The Asia-Pacific region has a significant concentration of producers of API intermediates, and chronic disease incidence has increased. Consequently, Asia-Pacific region is anticipated to capture more than 35% share of the market by 2030. The pharmaceutical and contract manufacturing industries are expanding in several nations, including China and India, which is projected to boost the Asia Pacific region. Due to considerations like cheaper labor costs and the accessibility of production-ready raw materials, these nations have emerged as desirable locations for outsourcing the manufacturing of active ingredients. The expansion of manufacturing capacity in the region is also encouraged by favorable regulatory policies in Asia Pacific, fostering the market’s development. Some of the factors impacting the market are strong demand for pharmaceuticals, increasing incidence of chronic illness, and biopharmaceutical drugs are expensive.

The prevalence of chronic diseases is rising rapidly around the world due to the aging of the population, the rise of sedentary lifestyles, and urbanization. As a result, there is an ever-growing market demand for therapeutic drugs. Additionally, several pharmaceutical firms’ introduction of novel pharmaceuticals to the market is projected to increase the focus on research and development operations, which would likely fuel the expansion of the market throughout the projection period. The rise in healthcare expenditures per capita in developing nations, coupled with the increase in diagnosis rates, has resulted in a large population requiring treatment. This rising prevalence of chronic diseases is also expected to increase demand for pharmaceuticals in the market for active pharmaceutical ingredients. Increasing pharmaceutical demand will drive the demand for branded and generic products. As a result of the rising incidence of chronic illness, the market is estimated to grow.

However, Research and development funding for novel drugs and APIs may be reduced due to pharmaceuticals. The pipeline of novel drugs and, consequently, their API intermediates could be limited, which could slow innovation. Due to the high cost of biological medications, market dynamics may shift, leading to more stringent restrictions and cost-cutting initiatives. These modifications may affect the pharmaceutical and, consequently, the market. This factor poses a challenge for the market. The market suffered greatly due to the COVID-19 outbreak. The lack of raw materials required for the production of API intermediates and the stringent government regulations governing the supply chain resulted in negatively impacting the market.

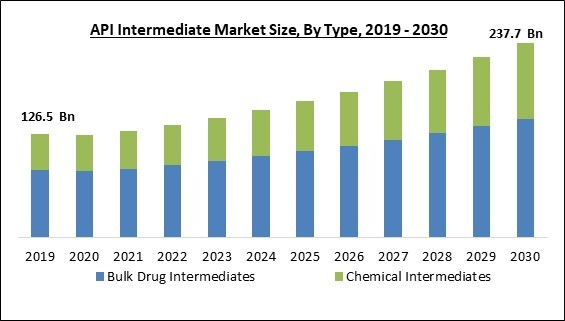

Type Outlook

By type, the market is classified into bulk drug intermediates and chemical intermediates. In 2022, the bulk drug intermediates segment held the highest revenue share in the market. Due to the rising frequency of chronic diseases and the growth in market participants who produce bulk drug intermediates, the bulk drug intermediates sector is anticipated to dominate the market. Active pharmaceutical ingredients (API) are frequently produced using bulk drug intermediates. The active pharmaceutical ingredient (API) is the essential component used in the production of medications to have the desired therapeutic effect.End-user Outlook

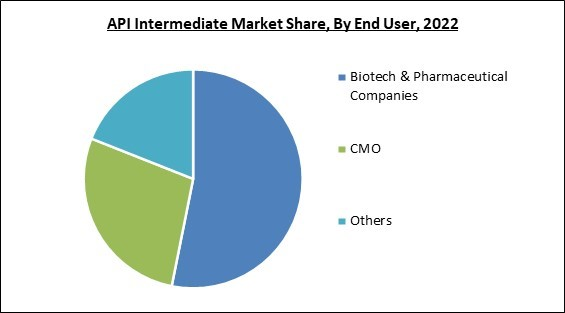

On the basis of end user, the market is segmented into biotech & pharmaceutical companies, CMO, and others. The CMOs segment recorded a remarkable revenue share in the market in 2022. CMOs frequently concentrate on particular therapeutic areas or specialize in the manufacturing of particular types of API intermediates. Their knowledge enables them to enhance manufacturing procedures, boost productivity, and guarantee high-quality output, attracting clients looking for dependable and effective API intermediates. Hence, their demand will increase the market segment further.Application Outlook

Based on application, the market is bifurcated into analgesics, anti-infective drugs, antidiabetic drugs, cardiovascular drugs, anticancer drugs, and others. In 2022, the cardiovascular drugs segment acquired a substantial revenue share in the market. Due to its healing qualities, API Intermediate is widely utilized in cardiovascular diseases. One of the main causes of death globally is cardiovascular disease. Throughout the projected period, there is anticipated to be a noticeable increase in the usage of API Intermediate in the treatment of cardiovascular disorders.Regional Outlook

Region wise, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. In 2022, the North America region led the market by generating the highest revenue share. The rise in senior populations is projected to contribute to the market in North America expanding at a noticeable rate over the forecast period. The aging population is more prone to chronic illnesses like cardiac, orthopedic, respiratory, and other diseases. Thus, an increase in the geriatric population increases the demand for pharmaceuticals and API intermediates, thereby driving market expansion. As a result, the growth of this market in the North American region has been fuelled by the rise in the incidence of these chronic illnesses.The market research report covers the analysis of key stakeholders of the market. Key companies profiled in the report include Cation Pharma, Espee Group, Sandoo Pharmaceuticals and Chemicals Co., Ltd., Cipla Limited, Cambrex Corporation, Vertellus, Dr. Reddy’s Laboratories Ltd., Evonik Industries AG (RAG-Stiftung), Pfizer, Inc., Shree Ganesh Remedies Limited.

Strategies Deployed in the Market

- Jul-2023: Evonik Industries AG partnered with Heraeus Precious Metals, a precious metal products provider, to expand its highly potent active pharmaceutical ingredients (HPAPIs) service portfolio. The partnership would enhance Evonik's HPAPI capabilities.

- May-2023: Evonik Industries AG signed a distribution partnership with IMCD, a specialty chemicals distributor, to market Evonik's medicines in the European market. The partnership provides Evonik with an opportunity to accelerate its business growth.

- Mar-2023: Evonik Industries AG expanded its geographical footprint by opening a new facility in Hanau, Germany. The new facility would serve as a lipid manufacturing hub. The lipids produced at the facility would be used in the company's RNA drugs.

- Feb-2023: Dr. Reddy’s Laboratories Ltd. entered a distribution partnership with Aster Pharmacy, a pharmacy chain based in the GCC, to market its medicines in the Gulf region. The partnership enables Dr. Reddy’s Laboratories to expand its customer base.

- Nov-2022: Cambrex Corporation announced the acquisition of Snapdragon Chemistry, a chemical process development service provider. The acquisition enhances Cambrex's capabilities in continuous flow process manufacturing and development.

- Oct-2022: Evonik Industries AG came into partnership with Phathom Pharmaceuticals, a biopharmaceutical company based in the US, to manufacture the gastrointestinal disorder treatment drug vonoprazan. The partnership comes in line with Evonik's commitment to deliver complex APIs for customers around the globe.

- May-2022: Pfizer Inc. established a drug development center in Chennai, India. The center would be used for the development of active pharmaceutical ingredients (APIs) and would aid the company's global manufacturing operations.

- Feb-2019: Aavis Pharmaceuticals, a subsidiary of Espee Group, received approval from the US Food and Drug Administration for its manufacturing plant in the United States. The approval places Espee as the 3rd company in Gujarat to have a US-based plant approved by the USFDA.

- Jan-2019: Cambrex Corporation acquired Avista Pharma Solutions, a CDMO based in the US. The acquisition strengthens Cambrex's capabilities in APIs by adding Avista’s early-stage development to Cambrex's portfolio.

Scope of the Study

Market Segments Covered in the Report:

By Type

- Bulk Drug Intermediates

- Chemical Intermediates

By End-user

- Biotech & Pharmaceutical Companies

- CMO

- Others

By Application

- Analgesics

- Antidiabetic Drugs

- Anti-Infective Drugs

- Cardiovascular Drugs

- Anticancer Drugs

- Others

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Cation Pharma

- Espee Group

- Sandoo Pharmaceuticals and Chemicals Co., Ltd.

- Cipla Limited

- Cambrex Corporation

- Vertellus

- Dr.Reddy’s Laboratories Ltd.

- Evonik Industries AG (RAG-Stiftung)

- Pfizer, Inc.

- Shree Ganesh Remedies Limited

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Cation Pharma

- Espee Group

- Sandoo Pharmaceuticals and Chemicals Co., Ltd.

- Cipla Limited

- Cambrex Corporation

- Vertellus

- Dr. Reddy’s Laboratories Ltd.

- Evonik Industries AG (RAG-Stiftung)

- Pfizer, Inc.

- Shree Ganesh Remedies Limited