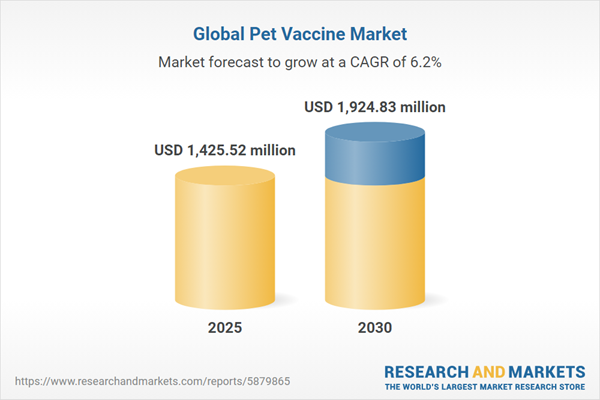

The global pet vaccine market is poised for steady growth, driven by rising pet ownership, increasing awareness of pet health, and the growing prevalence of zoonotic diseases. Pet vaccines are essential for maintaining animal immunity and safeguarding community health, particularly against diseases like rabies. Technological advancements, supportive government initiatives, and increased R&D investments further propel market expansion. The canine vaccine segment, especially injectable vaccines, is expected to see substantial growth due to their effectiveness in preventing infectious diseases.

Market Growth Drivers

Rising Pet Ownership and Disease Prevalence

The surge in pet ownership, particularly among millennials, drives demand for pet vaccines as owners prioritize animal health. The increasing prevalence of zoonotic diseases, such as rabies, underscores the need for regular vaccinations. Rabies, transmitted primarily by dogs, remains a significant global health concern, with high incidence in regions like Southeast Asia. The effectiveness of vaccines in preventing such diseases, coupled with growing public awareness and animal welfare campaigns, fuels market growth.Technological Advancements and Government Support

Innovations in vaccine development enhance efficacy and safety, boosting market adoption. Positive government initiatives, including subsidies and awareness programs, encourage pet vaccinations, particularly in regions with high disease burdens. Rising R&D expenditure supports the introduction of advanced vaccines, addressing emerging health challenges and expanding market potential. The focus on injectable vaccines, administered subcutaneously or intramuscularly, highlights their role in stimulating robust immune responses, making them a cornerstone of veterinary medicine.Canine Vaccine Market Expansion

The canine vaccine segment is anticipated to grow significantly, driven by the need to combat common diseases like rabies, canine parvovirus, and leptospirosis. Injectable vaccines, designed to protect against infectious pathogens, are widely used due to their reliability and ease of administration by veterinary professionals. The global demand for rabies vaccines, particularly in low- and middle-income countries, further bolsters this segment, supported by organizations like UNICEF ensuring affordable supply.Geographical Outlook

The United States dominates the North American pet vaccine market, driven by a large pet population and high pet ownership rates, particularly among millennial households. The country's focus on pet health, linked to benefits like improved human well-being, supports demand for vaccines. The substantial dog and cat population requires regular vaccinations, creating a robust market. Other North American countries, like Canada, also contribute through growing pet adoption and awareness. The Asia-Pacific region is expected to witness rapid growth, fueled by increasing pet ownership and government-backed health initiatives in countries like India and China.The pet vaccine market is set for steady growth, propelled by rising pet ownership, zoonotic disease prevalence, and advancements in vaccine technology. The canine segment, particularly injectable vaccines, leads due to its critical role in disease prevention. The United States remains a key market, while Asia-Pacific shows strong growth potential. Government support and R&D investments further enhance market prospects. As pet health awareness grows, the demand for effective vaccines is expected to rise, ensuring sustained market expansion.

Key Benefits of this Report:

- Insightful Analysis: Gain detailed market insights covering major as well as emerging geographical regions, focusing on customer segments, government policies and socio-economic factors, consumer preferences, industry verticals, and other sub-segments.

- Competitive Landscape: Understand the strategic maneuvers employed by key players globally to understand possible market penetration with the correct strategy.

- Market Drivers & Future Trends: Explore the dynamic factors and pivotal market trends and how they will shape future market developments.

- Actionable Recommendations: Utilize the insights to exercise strategic decisions to uncover new business streams and revenues in a dynamic environment.

- Caters to a Wide Audience: Beneficial and cost-effective for startups, research institutions, consultants, SMEs, and large enterprises.

What do businesses use our reports for?

Industry and Market Insights, Opportunity Assessment, Product Demand Forecasting, Market Entry Strategy, Geographical Expansion, Capital Investment Decisions, Regulatory Framework & Implications, New Product Development, Competitive Intelligence.Report Coverage:

- Historical data from 2020 to 2024 & forecast data from 2025 to 2030

- Growth Opportunities, Challenges, Supply Chain Outlook, Regulatory Framework, and Trend Analysis

- Competitive Positioning, Strategies, and Market Share Analysis

- Revenue Growth and Forecast Assessment of segments and regions including countries

- Company Profiling: Strategies, Products, Financial Information, and Key Developments among others

Pet Vaccine Market Segmentation:

By Animal Type

- Canine

- Feline

- Equine

- Avian

- Others

By Vaccination

- Core Vaccines

- Non-Core Vaccines

- Others

By Administration

- Injectable Vaccines

- Intranasal Vaccines

- Oral Vaccines

By Distribution Channel

- Veterinary Clinics

- Retail Pharmacies

- Online Platforms

- Animal Hospitals

By Geography

- North America

- Europe

- Asia Pacific

- South America

- Middle East & Africa

Table of Contents

Companies Mentioned

- Zoetis

- Merck Animal Health (MSD)

- Elanco

- Boehringer Ingelheim

- Virbac

- Vetoquinol

- Ceva Santé Animale

- Tianjin Ringpu Bio-Technology

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 149 |

| Published | August 2025 |

| Forecast Period | 2025 - 2030 |

| Estimated Market Value ( USD | $ 1425.52 million |

| Forecasted Market Value ( USD | $ 1924.83 million |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |