Due to the fast growth in technological adoption throughout various industries, such as manufacturing, healthcare, logistics, smart cities, and agriculture, Asia-Pacific region will acquire approximately 1/4thshare of the market by 2030. As the Indian government launched the Digital India initiative to transform India into a digitally empowered society and knowledge-based economy. The Korean government unveiled its "New Deal" initiative, which incorporates the Korean Digital New Deal, a strategy to achieve national digital transformation by deploying ICT to all industries. This digitalization throughout the APAC region creates significant growth opportunities for the market.

The major strategies followed by the market participants are Product Launches as the key developmental strategy to keep pace with the changing demands of end users. In May, 2023, IBM Corporation announced the launch of IBM Quantum Safe Explorer, IBM Quantum Safe Advisor, and IBM Quantum Safe Remediator, security tools offerings developed to protect data from quantum computing attacks. The launched products would aim to address quantum computing security risks. Additionally, In April, 2022, Fortinet Inc. announced the launch of FortiOS 7.2, to meet security at every network edge integrated with the performance and scale required to identify and prevent threats over an organization's complete infrastructure.

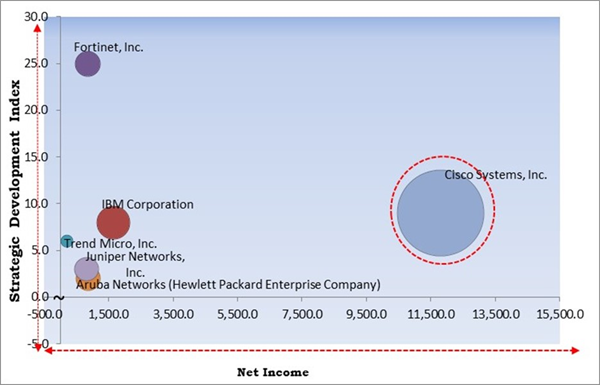

The Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the The Cardinal Matrix; Cisco Systems, Inc. are the forerunners in the Market. In November, 2022, Cisco Systems, Inc. added capabilities to mark vulnerabilities in various Cisco products which are Cisco Adaptive Security Appliance Software and Firepower Threat Defense Software, and Cisco FirePOWER Software for ASA FirePOWER Module. Companies such as Fortinet, Inc., Trend Micro, Inc., and IBM Corporation are some of the key innovators in the Market.

Market Growth Factors

Increasing adoption of digital technologies

The growing adoption of digitalized security solutions to improve optimization rapidly affects the market's expansion. Digitalized security solutions and services, such as adaptive security solutions, offer several benefits, including adaptability, scalability, and cost-effectiveness, allowing businesses to manage security operations more efficiently and centrally. Therefore, digitalized security operations are gaining widespread acceptance to increase security operators' use of IT and control systems, particularly IoT and other digital technologies. It is anticipated that these multiple features of digitalized security solutions will contribute to the expansion of the market.Demand growth for improved security solutions

Due to the increasing sophistication and frequency of cyberattacks, there is an ever-increasing demand for enhanced and current adaptive security solutions. Identifying and evaluating potential security threats to a company's systems, networks, and data, as well as establishing safeguards to prevent the analyzed threats, is necessary in the modern era, as cyber threats have become a significant concern for many stakeholders. As a result, the increasing frequency of cyberattacks and data intrusions is becoming a significant factor in raising awareness of security solutions, thereby contributing to market growth. Therefore, these variables significantly contribute to the market's tremendous growth and development potential.Market Restraining Factors

Lack of competent cybersecurity experts

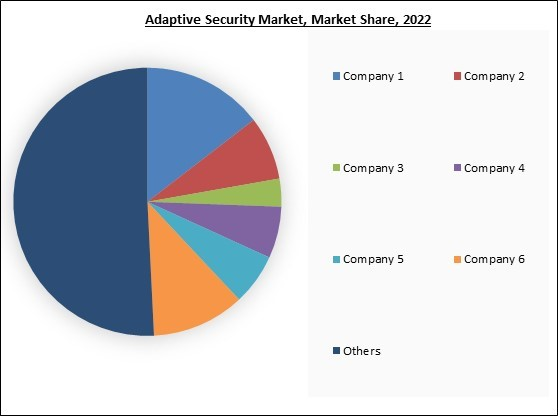

In the case of a security breach or incident, prompt and effective action is required. Only qualified cybersecurity professionals are needed to identify incidents, analysis, and response coordination. Their expertise expedites the containment, reduction, and recovery processes. A lack of competent professionals can result in delayed incident response, higher outages, and prolonged recovery periods, influencing adaptive security solutions' overall efficacy and trustworthiness. A lack of qualified personnel may confound the deployment of these solutions, leading to delays, erroneous or suboptimal configurations. This may hinder the creation and implementation of adaptive security technologies. This may harm the market, as the globe already confronts a significant paucity of qualified IT professionals.The leading players in the market are competing with diverse innovative offerings to remain competitive in the market. The above illustration shows the percentage of revenue shared by some of the leading companies in the market. The leading players of the market are adopting various strategies in order to cater demand coming from the different industries. The key developmental strategies in the market are Product Launches and Product Expansions.

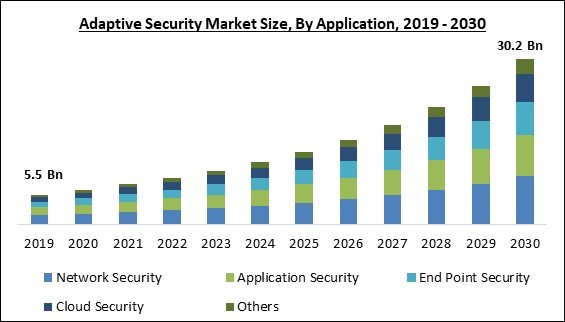

Application Outlook

On the basis of application, the market is categorized into network security, application security, end point security, cloud security, and others. The application security segment covered a considerable revenue share in the market in 2022. Numerous businesses utilize software applications to manage operations and preserve sensitive data. Adaptive application security solutions are intended to safeguard software applications in real time by automatically detecting and mitigating potential threats. These technologies include application firewalls, runtime application self-protection (RASP), and software configuration analysis.Component Outlook

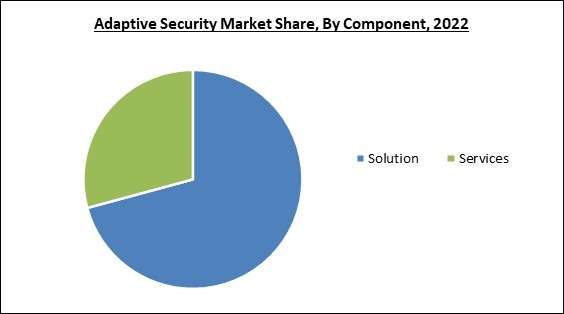

Based on component, the market is segmented into solutions and services. In 2022, the services segment covered a considerable revenue share in the market. Since adaptive security is a swiftly expanding market, services play a crucial role. Adaptive security services are intended to assist businesses in enhancing their security posture and responding in real-time to new attacks. These services include security consulting, managed security services, threat intelligence, and incident response.Industry Outlook

Based on the industry vertical, the market is bifurcated into BFSI, IT & telecom, retail & e-commerce, manufacturing, healthcare, energy & utilities, government & defense, and others. In 2022, the government & defense segment gained a notable revenue share in the market. The increasing prevalence of digital communication services positions mobile network security at the center of national security for all nations. Numerous nations are developing cyber security frameworks during escalating global geopolitical tensions. Governments can collaborate with operators to establish intelligent resilience and threat detection. This is anticipated to result in the expansion of the market.Deployment Mode Outlook

By deployment mode, the market is fragmented into on-premise and cloud. In 2022, the on-premises segment recorded the remarkable revenue share in the market. This on-premises segment grants businesses complete control over security protocols and data, which can benefit regulated industries or organizations. The organizations prefer on-premise deployment model due to minimized risk of security threats.Regional Outlook

Region wise, the market is analysed across North America, Europe, Asia-Pacific, and LAMEA. The North America region held the highest revenue share in the market in 2022. Major technology companies, like IBM, Cisco Systems, Inc., and others, which have significantly invested in sophisticated security platforms and services, are prevalent in the region. Thus, anticipated to stimulate market expansion. The rising investment in advanced technologies, which includes cloud-based services, ML, AI, business analytics solutions, and IoT to enhance business operations and the customer experience, is expected to drive the market.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Fortinet, Inc., Trend Micro, Inc., Rapid7, Inc., IBM Corporation, Cisco Systems, Inc., Aruba Networks (Hewlett Packard Enterprise Company), Juniper Networks, Inc., RSA Security LLC (Symphony Technology Group), Cloudwick Technologies, Inc. and Panda Security S.L.U. (WatchGuard Technologies, Inc)

Strategies Deployed in the Market

»Partnerships, Collaboration and Agreements:

- Apr-2023: Cisco Systems, Inc came into partnership with Radware, a leading cybersecurity and application delivery solution. Under this partnership, Cisco would integrate Cisco Secure Cloud DDoS Protection, powered by Radware with the Cisco Enterprise Agreement to streamline Secure Cloud DDoS Protection licensing and purchase for Cisco customers.

- Nov-2022: Aruba Networks, a subsidiary of Hewlett Packard Enterprise, collaborated with Lookout, Inc., the endpoint to the cloud security company. This collaboration aims to combine the HPE Aruba EdgeConnect Enterprise SD-WAN platform with Lookout's security service edge platform to deliver customers with a best-of-quality secure access service edge architecture that mixes network security with the combined security stack supporting secure web gateway, zero-trust network access, cloud access security broker and data loss protection.

- Aug-2022: Fortinet Inc. came into an agreement with NEC Corporation, a leader in network technologies and the integration of IT. Following this agreement, both companies would construct 5G networks for communication service providers. Additionally, Fortinet Inc. would deliver its complete security solutions consisting of FortiGate, the next-generation firewall and best-performing hyper-scale firewall, simultaneously NEC would provide professional services created on its firm track record in the telecom industry to offer carrier-grade sustainable networking needed in 5G.

- Jul-2021: Trend Micro teamed up with Microsoft to create cloud-based cyber security solutions on Microsoft Azure and generate co-selling opportunities. Furthermore, the collaboration helps the joint customers in digital transformations by utilizing both Trend Micro's security expertise and Azure's cloud computing platform.

»Product Launches and Product Expansions:

- May-2023: IBM Corporation announced the launch of IBM Quantum Safe Explorer, IBM Quantum Safe Advisor, and IBM Quantum Safe Remediator, security tools offerings developed to protect data from quantum computing attacks. The launched products would aim to address quantum computing security risks.

- Apr-2023: Fortinet, Inc. enhanced the Fortinet Security Fabric. The update would be with recent and improved products and the ability to support modern threat protection and correlated response for a self-protecting ecosystem over clouds, networks, and endpoints.

- Feb-2023: Fortinet Inc. launched FortiSP5, the modern breakthrough in ASIC technology. This product launch would fix computing power advantages across conventional CPU and network ASICs. Moreover, it would allow the capability to protect infrastructure over 5G, branch, edge computing, and operational technologies.

- Nov-2022: Fortinet Inc. released FortiGate Cloud-Native Firewall on Amazon Web Services, a managed, enterprise-grade next-generation firewall solution created especially for AWS settings. The launched product would include FortiGuard AI-powered Security Services for actual identification of and security against malicious internal and external threats. Additionally, it would be supported by FortiOS over AWS and on-prem environments for a consistent network security experience.

- Nov-2022: Cisco Systems, Inc added capabilities to mark vulnerabilities in various Cisco products which are Cisco Adaptive Security Appliance Software and Firepower Threat defence Software, Cisco Secure Firewall 3100 Series, Cisco Firepower Threat defence Software, and Cisco FirePOWER Software for ASA FirePOWER Module.

- Jun-2022: Fortinet Inc. introduced FortiRecon, a complete Digital Risk Protection Service. The launched product would make use of a powerful integration of machine learning, automation skills, and FortiGuard Labs cybersecurity specialists that manages a company's risk posture and suggests actionable steps to safeguard its brand reputation, corporate assets, and data. Moreover, to counter attacks at the reconnaissance phase, the first stage of a cyberattack, FortiRecon delivers a triple offering of outside-in coverage across External Attack Surface Management (EASM), Brand Protection (BP), and Adversary-Centric Intelligence (ACI) and this would significantly reduce the risk, time, and cost of later stage threat mitigation.

- Apr-2022: Fortinet Inc. announced the launch of FortiOS 7.2, the new upgrades to its major operating system, and the basis of the Fortinet Security Fabric. The launched product would further support Fortinet's capability to meet security at every network edge integrated with the performance and scale required to identify and prevent threats over an organization's complete infrastructure.

- Feb-2022: Juniper Networks, Inc. unveiled Secure Edge, a cloud-based firewall service. This launched product would enable customers to streamline, analyse, and apply current security policies utilize on their SRX firewalls.

- Mar-2021: IBM Corporation rolled out IBM Cloud Satellite, which would enable firms to release cloud service in any environment and everywhere. Through this product, the customer from industries, financial services, government, healthcare, retail as well as telecommunications would access an in-line and protected set of cloud services.

»Acquisitions and Mergers:

- Feb-2023: Trend Micro, Inc. acquired Anlyz, a provider of security operations centre technology. Through this acquisition, Trend Micro would expand its orchestration, automation, and integration abilities. Additionally, the acquisition would allow businesses and Managed Security Service Providers to enhance security outcomes, low-cost, and productivity.

- Jun-2021: Cisco took over Kenna Security, a company providing network security solutions. Through this acquisition, the company's customers would be able to solve crucial safety posture challenges by operating cross-functionally to quickly automate the prioritization, identification, and prediction of cybersecurity threats.

Scope of the Study

By Application

- Network Security

- Application Security

- End Point Security

- Cloud Security

- Others

By Industry

- BFSI

- Healthcare

- IT & Telecom

- Retail & Ecommerce

- Energy & Utilities

- Manufacturing

- Government & Defense

- Others

By Component

- Solution

- Services

By Deployment Mode

- Cloud

- On-premise

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Fortinet, Inc.

- Trend Micro, Inc.

- Rapid7, Inc.

- IBM Corporation

- Cisco Systems, Inc.

- Aruba Networks (Hewlett Packard Enterprise Company)

- Juniper Networks, Inc.

- RSA Security LLC (Symphony Technology Group)

- Cloudwick Technologies, Inc.

- Panda Security S.L.U. (WatchGuard Technologies, Inc)

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Fortinet, Inc.

- Trend Micro, Inc.

- Rapid7, Inc.

- IBM Corporation

- Cisco Systems, Inc.

- Aruba Networks (Hewlett Packard Enterprise Company)

- Juniper Networks, Inc.

- RSA Security LLC (Symphony Technology Group)

- Cloudwick Technologies, Inc.

- Panda Security S.L.U. (WatchGuard Technologies, Inc)