The textile industry in Thailand encompasses a comprehensive value chain, with more than 2,000 apparel and textile companies operating, primarily concentrated in Bangkok and eastern Thailand. This sector plays a pivotal role in contributing to the country's GDP and export earnings. Thailand stands out for its proficiency in the production, design, and marketing of home textiles, earning a global reputation as a silk producer and yarn manufacturer. Moreover, the nation excels in eco-friendly finishing, dyeing, and printing services that meet international standards, although there is room for further improvement.

Thailand's textile exports are primarily directed towards the United States, Japan, the United Kingdom, Russia, and China. The country's two economic drivers, the textile and garment industry, experienced a downturn in 2020 due to reduced foreign demand during the COVID-19 pandemic. Approximately 3,000 factories pivoted to producing masks and PPE protective clothing to survive the economic challenges. However, the Thai textile industry rebounded in 2021, restoring production to full capacity, and Thai garment and textile factories resumed operations at 100% capacity. The years 2021 and 2022 witnessed a surge in Thailand's apparel exports to the United States, driven by demand from apparel-producing regions like Vietnam, Cambodia, Indonesia, India, Europe, and U.S. garment factories.

In 2021, Thailand began relaxing control measures as the pandemic's impact waned. This, in turn, led to a rapid recovery of Thailand's textile and apparel industry exports in 2021 and 2022. During these years, textile and apparel exports amounted to US$6,526 million and US$6,850 million, respectively, representing year-on-year increases of 13.53% and 4.96%.

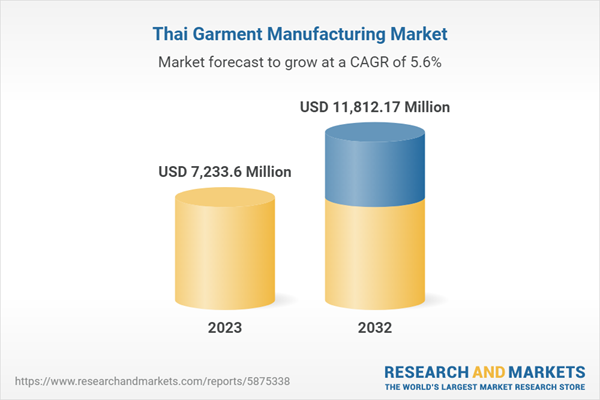

Overall, the global garment market presents substantial opportunities, with a steady upward trajectory fueled by the relocation of the global textile and apparel industry to Southeast Asia. Thailand's textile and apparel sector is experiencing rapid growth, supported and promoted by the Thai government, suggesting a promising future. the analyst anticipates that Thailand's textile and apparel exports will reach US$11.8 billion by 2032, with a Compound Annual Growth Rate (CAGR) of 5.6% from 2023 to 2032.

Topics covered:

- Thailand Garment Industry Overview

- The economic and policy environment of the Thai garment industry

- What is the impact of COVID-19 on the Thai garment industry?

- Thailand Garment Industry Market Size 2018-2022

- Analysis of major Thai garment companies

- Key Drivers and Market Opportunities in Thailand's Garment Industry

- What are the key drivers, challenges and opportunities for the Thai garment industry during the forecast period 2023-2032?

- Which are the key players in the Thailand Garment Industry market and what are their competitive advantages?

- What is the expected revenue of Thailand Garments Industry market during the forecast period of 2023-2032?

- What strategies have been adopted by the key players in the market to increase their market share in the industry?

- Which segment of the Thailand Garment Industry market is expected to dominate the market by 2032?

- What are the major unfavorable factors facing the Thai garment industry?

Table of Contents

Companies Mentioned

- Toray Industries (Thailand) Co. Ltd.

- Toray group

- NaRaYa

- Jaspal

- Thai Wacoal

- Disaya

- Vatanika

- Nanyang Garment

- Hi-Tech Garment

Methodology

Background research defines the range of products and industries, which proposes the key points of the research. Proper classification will help clients understand the industry and products in the report.

Secondhand material research is a necessary way to push the project into fast progress. The analyst always chooses the data source carefully. Most secondhand data they quote is sourced from an authority in a specific industry or public data source from governments, industrial associations, etc. For some new or niche fields, they also "double-check" data sources and logics before they show them to clients.

Primary research is the key to solve questions, which largely influence the research outputs. The analyst may use methods like mathematics, logical reasoning, scenario thinking, to confirm key data and make the data credible.

The data model is an important analysis method. Calculating through data models with different factors weights can guarantee the outputs objective.

The analyst optimizes the following methods and steps in executing research projects and also forms many special information gathering and processing methods.

1. Analyze the life cycle of the industry to understand the development phase and space.

2. Grasp the key indexes evaluating the market to position clients in the market and formulate development plans

3. Economic, political, social and cultural factors

4. Competitors like a mirror that reflects the overall market and also market differences.

5. Inside and outside the industry, upstream and downstream of the industry chain, show inner competitions

6. Proper estimation of the future is good guidance for strategic planning.

LOADING...

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 60 |

| Published | September 2023 |

| Forecast Period | 2023 - 2032 |

| Estimated Market Value ( USD | $ 7233.6 Million |

| Forecasted Market Value ( USD | $ 11812.17 Million |

| Compound Annual Growth Rate | 5.5% |

| Regions Covered | Thailand |

| No. of Companies Mentioned | 9 |