Vendors in the global market for curing agents are focusing on the development of waterborne coatings to substitute solvent-based coatings. Without the assistance of co-solvents, waterborne healing agents stay stable in water. These healing agents are sleek, anticorrosive, and at even low temperatures, they have healing skills. They are also cost-effective and eco-friendly. Waterborne epoxy coatings are gaining popularity among end-users due to such benefits.

Market Segmentation

“Curing Agents Market Report and Forecast 2025-2034” offers a detailed analysis of the market based on the following segments:Market Breakup by Type

- Epoxy Curing Agent

- Polyurethane-Based Curing Agents

- Silicone Rubber

- Others

Market Breakup by Application

- Coatings

- Electrical and Electronics

- Wind Energy

- Construction

- Composites

- Adhesives

- Others

Market Breakup by Region

- North America

- Europe

- Asia-Pacific

- Latin America

- Middle East and Africa

Market Analysis

It is anticipated that the increased use of epoxy healing agents in applications such as coatings, wind energy, electrical and electronics, construction, composites, adhesives, and others will boost the demand for curing agents in the coming years. The increasing need for high-performance, durable, and user-friendly goods is the main factor contributing to the development of the market for epoxy-based curing agents, further enhancing the curing agents market. The growing economy, growth in end-use industrial activity, and an increase in its demand in the Asia-Pacific region are driving the growth of the coatings industry, particularly from emerging economies such as China, India, Thailand, Indonesia, and Malaysia, which is aiding the growth of the curing agents market.Competitive Landscape

The report presents a detailed analysis of the following key players in the global curing agents market, looking into their capacity, market shares, and latest developments like capacity expansions, plant turnarounds, and mergers and acquisitions:- Hexion Inc.

- BASF SE

- Huntsman Corporation

- Olin Corporation (NYSE: OLN)

- Cardolite Corporation

- Evonik Industries AG

- Kukdo Chemical Co., Ltd.

- Others

Table of Contents

Companies Mentioned

The key companies featured in this Curing Agents market report include:- Hexion Inc.

- BASF SE (ETR: BAS)

- Huntsman Corporation (NYSE: HUN)

- Olin Corporation (NYSE: OLN)

- KUKDO Chemical (Kunshan) Co., Ltd.

- Evonik Industries AG (EVK: ETR)

- Cardolite Corporation

Table Information

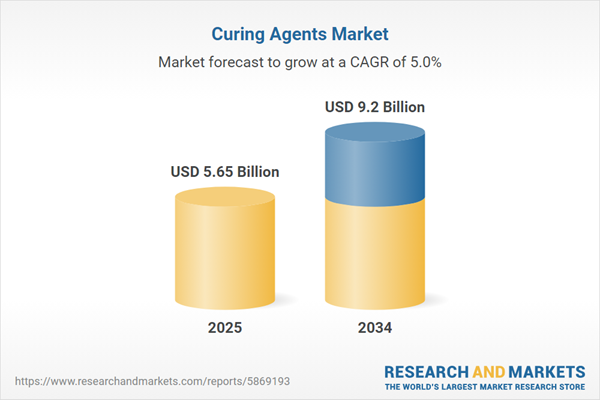

| Report Attribute | Details |

|---|---|

| No. of Pages | 160 |

| Published | August 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 5.65 Billion |

| Forecasted Market Value ( USD | $ 9.2 Billion |

| Compound Annual Growth Rate | 5.0% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |