This shift is especially evident in North America, where chicken has become the most consumed meat due to its cost advantage. Producers are responding by optimizing feed formulations using enzymes like carbohydrases and proteases, which allow for greater flexibility in ingredient selection and reduce reliance on costly additives such as synthetic amino acids and phosphates.

Environmental concerns are further reinforcing the adoption of feed enzymes. Livestock farming contributes substantially to agricultural greenhouse gas emissions and nutrient runoff. Enzyme supplementation improves nutrient digestibility, thus reducing nitrogen and phosphorus excretion into the environment. This not only aligns with global climate and sustainability targets but also helps producers comply with evolving environmental regulations. As sustainability becomes a central priority for livestock producers worldwide, the demand for feed enzymes is expected to continue rising.

Key Market Challenges

Variation in Raw Material Quality and Composition

Variation in raw material quality and composition presents a significant challenge in the feed enzymes market, primarily because enzymes act on specific substrates found in feed ingredients. The nutritional content and anti-nutritional factors like phytate, fiber, or non-starch polysaccharides can vary widely depending on the source, season, processing method, and geographic origin of the raw materials.For instance, corn sourced from different regions may have significantly different starch content, while soybean meal can vary in protein and fiber levels. Such fluctuations directly influence how effective enzymes like phytases, proteases, or carbohydrases are in breaking down feed components. This inconsistency makes it difficult for feed producers to standardize formulations, as enzyme dosages must be carefully calibrated to match substrate levels. Without precise formulation control, the benefits of enzyme inclusion - such as improved digestibility and feed conversion - can diminish, resulting in unpredictable animal performance outcomes.

Key Market Trends

Increasing Adoption of Multi-Enzyme Blends

The increasing adoption of multi-enzyme blends is becoming a defining trend in the global feed enzymes market, as producers seek more comprehensive and efficient solutions to improve animal nutrition. Traditional single-enzyme products, such as standalone phytases or proteases, are gradually being replaced by tailored enzyme combinations that target multiple anti-nutritional factors simultaneously. Multi-enzyme formulations typically include a mix of phytases, carbohydrases, and proteases, which act on phytic acid, fiber, starches, and proteins respectively.This approach significantly improves nutrient digestibility, feed conversion ratios, and animal growth performance across diverse livestock categories such as poultry, swine, and ruminants. These blends are especially beneficial in compound feed made from variable or low-cost raw materials, allowing producers to maintain high productivity while reducing reliance on expensive protein sources and synthetic additives. The result is not only economic benefit but also reduced nutrient waste and environmental impact.

Key Market Players

- Koninklijke DSM N.V.

- BASF SE

- Bluestar Adisseo Co

- Infinita Biotech Private Limited

- Antozyme Biotech Pvt Ltd

- BioResource International, Inc.

- Kemin Industries, Inc.

- Advanced Enzyme Technologies

- Novozymes A/S

- Huvepharma Inc

Report Scope:

In this report, Global Feed Enzymes market has been segmented into the following categories, in addition to the industry trends, which have also been detailed below:Feed Enzymes Market, By Type:

- Phytases

- Carbohydrases

- Proteases

Feed Enzymes Market, By Livestock:

- Poultry

- Ruminants

- Swine

- Aquatic Animals

- Others

Feed Enzymes Market, By Form:

- Dry

- Liquid

Feed Enzymes Market, By Source:

- Microorganisms

- Plants

Feed Enzymes Market, By Region:

- North America

- United States

- Mexico

- Canada

- Europe

- France

- Germany

- United Kingdom

- Spain

- Italy

- Asia-Pacific

- China

- India

- South Korea

- Japan

- Indonesia

- South America

- Brazil

- Argentina

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive landscape

Company Profiles: Detailed analysis of the major companies in global Feed Enzymes market.Available Customizations:

With the given market data, the publisher offers customizations according to a company’s specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Koninklijke DSM N.V.

- BASF SE

- Bluestar Adisseo Co

- Infinita Biotech Private Limited

- Antozyme Biotech Pvt Ltd

- BioResource International, Inc.

- Kemin Industries, Inc.

- Advanced Enzyme Technologies

- Novozymes A/S

- Huvepharma Inc

Table Information

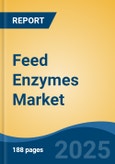

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | August 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.63 Billion |

| Forecasted Market Value ( USD | $ 2.62 Billion |

| Compound Annual Growth Rate | 8.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |