Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The market is well-positioned for sustained growth, underpinned by the continued digitalization of healthcare, the shift toward patient-centric service delivery, and the demand for smarter resource utilization. As healthcare delivery models become more complex, medical scheduling software is evolving from a support function into a strategic enabler of patient engagement and clinical efficiency. Companies that deliver scalable, intelligent, and seamlessly integrated platforms will be best placed to capture value and lead in this increasingly competitive and innovation-driven landscape.

Key Market Drivers

Increasing Demand for Lightweight Automotive Components

The increasing demand for lightweight automotive components is a significant driver of growth in the global thermoforming plastics market. As the automotive industry undergoes transformation to meet regulatory standards, enhance fuel efficiency, and improve performance, thermoforming plastics are increasingly being adopted as an ideal material solution. Globally, governments are implementing strict regulations on vehicle fuel efficiency and carbon emissions to combat climate change. For instance, regions like Europe, North America, and China have imposed stringent targets that automakers must meet.In India, vehicle fuel efficiency is governed by the Corporate Average Fuel Efficiency (CAFE) norms, established under the Energy Conservation Act, 2001. These regulations specifically target passenger vehicles with a gross vehicle weight (GVW) below 3,500 kilograms, requiring automakers to meet defined average fuel consumption and CO₂ emission benchmarks across their entire vehicle fleet. Reducing vehicle weight is one of the most effective ways to improve fuel economy and lower emissions. Thermoforming plastics offer a high strength-to-weight ratio, making them a preferred substitute for heavier materials such as metal, wood, and glass in non-structural automotive components. This transition toward lightweight materials directly contributes to the growing demand for thermoforming plastics in the automotive sector.

In 2024, global electric vehicle (EV) sales grew by an additional 3 million units, pushing the cumulative total to 17 million electric cars sold worldwide. This milestone marked a significant shift in the automotive landscape, with EVs accounting for over 20% of all new passenger car sales globally, underscoring a decisive move toward electrification in key markets. The rapid rise of electric vehicles is another critical factor. EVs require lightweight construction to maximize battery efficiency and range. Thermoforming plastics are extensively used in Battery housings, Interior components like door panels, dashboard fascias, and center consoles, Underbody panels and wheel well liners.

As global EV production continues to expand, particularly in Asia-Pacific, Europe, and the U.S., so does the demand for lightweight, thermoformed plastic parts. Thermoforming plastics offer significant manufacturing and economic advantages over traditional materials Lower tooling costs compared to injection molding or metal stamping, Faster prototyping and production turnaround, ideal for short runs or customization, Ability to produce complex geometries and large surface areas without high-cost tooling. This efficiency supports automakers and suppliers in reducing development time and production costs, especially in a competitive, cost-sensitive industry.

Key Market Challenges

Environmental Concerns and Regulatory Pressures on Plastic Usage

One of the most critical challenges facing the thermoforming plastics market is the growing global pushback against plastic usage due to environmental concerns.Plastic waste management remains a serious issue, particularly for single-use thermoformed plastic products used in food packaging and disposable consumer goods. Governments across regions such as the European Union, North America, and parts of Asia have introduced or tightened regulations aimed at reducing plastic consumption, banning specific plastic products, or mandating recycled content. Extended Producer Responsibility (EPR) schemes, carbon taxes, and packaging material compliance laws are increasing the operational and compliance costs for thermoforming plastic manufacturers.

Companies are under pressure to invest heavily in sustainable materials and recycling technologies, increasing production complexity and costs. Brands may shift to alternative packaging solutions (like paper-based, biodegradable, or compostable materials), potentially reducing demand for conventional thermoforming plastics. Environmental activism and consumer awareness are pushing food and retail brands to reconsider their plastic usage, particularly for single-use applications.

Key Market Trends

Integration of AI and Predictive Analytics into Scheduling Platforms

Medical scheduling software is moving beyond basic appointment booking and calendar management. The integration of Artificial Intelligence (AI) and predictive analytics is enabling platforms to Forecast no-show probabilities based on patient history, weather, location, and demographics, Automatically suggest optimized appointment slots to reduce physician idle time, Balance workloads and resources by predicting peak scheduling periods and recommending staffing adjustments.This trend reflects a broader industry shift toward data-driven decision-making and efficiency improvement. By leveraging AI, healthcare organizations can improve operational productivity while enhancing patient satisfaction through shorter wait times and greater appointment flexibility. Vendors who incorporate AI-driven features are gaining a competitive advantage and creating new revenue streams. As healthcare systems increasingly prioritize smart scheduling, demand for advanced, analytics-equipped platforms is expected to grow significantly.

Key Market Players

- Novolex

- Genpak

- Sonoco Products Company

- CM Packaging

- Placon Incorporated

- Anchor Packaging LLC

- Brentwood Industries, Inc

- Greiner Packaging International GmbH

- Dongguan Ditai Plastic Products Co., Ltd

- Palram Industries Ltd

Report Scope:

In this report, the Global Thermoforming Plastics Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Thermoforming Plastics Market, By Product:

- Polymethyl Methacrylate (PMMA)

- Bio-degradable Polymers

- Polyethylene (PE)

- Acrylonitrile Butadiene Styrene (ABS)

- Poly Vinyl Chloride (PVC)

- High Impact Polystyrene (HIPS)

- Polystyrene (PS)

- Polypropylene (PP)

Thermoforming Plastics Market, By Process:

- Plug Assist Forming

- Thick Gauge Thermoforming

- Thin Gauge Thermoforming

- Vacuum Snapback

Thermoforming Plastics Market, By Application:

- Healthcare & Medical

- Food Packaging

- Electrical & Electronics

- Automotive Packaging

- Construction

- Consumer Goods & Appliances

- Others

Thermoforming Plastics Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Thermoforming Plastics Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The leading companies profiled in this Thermoforming Plastics market report include:- Novolex

- Genpak

- Sonoco Products Company

- CM Packaging

- Placon Incorporated

- Anchor Packaging LLC

- Brentwood Industries, Inc

- Greiner Packaging International GmbH

- Dongguan Ditai Plastic Products Co., Ltd

- Palram Industries Ltd

Table Information

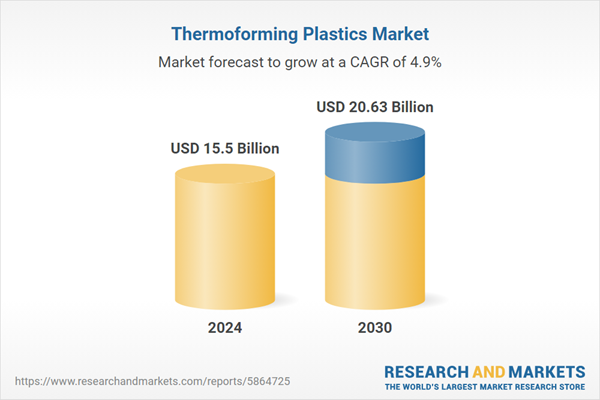

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | September 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 15.5 Billion |

| Forecasted Market Value ( USD | $ 20.63 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |