Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Urbanization, Food Security & Scarce Arable Land

Explosive urban growth is colliding with shrinking arable land per person, making proximity agriculture a strategic necessity. The UN projects that 68% of the world’s population will live in cities by 2050 (55% in 2018), concentrating food demand inside dense metros and stretching peri-urban supply chains. Vertical farming places production next to consumption, trimming spoilage and logistics emissions while stabilizing supply during disruptions. At the same time, the World Bank’s arable-land-per-capita series shows a long-run decline, reflecting demographic pressure and competing land uses; fewer hectares per person means conventional expansion can’t easily meet demand.Layer onto this FAO’s long-standing estimate that feeding mid-century populations will require ~70% more food production vs. 2005/07, and the case strengthens for yield-dense, land-efficient systems that exploit cubic rather than planar space. These structural forces (urbanization, land scarcity, higher demand) are precisely where vertical farms excel year-round output, tightly controlled environments, and high grams per square meter. Public-sector priorities are aligned: city-region food resilience, shorter supply lines, and reduced land conversion. As municipal planners and national food-security agencies wrestle with volatility - from climate shocks to transport bottlenecks - vertical farming’s ability to “in-fill” production within the built environment becomes a policy-friendly lever for resilience and equity in access to fresh produce.

Key Market Challenges

Energy Intensity & Power Price Volatility

Electricity is the single biggest operating cost for most vertical farms (LEDs, HVAC, dehumidification). When grid prices spike, unit economics can flip from marginally profitable to loss-making. The International Energy Agency (IEA) reported a 6% year-on-year decline in total EU electricity demand in H1-2023, driven largely by energy-intensive industries grappling with high prices - an indicator of how sensitive production businesses are to electricity shocks. The IEA’s 2025 mid-year update also notes that industrial electricity prices in the EU remain roughly twice U.S. levels, with renewed upward pressure possible in 2025 - conditions that can undermine scale-up plans for power-hungry farms.While long-term power purchase agreements (PPAs), on-site solar, and demand-response can mitigate risk, many urban farms lack roof area for sufficient PV, and 24/7 lighting needs don’t perfectly match solar output without storage. Policymakers are exploring industrial-tariff relief and green-power corridors, but eligibility and timelines vary. Until grids get cheaper, cleaner, and more stable - or farms systematically tap waste heat and recover latent energy - energy costs will remain the most material headwind to expansion, especially for leafy-green SKUs with tight margins. For investors, diligence now hinges on power strategy (tariffs, hedges, co-location with CHP or data-center waste heat) as much as on agronomy.

Key Market Trends

Food-Security Targets Driving Urban-Ag Pilots

National and city food-resilience goals are catalyzing pilots and early scaling of vertical farms. Singapore’s “30 by 30” program - produce 30% of nutritional needs domestically by 2030 on < 1% of land - explicitly backs high-density, resource-efficient production, with the Singapore Food Agency funding R&D and commercial trials. Similar logic underpins U.S. USDA’s UAIP grants, which channel public dollars into urban production, education, and composting networks that often include CEA facilities.In Europe, Green Deal strategies and Farm-to-Fork actions emphasize energy and water efficiency across agri-food, creating a policy umbrella for greenhouse and indoor-growing innovation (e.g., Horizon-funded projects on efficient climate control and water reuse). For city governments, vertical farms double as workforce and STEM-education hubs while supplying institutional buyers with local produce - use cases that can justify public procurement commitments. Expect more jurisdictions to adopt measurable resilience targets (percentage of fresh produce from local/urban sources; days of supply during emergencies) and to integrate vertical farming into disaster-preparedness and heat-mitigation plans (co-siting with district-energy or cooled-space programs). This policy pull - clear targets plus grant scaffolding - reduces early-stage risk and attracts private co-investment into scalable models.

Key Market Players

- AeroFarms LLC

- AmHydro

- Urban Crop Solutions

- Bowery Farming Inc.

- Freight Farms, Inc.

- Crop One Holdings, Inc.

- Altius Farms, Inc.

- Plenty Unlimited Inc.

- Upward Enterprises Inc.

- Intelligent Growth Solutions Limited

Report Scope:

In this report, Global Vertical Farming Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Vertical Farming Market, By Structure:

- Building-Based

- Container-Based

Vertical Farming Market, By Growing Mechanism:

- Hydroponics

- Aeroponics

- Aquaponics

Vertical Farming Market, By Crop Type:

- Leafy Green

- Pollinated Plants

- Nutraceutical Plants

Vertical Farming Market, By Component:

- Lighting

- Hydroponic Component

- Climate Control

- Sensors

- Others

Vertical Farming Market, By Application:

- Indoor

- Outdoor

Vertical Farming Market, By Region:

- North America

- United States

- Mexico

- Canada

- Europe

- France

- Germany

- United Kingdom

- Italy

- Spain

- Asia-Pacific

- China

- India

- South Korea

- Japan

- Australia

- South America

- Brazil

- Argentina

- Colombia

- Middle East and Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Vertical Farming Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- AeroFarms LLC

- AmHydro

- Urban Crop Solutions

- Bowery Farming Inc.

- Freight Farms, Inc.

- Crop One Holdings, Inc.

- Altius Farms, Inc.

- Plenty Unlimited Inc.

- Upward Enterprises Inc.

- Intelligent Growth Solutions Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 185 |

| Published | September 2025 |

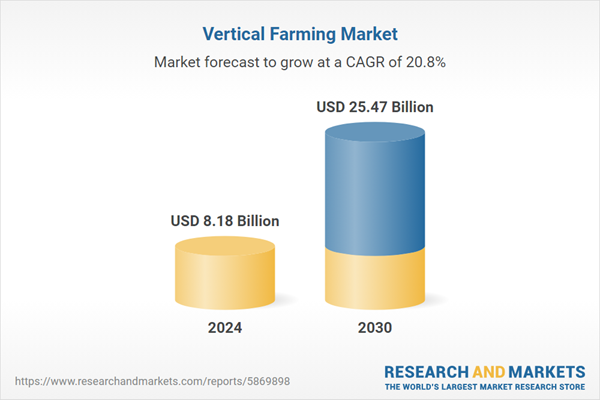

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 8.18 Billion |

| Forecasted Market Value ( USD | $ 25.47 Billion |

| Compound Annual Growth Rate | 20.8% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |