Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Moreover, Egypt's extensive irrigation systems, particularly those based on water from the Nile, provide a unique advantage for crop cultivation. However, soil degradation and nutrient depletion are common challenges, making fertilizers crucial to sustaining and enhancing soil quality. The country also benefits from its proximity to key global fertilizer production hubs, such as the Middle East and North Africa (MENA) region, which offers both a supply advantage and competitive pricing.

Despite the growth prospects, the Egypt fertilizers market faces several challenges that could impact its long-term sustainability. One of the key challenges is the rising cost of raw materials, particularly natural gas, which is essential for nitrogen fertilizer production. This volatility in raw material prices can affect the affordability and supply of fertilizers in the domestic market.

Key Market Drivers

Growth in Agriculture Industry

The growth in the agriculture industry is a key driver of the Egypt fertilizers market, as the demand for enhanced agricultural productivity, food security, and sustainability continues to rise. Key crops cultivated in Egypt include sugar beet, wheat, maize, rice, tomatoes, potatoes, onions, oranges, grapes, and dates. Additionally, sugarcane is a significant agricultural product, with a production volume of 15.97 million metric tons in 2022, as reported by the Food and Agriculture Organization (FAO). Egypt’s agricultural sector plays a crucial role in the country’s economy, contributing significantly to employment, GDP, and food production. With a rapidly growing population and a heightened focus on improving crop yields, fertilizers are becoming increasingly essential for meeting the needs of the agriculture industry. As a result, the fertilizers market in Egypt is experiencing robust growth, driven by the sector’s expansion and modernization.One of the primary drivers of this growth is the rising demand for food due to Egypt's growing population, which is expected to reach over 100 million by 2025. With this demographic shift, the agriculture industry faces immense pressure to increase food production, especially in the face of limited arable land and natural resource constraints. Fertilizers play a critical role in enhancing soil fertility, improving crop yields, and ensuring that farmers can meet the growing demand for food. The application of fertilizers enables Egyptian farmers to maximize the productivity of their land, making them a vital input for boosting agricultural output.

Additionally, the shift toward more intensive farming practices and the adoption of modern agricultural techniques are driving increased fertilizer consumption. In 2023, Egypt's fertilizer exports amounted to USD 2.6 billion (EGP 125.7 billion), representing 33% of the sector's total exports. Additionally, fertilizer exports in the first half of 2024 reached approximately USD 1.5 billion (EGP 72.5 billion) and are projected to range between USD 2.5 billion (EGP 120.9 billion) and USD 3 billion (EGP 145 billion) by year-end. As Egyptian farmers embrace advanced methods such as precision farming, irrigation systems, and high-yield crop varieties, the need for fertilizers has surged. These modern practices require tailored nutrient management, which has resulted in a growing reliance on specialized fertilizers to ensure optimal plant growth and soil health. Fertilizers, therefore, are integral to supporting these advanced farming methods and achieving the productivity targets set by the agriculture industry.

Surge in Technological Advancements

The surge in technological advancements has emerged as a key driver of the Egypt fertilizers market, significantly enhancing the efficiency, sustainability, and productivity of agricultural practices. Fertilizer production and demand in Egypt are projected to increase. Low-carbon technologies, such as renewable hydrogen and carbon capture and storage, are still in the early stages of development in the country, and implementing them within Egypt's fertilizer sector may present challenges. The successful deployment of these technologies, alongside other emission-reducing measures for fertilizers during usage, will require a supportive national policy framework and alignment with global initiatives to ensure a level playing field. As Egypt continues to focus on increasing its agricultural output to meet the demands of its growing population, innovations in fertilizer production, application, and management are playing a pivotal role in boosting agricultural yields and ensuring food security.A major technological advancement contributing to the growth of the fertilizer market in Egypt is the development of more efficient fertilizer formulations. Advances in controlled-release fertilizers and slow-release technologies enable nutrients to be delivered to crops over an extended period, reducing the frequency of application and minimizing nutrient losses. These innovations not only improve the effectiveness of fertilizers but also reduce the environmental impact by decreasing nutrient runoff and minimizing soil degradation. With Egypt's agricultural sector facing challenges related to water scarcity and soil quality, such sustainable practices are critical to ensuring long-term agricultural productivity.

Additionally, the increasing adoption of precision agriculture technologies is driving the demand for more tailored fertilizer solutions in Egypt. Precision agriculture involves the use of advanced technologies, such as satellite imaging, drones, and soil sensors, to monitor and manage crop health and soil conditions with high accuracy. This data-driven approach allows farmers to apply fertilizers more precisely, optimizing nutrient use and minimizing waste. As precision agriculture becomes more accessible, Egypt’s farmers are increasingly utilizing these technologies to improve crop yields, reduce costs, and enhance fertilizer efficiency.

Key Market Challenges

Rising Raw Material Costs

Natural gas is a key input in the production of nitrogenous fertilizers, particularly urea, ammonium nitrate, and ammonium sulfate. As natural gas is used as both a feedstock and an energy source in the production process, any increase in natural gas prices directly raises the production cost of nitrogen fertilizers. The volatility in global energy prices, driven by geopolitical factors, supply chain disruptions, and fluctuating demand, further exacerbates the situation. For Egypt, which imports a substantial portion of its natural gas, price hikes or supply uncertainties can lead to higher domestic fertilizer prices. This puts additional financial pressure on farmers, especially those relying on affordable fertilizers to boost crop yields.Egypt is rich in phosphate rock, and the country has historically been a major exporter of phosphate-based fertilizers. However, the prices of phosphate rock and potash, key ingredients in phosphatic and potassic fertilizers respectively, have been subject to volatility due to global demand fluctuations and disruptions in the supply chain. Rising global demand, especially from countries in Asia and other parts of Africa, has led to price hikes for these raw materials. This creates a challenging environment for local manufacturers who must cope with higher production costs while trying to remain competitive in both domestic and international markets.

For Egyptian fertilizer producers, the cost of phosphate rock has been increasingly influenced by international market dynamics, which are beyond the control of local producers. The increasing demand for high-quality phosphate and potash fertilizers globally, particularly from regions with intensive agricultural sectors, is driving up prices. Egypt’s domestic fertilizer market, which relies heavily on these raw materials, is feeling the pressure as costs rise.

Key Market Trends

Diversification of Fertilizer Products

The diversification of fertilizer products is a prominent trend in the Egypt fertilizers market, as both local and international manufacturers seek to address the evolving needs of the agricultural sector. In Egypt, the use of mineral fertilizers, particularly nitrogen, phosphate, and potash, is on the rise. In addition to mineral fertilizers, organic manures remain a primary source of plant nutrients, particularly nitrogen and micronutrients. With increasing demands for higher crop yields, soil health, and sustainability, fertilizer companies are expanding their product portfolios to cater to a wider range of agricultural practices and crop types. This trend is driven by the need to improve efficiency, minimize environmental impact, and meet the growing expectations of farmers across Egypt.One of the primary factors contributing to the diversification of fertilizer products is the growing demand for specialized fertilizers tailored to specific crops and soil conditions. In Egypt, where agriculture is heavily dependent on the Nile Delta and limited arable land, soil health and fertility management are crucial. Fertilizer producers are responding to these challenges by developing a variety of formulations, including nitrogen, phosphorus, potassium (NPK) blends, micronutrient fertilizers, and controlled-release fertilizers. These specialized products are designed to meet the unique nutrient requirements of different crops, from staple grains like wheat and rice to high-value crops like cotton and vegetables.

Another driver of this diversification is the shift towards more sustainable and eco-friendly farming practices. With growing concerns over the environmental impact of conventional fertilizers, Egyptian farmers are increasingly turning to organic and bio-based fertilizers, which offer a more sustainable alternative to traditional chemical fertilizers. Organic fertilizers, such as composts, manure-based products, and plant-derived fertilizers, are gaining popularity as they enhance soil health and contribute to long-term sustainability. Fertilizer manufacturers are responding by expanding their portfolios to include these environmentally friendly options, thereby meeting the demand for more sustainable agricultural practices.

Segmental Insights

Crop Type Insights

Based on Crop Type, Field Crops have emerged as the fastest growing segment in the Egypt Fertilizers Market in 2024. One of the primary drivers for the growth of field crops in the Egypt fertilizers market is the rising demand for staple foods to ensure food security. As Egypt’s population continues to grow, the need for essential crops such as wheat and corn - used in the production of bread and animal feed - has intensified. To meet these needs, farmers are increasingly relying on fertilizers to maximize yields and improve crop quality. Fertilizers play a vital role in enhancing the soil’s nutrient content, ensuring that field crops receive the necessary nutrients for optimal growth and productivity.The expansion of arable land in Egypt also contributes to the growth of field crops as the dominant segment. With agricultural land being expanded into reclaimed desert areas, the need for fertilizers has grown significantly to improve soil fertility in these new farming regions. Since these lands typically lack essential nutrients, fertilizers are critical to enhancing soil quality and boosting crop yields, making them indispensable for the cultivation of field crops.

Application Insights

Based on Application, Agriculture have emerged as the fastest growing segment in the Egypt Fertilizers Market during the forecast period. The government’s focus on achieving food security and increasing domestic agricultural output has spurred investment in fertilizer production and usage. Policies aimed at improving the efficiency of agricultural practices, including subsidies and support for modern farming technologies, have further promoted the adoption of fertilizers in the sector.Additionally, Egypt's agricultural industry is undergoing a transformation with a shift toward more efficient and sustainable farming practices. This shift has led to increased demand for high-quality, precision fertilizers designed to optimize crop production while minimizing environmental impact. The rise of controlled-environment agriculture and greenhouse farming also contributes to the growing need for specialized fertilizers.

Regional Insights

Based on Region, Cairo have emerged as the dominating region in the Egypt Fertilizers Market in 2024. Cairo benefits from its strategic location in the heart of Egypt, with easy access to major transportation networks, including roadways, railways, and ports. This infrastructure advantage facilitates the efficient distribution of fertilizers across the country and to international markets, making Cairo a critical logistics hub for fertilizer exports.As the capital and economic center of Egypt, Cairo is home to numerous large-scale fertilizer manufacturers, both state-owned and private, that contribute significantly to the national production capacity. The concentration of industry players in Cairo fosters healthy competition, innovation, and efficient supply chain management, which further strengthens its dominance in the market.

Key Market Players

- El-Nasr Company for Intermediate Chemicals

- Abu Qir Fertilizers and Chemical Industries Co SAE

- Egyptian Chemical Industries

- Alexandria Fertilizer Co.

- Aswan Fertilizers & Chemical Industries Co.

Report Scope

In this report, the Egypt Fertilizers Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Egypt Fertilizers Market, By Crop Type:

- Field Crops

- Horticultural Crops

- Turf

- Ornamental

- Others

Egypt Fertilizers Market, By Application:

- Agriculture

- Horticulture

- Gardening

- Others

Egypt Fertilizers Market, By Region:

- Cairo

- Giza

- Port Said

- Alexandria

- Qalyubia

- Suez

- Rest of Egypt

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Egypt Fertilizers Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- El-Nasr Company for Intermediate Chemicals

- Abu Qir Fertilizers and Chemical Industries Co SAE

- Egyptian Chemical Industries

- Alexandria Fertilizer Co.

- Aswan Fertilizers & Chemical Industries Co.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | February 2025 |

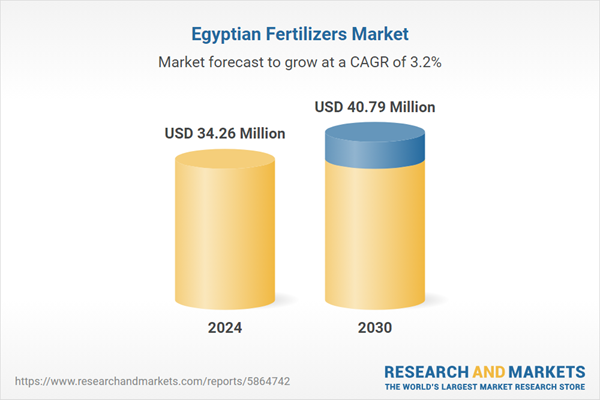

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 34.26 Million |

| Forecasted Market Value ( USD | $ 40.79 Million |

| Compound Annual Growth Rate | 3.1% |

| Regions Covered | Egypt |

| No. of Companies Mentioned | 5 |