Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Rising Demand for Protein-Rich and Functional Foods

The growing global appetite for protein-rich and functional foods is a major factor fueling demand for protein hydrolysis enzymes. As health awareness increases, consumers are seeking diets rich in protein for benefits like muscle development, weight management, and improved metabolic health. Protein hydrolysates - created using hydrolysis enzymes - enhance digestibility and absorption, making them ideal for inclusion in nutritional supplements, sports nutrition, and infant formulas. These enzymes help improve the texture, flavor, and bioavailability of proteins, aligning with the food industry's goal of optimizing product performance. Furthermore, regulatory initiatives promoting healthier diets are accelerating adoption of protein-enriched foods, reinforcing the critical role of hydrolysis enzymes in meeting consumer and legislative demands for functional, accessible nutrition.Key Market Challenges

Regulatory and Safety Concerns

The protein hydrolysis enzymes market is significantly impacted by stringent regulatory and safety requirements. Products must meet the standards of regulatory authorities such as the U.S. FDA and the European Medicines Agency, which enforce extensive testing for safety, allergenicity, and efficacy. The approval process can be resource-intensive, delaying market entry and increasing development costs - particularly for smaller firms. Concerns over potential adverse effects, including allergic reactions, necessitate in-depth safety studies. Additionally, evolving regulatory landscapes require manufacturers to stay continuously updated with international guidelines, increasing operational and compliance burdens. This complex environment can act as a barrier to entry and hinder innovation or product rollout timelines.Key Market Trends

Technological Advancements in Enzyme Engineering

Technological innovation is driving significant changes in the protein hydrolysis enzymes market. Advances in enzyme engineering - such as protein folding, direct evolution, and genetic modification - have enabled the development of enzymes with enhanced specificity, activity, and stability. These improvements allow tailored solutions for different industries, improving the efficiency of protein hydrolysate production. Furthermore, the use of artificial intelligence (AI) and machine learning (ML) in enzyme development is accelerating the discovery of novel enzymes, optimizing production processes, and reducing costs. By enabling predictive modeling and performance analysis, AI tools are helping manufacturers design more efficient and sustainable enzyme-based solutions, fueling further market expansion.Key Market Players

- Novozymes A/S

- DuPont Inc

- Dyadic International Inc.

- Associated British Foods Plc

- Amano Enzyme Inc.

- BASF SE

- Kerry Group

- Biocatalysts Ltd.

- Advanced Enzyme Technologies Limited

- Koninklijke DSM N.V.

Report Scope:

In this report, global protein hydrolysis enzymes market has been segmented into the following categories, in addition to the industry trends, which have also been detailed below:Protein Hydrolysis Enzymes Market, By Source:

- Animals

- Plants

- Micro-Organisms

Protein Hydrolysis Enzymes Market, By Method of Production:

- Fermentation

- Extraction

Protein Hydrolysis Enzymes Market, By Application:

- Detergent

- Pharmaceutical

- Food and Beverages

- Textile

- Others

Protein Hydrolysis Enzymes Market, By Region:

- North America

- United States

- Mexico

- Canada

- Europe

- France

- Germany

- United Kingdom

- Spain

- Italy

- Asia-Pacific

- China

- India

- South Korea

- Japan

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the global Protein Hydrolysis Enzymes market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Novozymes A/S

- DuPont Inc

- Dyadic International Inc.

- Associated British Foods Plc

- Amano Enzyme Inc.

- BASF SE

- Kerry Group

- Biocatalysts Ltd.

- Advanced Enzyme Technologies Limited

- Koninklijke DSM N.V.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | May 2025 |

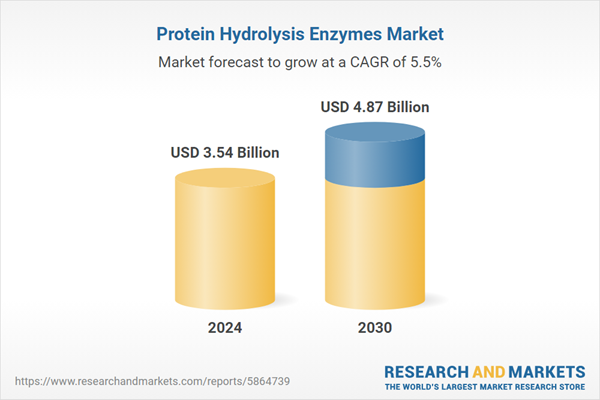

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 3.54 Billion |

| Forecasted Market Value ( USD | $ 4.87 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |