Some of the factors driving the global 5G Small Cell market are key organizations emphasizing research and development activities and the growing demand for low-latency bandwidth connections. Additionally, the overall 5G market will grow during the forecast period due to the strong deployment of numerous small cells and macrocell base stations worldwide.

The increased business usage of the 5G network created a demand for small cell, especially in small and medium-sized industries. In October 2023, Nokia launched the Nokia DAC PW Compact for the private wireless connectivity needs of small and mid-sized industrial sites. This technology improved the business processes with a 60 percent reduction in energy consumption over Wi-Fi.

Moreover, supporting government policies, such as Telecom Regulatory Authority of India (TRAI) recommendations on the Use of Street Furniture for Small Cells and Aerial Fibre deployment, would play a pivotal role in network upgradation and expansion. Similarly, EE deployed over 1,000 small cells across the UK, marking 400 new deployments, including its first 5G sites, as reported in August 2024, installed in Croydon, London.

Further, the industry participants are forming strategic alliances and working together to expand the market for their goods and services and their availability across a range of geographies. For instance, in May 2024, MosoLabs unveiled Moso Canopy 5GID2, the first 5G indoor radio for private networks using the Qualcomm FSM200 5G RAN platform. MosoLabs is a company building solutions for LTE and 5G private and neutral host networks. This was the industry's first 3GPP Release 16 5G SA small cell platform supporting Industry 4.0. the collaboration between MosoLabs and Qualcomm would provide specific use cases across different vertical segments.

5G small cell market drivers

Booming 5G Deployment

The rise in popularity of modern communication networks has resulted in a faster pace of enabling 5G technology deployment with a growing demand for high-speed bandwidth. Large countries are investing in network construction and starting the necessary plans. As a result, rising expenditures for 5G technology are also evident.In October 2023, the Minister of Innovation, Science and Industry, as a way of supporting 5G deployment in rural areas, announced 'The Spectrum Outlook 2023 to 2027'. Meanwhile, the 3,800 MHz auction took place in October 2023, marking it as the third to enable 5G. Hence, the rising deployment of 5G connection is expected to propel the market for 5G small cell in the coming years.

In 2028, 5G will outpace other forms of mobile access technologies in terms of subscriptions. Nearly 5.6 billion subscriptions are projected by 2029, representing 60% of all mobile subscriptions. Projections show that North America will account for approximately 90% of 5G penetration by 2029, while Gulf Cooperation Council (GCC) will rank second at 89%, and Western Europe will occupy the third spot at 86%.Moreover, according to the data from the International Telecommunication Union, the world's population covered by 5G has increased from 31% in 2022 to 38% in 2023. This expansion increased the demand for 5G small cells for their low-power and short-range wireless transmission systems. This technology can easily cover small geographical areas such as shopping malls, businesses, homes, etc.

Geographical Outlook of the 5G Small Cell Market:

The United States is expected to hold substantial market share in the forecasted period.The increasing demand for modern communication networks and high-speed bandwidth are boosting the market in the projected period. Additionally, the rising investment in the 5G technology market will also boost market growth. For instance, in September 2023, the U.S. National Science Foundation (NSF) invested US$25 million in advanced technologies and communication to operate securely through 5G networks.

Strategic partnership and collaboration among the 5G small cell players in the United States is propelling its market growth in the projected period. For instance, in September 2023, EnerSys, which is regarded as a global leader in stored energy solutions mainly for its industrial applications, launched its DPX Distributed Power Transport System. This system will accelerate 5G small cell deployment while also featuring the new EnShield Technology of the company.

Additionally, the growing 5G deployment is a major market driver for the small cell market primarily due to the need for enhanced network coverage and capacity in densely populated areas. For instance, according to the Cellular Telephone Industries Association (CTIA), in 2022, there were nearly 162 million active 5G devices, almost double the number compared to 2021. 5G devices make up 1/3 of the total connections in the US, and by 2028, 91% of the total wireless connections will be 5G. Hence, such increasing 5G penetration in the country is positively impacting the 5G small cell market in the projected period.

Reasons for buying this report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape up future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decision to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive IntelligenceReport Coverage:

- Historical data & forecasts from 2022 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, Customer Behaviour, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others)

The5G small cellmarket is segmented and analyzed as follows:

By Frequency Range

- Low band

- Mid band

- High band (mmWave)

By Network

- O-RAN

- V-RAN

- C-RAN

By Functional Module

- Radio Unit (RU)

- Baseband Unit (BU)

- Central Unit (CU)

By Deployment

- Indoor

- Outdoor

By Geography

- Americas

- United States

- Others

- Europe, Middle East and Africa

- Germany

- UK

- Others

- Asia-Pacific

- China

- Japan

- South Korea

- Others

Table of Contents

Companies Mentioned

- Telefonaktiebolaget LM Ericsson

- Altice Labs

- Cisco Systems, Inc.

- NEC Corporation

- Commscope

- Crown Castle

- NXP Semiconductors

- Airspan

- Sercomm Corporation

- Samsung

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 132 |

| Published | December 2024 |

| Forecast Period | 2025 - 2030 |

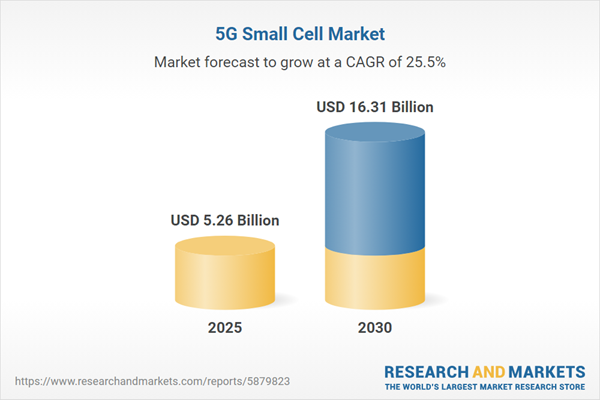

| Estimated Market Value ( USD | $ 5.26 Billion |

| Forecasted Market Value ( USD | $ 16.31 Billion |

| Compound Annual Growth Rate | 25.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |