With a growing internet user base, a greater number of people will face the threat of a cyber-attack in the agriculture industry

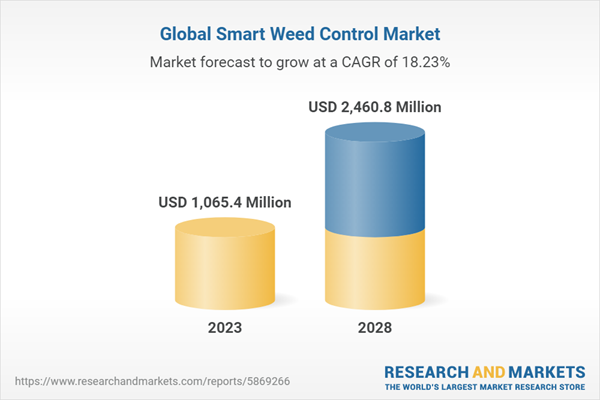

The global smart weed control market, valued at $842.7 million in 2022, is expected to reach $2,460.8 million by 2028, exhibiting a robust CAGR of 18.23% during the forecast period (2023-2028). This growth is primarily driven by the agricultural industry's growing emphasis on achieving higher crop yields while minimizing input costs. Smart weed control technologies offer precise and targeted approaches for weed management, optimized herbicide application, and effective weed control. By enabling farmers to make data-driven decisions, enhance operational efficiency, reduce resource wastage, and mitigate environmental impact, these technologies are poised to fuel the expansion of the global smart weed control market in the coming years.

Introduction of Smart Weed Control

Smart weed control leverages advanced technologies such as machine learning, computer vision, and robotics to efficiently identify and eliminate unwanted vegetation. By analyzing plant characteristics and growth patterns, these systems target weeds while minimizing the impact on desirable crops, reducing the need for chemical herbicides and manual labor. Autonomous drones, sensors, and AI-powered machinery work together to precisely apply treatment, optimizing resource usage and promoting sustainable agriculture. This innovative approach enhances yield, minimizes environmental harm, and revolutionizes weed management for modern farming, ensuring efficient and eco-friendly crop production.

Hence, smart weed control is becoming increasingly necessary in modern agriculture due to its potential to revolutionize weed management practices and address critical challenges faced by farmers and land managers. Traditional weed control methods, such as indiscriminate herbicide application and manual weeding, have limitations that smart weed control seeks to overcome. One of the primary reasons for the necessity of smart weed control is environmental sustainability. Conventional herbicide application can lead to chemical drift, causing unintended damage to non-target plants and impacting wildlife. Smart weed control, on the other hand, offers precise and targeted herbicide application, minimizing chemical usage and reducing the risk of environmental contamination.

In 2022, the global market for smart weed control reached a valuation of $842.7 million. Over the forecast period, the market is projected to exhibit a CAGR of 18.23%, reaching a value of $2,460.8 million by 2028. The market's expansion is influenced by a multitude of significant factors. These include the escalating worldwide need for food, the diminishing accessibility of water resources and arable land, the scarcity of the agricultural workforce, and the upward trend in agricultural input costs. As a cumulative effect, these factors are projected to drive the increased adoption of smart weed control technologies in the agricultural sector. These advanced technologies empower farmers to optimize resource allocation, enhance crop yield, and ultimately elevate overall agricultural productivity.

Market Segmentation

Segmentation 1: by Application

- Agriculture

- Non-Agriculture

Agriculture Applications to Dominate the Global Smart Weed Control Market (by Application)

During the projected timeframe (2023-2028), agriculture application is expected to occupy a significant market share in the global smart weed control market. Regions such as North America, the U.K., Europe, and China are anticipated to experience substantial growth in smart weeding, which can be attributed to the increasing adoption of precision agriculture practices, rising demand for sustainable farming solutions, and the need to optimize resource utilization for enhanced crop management.

Smart weed control in agricultural crops involves the integration of advanced technologies and data-driven approaches to effectively manage and control weeds. This approach goes beyond traditional blanket herbicide applications and focuses on targeted and precise weed management strategies. One key component of smart weed control is the use of precision sprayers equipped with sensors and GPS guidance systems. These sprayers can accurately detect weeds in real time and apply herbicides only to the targeted areas where weeds are present. This targeted approach minimizes herbicide usage, reduces chemical drift, and decreases the potential for crop damage, resulting in cost savings for farmers and reduced environmental impact.

Another aspect of smart weed control is the integration of remote sensing technologies, such as aerial drones or satellite imagery. These technologies enable farmers to monitor and detect weed infestations across large areas of agricultural fields. By capturing high-resolution images and using advanced algorithms, farmers can identify weed hotspots and implement timely and targeted weed control measures.

Segmentation 2: by Type

- Weed Mapping

- Weed Sensing and Management

Weed Sensing and Management Segment to Dominate the Global Smart Weed Control Market (by Type)

During the forecasted period, the weed sensing and management segment is expected to hold a significant market share in the global smart weed control market. Regions such as North America, Asia-Pacific, Europe, and China are expected to experience notable CAGR in this segment. These regions, characterized by vast geographical areas and diverse weed species, face challenges in achieving efficient weed control and yield enhancement.

Weed sensing and management refers to the use of advanced technologies and data-driven approaches to detect, monitor, and control weeds in agriculture and other landscapes. Weed sensing involves the application of various sensors and imaging technologies to identify and differentiate between crop plants and weed species. These sensors can detect specific wavelengths of light or other characteristics that help in distinguishing weeds from crops, allowing for accurate weed mapping and monitoring. The necessity of weed sensing and management arises from the significant challenges that weeds pose to agriculture and natural ecosystems.

Weeds compete with crops for essential resources such as sunlight, water, and nutrients, leading to reduced crop yields and economic losses for farmers. Moreover, some weed species are aggressive and invasive, posing a threat to native biodiversity and ecosystem balance. Weed sensing and management technologies offer a more precise and sustainable solution. By accurately identifying weed-infested areas and differentiating between crops and weeds, farmers can target interventions only where necessary. This targeted approach reduces the need for broad-spectrum herbicides, minimizing environmental impacts and safeguarding beneficial flora and fauna.

Moreover, weed sensing provides real-time data on weed distribution and growth patterns, enabling farmers to make informed decisions regarding the most effective weed management strategies. By using data analytics and artificial intelligence, farmers can optimize herbicide dosage, improve timing for weed control interventions, and ultimately achieve more efficient and cost-effective weed management.

Segmentation 3: by Region

- North America - U.S., Canada, Mexico

- Europe - Germany, France, Italy, Spain, The Netherlands, Belgium, Switzerland, Ukraine, Greece, and Rest-of Europe

- China

- U.K.

- Asia-Pacific - Japan, India, Australia and New Zealand, South Korea, and Rest-of-Asia-Pacific

- South America - Brazil and Rest-of-South America

- Middle East and Africa - Israel, South Africa, Turkey, and Rest-of-Middle East and Africa

During the forecast period, Europe, North America, and Asia-Pacific are projected to witness substantial demand for the smart weed control market. The consolidation of small farms and the consequent expansion of average field sizes is expected to create favorable conditions for the adoption of smart weed control.

The utilization of smart weed control technologies is witnessing a notable expansion in Europe, North America, Asia-Pacific, and China. This growth can be attributed to heightened research and development activities, alongside experimental field studies conducted by institutions and government entities aimed at assessing the economic advantages associated with smart weed control technologies. In South America, China, and the U.K., the rapid proliferation of start-up ventures, coupled with the demand for efficient weed elimination in food production to minimize costs, is driving the adoption of smart weed control solutions, consequently stimulating market growth.

Recent Developments in the Global Smart Weed Control Market

- In April 2023, One Smart Spray announced its new brand name, One Smart Spray. This new brand name would support the commercialization activities globally. In addition, this strategy is expected to create value among farmers and manufacturers.

- In August 2022, Trimble Inc. signed an agreement to acquire Bilberry (a selective spraying company). Through this acquisition, Trimble Inc. would expand its selective spraying capabilities for smart weed control.

- In November 2022, Ecorobotix SA launched new product features to its ARA precision sprayer. New features added to this sprayer include plant-by-plant recognition, ultra-high precision crop treatment, automatic height adjustment of the spray bar, and automatic shutdown of spraying at each row.

Demand - Drivers, Challenges, and Opportunities

Market Demand Drivers: Growing Crop Losses Due to Weed Infestation

Weed infestation refers to the proliferation and dominance of unwanted plant species within cultivated fields or natural ecosystems. Weeds are plants that exhibit vigorous growth and can compete with crops or desired vegetation for essential resources such as water, nutrients, sunlight, and space. These plants have adaptive traits that allow them to thrive in various environments, making them resilient and difficult to control.

The impact of weed infestation on agricultural systems is significant. Weeds compete with crops for resources, primarily water, nutrients, and sunlight. This competition reduces the availability of these vital resources for crops, leading to stunted growth, decreased photosynthesis, and ultimately reduced crop yields. Weeds also interfere with crop quality by contaminating harvested produce, reducing its market value, and increasing the risk of spoilage or rejection.

Moreover, weeds can act as hosts for pests and diseases. They provide refuge and food sources for insects, mites, nematodes, and pathogens that can attack crops. This association between weeds and pests/diseases creates favorable conditions for infestations, increasing the vulnerability of crops to further damage. In addition, some weed species release chemicals that inhibit the growth of nearby plants, a phenomenon known as allelopathy, further affecting crop performance. Globally, about 1,800 weed species are causing a 31.5% drop in crop production, equivalent to an economic loss of $32 billion per year.

Market Challenges: Rising Concern over Data Security with Increasing Cyber Attacks

Smart weed control systems use embedded and connected technologies such as remote sensing, global positioning systems, and communication systems to generate big data, machine learning, and data analytics. With the help of these technologies, agricultural inputs such as fertilizer, seeds, herbicides, and pesticides can be applied more precisely and can control or reduce the effect of weeds, resulting in better crop yield and reduced cost. As a result of this rapidly advancing digital revolution, the agricultural sector is more vulnerable to cyberattacks and other threats.

Since smart weed management techniques generate a huge amount of data, there are chances of security issues. There are concerns over the ownership, use of the data, and how the companies will store it. While many farmers are using the digital mode to process the information, many are reluctant to share their information with the companies that provide smart weed control solutions. This mixed feeling among the farmers is mainly due to the undefined legal and regulatory framework around data privacy, cybersecurity, and liability. In the absence of such laws, the farmers are reluctant to share the data with smart weed management solution providers. It has been found that a few third-party companies have unlawfully shared farmers’ data with third-party clients who used this information unethically to regulate the prices and to keep the grower payments below competitive levels. Hence, there is a concern among farmers regarding data privacy.

Around 92% of the total malware attacks are delivered through emails. With a growing internet user base, a greater number of people will face the threat of a cyber-attack in the agriculture industry. Smart weed management is a data-intensive operation, which means a huge amount of data is generated and analyzed during operations. Growing cyber-attacks put agricultural data under constant threat of breaching, which could lead to huge monetary as well as operational losses.

Market Opportunities: Development of Innovative and Affordable Smart Weed Control Solutions

The development of innovative and affordable smart weed control solutions is an essential aspect of modern agriculture. With the increasing demand for sustainable farming practices and the need to minimize the use of harmful herbicides, researchers and engineers have been actively working toward creating effective and environmentally friendly weed control methods. One approach to smart weed control involves the use of advanced sensors and machine learning algorithms. These sensors can be integrated into robotic platforms or mounted on drones to scan agricultural fields and identify weeds accurately. The sensors can detect specific characteristics of plants, such as color, shape, and size, allowing them to differentiate between crops and weeds. This data is then processed using machine learning algorithms, which can quickly analyze vast amounts of information and make precise decisions about which plants to target for elimination.

Once the weeds are identified, targeted application methods can be employed to eliminate them selectively. For example, precision sprayers can be used to deliver herbicides directly to the identified weed species, minimizing the use of chemicals and reducing the risk of crop damage. By combining sensor technology, machine learning, and precise application methods, farmers can effectively control weeds while reducing the overall environmental impact and optimizing resource usage. Affordability is another crucial factor in the development of smart weed control solutions. In order to ensure widespread adoption, these technologies must be economically viable for farmers of all scales.

Researchers from universities, governments, and key companies operating in the market are actively working on reducing the costs associated with sensors, robotic platforms, and data analysis algorithms. Advances in technology, economies of scale, and increased competition are driving down prices, making these solutions more accessible to farmers. For example, in 2021, the University of Florida/Institute of Food and Agricultural Sciences (UF/IFAS) collaborated with Carnegie Mellon University to develop an autonomous sprayer robot for precise weed control in multiple vegetable crops (e.g., peppers, tomatoes, etc.).

How can this report add value to an organization?

Product/Innovation Strategy: The product segment helps the reader to understand the different technologies used for smart weed control and their potential globally. Moreover, the study gives the reader a detailed understanding of the different solutions provided by smart weed control providers for imaging, processing, and analyzing. Compared to conventional agricultural methods, smart weed control enables more exact targeting of planting, soil mapping, and forestry, allowing farmers to save money by maximizing the use of their inputs.

Growth/Marketing Strategy: The global smart weed control market has seen major development by key players operating in the market, such as business expansion, partnership, collaboration, and joint venture. The favored strategy for the companies has been partnership, collaboration, and joint venture activities to strengthen their position in the global smart weed control market.

Competitive Strategy: Key players in the global smart weed control market analyzed and profiled in the study involve smart weed control-based product manufacturers, including market segments covered by distinct product kinds, applications served, and regional presence, as well as the influence of important market tactics employed. Moreover, a detailed competitive benchmarking of the players operating in the global smart weed control market has been done to help the reader understand how players stack against each other, presenting a clear market landscape. Additionally, comprehensive competitive strategies such as partnerships, agreements, and collaborations will aid the reader in understanding the untapped revenue pockets in the market.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, applications, and market penetration. The global smart weed control market is a highly competitive and fragmented industry, with many players vying for market share. The market is characterized by the presence of agricultural companies, technology-based firms, and start-ups. To survive competition in the fast-growing artificial intelligence (AI) and Internet of Things (IoT) integrated agriculture market, companies have developed strong strategies in recent years. Among all the strategies, the most preferred one by key players has been partnerships, collaborations, joint ventures, and alliances with other firms.

Deere & Company is one of the largest players in the market, with a strong presence in smart sprayers. The company offers a range of advanced solutions for mobile scouting and spraying, including precision agriculture technology and digital tools. The company has also made strategic acquisitions to expand its capabilities in the market, such as the acquisition of Bear Flag Robotics in 2021, a start-up focused on autonomous driving technology for tractors.

Other major players in the market include Trimble Inc, Naio Technologies, Carbon Robotics, Ecorobotix SA, and WEED-IT. Carbon Robotics offers robots that identify weed and thin specialty vegetable crops precisely with the help of lasers.

Key Companies Profiled:

- Carbon Bee AgTech

- Deere & Company

- Trimble Inc.

- One Smart Spray

- WEED-IT

- Ecorobotix SA

- Naio Technologies

- Latitudo 40

- Greeneye Technology

- XAG Co., Ltd.

- Carbon Robotics

- FarmWise

Table of Contents

Companies Mentioned

- Carbon Bee AgTech

- Deere & Company

- Trimble Inc.

- One Smart Spray

- WEED-IT

- Ecorobotix SA

- Naio Technologies

- Latitudo 40

- Greeneye Technology

- XAG Co., Ltd.

- Carbon Robotics

- FarmWise

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 214 |

| Published | August 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 1065.4 Million |

| Forecasted Market Value ( USD | $ 2460.8 Million |

| Compound Annual Growth Rate | 18.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 12 |