Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Aging population

The aging population is a significant factor driving the growth of the Canada Contact Lenses Market. As people age, they become more likely to experience age-related vision problems, such as presbyopia and cataracts, which may require vision correction. Contact lenses are a popular option for people with these conditions, as they can provide more natural vision correction than glasses and are often more convenient for active lifestyles. Additionally, contact lenses can help address issues related to glare and depth perception, which can be particularly problematic for older adults. As the Canadian population continues to age, the prevalence of age-related vision problems is expected to increase. This, in turn, is expected to drive demand for contact lenses and other vision correction options. Moreover, the aging population is more likely to be interested in cosmetic contact lenses. This demographic group may be more willing to try colored contact lenses or other cosmetic options, driving demand for these products. Canada's population increased by more than a million people for the first time in history in 2022, almost entirely due to a surge in immigrants and temporary residents, Statistics CanadaTechnological advancements

Technological advancements have played a significant role in driving the growth of the Canada Contact Lenses Market. The development of new materials and manufacturing techniques has led to significant improvements in the comfort, safety, and convenience of contact lenses, making them more attractive to consumers. One of the key technological advancements in recent years has been the development of silicone hydrogel lenses. These lenses provide superior oxygen permeability, allowing for longer wear times and reduced risk of corneal complications. This has led to increased adoption of contact lenses among people who previously found them uncomfortable or impractical.Additionally, the availability of daily disposable lenses has made contact lenses more accessible and convenient for consumers. Daily disposables do not require cleaning or storage, reducing the risk of eye infections and making them more appealing to people with active lifestyles. Advancements in lens design and manufacturing have led to the development of custom-made contact lenses that can be tailored to an individual's specific eye shape and prescription. This has led to improved comfort and visual acuity for people with complex prescriptions or irregular corneas.

Growing usage in Fashion and cosmetics industry

Fashion and cosmetics have emerged as significant drivers of growth in the Canada Contact Lenses Market. Contact lenses can be used to enhance or change the appearance of the eyes, making them an attractive option for people interested in fashion and cosmetics. Colored contact lenses are a popular cosmetic option, allowing people to change the color of their eyes to match their clothing or makeup. Additionally, contact lenses can be used to create special effects or enhance the appearance of the eyes for theatrical or performance purposes.In recent years, there has been a growing trend towards natural-looking makeup and more subtle enhancements. Contact lenses can help to achieve this look by providing a more natural-looking correction of vision while also enhancing the appearance of the eyes. The availability of colored and cosmetic contact lenses has expanded the market beyond traditional vision correction, attracting new consumers who may not have considered contact lenses before. This has led to increased demand for these products and the emergence of new players in the market. In April 2022, Alcon launched Precision launched a disposable contact lens for astigmatism in Canada. Which is a daily disposable silicone hydrogel (SiHy) contact lens and is designed for astigmatic patients.

Increased awareness of eye health

Increased awareness of eye health has played a significant role in driving the growth of the Canada Contact Lenses Market. As people become more aware of the importance of regular eye exams and proper eye care, they are more likely to seek out vision correction options, including contact lenses. Regular eye exams can help to detect and address vision problems early, reducing the risk of complications and improving overall eye health.Contact lenses can be an effective option for correcting vision problems, particularly for people with mild to moderate refractive errors. Moreover, increased awareness of eye health has led to a growing demand for contact lenses that are safe, comfortable, and reliable. Consumers are more likely to seek out high-quality products that are backed by scientific research and comply with strict safety and quality standards. The growing focus on eye health has led to increased demand for contact lenses with specialized features, such as UV protection, blue light filtering, and moisture retention. These features can help to protect the eyes from damage and improve overall eye health. Meanwhile, only 39 per cent are familiar with age-related macular degeneration (AMD) which is the second leading cause of blindness, affecting nearly 2 million Canadians.

Online sales channels

Online sales channels have emerged as a significant driver of growth in the Canada Contact Lenses Market. The convenience and accessibility of online shopping have made it easier for consumers to purchase contact lenses from the comfort of their homes. Online sales channels offer a wide variety of contact lenses, including specialty products that may not be available at traditional brick-and-mortar stores. This has expanded the market and created opportunities for market players to reach new consumers. Moreover, online sales channels often offer competitive pricing, discounts, and promotions that can make contact lenses more affordable for consumers.This has made it easier for people to purchase contact lenses regularly and to try new products. The availability of online resources, such as product reviews, customer ratings, and expert advice, has helped to increase consumer confidence in purchasing contact lenses online. This has led to increased adoption of online sales channels among both new and existing contact lens wearers. The increasing popularity of online sales channels has led to the emergence of new market players and the expansion of the market. Online sales channels offer convenience and accessibility for consumers, making it easier for them to purchase contact lenses regularly and to try new products.

Recent Development

- Acuvue Oasys with Transitions: This contact lens product from Johnson & Johnson was launched in Canada in 2019. It features light-adaptive technology that automatically darkens and lightens in response to changing light conditions, reducing glare and providing additional protection against harmful UV rays.

- Bausch + Lomb ULTRA Multifocal for Astigmatism: This product was launched in Canada in 2019 and is designed for people with presbyopia and astigmatism. It features a unique lens design that provides clear vision at all distances and is made with Bausch + Lomb's MoistureSeal technology for all-day comfort.

- CooperVision MiSight 1 Day: This contact lens product was launched in Canada in 2020 and is designed to slow the progression of myopia (nearsightedness) in children. It features a unique lens design that reduces the strain on the eye and helps to reduce the progression of myopia over time.

Market Segmentation

Canada Contact Lenses Market can be segmented by material type, design type, wear type, application, distribution channel, and region. Based on Material Type, Canada Contact Lenses market can be segmented into Silicone hydrogel, Hydrogel, Others. Based on Design Type, Canada Contact Lenses market can be segmented into Spherical, Toric, Multifocal, Others. Based on Wear Type, Canada Contact Lenses market can be segmented into Monthly Disposable, Daily Disposable & Yearly Disposable. Based on Application, Canada Contact Lenses market can be segmented into Corrective, Cosmetic & Others. Based on Distribution Channel, Canada Contact Lenses market can be segmented into Retail Stores, Hospitals & Clinics, online.Market Players

Bausch & Lomb Canada Inc, Alcon Canada, Inc., Johnson & Johnson Inc., Cooper Vision Ltd, Carl Zeiss Canada Ltd., Essilor Luxottica Canada Inc., Minuteman Canada Inc, Contamac Holdings Ltd. are some of the leading players operating in the Canada Contact Lenses Market.Report Scope

In this report, the Canada Contact Lenses market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Canada Contact Lenses Market, by Material Type:

- Silicone hydrogel

- Hydrogel

- Others

Canada Contact Lenses Market, by Design Type:

- Spherical

- Toric

- Multifocal

- Others

Canada Contact Lenses Market, by Wear Type:

- Monthly Disposable

- Daily Disposable

- Yearly Disposable

Canada Contact Lenses Market, by Application:

- Corrective

- Cosmetic

- Others

Canada Contact Lenses Market, by Distribution Channel:

- Retail Stores

- Hospitals & Clinics

- Online

Canada Contact Lenses Market, by Region:

- Ontario region

- Quebec region

- Alberta region

- British Columbia region

- Saskatchewan and Manitoba region

- Rest of Canada

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Canada Contact Lenses Market.Available Customizations

The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Bausch & Lomb Canada Inc.

- Alcon Canada, Inc.

- Johnson & Johnson Inc.

- Cooper Vision Ltd.

- Carl Zeiss Canada Ltd.

- Essilor Luxottica Canada Inc.

- Minuteman Canada Inc.

- Contamac Holdings Ltd

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 75 |

| Published | August 2023 |

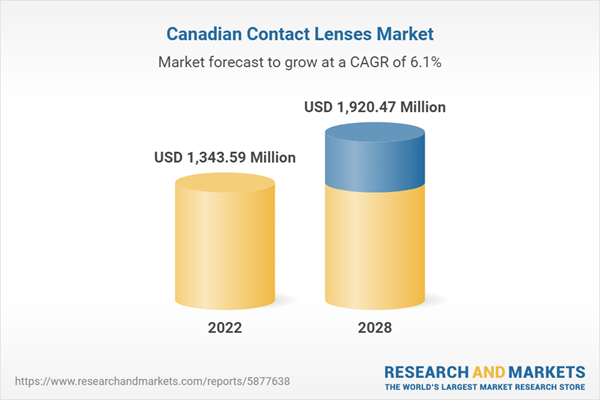

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 1343.59 Million |

| Forecasted Market Value ( USD | $ 1920.47 Million |

| Compound Annual Growth Rate | 6.0% |

| Regions Covered | Canada |

| No. of Companies Mentioned | 8 |