Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

One of the primary growth drivers of the market is the rising need for clean air and potable water, particularly in rapidly industrializing economies such as China, India, and Southeast Asian nations. Governments and private sectors are increasingly investing in advanced filtration technologies to address issues related to pollution, industrial effluents, and groundwater contamination. This has led to a significant rise in demand for activated carbon fibers in HVAC systems, wastewater treatment plants, and industrial exhaust filters.

Key Market Drivers

Rising Demand for Air and Water Purification

The global activated carbon fiber (ACF) market is witnessing robust growth, largely fueled by the rising demand for air and water purification solutions across industrial, commercial, and residential sectors. With increasing concerns about environmental pollution, particularly in urban areas, governments and private entities are investing in advanced filtration technologies. According to the World Health Organization (WHO), in 2022, at least 1.7 billion people worldwide relied on drinking water sources contaminated with fecal matter. Microbial contamination resulting from fecal pollution represents the most significant threat to the safety of drinking water.Activated carbon fiber, known for its high adsorption capacity and fast adsorption rates, is emerging as a preferred material for removing harmful contaminants, volatile organic compounds (VOCs), and odors from air and water systems.

In the water treatment sector, activated carbon fiber is gaining traction in both municipal and point-of-use applications due to its effectiveness in removing chlorine, heavy metals, pesticides, and other hazardous substances. Its superior surface area and pore structure allow for more efficient filtration compared to traditional activated carbon. Meanwhile, the air purification segment is seeing rising incorporation of ACF in HVAC systems, air purifiers, and industrial exhaust treatment units to combat rising particulate pollution, especially in regions like Asia-Pacific where industrialization and urban population density are high. As per the Worldometer, The population density in Asia is 156 per Km² (404 people per mi²).

The tightening of global environmental regulations and emission control standards is accelerating the adoption of activated carbon fiber in industries such as chemical manufacturing, power generation, and electronics. Companies are increasingly turning to ACF-based filters to comply with air and water discharge norms, thereby avoiding regulatory penalties and improving sustainability credentials. As awareness around health hazards linked to poor air and water quality continues to grow, the activated carbon fiber market is expected to expand further, offering significant opportunities for innovation and investment in next-generation purification technologies.

Key Market Challenges

Limited Availability of Cost-Effective Raw Materials

The production of ACF typically depends on materials such as pitch, polyacrylonitrile (PAN), and cellulose, which can be subject to price volatility and regional supply constraints. As global demand for sustainable and renewable feedstocks increases, the competition for bio-based raw materials may further constrain the growth of the ACF market. In addition, technological limitations in product performance and customization remain a barrier to market expansion. While ACF exhibits high adsorption capacity and fast kinetics, its mechanical properties and stability under extreme conditions often fall short in applications such as industrial gas processing or high-pressure filtration. Continuous R&D investment is necessary to enhance the structural integrity and chemical resistance of ACF products to broaden their usability.The market is also challenged by regulatory and environmental compliance requirements, which vary significantly across regions. Manufacturers must navigate stringent standards related to emissions, waste disposal, and occupational safety, especially in developed markets such as North America and Europe. Compliance adds complexity and cost to production operations and can delay product rollouts.

Key Market Trends

Technological Advancements

Technological advancements have emerged as a key driving force behind the growth of the global activated carbon fiber (ACF) market. ACF, known for its high surface area, fast adsorption rates, and superior regeneration capabilities compared to granular or powdered activated carbon, is finding increasingly sophisticated applications across industries. Innovations in production technologies, such as electrospinning and chemical vapor deposition (CVD), are enabling the fabrication of ACF with customized pore structures and enhanced adsorption efficiencies. These advancements are expanding the utility of ACF in emerging fields such as environmental remediation, energy storage, and wearable electronics.In the environmental sector, the integration of nanotechnology with activated carbon fiber production has significantly improved pollutant removal capabilities. Modern ACFs are now being engineered to adsorb specific contaminants, such as heavy metals, volatile organic compounds (VOCs), and greenhouse gases, with high selectivity. This has positioned ACF as a preferred choice in air and water purification systems. Additionally, recent developments in functional surface modification techniques are allowing manufacturers to tailor ACF surfaces for specific industrial uses, including catalytic supports and biomedical applications.

The growing demand for sustainable energy solutions has led to the deployment of ACF in advanced energy storage devices like supercapacitors and lithium-ion batteries. Technological improvements in carbon fiber processing have enabled the development of lightweight, conductive, and durable ACF electrodes, which contribute to improved energy density and charge-discharge performance. Research institutions and key industry players are also exploring ACF composites for use in hydrogen storage and fuel cell technologies, further broadening market potential.

The convergence of material science, nanotechnology, and process engineering is accelerating the commercialization of high-performance activated carbon fiber materials. As industries increasingly seek efficient, lightweight, and eco-friendly alternatives, technological innovations will continue to play a pivotal role in shaping the future trajectory of the global ACF market.

Key Market Players

- Anshan Sinocarb Carbon Fibers Co., Ltd.

- Kuraray Co., Ltd.

- Awa Paper & Technological Company, Inc.

- Toyobo Co. Ltd.

- Hangzhou Nature Technology Co., Ltd.

- Evertech Envisafe Ecology Co., Ltd.

- HPMS Graphite

- Osaka Gas Chemicals Co., Ltd.

- Auro Carbon & Chemicals

- Unitika Ltd.

Report Scope

In this report, Global Activated Carbon Fiber market has been segmented into the following categories, in addition to the industry trends, which have also been detailed below:Activated Carbon Fiber Market, By Type:

- Natural

- Synthetic

Activated Carbon Fiber Market, By Application:

- Air Purification

- Water Treatment

- Catalyst Carrier

- Others

Activated Carbon Fiber Market, By Region:

- North America

- United States

- Mexico

- Canada

- Europe

- France

- Germany

- United Kingdom

- Spain

- Italy

- Asia-Pacific

- China

- India

- South Korea

- Japan

- Malaysia

- South America

- Brazil

- Argentina

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive landscape

Company Profiles: Detailed analysis of the major companies in global Activated Carbon Fiber market.Available Customizations:

With the given market data, the publisher offers customizations according to a company’s specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The leading companies profiled in this Activated Carbon Fiber market report include:- Anshan Sinocarb Carbon Fibers Co., Ltd.

- Kuraray Co., Ltd.

- Awa Paper & Technological Company, Inc.

- Toyobo Co. Ltd.

- Hangzhou Nature Technology Co., Ltd.

- Evertech Envisafe Ecology Co., Ltd.

- HPMS Graphite

- Osaka Gas Chemicals Co., Ltd.

- Auro Carbon & Chemicals

- Unitika Ltd.

Table Information

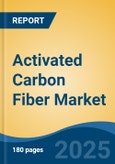

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | September 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 4.12 Billion |

| Forecasted Market Value ( USD | $ 5.93 Billion |

| Compound Annual Growth Rate | 6.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |