List of Tables

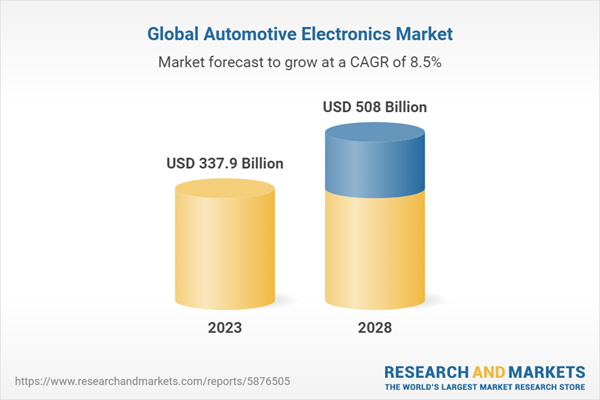

Summary Table: Global Market for Automotive Electronics, by Region, Through 2028

Table 1: Automotive Electronic Content Share in the Cost of a Car

Table 2: Autonomy Levels in Autonomous Vehicles

Table 3: Market Dynamics Impact Analysis

Table 4: Global Market for Automotive Electronics, by Application, Through 2028

Table 5: Global Market for Powertrain/Transmission and Chassis Electronics, by Region, Through 2028

Table 6: Global Market for Automotive Safety and Security Electronics, by Region, Through 2028

Table 7: Global Market for Automotive Comfort and Body Electronics, by Region, Through 2028

Table 8: Global Market for Automotive Entertainment Electronics, by Region, Through 2028

Table 9: Global Market for Automotive Other Electronics, by Region, Through 2028

Table 10: Global Market for Automotive Electronics, by Vehicle Type, Through 2028

Table 11: Global Market for Automotive Electronics in Passenger Cars, by Region, Through 2028

Table 12: Global Market for Automotive Electronics for Commercial Vehicles, by Region, Through 2028

Table 13: Global Market for Automotive Electronics for Other Types of Vehicles, by Region, Through 2028

Table 14: Global Market for Automotive Electronics, by Propulsion Type, Through 2028

Table 15: Global Market for Automotive Electronics in IC Engine Vehicles, by Region, Through 2028

Table 16: Global Market for Automotive Electronics in Electric Vehicles, by Region, Through 2028

Table 17: Global Market for Automotive Electronics in Other Types of Propulsion System Vehicles, by Region, Through 2028

Table 18: Global Market for Automotive Electronics, by Sales Channel, Through 2028

Table 19: Global Market for Automotive Electronics through the OEM Channel, by Region, Through 2028

Table 20: Global Market for Automotive Electronics through the Aftermarket Channel, by Region, Through 2028

Table 21: Global Market for Automotive Electronics, by Region, Through 2028

Table 22: North American Market for Automotive Electronics, by Country, Through 2028

Table 23: North American Market for Automotive Electronics, by Application, Through 2028

Table 24: North American Market for Automotive Electronics, by Vehicle Type, Through 2028

Table 25: North American Market for Automotive Electronics, by Propulsion Type, Through 2028

Table 26: North American Market for Automotive Electronics, by Sales Channel, Through 2028

Table 27: European Market for Automotive Electronics, by Country, Through 2028

Table 28: European Market for Automotive Electronics, by Application, Through 2028

Table 29: European Market for Automotive Electronics, by Vehicle Type, Through 2028

Table 30: European Market for Automotive Electronics, by Propulsion Type, Through 2028

Table 31: European Market for Automotive Electronics, by Sales Channel, Through 2028

Table 32: Asia-Pacific Market for Automotive Electronics, by Country, Through 2028

Table 33: Asia-Pacific Market for Automotive Electronics, by Application, Through 2028

Table 34: Asia-Pacific Market for Automotive Electronics, by Vehicle Type, Through 2028

Table 35: Asia-Pacific Market for Automotive Electronics, by Propulsion Type, Through 2028

Table 36: Asia-Pacific Market for Automotive Electronics, by Sales Channel, Through 2028

Table 37: Rest of the World Market for Automotive Electronics, by Sub-region, Through 2028

Table 38: Rest of the World Market for Automotive Electronics, by Application, Through 2028

Table 39: Rest of the World Market for Automotive Electronics, by Vehicle Type, Through 2028

Table 40: Rest of the World Market for Automotive Electronics, by Propulsion Type, Through 2028

Table 41: Rest of the World Market for Automotive Electronics, by Sales Channel, Through 2028

Table 42: Automotive Industry Trends from ESG Perspective

Table 43: Environmental Factors in the Automotive Electronics Industry

Table 44: Social Factors for the Automotive Electronics Industry

Table 45: Governance Factors for the Automotive Electronics Industry

Table 46: ESG Score for Automotive Electronics Companies

Table 47: Robert Bosch GmbH: Goals and Achievements on ESG

Table 48: Essential Patents Published on Automotive Electronics, by Applicant Company, 2022-June 2023

Table 49: M&A in Automotive Electronics, May 2020-April 2023

Table 50: Start-up Funding in Automotive Electronics, January 2020-May 2023

Table 51: Aptiv Plc: Financials, 2021 and 2022

Table 52: Aptiv Plc: Key Developments, 2022

Table 53: Aptiv Plc: Product Offerings

Table 54: Continental AG: Financials, 2021 and 2022

Table 55: Continental AG: Key Developments, 2022 and 2023

Table 56: Continental AG: Product Offerings

Table 57: Denso Corp.: Financials, 2021 and 2022

Table 58: Denso Corp.: Key Developments, 2022

Table 59: Denso Corp.: Product Offerings

Table 60: Hella GmbH & Co. KGaA: Key Developments, 2022

Table 61: Hella GmbH & Co. KGaA: Product Offerings

Table 62: Hyundai Mobis: Financials, 2021 and 2022

Table 63: Hyundai Mobis: Key Developments, 2022 and 2023

Table 64: Hyundai Mobis: Product Offerings

Table 65: Lear Corp.: Financials, 2021 and 2022

Table 66: Lear Corp.: Key Developments, 2022

Table 67: Lear Corp.: Product Offerings

Table 68: Magna International Inc.: Financials, 2021 and 2022

Table 69: Magna International Inc.: Key Developments, 2022 and 2023

Table 70: Magna International Inc.: Current Status and Future Targets for ESG

Table 71: Magna International Inc.: Product Offerings

Table 72: Panasonic Automotive Systems Co., Ltd.: Key Developments, 2022

Table 73: Panasonic Automotive Systems Co., Ltd.: Product Offerings

Table 74: Robert Bosch GmbH: Financials, 2021 and 2022

Table 75: Robert Bosch GmbH: Key Developments, 2022 and 2023

Table 76: Robert Bosch GmbH: Product Offerings

Table 77: Sumitomo Electric Industries Ltd.: Financials, 2021 and 2022

Table 78: Sumitomo Electric Industries Ltd.: Product Offerings

Table 79: Valeo: Financials, 2021 and 2022

Table 80: Valeo: Key Developments, 2022 and 2023

Table 81: Valeo: Product Offerings

Table 82: ZF Friedrichshafen AG: Financials, 2021 and 2022

Table 83: ZF Friedrichshafen AG: Key Developments, 2021-2023

Table 84: ZF Friedrichshafen AG: Product Offerings

Table 85: List of Small-Scale Players in the Automotive Electronics

Table 86: Acronyms and Abbreviations Used in This Report

List of Figures

Figure A: Research Methodology Steps

Summary Figure A: Global Market Shares of Automotive Electronics, by Region, 2022

Summary Figure B: Global Market Shares of Automotive Electronics, by Region, 2028

Figure 1: Value Chain Analysis for Market for Automotive Electronics

Figure 2: Porter’s Five Forces Model for Market for Automotive Electronics

Figure 3: Market Dynamics in the Global Market for Automotive Electronics

Figure 4: Restraints in the Global Market for Automotive Electronics

Figure 5: Global IC Engine Vehicle Production, by Vehicle Type, 2018-2022

Figure 6: Opportunities in the Global Market for Automotive Electronics

Figure 7: Global Market Shares of Automotive Electronics, by Application, 2022

Figure 8: Global Market Shares of Automotive Electronics, by Application, 2028

Figure 9: Powertrain/Transmission Electronics in Automotive Vehicles

Figure 10: Functions of an ECU in a Vehicle

Figure 11: Chassis Electronics in Automotive Vehicles

Figure 12: Advantages of Air Suspension Systems

Figure 13: Global Market Shares of Powertrain/Transmission and Chassis Electronics, by Region, 2022

Figure 14: Global Market Shares of Powertrain/Transmission and Chassis Electronics, by Region, 2028

Figure 15: Safety Electronics in Automotive Vehicles

Figure 16: Features of an Automated Parking System

Figure 17: Functions of ADAS

Figure 18: Security Electronics in Automotive Vehicles

Figure 19: Global Market Shares of Automotive Safety and Security Electronics, by Region, 2022

Figure 20: Global Market Shares of Automotive Safety and Security Electronics, by Region, 2028

Figure 21: Comfort Electronics in Automotive Vehicle

Figure 22: Body Electronics in Automotive Vehicles

Figure 23: Global Market Shares of Automotive Comfort and Body Electronics, by Region, 2022

Figure 24: Global Market Shares of Automotive Comfort and Body Electronics, by Region, 2028

Figure 25: Entertainment Electronics in Automotive Vehicles

Figure 26: Global Market Shares of Automotive Entertainment Electronics, by Region, 2022

Figure 27: Global Market Shares of Automotive Entertainment Electronics, by Region, 2028

Figure 28: Other Electronics in the Automotive Vehicles

Figure 29: Global Market Shares of Automotive Other Electronics, by Region, 2022

Figure 30: Global Market Shares of Automotive Other Electronics, by Region, 2028

Figure 31: Global Market Shares of Automotive Electronics by Vehicle Type, 2022

Figure 32: Global Market Shares of Automotive Electronics, by Vehicle Type, 2028

Figure 33: Global Market Shares of Automotive Electronics for Passenger Cars, by Region, 2022

Figure 34: Global Market Shares of Automotive Electronics for Passenger Cars, by Region, 2028

Figure 35: Global Market Shares of Automotive Electronics for Commercial Vehicles, by Region, 2022

Figure 36: Global Market Shares of Automotive Electronics for Commercial Vehicles, by Region, 2028

Figure 37: Global Market Shares of Automotive Electronics for Other Types of Vehicles, by Region, 2022

Figure 38: Global Market Shares of Automotive Electronics for Other Types of Vehicles, by Region, 2028

Figure 39: Global Market Shares of Automotive Electronics, by Propulsion Type, 2022

Figure 40: Global Market Shares of Automotive Electronics, by Propulsion Type, 2028

Figure 41: Global Market Shares of Automotive Electronics in IC Engine Vehicles, by Region, 2022

Figure 42: Global Market Shares of Automotive Electronics in IC Engine Vehicles, by Region, 2028

Figure 43: Global Market Shares of Automotive Electronics in Electric Vehicles, by Region, 2022

Figure 44: Global Market Shares of Automotive Electronics in Electric Vehicles, by Region, 2028

Figure 45: Global Market Shares of Automotive Electronics in Other Types of Propulsion System Vehicles, by Region, 2022

Figure 46: Global Market Shares of Automotive Electronics in Other Types of Propulsion System Vehicles, by Region, 2028

Figure 47: Global Market Shares of Automotive Electronics, by Sales Channel, 2022

Figure 48: Global Market Shares of Automotive Electronics, by Sales Channel, 2028

Figure 49: Global Market Shares of Automotive Electronics through the OEM Channel, by Region, 2022

Figure 50: Global Market Shares of Automotive Electronics through the OEM Channel, by Region, 2028

Figure 51: Global Market Shares of Automotive Electronics through the Aftermarket Channel, by Region, 2022

Figure 52: Global Market Shares of Automotive Electronics through the Aftermarket Channel, by Region, 2028

Figure 53: Global Market Shares of Automotive Electronics, by Region, 2022

Figure 54: Global Market Shares of Automotive Electronics, by Region, 2028

Figure 55: North American Market Shares of Automotive Electronics, by Country, 2022

Figure 56: North American Market Shares of Automotive Electronics, by Country, 2028

Figure 57: North American Market Shares of Automotive Electronics, by Application, 2022

Figure 58: North American Market Shares of Automotive Electronics, by Application, 2028

Figure 59: North American Market Shares of Automotive Electronics, by Vehicle Type, 2022

Figure 60: North American Market Shares of Automotive Electronics, by Vehicle Type, 2028

Figure 61: North American Market Shares of Automotive Electronics, by Propulsion Type, 2022

Figure 62: North American Market Shares of Automotive Electronics, by Propulsion Type, 2028

Figure 63: North American Market Shares of Automotive Electronics, by Sales Channel, 2022

Figure 64: North American Market Shares of Automotive Electronics, by Sales Channel, 2028

Figure 65: European Market Shares of Automotive Electronics, by Country, 2022

Figure 66: European Market Shares of Automotive Electronics, by Country, 2028

Figure 67: European Market Shares of Automotive Electronics, by Application, 2022

Figure 68: European Market Shares of Automotive Electronics, by Application, 2028

Figure 69: European Market Shares of Automotive Electronics, by Vehicle Type, 2022

Figure 70: European Market Shares of Automotive Electronics, by Vehicle Type, 2028

Figure 71: European Market Shares of Automotive Electronics, by Propulsion Type, 2022

Figure 72: European Market Shares of Automotive Electronics, by Propulsion Type, 2028

Figure 73: European Market Shares of Automotive Electronics, by Sales Channel, 2022

Figure 74: European Market Shares of Automotive Electronics, by Sales Channel, 2028

Figure 75: Critical Steps Taken By the Government for the Successful Deployment of Electric Vehicles and Autonomous Vehicles in the U.K.

Figure 76: Asia-Pacific Market Shares of Automotive Electronics, by Country, 2022

Figure 77: Asia-Pacific Market Shares of Automotive Electronics, by Country, 2028

Figure 78: Asia-Pacific Market Shares of Automotive Electronics, by Application, 2022

Figure 79: Asia-Pacific Market Shares of Automotive Electronics, by Application, 2028

Figure 80: Asia-Pacific Market Shares of Automotive Electronics, by Vehicle Type, 2022

Figure 81: Asia-Pacific Market Shares of Automotive Electronics, by Vehicle Type, 2028

Figure 82: Asia-Pacific Market Shares of Automotive Electronics, by Propulsion Type, 2022

Figure 83: Asia-Pacific Market Shares of Automotive Electronics, by Propulsion Type, 2028

Figure 84: Asia-Pacific Market Shares of Automotive Electronics, by Sales Channel, 2022

Figure 85: Asia-Pacific Market Shares of Automotive Electronics, by Sales Channel, 2028

Figure 86: Rest of the World Market Shares of Automotive Electronics, by Sub-region, 2022

Figure 87: Rest of the World Market Shares of Automotive Electronics, by Sub-region, 2028

Figure 88: Rest of the World Market Shares of Automotive Electronics, by Application, 2022

Figure 89: Rest of the World Market Shares of Automotive Electronics, by Application, 2028

Figure 90: Rest of the World Market Shares of Automotive Electronics, by Vehicle Type, 2022

Figure 91: Rest of the World Market Shares of Automotive Electronics, by Vehicle Type, 2028

Figure 92: Rest of the World Market Shares of Automotive Electronics, by Propulsion Type, 2022

Figure 93: Rest of the World Market Shares of Automotive Electronics, by Propulsion Type, 2028

Figure 94: Rest of the World Market Shares of Automotive Electronics, by Sales Channel, 2022

Figure 95: Rest of the World Market Shares of Automotive Electronics, by Sales Channel, 2028

Figure 96: ESG Factors for the Automotive Electronics Industry

Figure 97: Current Trends in the Global Market for Automotive Electronics

Figure 98: Emerging Technologies in the Global Market for Automotive Electronics

Figure 99: Applications of 5G Technology in Connected Vehicles

Figure 100: Applications of Blockchain Technology in Automotive Vehicles

Figure 101: Critical Applications of Edge Computing in Automotive Vehicles

Figure 102: M&A in Automotive Electronics, 2021-2023

Figure 103: Distribution Share of M&A Deals in the Market for Automotive Electronics, by Region, 2020-2023

Figure 104: Start-up Funding in the Market for Automotive Electronics, 2020-2023

Figure 105: Distribution Share of Start-up Funding Amount, by Various Rounds, 2020-2023

Figure 106: Global Market Shares of Automotive Electronics, by Leading Players, 2022

Figure 107: Adopted Strategies Share in the Global Market for Automotive Electronics, by Strategy Type, 2022

Figure 108: Aptiv Plc: Financials, 2021 and 2022

Figure 109: Aptiv Plc: Revenue Share, by Business Segment, 2022

Figure 110: Aptiv Plc: Revenue Share, by Region, 2022

Figure 111: Continental AG: Financials, 2021 and 2022

Figure 112: Continental AG: Revenue Share, by Business Segment, 2022

Figure 113: Continental AG: Revenue Share, by Region/Country, 2022

Figure 114: Denso Corp.: Financials, 2021 and 2022

Figure 115: Denso Corp.: Revenue Share, by Business Segment, 2022

Figure 116: Denso Corp.: Revenue Share, by Region/Country, 2022

Figure 117: Denso Corp.: Revenue Share, by Customers, 2022

Figure 118: Hella GmbH & Co. KGaA: Revenue Share, by Business Segment, 2022

Figure 119: Hella GmbH & Co. KGaA: Revenue Share, by Region, 2022

Figure 120: Hyundai Mobis: Financials, 2021 and 2022

Figure 121: Hyundai Mobis: Revenue Share, by Business Segment, 2022

Figure 122: Lear Corp.: Financials, 2021 and 2022

Figure 123: Lear Corp.: Revenue Share, by Business Segment, 2022

Figure 124: Lear Corp.: Revenue Share, by Region, 2022

Figure 125: Magna International Inc.: Financials, 2021 and 2022

Figure 126: Magna International Inc.: Revenue Share, by Business Segment, 2022

Figure 127: Magna International Inc.: Revenue Share, by Region, 2022

Figure 128: Robert Bosch GmbH: Financials, 2021 and 2022

Figure 129: Robert Bosch GmbH: Revenue Share, by Business Segment, 2022

Figure 130: Robert Bosch GmbH: Revenue Share, by Region, 2022

Figure 131: Sumitomo Electric Industries Ltd.: Financials, 2021 and 2022

Figure 132: Sumitomo Electric Industries Ltd.: Revenue Share, by Business Segment, 2022

Figure 133: Sumitomo Electric Industries Ltd.: Revenue Share, by Region, 2022

Figure 134: Valeo: Financials, 2021 and 2022

Figure 135: Valeo: Revenue Share, by Business Segment, 2022

Figure 136: Valeo: Revenue Share, by Region, 2022

Figure 137: ZF Friedrichshafen AG: Financials, 2021 and 2022

Figure 138: ZF Friedrichshafen AG: Revenue Share, by Business Segment, 2022

Figure 139: ZF Friedrichshafen AG: Revenue Share, by Region, 2022