Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The market benefits from strong structural demand, underpinned by growth in sectors such as packaging, hygiene, automotive, construction, and electronics. Simultaneously, the landscape is being reshaped by rising expectations for customization, regulatory compliance, and environmental performance. Tackifier suppliers are now under increasing pressure to move beyond traditional formulations and develop engineered, application-specific resins that align with shifting end-user requirements and stricter global standards.

The tackifiers market is well-positioned to capitalize on long-term industry trends. However, sustained growth will hinge on suppliers' ability to deliver technical innovation, product differentiation, and localized supply resilience. The competitive edge will belong to those players that can integrate advanced R&D capabilities, raw material flexibility, and supply chain responsiveness as performance, sustainability, and operational agility become the defining metrics for success in this evolving market.

Key Market Drivers

Rising Demand for Adhesives in Packaging and E-commerce

The rising demand for adhesives in packaging and e-commerce is one of the most influential forces propelling the growth of the global tackifiers market. Tackifiers used to enhance the stickiness, bond strength, and performance of adhesive formulations are indispensable in meeting the evolving requirements of modern packaging systems. As both packaging and e-commerce sectors undergo rapid transformation, tackifier demand is accelerating in parallel. By 2025, approximately 2.77 billion consumers representing nearly one-third of the global population are projected to engage in online shopping, underscoring a marked acceleration in the global shift toward e-commerce.This upward trend is expected to continue, with the number of digital shoppers anticipated to reach 2.86 billion by 2026. The global shift towards online retail and direct-to-consumer delivery models has dramatically increased the volume, variety, and complexity of packaging solutions. E-commerce packaging must meet several functional criteria Secure sealing for shipping and transit, Resistance to environmental stress (temperature, moisture, vibration), Easy-open and reclosable designs, Aesthetic consistency for brand integrity. To achieve these outcomes, hot melt adhesives (HMAs) and pressure-sensitive adhesives (PSAs) are extensively used both of which rely on tackifiers to provide optimal tack, peel strength, and fast-setting behavior. As adhesive consumption grows in e-commerce logistics, so too does the demand for high-performance tackifiers.

Corrugated boxes, labels, tapes, and flexible packaging films are the backbone of modern packaging systems. These materials require adhesive technologies where tackifiers are essential for Bonding layered materials (in flexible laminates), Maintaining adhesion in automated case and carton sealing lines, Enabling permanent or removable label adhesion. With corrugated packaging alone seeing exponential growth in last-mile delivery and bulk shipping, the use of tackifiers in packaging adhesives has become both frequent and high volume particularly in Asia-Pacific, North America, and Western Europe, where e-commerce penetration is highest.

Modern packaging operations are becoming more automated and high-throughput, requiring adhesives that can set quickly and bond reliably under tight production timelines. Tackifiers, especially solid hydrocarbon resins, play a critical role in Adjusting the open time and tack profile of adhesives, Maintaining bond strength even under high-speed application, Supporting consistent performance across varied substrates like cardboard, plastics, and metalized films. As packaging manufacturers seek to enhance operational efficiency, they are shifting toward high-performance adhesive systems, which drives sustained demand for tailored tackifier solutions.

Key Market Challenges

Volatility in Raw Material Prices and Supply Availability

Tackifiers especially synthetic variants like C5, C9, and hydrogenated hydrocarbon resins are largely derived from petrochemical feedstocks such as naphtha, crude oil derivatives, and by-products from ethylene cracking. Any fluctuation in oil prices or disruptions in petrochemical supply chains significantly affects the cost structure and availability of key raw materials.Manufacturers face margin pressure when feedstock costs spike, particularly in the absence of long-term supply contracts or hedging strategies. Price volatility makes it difficult to maintain stable pricing for downstream adhesive producers, impacting long-term planning and contract negotiations. Supply disruptions such as plant shutdowns, geopolitical instability, or logistical bottlenecks can cause shortages or lead to dependence on a limited number of suppliers, especially in regions like Asia-Pacific where much of the global capacity is concentrated.

This challenge affects the cost competitiveness and supply reliability of tackifier producers, particularly smaller players who lack scale or integration with upstream feedstock suppliers.

Key Market Trends

Product Customization for Application-Specific Performance

Tackifiers are no longer viewed as one-size-fits-all additives. End-use industries are increasingly demanding tailor-made adhesive solutions that address highly specific performance criteria such as bonding to low-energy substrates, resistance to extreme temperatures, or compatibility with advanced polymers. This is giving rise to a strong trend of application-specific tackifier development.Tackifier manufacturers are collaborating more closely with adhesive formulators and OEMs (especially in packaging, automotive, hygiene, and electronics) to develop fit-for-purpose resins. Customized solutions offer enhanced value and stronger customer lock-in, shifting the market from commodity-driven to solution-oriented engagements. Players that invest in technical support, formulation expertise, and customer co-development capabilities will gain a competitive edge.

As adhesives are used in more complex, multifunctional applications, tackifiers must deliver precision performance not just adhesion. This trend is driving a shift toward high-margin, engineered tackifier products that elevate functionality beyond basic bonding.

Key Market Players

- SI Group, Inc.

- Henkel AG & Co. KGaA

- ZEON CORPORATION

- Eastman Chemical Company

- Arkema

- Kolon Industries, Inc.

- H.B. Fuller Company

- Exxon Mobil Corporation

- BASF SE

- Kraton Corporation

Report Scope:

In this report, the Global Tackifiers Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Tackifiers Market, By Product:

- Synthetic

- Natural

Tackifiers Market, By Form:

- Solid

- Liquid

- Resin Dispersion

Tackifiers Market, By Application:

- Packaging

- Bookbinding

- Non-woven

- Construction

- Automotive

- Others

Tackifiers Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Tackifiers Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The leading companies profiled in this Tackifiers market report include:- SI Group, Inc.

- Henkel AG & Co. KGaA

- ZEON CORPORATION

- Eastman Chemical Company

- Arkema

- Kolon Industries, Inc.

- H.B. Fuller Company

- Exxon Mobil Corporation

- BASF SE

- Kraton Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | September 2025 |

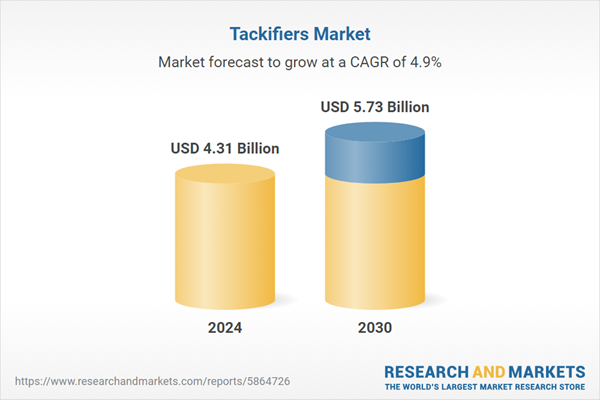

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.31 Billion |

| Forecasted Market Value ( USD | $ 5.73 Billion |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |