The isopropyl alcohol market is expected to surge, owing to the requisite role of isopropyl alcohol in cleaning, sanitization, and disinfectants. The sanitizers market size was further propelled due to increasing demand during the COVID-19 pandemic. Sterilization and sanitization of medical devices is crucial to meet healthcare standards and isopropyl alcohol is most widely used in pharmaceutical and the healthcare sector. The need for hygiene and infection prevention in both hospitals and pharmaceutical facilities have been on the rise and is a key factor driving the market.

Isopropyl Alcohol Market Trends

The market for isopropyl alcohol is growing considerably due to increased demand for personal care and cosmetics applications. The advancements in chemical production efficiency lend to larger applications chemical manufacturing processes and have now afforded more access to industry-grade applications. In the cosmetics space, it’s used in products like cleansers, toners and makeup removers. The performance of isopropyl alcohol as an additive ingredient in hand sanitizers will make isopropyl alcohol more ubiquitous in consumer products, especially in personal hygiene. Consumer interests in health and sanitary cleanliness will lead to more products with isopropyl alcohol, including hand sanitizers and sanitizing solutions. Accessibility to a versatile chemical such as isopropyl alcohol is an additional driver of adoption in the manufacturing of isopropyl alcohol as well as in other formulations in many industrial uses. Overall, it is indicative of a strong growth curve sustained by adoption and also moderation of any other consumer or industrial applications.Application Insights

The isopropyl alcohol compound is also famous for its solvent property since it can even dissolve a wide range of surface dirt, oils, and substances. Isopropyl alcohol is often used in the cosmetic and pharmaceutical industries to create lotions and creams, and medicinal solutions. The chemical industry appreciates its solvent properties, utilizing it in chemistry and compound production. The overall industrial and consumer products demand for isopropyl alcohol is primarily based on the variety of solvent uses in isopropyl alcohol.Isopropyl alcohol is also used as a cleaning agent. It is commonly found in disinfectants, household cleaners, and sanitizers, used most commonly within hospitals and medical settings. As an antiseptic, isopropyl alcohol both cleans wounds as well as sterilizes medical and surgical equipment, reducing the chance for infection to occur. Due to its antiseptic properties, isopropyl alcohol has a role in personal care products such as hand sanitizers and antiseptic wipes for general consumers, and as a chemical intermediate in the production of other chemicals. Therefore, isopropyl alcohol is a needed product or resource within many industrial sectors.

End Use Insights

The cosmetics & personal care industry represents one of the primary end-users of isopropyl alcohol where it is widely used as a solvent, preservative, and disinfectant in products like skincare lotions, toners, makeup removers, and hair care products. Its capacity to dissolve oil-based and water-based products allows isopropyl alcohol to be used as a key ingredient in the manufacturing of cosmetics. Isopropyl alcohol can also be used in personal hygiene and personal care products like hand sanitizers, where it can maximize productivity for germ-killing functions. Due to the continuing consumer focus on hygiene and skincare, the consumption of isopropyl alcohol for cosmetics and personal care is likely to further increase.Isopropyl alcohol is broadly used in the pharmaceutical industry as a solvent, in antiseptics, disinfectants, and cleaning solutions. It is also commonly used in the sterilization of medical devices and the disinfection of healthcare equipment. Isopropyl alcohol serves as a vital component, beyond healthcare, within the food and beverages sector, serving the purpose of flavor extraction or food processing while also sterilizing the equipment. It is also widely used in paints and coatings as a solvent to achieve the desired texture and finish as well. Finally, isopropyl alcohol plays an essential role in chemical processes, as it is utilized as a solvent and a chemical intermediate for creating different compounds. Isopropyl alcohol is widely used across these industries and being a major driver of its global market growth.

Regional Insights

Asia-Pacific Isopropyl Alcohol Market

The Asia-Pacific market holds a significant share of the global isopropyl alcohol market with rapid industrialization and increasing demand for consumer products. Asia-Pacific accounts for a significant portion of the global isopropyl alcohol market, following the cosmetics, pharmaceutical, and chemical sectors. Absence of effective penetration in hygiene and personal care production, especially post-COVID-19 in the region has increased the demand for isopropyl alcohol in hand sanitizers, disinfectants, and cleaning agents. Furthermore, chemical manufacturing approaches and production proficiency of nations such as China and India also add to the progression of the market. The healthcare sector is witnessing robust growth and the wider application of isopropyl alcohol in the industry, aiding the direct expansion of the market in Asia-Pacific, and becomes an indirect driving factor for the regional market that is expected to contribute a major portion towards the overall value of global isopropyl alcohol market.China Isopropyl Alcohol Market

China is a leading global supplier of isopropyl alcohol, thanks to large-scale manufacturing capacity and strong chemical production capabilities. Additionally, with the growing demand of disinfectants and cleaning products, the market of China will maintain steady growth trends. Stringent government regulations with respect to concentrations and standards led to isopropyl alcohol becoming a clean agent, boosting its demand for several industrial applications including automotive, electronics, and paints.India Isopropyl Alcohol Market

The isopropyl alcohol market is experiencing consistent growth in India, driven by its increasing adoption in different applications, particularly in personal care and pharmaceutical industries. Enhanced hygiene and personal care consciousness, especially post-COVID-19 pandemic, has significantly boosted the demand for isopropyl alcohol in hand sanitizers and disinfectants. Moreover, the growing industrial sectors of India such as chemicals and paints have also boosted the growth of the market. The continuous thrust on optimizing production efficiencies and developing indigenous manufacturing capabilities is making India a major market for isopropyl alcohol in the Asia-Pacific region.North America Isopropyl Alcohol Market

The North America isopropyl alcohol market is growing at a steady rate due to strong demand from end user industries including pharmaceuticals, cosmetics and chemicals. Due to increasing demand for personal care, sanitization and disinfection products, the market has witnessed substantial growth in recent years, particularly in light of the COVID-19 pandemic. In addition, industrial use, including electronics manufacture, paints and coatings, is still bringing in the demand for isopropyl alcohol. Furthermore, North America's advanced healthcare and pharmaceutical sectors are crucial to the expansion of this market.U.S. Isopropyl Alcohol Market

In the U.S., the demand for isopropyl alcohol is strong because it is used widely in personal care products, sanitizers, and disinfectants. Distilled alcohol-based sanitizing products, among other products, have become commonplace in the U.S. since the onset of the pandemic. The increasing requirements for the healthcare and pharmaceutical industries also leads to the growth in demand for isopropyl alcohol, used for the sterilization of medical devices and equipment. In addition, consumers investing heavily on beauty products also contribute to the overall growth of the market in the U.S., making it a key player in North America segment.Canada Isopropyl Alcohol Market

With isopropyl alcohol being an essential ingredient in disinfectants and cleaning products, and used widely in hand sanitizers, there has been an increase of isopropyl alcohol consumption in Canada. The increasing numbers of pharmaceutical/fashion industries in Canada are the key factor driving the market, as the demand for hygiene liquids is perpetually increasing. Furthermore, the chemical industry in Canada is growing, contributing to industrial applications of isopropyl alcohol in coatings, paints, and solvents. The growing emphasis on health and safety standards is expected to span throughout North America, where Canada will remain an important market for isopropyl alcohol, fostering its growth.Europe Isopropyl Alcohol Market

The Europe market observes an increased usage of hand sanitizers, disinfectants, and cleaning products that may be attributed to the growing consciousness towards personal hygiene and cleanliness, especially after the COVID-19 pandemic. Europe’s established chemical and manufacturing industries, where isopropyl alcohol is used as a solvent and in coatings, paints and cleaning agents, also support the market. Moreover, strict regulatory measures on safety and health standards have fostered a consistent demand for quality isopropyl alcohol.Germany Isopropyl Alcohol Market

The isopropyl alcohol market growth in Germany is supported by a robust industrial and manufacturing base. The pharmaceutical and cosmetic industries in Germany are key drivers of demand, with Germany manufacturing a variety of personal care and medical products. Germany’s chemical and automotive industries use isopropyl alcohol to clean, as a solvent and in coatings. Especially during the pandemic, consumers’ hygiene and cleanliness awareness has been increased which has increased demand for isopropyl alcohol-based sanitizers and disinfectants. The country has a well-developed industrial infrastructure, making it one of the largest markets for isopropyl alcohol in Europe.UK Isopropyl Alcohol Market

Isopropyl alcohol demand in the UK is mainly owing to the cosmetic and pharmaceutical sector with significant increased demand for use in sanitizers and disinfectants. The usage of personal care products and use of skin and hair care products have surged owing to the increase in population, thereby increasing the demand for isopropyl alcohol as a preservative and solvent. Additionally, isopropyl alcohol is employed in the pharmaceutical sector in the UK for sanitizing and sterilizing, which is anticipated to drive the market growth. Demand for isopropyl alcohol in the UK is further bolstered by the comparatively recent focus on healthcare, hygiene, as well as the expanding applications across the industrial sectors.Key Isopropyl Alcohol Company Insights

Strategic investments, technological developments and expansion into emerging markets are some factors driving both competition and innovation within the isopropyl alcohol business, with a few key players leading the way. With the increasing demand across most industries, leading players contribute much towards the overall application spanning from pharmaceuticals, cosmetics to chemicals.Royal Dutch Shell

Royal Dutch Shell is a major global manufacturer of isopropyl alcohol, Royal Dutch Shell produces chemicals and solvents of the highest quality. The company’ large distribution network and investment in green practices enable it to supply this surge in demand to many sectors.Alumina Trading

Alumina Trading is an international distributor of isopropyl alcohol with top-quality products and support logistics. They specialize in innovation and efficiency, allowing them to maintain a strong presence in the market.Exxon Mobil Corporation

Exxon Mobil Corporation is among the prominent players in the isopropyl alcohol business. The company leverages its extensive oil and gas network to produce high-purity alcohols for applications in industrial, pharmaceutical, and cleaning purposes. Its global footprint ensures quality and supply stability.Sasol Limited

Sasol Limited is a top supplier of isopropyl alcohol, offering innovative chemical solutions across industries. Sasol has a solid position in the isopropyl alcohol industry with an emphasis on sustainable production and technology.Key Isopropyl Alcohol Companies:

- Royal Dutch Shell plc

- The Dow Chemical Company

- Exxon Mobil Corporation

- Sasol Limited

- Chang Chun Group

- Alumina Trading

- Mistral Industrial Chemicals

- INEOS Corporation

- ReAgent Chemicals Ltd.

- LyondellBasell Industries

- Linde Gas

- Ecolab

- Others

Recent Developments

- In March 2025, to manufacture a very pure version of isopropyl alcohol that is used in the tech industry to clean and process microchips, Exxon Mobil said that it will invest $100 million to improve its chemical plant in Baton Rouge, Louisiana. By 2027, the chemical plant improvement will be finished, enabling Exxon to increase its production of high-purity isopropyl alcohol.

- In August 2024, for better quality, Eastman unveiled a brand-new electronic-grade solvent. The EastaPure range of electronic-grade isopropyl alcohol (IPA) offers semiconductor manufacturers in the United States a dependable, domestically produced solvent.

- In June 2024, the first isopropyl alcohol (IPA) plant of its sort in Spain was introduced by Cepsa. In addition to hydroalcoholic gels, this substance is utilized in industrial and domestic cleaning solutions. The new IPA plant will be situated in Palos de la Frontera (Huelva) and will be the first of its kind in Spain to use green hydrogen. It will be able to substitute sustainable raw materials for fossil-based ones when producing isopropyl alcohol.

- In December 2023, under the International Sustainability and Carbon Certification (ISCC) PLUS system for certifying sustainable products, Mitsui Chemicals, Inc. declared that it has obtained certification for two further phenol-chain products.

- In May 2023, the semiconductor high purity process chemicals (HPPC) company, CMC Materials KMG Corporation (KMG), has been acquired by FUJIFILM Corporation from the US-based Entegris, Inc., according to the final agreement.

Global Isopropyl Alcohol Market Report Segmentation

The study on the isopropyl alcohol market delivers detailed analysis on region-level perspective depending on specific contemporary industry trends. It considers various segments, such as application and end use. By assessing all these segments, this report presents a thorough discussion of market drivers, regulations, and emerging opportunities observed in the market.Application Outlook (Revenue, Billion, 2025-2034)

- Process Solvent

- Cleaning Agent

- Intermediate

- Coating Solvent

- Antiseptic and Astringent

- Others

End-Use Outlook (Revenue, Billion, 2025-2034)

- Cosmetics and Personal Care

- Pharmaceutical

- Food and Beverages

- Paints and Coatings

- Chemical

- Others

Region Outlook (Revenue, Billion, 2025-2034)

- North America

- United States of America

- Canada

- Europe

- United Kingdom

- Germany

- France

- Italy

- Others

- Asia-Pacific

- China

- Japan

- India

- ASEAN

- Australia

- Others

- Latin America

- Brazil

- Argentina

- Mexico

- Others

- Middle East and Africa

- Saudi Arabia

- United Arab Emirates

- Nigeria

- South Africa

- Others

Isopropyl Alcohol Market Report Snapshots

Isopropyl Alcohol Companies

Table of Contents

Companies Mentioned

The key companies featured in this Isopropyl Alcohol market report include:- Royal Dutch Shell plc

- The Dow Chemical Company

- Exxon Mobil Corporation

- Sasol Limited

- Chang Chun Group

- Alumina Trading

- Mistral Industrial Chemicals

- INEOS Corporation

- ReAgent Chemicals Ltd.

- LyondellBasell Industries

- Linde Gas

- Ecolab

Table Information

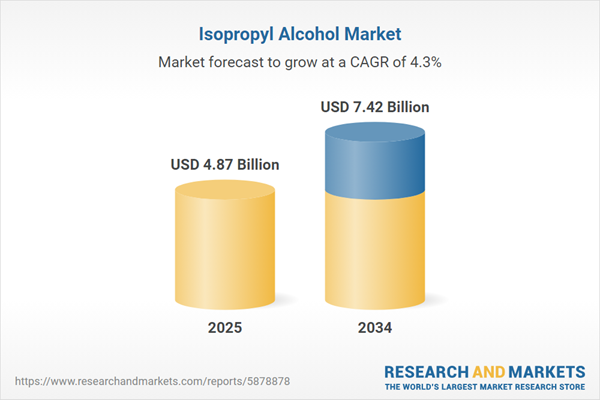

| Report Attribute | Details |

|---|---|

| No. of Pages | 153 |

| Published | August 2025 |

| Forecast Period | 2025 - 2034 |

| Estimated Market Value ( USD | $ 4.87 Billion |

| Forecasted Market Value ( USD | $ 7.42 Billion |

| Compound Annual Growth Rate | 4.3% |

| Regions Covered | Global |

| No. of Companies Mentioned | 13 |