Cigarette smoking and long-term exposure to other respiratory contaminants are typically the cause of various diseases, including asthma. The asthma segment will capture more than 30% share of the market by 2030. The World Health Organization (WHO) estimates that annually, tobacco kills more than eight million people. 7 million deaths are due to direct tobacco use, while approximately 1.2 million are due to latent or secondhand smoking. Cigarette smoking is one of the most prevalent forms of tobacco use worldwide. Over 80% of the 1.3 billion tobacco consumers reside in low- and middle-income countries, where mortality and illness due to tobacco use are prevalent. Some of the factors impacting the market are globally increasing air pollution, developing technological advances and concerns related to patient data security.

Automobiles, forest fires, household combustion, and industrial facilities are widely recognized sources of air pollution. Particulate matter, ozone, carbon monoxide, sulfur dioxide, and nitrogen are the pollutants of most threat to public health. Both indoor and external air pollution contribute significantly to mortality and morbidity by causing respiratory and other diseases. According to the World Health Organization, nearly all the world's population consumes air with elevated levels of pollutants exceeding WHO guidelines. Low- and middle-income countries are the most vulnerable to these threats. Additionally, the increasing adoption of AI and IoT has been identified as one of the most significant market trends. AI technology analyzes intricate medical data using algorithms and software, reducing the need for direct human input. This will aid in decreasing the likelihood of human error, reducing treatment costs, and enhancing healthcare outcomes. Therefore, Long-term exposure to ambient air contaminants is associated with an increase in the incidence of respiratory diseases and the increasing incorporation of AI and the adoption of IoT will improve the treatment of asthma and COPD, thereby increasing demand.

Furthermore, in order to provide care for the infected population, there is a growing demand for medical supplies. Respiratory support devices like atomizers, oxygen generators, life-support machines, and monitors are some of the most frequently utilized medical devices in primary medical care. The continuous outbreak of the COVID-19 pandemic had a positive effect on the medical device industry. It affects the market for digital dose inhalation. However, this escalating pandemic affects the supply chain and reduces demand for digital dose inhalation devices, resulting in the temporary shutdown of industries and the announcement of lockdowns by governments in numerous regions.

Additionally, due to concerns about patient data security, it is predicted that the market will expand slowly. Due to a lack of knowledge of the symptoms of COPD and asthma, the vast majority of individuals with respiratory illnesses go undiagnosed and are consequently given the incorrect treatment. This may be a result of patients not being technologically savvy and the payment restrictions. The device's limited availability is another issue that, given the existing circumstance, will have a negative impact on the market for digital dosage inhalers throughout the projection period.

Type Outlook

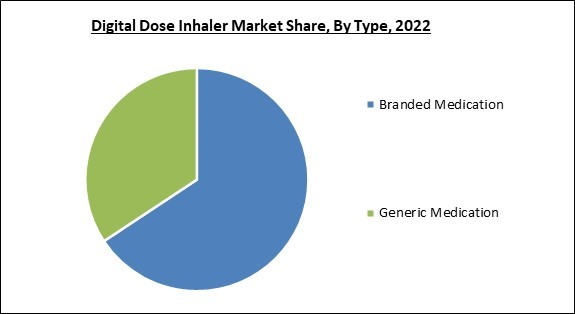

On the basis of type, the market is fragmented into branded medication and generic medication. The generic medication segment garnered the highest revenue share in the market. Frequently, digital inhalers include sensors and connectivity features that monitor and track medication usage. They can log the date, time, and frequency of inhaler use, providing valuable information to patients, healthcare providers, and researchers. A few digital inhalers can be programmed with medication reminders and alerts.Product Outlook

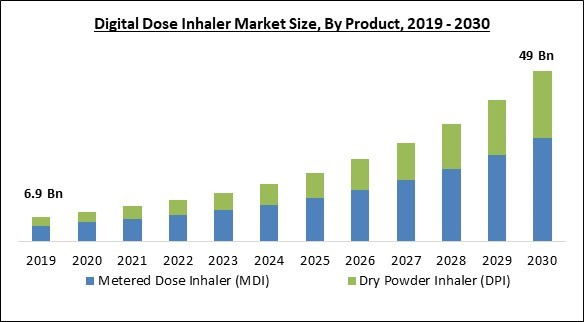

Based on Product, the market is segmented into metered dose inhaler (MDI) and dry powder inhaler (DPI). In 2022, the metered dose inhaler (MDI) segment held the highest revenue share in the market. This is due to rising healthcare costs and increased respiratory disease cases. Furthermore, consistent technological advancements related to the development of inhalation medication, like mechanistic Pharmacokinetic/Pharmacodynamics (PK/PD) modeling, and nanotechnology-based formulations with high drug loads delivered in smaller dose sizes, are some of the critical factors involved in enhancing the therapeutic efficacy of the medication and influencing the overall market.Indication Outlook

By indication, the market is bifurcated into asthma, chronic obstructive pulmonary disease (COPD), and others. In 2022, the chronic obstructive pulmonary disease (COPD) segment dominated the market. The segment is anticipated to dominate over the forecast period due to the global increase in COPD incidence. Tobacco use, air pollution, pollen, chemical vapors, and childhood infections are all causes of COPD. Digital Dose Inhalers aid COPD patients in monitoring their respiratory health and drug adherence, enabling them to manage their illness more effectively.Regional Outlook

Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2022, the North America region led the market by generating the highest revenue share. This is due to rigorous research and development efforts, as well as an increased awareness of the high-tech respiratory devices currently available. In addition, an increase in the prevalence of respiratory conditions among children and older people will drive market expansion over the forecast period.The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include Sensirion AG, Teva Pharmaceuticals Industries Ltd., OPKO Health, Inc., Propeller Health (ResMed, Inc.), Novartis AG, AstraZeneca PLC, Glenmark Pharmaceuticals Limited, Beximco Pharmaceuticals Ltd., GlaxoSmithKline PLC and Mundipharma Deutschland GmbH & Co. KG.

Strategies Deployed in the Market

- Jun-2023: Teva Pharmaceutical signed an agreement with Phil, Inc., a patient access platform company. Under this agreement, both companies would make Digihaler products available for prescription utilizing the PhilRx Patient Access Platform. The Digihaler system offered by Teva is a smart inhaler that delivers objective inhaler data to support doctors and patients in asthma management.

- Jan-2023: AstraZeneca received FDA approval for Airsupra, a pressurized metered-dose inhaler. The approval in the US is for the as-required treatment or prevention of bronchoconstriction and to decrease the risk of exacerbations in people suffering from Asthma of 18 years or more.

- Jun-2022: Glenmark Pharm announced the launch of Indament, a novel fixed-dose combination (FDC) drug. The launched drug would be available in three forms with a fixed dose of Indacaterol 150 mcg and variable doses of Mometasone 80 mcg, 160 mcg and 320 mcg to be taken once daily.

- Apr-2022: GlaxoSmithKline Pharmaceuticals rolled out Trelegy Ellipta, the first once-daily single-inhaler triple therapy, for Chronic Obstructive Pulmonary Disease patients. The product is used as a maintenance treatment to avert and relieve symptoms related to Chronic Obstructive Pulmonary Disease for patients of age 18 and above.

- Sep-2020: Teva Respiratory, LLC., a U.S. affiliate of Teva Pharmaceutical Industries Ltd., introduced AirDuo Digihaler inhalation powder and ArmonAir Digihaler inhalation powder, the digital maintenance inhalers for patients with asthma. The AirDuo Digiinhaler is utilized to manage symptoms of wheezing in patients and asthma. The ArmonAir Digihaler for the treatment of asthma in patients.

- Jul-2020: Teva Respiratory, LLC., a U.S. affiliate of Teva Pharmaceutical Industries Ltd. released ProAir Digihaler Inhalation Powder, the digital rescue inhaler indicated in patients of four years and above. The product is used for the prevention and treatment of bronchospasm who have reversible obstructive airway disease.

- Jul-2020: Novartis received approval from European commision for Enerzair® Breezhaler®, including the sensor and app. The Product offers inhalation confirmation, medication reminders, and access to objective data to better help therapeutic decisions.

- May-2020: Glenmark Pharmaceuticals Ltd. introduced AIRZ-FF, a Single Inhaler Triple Therapy. The launched product is for Chronic Obstructive Pulmonary Disease with the combination of two bronchodilators, Glycopyrronium & Formoterol, and the inhalation corticosteroid Fluticasone propionate. Furthermore, the AIRZ-FF decreases the risk of Severe attacks and eliminates dependence on multiple inhalers.

- May-2020: Propeller Health came into partnership with AstraZeneca, a global pharmaceutical company. This partnership would offer respiratory patients a tool to help control their condition and enhance their medication adherence, a key factor in keeping people out of the hospital. Moreover, Propeller Health got FDA approval for a sensor and app to be used with AstraZeneca's Symbicort inhaler for asthma and COPD.

Scope of the Study

Market Segments Covered in the Report:

By Product

- Metered Dose Inhaler (MDI)

- Dry Powder Inhaler (DPI)

By Type

- Branded Medication

- Generic Medication

By Indication

- COPD

- Asthma

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Sensirion AG

- Teva Pharmaceuticals Industries Ltd.

- OPKO Health, Inc.

- Propeller Health (ResMed, Inc.)

- Novartis AG

- AstraZeneca PLC

- Glenmark Pharmaceuticals Limited

- Beximco Pharmaceuticals Ltd.

- GlaxoSmithKline PLC

- Mundipharma Deutschland GmbH & Co. KG

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Sensirion AG

- Teva Pharmaceuticals Industries Ltd.

- OPKO Health, Inc.

- Propeller Health (ResMed, Inc.)

- Novartis AG

- AstraZeneca PLC

- Glenmark Pharmaceuticals Limited

- Beximco Pharmaceuticals Ltd.

- GlaxoSmithKline PLC

- Mundipharma Deutschland GmbH & Co. KG