The increasing funding activities in laboratory automation are acting as a robust driver for the market

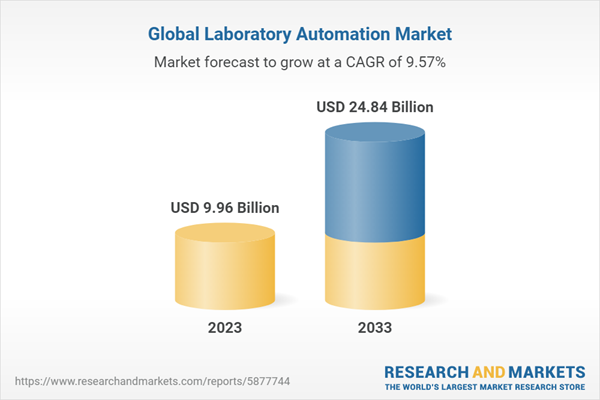

The global laboratory automation market was valued at $9.17 billion in 2022 and is anticipated to reach $24.84 billion by 2033, witnessing a CAGR of 9.57% during the forecast period 2023-2033. Laboratory automation refers to the use of technology and equipment to perform various laboratory tasks, experiments, and analyses with minimal human intervention. The goal of laboratory automation is to increase efficiency, accuracy, reproducibility, and throughput in scientific research, testing, and experimentation.

Market Introduction

As per BIS Research, the laboratory automation market by product has been segmented into liquid handling instruments, appliances, accessories, and software. The liquid handling instruments segment includes both fully automated and semi-automated liquid handling systems and software, including the laboratory information management system (LIMS) software, in addition to the liquid handling system software. These laboratory automation liquid handling instruments are generally used in applications such as drug discovery and pharma development, cell culture and regenerative medicine, genomics and molecular biology, and clinical diagnostics, and the key end users targeted include life sciences and biopharma companies, diagnostic labs, CROs, CDMOs, and research and academics, among others.

Industrial Impact

The current landscape of the laboratory automation market is characterized by a dynamic interplay of various stakeholders, technologies, and trends that collectively shape the industry's growth and innovation. This ecosystem encompasses a wide range of components, from technology providers and manufacturers to distributors, end users, regulatory bodies, and industry associations.

The future potential of the laboratory automation market is immense, driven by rapid technological advancements, evolving industry demands, and the need for increased efficiency and precision in scientific research, diagnostics, and production processes. As industries such as pharmaceuticals, biotechnology, healthcare, and beyond continue to expand, laboratory automation is expected to play a pivotal role in shaping their growth trajectories. Integration of artificial intelligence, machine learning, and robotics is further anticipated to lead to smarter and more autonomous laboratories, enabling real-time data analysis, predictive insights, and adaptive experiment design. Seamless connectivity between instruments, cloud-based data management, and remote monitoring will further revolutionize the way laboratories operate, enhancing collaboration and enabling researchers to focus on complex tasks requiring human expertise.

Market Segmentation

Segmentation 1: by Product

- Liquid Handling

- Appliances and Accessories

- Software

Liquid Handling to Dominate the Global Laboratory Automation Market (by Product Type)

Based on product type, the laboratory automation market was led by the liquid handling segment, with a 66.73% share in 2022. Precise liquid handling is of paramount significance across a spectrum of sectors, encompassing biotechnology, pharmaceuticals, research facilities, diagnostic labs, academia, and more. These systems find diverse utility in laboratories, spanning domains such as drug discovery, genomics, clinical analysis, proteomics, and numerous other disciplines.

Segmentation 2: by Application

- Clinical Diagnostics

- Proteomics

- Genomics and Molecular Biology

- Drug Discovery and Pharma Development

- Cell Culture and Regenerative Medicine

- Forensic Applications

- Others

Drug Discovery and Pharma Development to Occupy the Largest Share in the Global Laboratory Automation Market (by Application)

Currently, the drug discovery and pharma development segment is dominating the laboratory automation market, and it held a market share of 30.97% in 2022.

Segmentation 3: by End User

- Pharmaceutical and Biotechnology Organizations

- Bio-Pharmaceutical Industries and CROs

- Clinical Laboratories

- Academic Institutes and Research Organizations

- Other End Users

Pharmaceutical and Biotechnology Organizations to Dominate the Global Laboratory Automation Market (by End User)

Based on end users, the laboratory automation market was led by pharmaceutical and biotechnology organizations, with a 32.18% share in 2022. The pharmaceutical and biotechnology organizations are key end users driving the growth of the laboratory automation market. These industries heavily rely on precise and efficient laboratory processes for drug discovery, development, and production. Laboratory automation offers them a range of benefits that align with their complex and dynamic requirements.

Segmentation 4: by Region

- North America - U.S., Canada

- Europe - Germany, U.K., France, Italy, Spain, and Rest-of-Europe

- Asia-Pacific - Japan, India, China, South Korea, Australia, and Rest-of-Asia-Pacific

- Latin America - Brazil, Mexico, and Rest-of-Latin America

- Rest-of-the-World

Regions such as North America and Europe have technologically advanced industries and allocate considerable budgets for laboratory advancements. Moreover, they have the maximum adoption of laboratory automation solutions, due to which these regions hold the maximum share in the global laboratory automation market. Furthermore, Asia-Pacific is anticipated to register significant growth during the forecast period 2023-2033 owing to factors such as the growing pharmaceutical and biotechnology industry and the need for automation due to a shortage of laboratory workforce.

Recent Developments in the Laboratory Automation Market

- In May 2023, Abbott Laboratories launched its GLP Systems Track Laboratory Automation Solution. By utilizing an automated sample delivery track system, the GLP TLA system demonstrates remarkable efficiency by seamlessly processing a total of 900 samples per hour.

- In June 2023, Becton, Dickinson and Company introduced the BD FACSDuet Premium Sample Preparation System, an innovative automated device tailored for sample preparation in clinical diagnostics utilizing flow cytometry. This cutting-edge instrument offers a comprehensive ""walkaway"" workflow solution, enhancing consistency and reproducibility in cellular diagnostics. By incorporating liquid-handling robotics, the BD FACSDuet system fully automates the sample preparation procedure, catering to both in vitro diagnostics (IVD) and customizable tests.

- In January 2023, Becton, Dickinson and Company unveiled an innovative robotic track system designed for the BD Kiestra microbiology laboratory solution. This system streamlines the processing of lab specimens through automation, potentially leading to a reduction in manual labor and waiting times for test results.

- In February 2023, Beckman Coulter collaborated with SCIEX to bring automation to SCIEX’s Echo MS system.

- In July 2023, Beckman Coulter obtained FDA clearance for the DxC 500 AU Chemistry Analyzer, which is an automated system for chemistry analysis.

Demand - Drivers, Challenges, and Opportunities

Market Demand Drivers:

Improved Turn-Around Time and Reduced Cost by Implementing Laboratory Automation: There has been a rising need for increased efficiency, productivity, and accuracy in laboratories, which can be tackled by implementing laboratory automation solutions. This ability of laboratory automation solutions to increase efficiency, productivity, and accuracy by improving the turn-around time and reducing cost in a laboratory can act as a prominent driver for the market.

Increased Demand for Laboratory Automation due to Shortage of Skilled Laboratory Staff: The shortage of skilled laboratory staff has become a pressing concern in various industries, including healthcare, pharmaceuticals, biotechnology, and research. In a survey conducted in July 2022 by Lighthouse Lab Services, titled “2022 Wage and Morale Survey of Medical Laboratory Professionals,” it was revealed that 40% of the respondents of the survey reported their laboratories to be moderately understaffed, while 33% characterized their labs as significantly understaffed.

Technological Advancements in the Field of Laboratory Automation: The laboratory automation landscape is being shaped by an ever-advancing wave of technological innovations. These innovations are revolutionizing the way laboratories operate, accelerating research, and expanding the horizons of scientific discovery.

Increasing Funding Activities in the Market: The increasing funding activities in laboratory automation are acting as a robust driver for the market. These financial support mechanisms, whether from private investments, government initiatives, or research institutions, play a pivotal role in shaping the trajectory of the laboratory automation market. These fundings enable technological advancements, acceleration of research and development, and empower laboratories to embrace cutting-edge solutions.

Market Challenges:

High Capital Investment and Maintenance Costs:The laboratory automation market faces significant restraints due to the high capital investment and maintenance costs associated with the adoption and maintenance of automation technologies. While laboratory automation offers numerous benefits, the substantial upfront expenses and ongoing maintenance costs can pose challenges for potential adopters.

Complexity of Integration with Existing Laboratory: While laboratory automation promises enhanced efficiency and innovation, the seamless integration of these advanced solutions with existing laboratory setups poses a notable challenge. The complexity of merging new automation technologies with established workflows and infrastructure might hamper the growth of the laboratory automation market.

Market Opportunities:

Partnerships and Alliances Creating an Opportunity for Growth: Partnerships and collaborations can create a significant opportunity for growth. They can facilitate the growth of a market player by leveraging shared expertise, increased customer base, enhanced product offering, access to new markets, access to new technologies, shared costs, increased credibility, and joint innovation and R&D are some of the benefits that partnerships and collaboration may offer to a market player seeking the expansion of its footprint.

Increasing Opportunity for Laboratory Automation in Emerging Economies: Emerging economies present an increasing opportunity for laboratory automation solutions owing to several factors, such as rapid industrialization, advancements in research and development, and the lack of specialized healthcare professionals, among others. Emerging economies are actively investing in research and development, spanning fields such as pharmaceuticals, biotechnology, and life sciences, among others.

How Can This Report Add Value to an Organization?

Product/Innovation Strategy: The global laboratory automation market has been segmented on the basis of various categories, such as product, application, end user, and region. The product segment has been further sub-segmented into semi-automated and fully automated liquid handling systems. This can help readers get a clear overview of which segments account for the largest share and which ones are well-positioned to grow in the coming years. Additionally, the market shares of the companies that lie in these segments are also given for liquid handling systems.

Growth/Marketing Strategy: New offerings, partnerships, collaborations, business expansions, and regulatory and legal activities accounted for the maximum number of key developments, and nearly 86% of the total developments in the global laboratory automation market were between January 2021 and July 2023.

Competitive Strategy: The global laboratory automation market is a highly fragmented market, with many smaller and private companies constantly entering the market. Key players in the global laboratory automation market analyzed and profiled in the study involve established players that offer various kinds of instruments, appliances and accessories and software.

Key Market Players and Competition Synopsis

The companies that are profiled have been selected based on inputs gathered from primary experts and analyzing company coverage, product portfolio, and market penetration.

Key Companies Profiled:

- Danaher Corporation

- Thermo Fisher Scientific, Inc.

- F. Hoffmann-La Roche Ltd

- Abbott Laboratories

- Revvity, Inc.

- Eppendorf SE

- Waters Corporation

- Endress+Hauser Group Services AG

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc

- BIOMÉRIEUX

- QIAGEN N.V.

- Siemens Healthcare GmbH

- Tecan Trading AG

Table of Contents

Executive Summary

The global laboratory automation market is estimated to reach $24.84 billion in 2033, reveals the premium market intelligence study by BIS Research. The study also highlights that the market is set to witness a CAGR of 9.57% during the forecast period 2023-2033.

USP of the Report

- Product specifications, product benchmarking, and comparative analysis

- Market share given globally, for fully automated and semi-automated

- Both value-based and volume-based analysis provided

- Market dynamic analysis of the opportunities, trends, and challenges in the market

- Competitive benchmarking of key players for each product type

- Growth share analysis for key segments

Analyst Perspective

According to Nitish Kumar, Principal Consultant with the publisher, “Growing healthcare research and development throughout the world is generating a need for better laboratory automation as well. This is the key reason behind the rising adoption of laboratory automation systems around the world. The Asia-Pacific laboratory automation market, particularly, is expected to register significant growth during the forecast period 2023-2033.”

Key Companies Operating in The Market

The global laboratory automation market is a highly fragmented market, with many smaller and private companies constantly entering the market. Key players in the global laboratory automation market analyzed and profiled in the study involve established players that offer various kinds of instruments, appliances and accessories and software.

The key players profiled in the report include Danaher Corporation, Thermo Fisher Scientific, Inc., F. Hoffmann-La Roche Ltd, Abbott Laboratories, Revvity, Inc., MGI Tech Co., Ltd., Eppendorf SE, Waters Corporation, Endress+Hauser Group Services AG, Becton, Dickinson and Company, Bio-Rad Laboratories, Inc, BIOMÉRIEUX, QIAGEN N.V., Siemens Healthcare GmbH, and Tecan Trading AG

Key Questions Answered in the Report

- What are the major market drivers, challenges, and opportunities in the global laboratory automation market?

- What are the significant developmental strategies implemented by the major players to sustain in the competitive market?

- What is the unit sold for liquid handling automation systems in the market?

- What are the average prices for different products in the market?

- Who are the leading players with significant offerings to the laboratory automation market? What is the current market dominance for each of these leading players?

- What is the regulatory framework in the global laboratory automation market?

- What is the growth potential of the global laboratory automation market in North America, Europe, Asia-Pacific, Latin America, and Rest-of-the-World?

Companies Mentioned

- Danaher Corporation

- Thermo Fisher Scientific, Inc.

- F. Hoffmann-La Roche Ltd

- Abbott Laboratories

- Revvity, Inc.

- Eppendorf SE

- Waters Corporation

- Endress+Hauser Group Services AG

- Becton, Dickinson and Company

- Bio-Rad Laboratories, Inc

- BIOMÉRIEUX

- QIAGEN N.V.

- Siemens Healthcare GmbH

- Tecan Trading AG

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 222 |

| Published | September 2023 |

| Forecast Period | 2023 - 2033 |

| Estimated Market Value ( USD | $ 9.96 Billion |

| Forecasted Market Value ( USD | $ 24.84 Billion |

| Compound Annual Growth Rate | 9.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 14 |