The deployment of 5G technology has unfolded new paths for expanding network capacity and customer experience at a reasonable cost. Open RAN enhances 5G deployments by establishing a direct link between the main network and the user's devices, thereby providing subscriber information and location. This increased use of the 5G technology has grabbed different sectors including defense to make use of the Open RAN for the 5G deployment. In October 2024, Airspan Networks Holdings LLC announced the strategic Memorandum of Understanding (MoU) with Pavo Group, a global provider of security and defense solutions. Airspan Networks Holdings LLC is the leading developer of 4G and 5G Open RAN solutions.

This partnership would give the combined expertise of both companies. It would use the deployment of mobile telecommunications for defense, security, and critical infrastructure networks. The MoU will focus on integrating 4G and 5G into robust, secure networks, supporting the needs of military, law enforcement, and utility providers in high-demand, high-security environments. This integration would enhance real-time communication and data sharing, strengthening awareness, decision-making, and operational effectiveness.

O-RAN market drivers:

The rising demand for convenience and healthy foods is predicted to promote the O-RAN market expansion.The growing deployment of 5G has boosted the demand for the Open RAN. It is a complementary framework to 5G that provides the infrastructure to support 5G's advancements. The O-RAN provides the faster deployment of 5G networks. In December 2024, Liberty announced the collaboration with Samsung Networks Latin America to test Samsung's O-RAN-compliant virtualized Radio Access Network (vRAN) and radios in its mobile network in Puerto Rico.

Liberty would be the first telecom operator in Puerto Rico and Latin America to introduce 5G vRAN and Open RAN technologies. This collaboration would allow Liberty to expand its 5G mobile network more easily with less hardware equipment. This new introduction of technology would be a significant addition to the Puerto Rico population with 5G coverage, although Liberty's 5G population coverage reached 97.5% in Puerto Rico.

Moreover, the coverage for 5G has been increasing around the world, with 18% population under the 5G coverage in 2021, increased to 31% of the population in 2022, and reaching 38% in 2023. However, this increased distribution is very remained uneven with Europe boasting the most extensive 5G coverage, with 68% of the population covered, followed by the Americas region with 59% and the Asia-Pacific region with 42%. However, only 12% population in the Arab States region, 8% in the CIS region, and 6% in the African region are within the 5G network.

The growing use of the O-RAN technology will provide a new and agile architecture, and reliable mobile connectivity, driving innovation in commercial networks and further bolstering 5G capabilities worldwide.

O-RAN market geographical outlook:

Based on geography, the O-RAN market is segmented into the Americas, Europe Middle East and Africa, and the Asia-Pacific.The Open Radio Access Network (Open RAN) market in the United States is experiencing significant growth. One of the primary drivers of Open RAN adoption is the increasing demand for flexible and cost-effective network solutions. Traditional radio access networks often involve proprietary hardware and software, which can lead to vendor lock-in and high operational costs. Open RAN, by contrast, allows for multi-vendor integration, enabling telecom operators to mix and match components from different suppliers, thereby reducing costs and enhancing operational efficiency23. Major players like AT&T and Verizon are actively investing in Open RAN technologies to diversify their network infrastructure and improve service delivery.The U.S. government has recognized the strategic importance of Open RAN in enhancing network security and reducing dependency on foreign technology suppliers, particularly from countries like China. Initiatives such as the Open RAN Policy Coalition have been established to promote this technology as part of a broader effort to bolster domestic telecommunications capabilities. This regulatory backing not only fosters competition among local vendors but also encourages innovation within the industry.

Open RAN enhances 5G deployments by establishing a direct link between the main network and the user's devices, thereby providing subscriber information and location. Hence, various partnerships, demonstrations & trials, and investments are being implemented to complement the 5G deployment. For instance, In February 2022, Juniper Networks formed a collaboration with Parallel Universe and Vodafone both of which are pioneers in O-RAN solutions. The collaboration aimed to conduct a multi-vendor RAN Intelligent Controller trial thereby addressing business challenges faced by mobile operators around viable revenue generation, personalized user experience, and reduction in OPEX and CAPEX for 5G & 4G services. The trial emphasized developing open and agile mobile data delivery in any software-driven O-RAN environment. Furthermore, a few more key developments are imperative in driving the growth of the market. For instance in February 2024. MaxLiner Inc. launched 'MXL17xxx' which is a highly integrated SoC optimized for 5G Open Radio Network and supports major Radio Units applications inclusive of massive MIMO, all-in-one small cell, and traditional macro.

In February 2022, Qualcomm Technologies formed a collaboration with Fujitsu to commercialize next-generation 5G mmWave DUs and RUs and further drive the transition towards modern 5 G mobile infrastructure. The collaboration was done under NTT Docomo's '5G OREC Initiative,' which aimed to streamline modern network deployment and reduce the total cost by offering virtualized, O-RAN complaint, and cloud-native 5G solutions.

Reasons for buying this report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape up future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decision to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive IntelligenceReport Coverage:

- Historical data & forecasts from 2022 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, Customer Behaviour, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling (Strategies, Products, Financial Information, and Key Developments among others)

The O-RAN market is analyzed into the following segments:

By Technology

- Massive MIMO

- Non-Massive MIMO

By Spectrum Band

- Sub-6-Ghz

- mmWave

By Architecture

- CU

- DU

- RU

- Others

By Geography

- Americas

- United States

- Others

- Europe Middle East and Africa

- Germany

- UK

- Others

- Asia-Pacific

- China

- Japan

- South Korea

- Others

Table of Contents

Companies Mentioned

- Fujitsu Limited

- Nokia Corporation

- Samsung

- Qualcomm Technologies

- Mavenir

- Cisco Systems, Inc.

- NEC Corporation

- Airspan Networks

Table Information

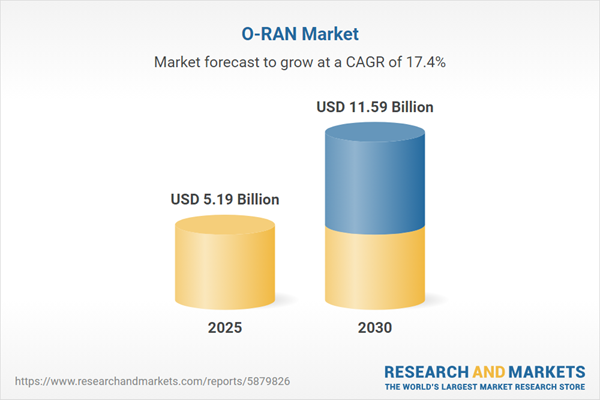

| Report Attribute | Details |

|---|---|

| No. of Pages | 114 |

| Published | December 2024 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 5.19 Billion |

| Forecasted Market Value ( USD | $ 11.59 Billion |

| Compound Annual Growth Rate | 17.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |