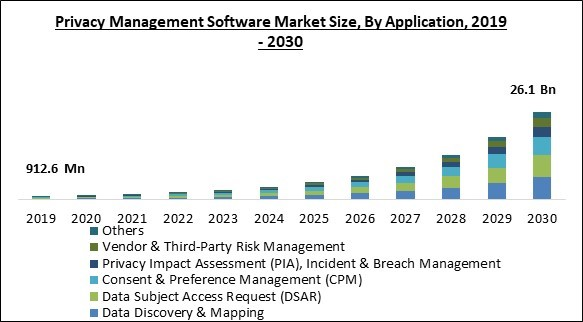

The consent & preference management (CPM) offers better transparency for privacy management. Therefore, the consent & preference management segment would acquire approximately 20% share of the market by 2030. Every aspect of end-user choices acquiring collection, synchronization, and exploitation is supported by the consent & preference management (CPM) segment. The goal is to give data subjects more visibility and control by enabling them to choose how much of their data to reveal, to whom, and for what reason. CPM solutions offer enterprises a solid base for compliance-backed data utilization, enabling thorough tracking and audit ability.

The major strategies followed by the market participants are Partnerships as the key developmental strategy to keep pace with the changing demands of end users. For instance, In November,2022, BigID, Inc. partnered with Wiz to provide solutions for enhanced cloud security to offer solutions for enhanced data visibility. Additionally, In March, 2022, Exterro, Inc. signed a partnership with QuisLex to integrate it with QuisLex’s data breach review team. The combined expertise would enable the customers to quickly mitigate effects due to security breaches.

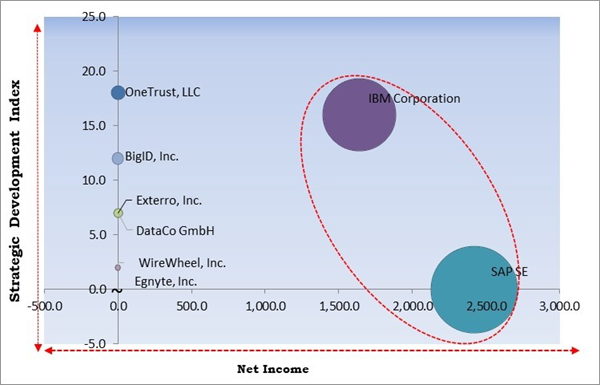

The Cardinal Matrix - Market Competition Analysis

Based on the Analysis presented in the The Cardinal Matrix; IBM Corporation and SAP SE are the forerunners in the Market. In May, 2023, IBM Corporation partnered with SAP SE to integrate IBM Watson technology with SAP solutions and to enable IBM's clients to create better customer experiences. Companies such as OneTrust, LLC, BigID, Inc., Exterro, Inc. are some of the key innovators in the Market.

Market Growth Factors

Demand for Cloud-Based Deployment will Propel Market Expansion

This market is anticipated to expand steadily throughout the forecasted period due to ongoing research & development efforts to make the market's vital advancements. The cloud deployment option is suitable for businesses who want to install analytics solutions with minimal expense. It essentially makes it possible for the company to acquire data with all its services at an affordable cost. It implies that the fast-growing need for cloud-based deployment is expected to fuel the growth of the market in the near future.Protection of Personal Data is Required Due to Growing Privacy Concerns

People are becoming more conscious of the possible hazards to their privacy as a result of the rapid expansion of digital technologies and the enormous collection and processing of personal data. Organizations are placing higher demands on companies to safeguard personal data and establish ethical data handling procedures. Using data privacy management software, businesses may create efficient data governance frameworks. Organizations can use it to develop data handling rules, monitor data flows, and set safeguards to guarantee ethical data processing procedures. This encourages data management that is transparent and accountable. Owing to the rising risk of privacy concerns, the adoption of privacy management software is estimated to rise.Market Restraining Factors

System Integration with Privacy Management Software

A company's existing systems and databases must smoothly interact with privacy management software. However, changes in data formats, protocols, or system architectures may lead to issues with compatibility. These technical differences may complicate and lengthen the integration process. Regarding privacy management, organizations frequently have special procedures and regulations. Customization and setup might be needed to integrate privacy management software following certain business regulations, data structures, and workflows. This customization might be difficult and might ask for advanced knowledge.Application Outlook

On the basis of application, the market is segmented into data discovery & mapping; data subject access request (DSAR); consent & preference management (CPM); privacy impact assessment (PIA), incident & breach management; vendor & third-party risk management; and others. The privacy impact assessment (PIA), incident & breach management segment acquired a substantial revenue share in the market in 2022. The policies & procedures businesses implement to properly handle and respond to security incidents & data breaches are called incident & breach management. These incidents can involve virus assaults, illegal system access, data leaks, or any other security occurrence compromising the confidentiality, integrity, or accessibility of sensitive data.Enterprise Size Outlook

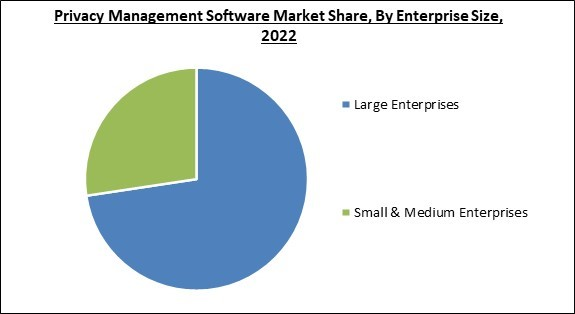

By enterprises size, the market is fragmented into large enterprises, and SMEs. In 2022, the large enterprises segment witnessed the largest revenue share in the market. Large enterprises are referred to as those with more than 1,000 employees. Large enterprises have substantially adopted privacy management software, which can be attributed to several variables, including rising need for data protection, risk management, and organizational effectiveness.Deployment Type Outlook

Based on deployment type, the market is classified into cloud, and on-premises. The cloud segment recovered a remarkable revenue share in the market in 2022. Organizations may manage privacy-related tasks, compliance, and data protection in a cloud computing environment with the help of adaptable and scalable cloud privacy management software. It provides advantages, including lower infrastructure costs, better accessibility, and the capacity to use reliable cloud service providers' infrastructure & security features.Vertical Outlook

Based on vertical, the market is categorized into BFSI, government & defense, healthcare & life science, retail & ecommerce, manufacturing, IT & telecommunications, and others. In 2022, the BFSI segment generated the maximum revenue share in the market. The BFSI sector deals with the financial data of clients and there are high chances of direct financial losses in case of any sort of data breaches. Due to this, to maintain compliance with data protection laws, preserve customer privacy, and reduce privacy risks, BFSI firms must use privacy management software. Privacy management software is essential for BFSI firms to safeguard client data and uphold confidence in the digital age.Regional Outlook

Region wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region led the market by generating the highest revenue share. The mix of federal, state, and sector-specific privacy laws, developing regulatory frameworks, advocacy initiatives, and public demand for privacy rights describe the privacy environment in North America. The region's market of privacy management software is anticipated to expand due to the demand for comprehensive federal privacy legislation and the requirement.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include IBM Corporation, SAP SE, OneTrust, LLC, Securiti, Inc., BigID, Inc., Egnyte, Inc., WireWheel, Inc., Truyo (IntraEdge, Inc.), DataCo GmbH, Exterro, Inc. (Leeds Equity Partners, LLC)

Strategies Deployed in the Market

»Partnerships, Collaboration and Agreements:

- May-2023: IBM Corporation partnered with SAP SE, a software company headquartered in Germany, to integrate IBM Watson technology with SAP solutions. The partnership would enable IBM's clients to create better customer experiences.

- Apr-2023: BigID, Inc. signed a partnership with Thales, a data security solutions provider, to integrate its Data Intelligence suite with Thales CipherTrust Platform. The combined offerings by the two companies would enable their clients to securely manage their sensitive data.

- Nov-2022: BigID, Inc. partnered with Wiz, a cloud security platform, to provide solutions for enhanced cloud security. The partnership would provide the joint customers of the two companies with solutions for enhanced data visibility.

- Mar-2022: Exterro, Inc. signed a partnership with QuisLex, a breach response solutions provider, to integrate it with QuisLex’s data breach review team. The combined expertise of the two companies would enable the customers to quickly mitigate effects due to security breaches.

- Sep-2021: Egnyte, Inc. entered into a partnership with Truyo, an automated data privacy management solutions provider, to develop solutions for the subject access request (SAR) process. The partnership would facilitate the customers to automate the privacy requests for both structured and unstructured forms of data.

»Product Launches and Product Expansions:

- Apr-2023: BigID, Inc. announced the launch of Data Risk Management, a service used for risk prioritization and actions. The benefits of the product include Risk defining, Quick response, and automated remediation of data risks.

- Nov-2022: IBM Corporation introduced IBM Business Analytics Enterprise, a collection of services that are used for business intelligence planning, forecasting, and budgeting. It features IBM Planning Analytics with Watson, IBM Analytics Content Hub, and IBM Cognos Analytics with Watson.

- Apr-2022: Exterro, Inc. introduced Exterro Data Discovery, a service used for the automated location of privacy data and actions. The service features enhanced scan speeds, Automated risk scoring, Policy compliance, Data leakage prevention, and automated data tracking.

- Nov-2021: BigID, Inc. unveiled the Privacy Impact Assessment (PIA) app for the assessment and communication of organizational risk. With the app, Organizations can reduce privacy risks, monitor business processes, report on obedience, and team up with data owners across an organization.

- May-2021: DataCo GmbH announced the launch of DataGuard Consent Management, a platform used of managing the customer's consents and preferences. The features of the platform include enhanced customer engagement, obedience management, Transparency, and better profitability.

»Acquisitions and Mergers:

- May-2023: IBM Corporation completed the acquisition of Polar Security, an Israeli software company. The acquisition enhances IBM's Security Guardium platform.

- Jul-2022: IBM Corporation announced the acquisition of Databand.ai, a dataOps monitoring solutions provider. The acquisition aids the company in its growth strategy within the data observability market. Furthermore, the acquisition enhances IBM's AI and hybrid cloud offerings.

- Apr-2021: DataCo GmbH completed the acquisition of MyLife Digital (MLD) from Inc & Co., a data trust solutions provider. The acquisition expands the customer base for DataCo.

- Mar-2021: OneTrust LLC announced the acquisition of DocuVision Inc., a redaction solutions provider. The acquisition enhances OneTrust's data redaction capabilities by adding DocuVision's Redacted.ai to OneTrust's portfolio.

Scope of the Study

By Application

- Data Discovery & Mapping

- Data Subject Access Request (DSAR)

- Consent & Preference Management (CPM)

- Privacy Impact Assessment (PIA), Incident & Breach Management

- Vendor & Third-Party Risk Management

- Others

By Enterprise Size

- Large Enterprises

- Small & Medium Enterprises

By Deployment Type

- On premise

- Cloud

By Vertical

- BFSI

- IT & Telecom

- Government & Defense

- Healthcare & Lifesciences

- Retail & eCommerce

- Manufacturing

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- IBM Corporation

- SAP SE

- OneTrust, LLC

- Securiti, Inc.

- BigID, Inc.

- Egnyte, Inc.

- WireWheel, Inc.

- Truyo (IntraEdge, Inc.)

- DataCo GmbH

- Exterro, Inc. (Leeds Equity Partners, LLC)

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- IBM Corporation

- SAP SE

- OneTrust, LLC

- Securiti, Inc.

- BigID, Inc.

- Egnyte, Inc.

- WireWheel, Inc.

- Truyo (IntraEdge, Inc.)

- DataCo GmbH

- Exterro, Inc. (Leeds Equity Partners, LLC)