Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Urban Mobility and Convenience

Greece's urban areas, especially cities like Athens and Thessaloniki, are known for their traffic congestion and limited parking spaces. Motorcycles and scooters offer a practical solution for navigating through congested streets and finding parking in tight spots. The convenience of two-wheelers for daily commuting and short-distance travel in busy cities is a significant driver for their popularity in Greece.Favorable Weather Conditions

Greece enjoys a Mediterranean climate with mild winters and long, sunny summers. The pleasant weather throughout much of the year encourages year-round riding for motorcycle and scooter enthusiasts. The ability to ride motorcycles and scooters comfortably during most seasons makes them appealing options for both practical commuting and recreational purposes.Economic Benefits

Two-wheelers, especially scooters and mopeds, typically have lower upfront costs compared to cars and require less maintenance. Additionally, their fuel efficiency translates to reduced operating expenses, making them a cost-effective transportation option for budget-conscious consumers. As Greece faces economic challenges, the affordability of two-wheelers becomes an attractive feature for many potential buyers.Heritage and Culture

Greece has a strong cultural connection to motorcycles and scooters. Motorcycling has been a popular mode of transportation and a symbol of freedom and adventure for decades. This cultural affinity towards two-wheelers has contributed to their continued popularity and adoption, especially among young riders and enthusiasts.Eco-Friendly and Sustainable Transportation

With growing environmental concerns worldwide, the demand for eco-friendly transportation has increased. Electric two-wheelers, including electric scooters and e-bikes, have gained traction in the Greek market. Consumers are opting for these electric alternatives to reduce greenhouse gas emissions and lower their environmental impact. The Greek government's focus on sustainable mobility and initiatives promoting electric vehicles have further encouraged the adoption of electric two-wheelers.Government Support and Infrastructure Improvements

The Greek government has been implementing measures to improve road safety and promote two-wheelers as a viable means of transportation. This includes creating dedicated bike lanes, introducing traffic calming measures, and raising awareness about safe riding practices. These efforts aim to enhance the safety of motorcycle and scooter riders, making two-wheelers a more attractive choice for daily commuting.Key Market Challenges

Road Safety Concerns

One of the significant challenges in the two-wheeler market is road safety. Greece has a relatively high rate of traffic accidents involving motorcycles and scooters, often attributed to factors like reckless riding, inadequate safety gear usage, and the lack of awareness about safe riding practices. Improving road safety for two-wheeler riders requires a combination of stricter enforcement of traffic rules, awareness campaigns, and initiatives to promote responsible riding behavior.Traffic Congestion and Infrastructure

While motorcycles and scooters offer an advantage in navigating through congested urban areas, they still face challenges related to traffic congestion. The lack of dedicated and well-maintained motorcycle lanes can lead to unsafe riding conditions. Furthermore, insufficient infrastructure to accommodate the increasing number of two-wheelers can hinder market growth. Addressing these issues through better urban planning and investment in dedicated motorcycle lanes and parking facilities can enhance the appeal of two-wheelers as a practical urban mobility solution.Environmental Regulations

While electric two-wheelers have gained popularity as eco-friendly options, there may be challenges related to environmental regulations and incentives. Changes in government policies and regulations, including taxation and subsidies, can impact the cost and accessibility of electric two-wheelers. Clear and consistent policies that promote and support electric mobility can foster further adoption of electric scooters and e-bikes in the market.Seasonal Variations

Although Greece enjoys favorable weather conditions for much of the year, seasonal variations can still impact the two-wheeler market. During colder and wetter months, there might be a decline in two-wheeler sales and usage. To address this challenge, businesses may need to adjust their marketing and promotional strategies to encourage year-round riding or offer incentives during the off-season.Economic Uncertainty

Greece has experienced economic challenges over the years, and fluctuations in the country's economic conditions can affect consumer spending behavior. During periods of economic uncertainty, consumers may postpone non-essential purchases, including new motorcycles and scooters. This economic instability can present challenges for manufacturers and dealers in maintaining steady sales.Insurance Costs

Insurance costs for motorcycles and scooters can be relatively high compared to other vehicles. The risk of accidents and the vulnerability of riders contribute to these higher insurance premiums. High insurance costs may deter some potential buyers from choosing two-wheelers as their preferred mode of transportation. The government and insurance industry could work together to explore options for reducing insurance premiums and encouraging responsible riding behavior.Key Market Trends

Shift Towards Electric Two-Wheelers

One prominent trend in the Greece two-wheeler market is the increasing adoption of electric two-wheelers, including electric scooters and electric bicycles (e-bikes). The demand for eco-friendly and sustainable transportation options has led to a surge in interest in electric vehicles. Electric two-wheelers offer lower operating costs, reduced environmental impact, and favorable incentives from the government, making them an attractive choice for both urban commuting and recreational riding.Urban Mobility Solutions

As Greece's cities face traffic congestion and limited parking spaces, two-wheelers have become popular urban mobility solutions. Motorcycles and scooters offer convenience and agility, allowing riders to navigate through congested streets and reach their destinations faster. Additionally, bike-sharing programs and rental services have gained traction in major urban areas, providing residents and tourists with flexible and cost-effective transportation options.Diverse Range of Models

The Greece two-wheeler market offers a diverse range of models, catering to various consumer preferences and needs. From small-displacement scooters and mopeds ideal for city commuting to powerful motorcycles for touring and adventure enthusiasts, consumers have a wide selection to choose from. This variety of models allows manufacturers to target different segments of the market and cater to a broad range of riders.Safety and Infrastructure Improvements

Road safety has been a focus in the two-wheeler market. The government and relevant authorities have taken initiatives to improve road safety for motorcyclists and scooter riders. This includes the development of dedicated motorcycle lanes, traffic calming measures, and awareness campaigns to promote safe riding practices. Such efforts aim to reduce the number of accidents and enhance the overall safety of two-wheeler riders on Greek roads.Tourist Attraction and Recreational Riding

Greece's picturesque landscapes and coastal routes make it an attractive destination for tourists and recreational riders. Motorcycle tourism has seen growth, with enthusiasts exploring the country's scenic countryside on leisure rides. The availability of rental services and organized motorcycle tours has contributed to the appeal of Greece as a destination for motorcycle enthusiasts from around the world.Digitalization and Connectivity

Similar to the global automotive industry, the two-wheeler market in Greece has seen a trend toward digitalization and connectivity features. Some modern motorcycles and scooters come equipped with advanced technology, including smartphone connectivity, GPS navigation, and Bluetooth integration. These features enhance the overall riding experience and cater to tech-savvy consumers seeking more connectivity options.Segmental Insights

Vehicle Type Insights

In Greece, the vehicle type with the maximum two-wheeler market share is the Scooter/Moped. This can be attributed to several reasons. Firstly, the compact nature of scooters and mopeds makes them ideal for navigating through Greece's narrow city streets and heavy traffic. Additionally, they offer economical fuel consumption and lower emissions compared to standard motorcycles, which aligns with the country's sustainability goals. Furthermore, scooters and mopeds are known for their agility and maneuverability, allowing riders to easily navigate tight corners and crowded areas. Moreover, the lightweight design of these vehicles makes them easier to handle and park, enhancing convenience for riders. Lastly, the lower purchase and maintenance costs, along with the availability of spare parts, make them a preferred choice for most of the Greek population, providing an affordable and practical transportation solution.Propulsion Type Insights

In Greece, the debate between Internal Combustion Engine (ICE) vehicles and Electric Vehicles (EVs) is gaining momentum. On one hand, ICE vehicles dominate the market due to their long-established presence and extensive infrastructure. However, the country's commitment to sustainability and reducing carbon emissions is paving the way for EVs. The Greek government has announced incentive programs for electric vehicle purchase and public charging infrastructure development, highlighting a shift towards eco-friendly transport solutions. Yet, the transition is not without challenges. High purchase costs and range anxiety are still significant barriers for prospective EV buyers in Greece.Regional Insights

The Attica Region, home to Greece's vibrant capital city, Athens, boasts the highest number of two-wheelers in the country. This can be attributed to the region's remarkable population density and bustling urban lifestyle. With its narrow streets and heavy traffic, maneuvering a two-wheeler becomes an ideal choice for commuters seeking convenience and flexibility. Additionally, the affordability and cost-effectiveness of these vehicles further contribute to their popularity among residents. Furthermore, the region's mild climate throughout the year creates an inviting environment for two-wheeler usage, encouraging more people to embrace this mode of transportation as a practical and enjoyable way to navigate the city.Key Market Players

- Hero MotoCorp Limited

- Honda Motor Co. Limited

- Bajaj Auto Limited

- Royal Enfield

- Piaggio & C. SpA

- Yamaha Motor Europe N.V

- Sanyang Motor Co., Ltd.

- Suzuki Motorcycle

Report Scope:

In this report, the Greece Two-Wheeler Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Greece Two-Wheeler Market, By Vehicle Type:

- Scooter/Moped

- Motorcycle

Greece Two-Wheeler Market, By Propulsion Type:

- ICE

- Electric

Greece Two-Wheeler Market, By Region:

- Northern Greece

- Attica Region

- Peloponnese

- Central Greece

- Rest of Greece

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Greece Two-Wheeler Market.Available Customizations:

Greece Two-Wheeler Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Hero MotoCorp Limited

- Honda Motor Co. Limited

- Bajaj Auto Limited

- Royal Enfield

- Piaggio & C. SpA

- Yamaha Motor Europe N.V.

- Sanyang Motor Co., Ltd.

- Suzuki Motorcycle

Table Information

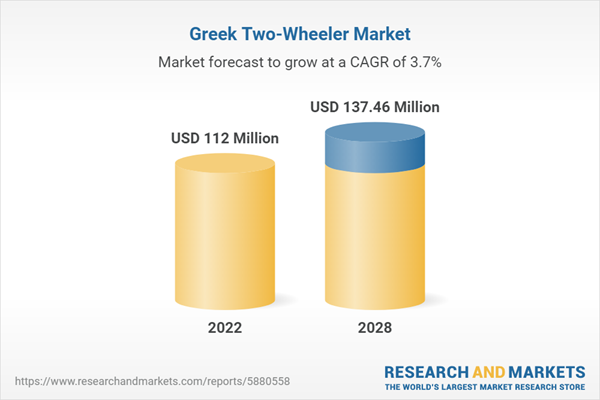

| Report Attribute | Details |

|---|---|

| No. of Pages | 95 |

| Published | September 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 112 Million |

| Forecasted Market Value ( USD | $ 137.46 Million |

| Compound Annual Growth Rate | 3.6% |

| Regions Covered | Greece |

| No. of Companies Mentioned | 8 |