Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Data centers are created and built as mission-critical infrastructure to process data produced by consumers and commercial end users. Fiber optic cables connected to satellites or telecommunication broadband connectivity connect data centers to customers and companies. Servers, storage, network, and other IT infrastructure are all included in data centers to process and store user data. In order to provide end customers with services that are highly available, extremely dependable, and scalable, data centers also include power and cooling infrastructure. Depending on their location, size, and capacity, data centers can cost hundreds to billions of dollars to construct.

5G Will Increase Investments in Edge Data Centers

Edge computing is becoming more popular in the market as a result of the rising use of connected devices among consumers and organizations. In many Tier II and Tier III cities as well as in rural areas, this has resulted in a significant demand for higher-bandwidth internet, necessitating the construction of data centers to process information on par with big cities’ data requirements. Edge data centers have developed a decentralized data center architecture in which numerous edge data centers are linked to a single hyperscale facility. Over 50 Saudi Arabian cities have 5G coverage as of February 2021, with significant market participants including Zain, Saudi Telcom Company, and MOBILY. In 44 cities, Zain is offering 5G connections. Saudi Telecom Company is second with 22 cities, while MOBILY is third with 21 cities. An ICT infrastructure business in Saudi Arabia named TAWAL has teamed up with Nokia to offer turnkey services for the deployment and extension of 5G for TAWAL's infrastructure in Saudi Arabia. Throughout Saudi Arabia, TAWAL will upgrade approximately 670 4G sites with Nokia's 5G technology. In 2021, Nokia will also swap out older towers for newer ones. Together with network infrastructure partner Infovista and its radio planning portfolio, Zain began Phase II of its 5G deployment in Saudi Arabia in January 2021.Moreover, In Saudi Arabia, Nokia and Saudi Telecom Company (STC) have partnered to develop innovative 5G use cases. Nokia will oversee STC's Technology Innovation Center and provide STC with use cases for the latest 5G technology. Additionally, STC has been contracted to offer 5G and IoT services for the construction of NEOM, a megacity being built in Saudi Arabia. Additionally, STC has teamed with Huawei and CISCO for the project's core infrastructure needs, as well as Ericsson and Nokia for the delivery of 5G radio networks. Additionally, starting in December 2020, STC will work with MediaTek and Ericsson to offer 5G non-standalone data calls by using MediaTek's 5G chipset and Ericsson's Ericsson Spectrum Sharing (ESS) in the FDD band.

Growing Use of Refined Energy

Many data center service providers have invested in clean, renewable energy sources to run their existing and future facilities as a result of the rising data center power usage and the desire to reduce carbon footprint. The two main energy sources in Saudi Arabia are oil and natural gas, both of which have a negative influence on the environment. Moreover, The King Salman Renewable Energy Initiative and Vision 2030 both call for the National Renewable Energy Program (NREP) to be implemented in order to fully utilize the country's potential for renewable energy. Over the next ten years, Saudi Arabia is anticipated to receive an investment of more than USD20 million for the production of renewable energy.Market Segmentation

The Saudi Arabia Data Center Market is divided into solution, type, and end user industry. Based on Solution, the market is divided into IT Infrastructure, General Infrastructure, Electrical Infrastructure, Mechanical Infrastructure and Others. Based on type, the market is segmented into Corporate and Web Hosting. Based on End User Industry, the market is divided into IT & Telecom, Government, BFSI, Healthcare and Others.Market Players

Major market players in the Saudi Arabia Data Center Market are Nournet, Detasad (Detecon Al Saudia Co. Ltd.), Etihad Etisalat Company (Mobily), Saudi Telecom Company, Salam Mobile Company, Gulf Data Hub, DETASAD (Detecon Al Saudia Co. Ltd.), Go DC (Etihad Atheeb Telecom. (GO)), Nashirnet (Cloud Layers Co.), Saudi FAS Holding Co.Report Scope

In this report, the Saudi Arabia Data Center Market has been segmented into following categories, in addition to the industry trends which have also been detailed below:Saudi Arabia Data Center Market, by Solution:

- IT Infrastructure

- General Infrastructure

- Electrical Infrastructure

- Mechanical Infrastructure

- Others

Saudi Arabia Data Center Market, by Type:

- Corporate

- Web Hosting

Saudi Arabia Data Center Market, by End User Industry:

- IT & Telecom

- Government

- BFSI

- Healthcare

- Others

Saudi Arabia Data Center Market, by Region:

- Eastern Region

- Northern & Central Region

- Western Region

- Southern Region

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Saudi Arabia Data Center Market.Available Customizations

The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Nournet

- Detasad (Detecon Al Saudia Co. Ltd.)

- Etihad Etisalat Company (Mobily)

- Saudi Telecom Company

- Salam Mobile Company

- Gulf Data Hub

- DETASAD (Detecon Al Saudia Co. Ltd.)

- Go DC(Etihad Atheeb Telecom. (GO))

- Saudi FAS Holding Co.

- Nashirnet (Cloud Layers Co.)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 88 |

| Published | September 2023 |

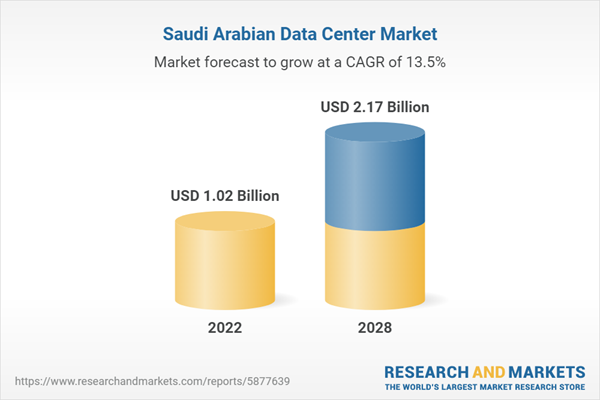

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 1.02 Billion |

| Forecasted Market Value ( USD | $ 2.17 Billion |

| Compound Annual Growth Rate | 13.4% |

| Regions Covered | Saudi Arabia |

| No. of Companies Mentioned | 10 |