Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

The Rising Construction Sector of UAE is a Key Factor that Driving the UAE Floor Adhesive Market Growth

The construction and real estate boom in the UAE significantly contributed to the growth of the floor adhesive market due to the high migration rate, rising tourism, and surge in industrial projects. Increased demand for luxurious residences in UAE is seeing the price of homes in Dubai rise from 6 percent to 7.9 percent in 2023 and represent the highest value increase around the world. According to Dubai real estate agency Unique Properties, there has been a 62 percent rise in emirate houses over the past decade. The construction and real estate boom in the UAE has led to a surge in the number of construction projects, including residential buildings, commercial complexes, industrial facilities, and infrastructure development. These projects require flooring installations, and floor adhesives are essential for securing and bonding various types of flooring materials. The increased construction activity directly drives the demand for floor adhesives. Construction and real estate have introduced a wide range of flooring options, including ceramic tiles, vinyl, carpet, laminate, engineered wood, and other specialty flooring materials. Each type of flooring requires specific adhesives for proper installation to make attractive flooring choices. As developers and property owners seek to offer diverse flooring options, the demand for a variety of floor adhesives increases in the UAE region. The UAE's construction and real estate boom have raised the standards for aesthetics and design in buildings as developers and property owners aim to create visually appealing and luxurious spaces to attract buyers, tenants, and investors. Floor adhesives play a critical role in achieving the desired aesthetics by securely installing flooring materials, creating seamless transitions, and enabling intricate patterns or designs. The demand for high-quality floor adhesives aligns with the need for exceptional aesthetics in the market. The UAE's construction and real estate boom also involves significant infrastructure development projects such as airports, roads, bridges, and transportation systems. These projects often require specialized flooring solutions, including heavy-duty flooring for areas with high traffic or specific functionality. Floor adhesives suitable for industrial and infrastructure applications, such as epoxy-based adhesives, have become essential for securing durable and robust flooring systems. Alongside new construction projects, the existing building in the UAE requires regular renovation and maintenance. Renovation projects may involve updating outdated flooring materials, repairing damaged floors, or revamping spaces to match modern design trends. Floor adhesives are essential for such renovation activities, providing effective solutions for replacing or re-installing flooring materials. The ongoing need for renovation and maintenance in the booming construction sector contributes to sustained demand for floor adhesives. Therefore, the growing demand from the construction sector is a key driver for the UAE floor adhesive market in the projected period.Favorable Government Initiatives are Impacting the UAE Floor Adhesive Market Growth

Favorable government policies play a crucial role in driving the growth of the UAE floor adhesive market. The UAE has several transportation and infrastructure projects currently under development, such as the USD 2.7 billion Sheikh Zayed double-deck road scheme, apart from conventional, unconventional transport projects, such as the USD 5.9 billion proposed hyperloop project between Dubai and Abu Dhabi. The UAE government has been actively investing in infrastructure development projects, such as transportation networks, airports, and utilities. These investments create a favorable environment for the construction industry, which directly impacts the demand for floor adhesives. Government-led infrastructure projects drive the need for high-quality flooring solutions and, consequently, increase the demand for floor adhesives in the market. The UAE government establishes regulations and standards for the construction industry to ensure safety, quality, and environmental sustainability. These regulations often include guidelines for flooring installations and materials. Compliance with these regulations necessitates the use of approved floor adhesives that meet specific performance and safety criteria. The enforcement of construction regulations and standards drives the demand for compliant floor adhesives in the market. The UAE government has shown a strong commitment to sustainability and green building practices. Initiatives such as the Estidama Pearl Rating System and the Dubai Green Building Regulations promote energy efficiency, environmental conservation, and reduced carbon emissions in construction projects. As a result, there is a growing demand for eco-friendly and low-VOC floor adhesives that contribute to sustainable building practices. Favorable government policies and incentives that encourage the adoption of such adhesives drive the market growth in this segment. The UAE government has been actively supporting the growth of small and medium enterprises (SMEs) in various sectors, including construction. This support includes providing access to financing, streamlined business regulations, and fostering an entrepreneurial ecosystem. These initiatives create opportunities for local floor adhesive manufacturers and suppliers, promoting market growth by encouraging the participation of SMEs and stimulating competition. The UAE government has established free zones and implemented policies that facilitate international trade and foreign investment. These free zones offer favorable tax regimes, simplified customs procedures, and business-friendly regulations. As a result, the UAE serves as a regional hub for trading and distribution of construction materials, including floor adhesives. The government's facilitation of international trade encourages the entry of global adhesive manufacturers and contributes to market growth by providing a diverse range of products. The combined effect of these factors has propelled the demand for floor adhesives and supported the UAE floor adhesive market growth.Key Market Challenges

Volatility in Prices of Raw Materials

As floor adhesive is a crucial component in construction and interior design projects, fluctuations in raw material costs have significant implications for manufacturers, suppliers, and, ultimately, consumers. The primary raw materials used in floor adhesive production include polymers (such as acrylics and vinyl acetates), resins, solvents, additives, and fillers. Global supply chain disruptions can lead to shortages or delayed deliveries of essential raw materials. This situation can severely hamper production schedules and lead to production bottlenecks. Additionally, manufacturers may be forced to seek alternative raw materials, compromising the quality and performance of the final product.Shortage of Skilled Labor

The floor adhesive market has witnessed significant technological advancements, and new adhesive application techniques require workers to adapt and acquire new skills. Without proper training and exposure to the latest techniques, the workforce may lag behind, impacting productivity and quality of work. The shortage of skilled workers can lead to delays in project completion, causing financial losses to construction companies and affecting their reputation in the market. Moreover, as the demand for skilled workers rises, so do labor costs, which can impact the overall profitability of businesses operating in the floor adhesive market.Key Market Trends

Growing Preference for High-Performance Adhesives

As the demand for durable, aesthetically appealing, and long-lasting flooring solutions increases, the UAE floor adhesive market has seen a significant shift towards high-performance adhesives. These advanced adhesive products have become increasingly popular among developers, architects, contractors, and end-users seeking superior bonding strength, flexibility, and resilience. High-performance adhesives excel in providing exceptional bonding strength between the flooring material and the substrate, minimizing the risk of tiles or other flooring elements becoming loose or dislodged. This attribute not only enhances the safety and durability of the flooring but also reduces the need for frequent repairs and replacements, saving both time and money for property owners and facility managers. High-performance adhesives, particularly those with low-VOC (volatile organic compounds) formulations, align with the principles of sustainable construction. Low-VOC adhesives emit fewer harmful chemicals into the air, improving indoor air quality and contributing to a healthier environment for occupants. High-performance adhesives offer excellent flexibility, allowing the flooring to adapt to slight substrate movements without cracking or delaminating. This characteristic enhances the structural integrity of the flooring system and reduces the likelihood of damage over time.Increasing Adoption of Tile Adhesives

Among various types of floor adhesives, the adoption of tile adhesives has gained significant traction, driven by their numerous advantages and the rising popularity of tiles as flooring choices. Ceramic and porcelain tiles, in particular, are highly sought after for their ability to emulate natural stone or wood while offering easier maintenance. Additionally, tiles are well-suited for the hot and humid climate of the UAE, as they help keep indoor spaces cool and are resistant to moisture-related issues. The UAE's construction industry operates at a fast pace, with numerous projects requiring swift completion. Tile adhesives offer significant advantages in this regard, as they enable faster and more efficient installation compared to conventional mortar-based techniques.Segmental Insights

Resin Type Insights

In 2022, the floor adhesives market was dominated by acrylic adhesives and is predicted to continue expanding over the coming years. A significant portion is credited to the qualities of acrylic resins, which offer rapid curing time and enhanced bonding to challenging substrates. They provide excellent durability against environmental factors. Acrylic resins are employed in the creation of water-based and heat-resistant glues, as well as adhesives that cure under Ultraviolet (UV) light. These are favored for installing resilient and wooden floors on dry, porous, or uneven surfaces. They exhibit strong resistance to plasticizer migration and create durable and long-lasting bonds.End Use Insights

In 2022, the floor adhesives market was dominated by the commercial segment and is predicted to continue expanding over the coming years. Commercial applications are exposed to heavy footfall zones, hence necessitating long-lasting flooring like flexible and wooden. In such flooring uses, glues are essential items and are present in various business structure uses like workplaces, corner shops, shopping centers, and retail locations. The growing construction of business structures, for instance, drugstores, grocery stores, and large retail stores, in recent years is anticipated to support the expansion of this segment in the future. Furthermore, there is a strong demand for office spaces, particularly in urban areas of developing nations, which is also driving the need for high-quality flooring glues.Regional Insights

The Dubai region has established itself as the leader in the UAE Floor Adhesive Market. Dubai is dominating the UAE floor adhesive market due to several key factors that contribute to its significant presence and influence in the construction and adhesive industries. Dubai's real estate sector is renowned for its ambitious projects, including iconic skyscrapers, luxury hotels, and massive residential complexes. These developments drive the need for high-quality floor adhesives to ensure the proper installation of flooring materials in such large-scale projects.Key Market Players

- Al Muqarram Industry LLC

- NAPCO Middle East Limited

- XCHEM International LLC

- Pidilite MEA Chemicals LLC

- Terraco UAE Ltd

- ARDEX MIDDLE EAST FZE

- Al Mehraj Industries Company LLC

- Corrotech Construction Chemicals

- SIKA UAE L.L.C.

- Wacker Chemicals MIDDLE EAST

Report Scope:

In this report, the UAE Floor Adhesive Market has been segmented into the following categories, in addition to the industry trends, which have also been detailed below:UAE Floor Adhesive Market, By Resin Type:

- Polyurethane Adhesive

- Epoxy Adhesive

- Vinyl Adhesive

- Acrylic Adhesive

- Others

UAE Floor Adhesive Market, By Technology:

- Water-Based Adhesive

- Hot-Melt Adhesive

- Solvent-Based Adhesive

UAE Floor Adhesive Market, By End-Use Industry:

- Residential

- Industrial

- Commercial

UAE Floor Adhesive Market, By Application:

- Wood.

- Carpet

- Laminate

- Tile & Stone

- Others

UAE Floor Adhesive Market, By Region:

- Dubai

- Abu Dhabi

- Sharjah

- Rest of the UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the UAE Floor Adhesive Market.Available Customizations:

UAE Floor Adhesive Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Al Muqarram Industry LLC

- NAPCO Middle East Limited

- XCHEM International LLC

- Pidilite MEA Chemicals LLC

- Terraco UAE Ltd

- ARDEX MIDDLE EAST FZE

- Al Mehraj Industries Company LLC

- Corrotech Construction Chemicals

- SIKA UAE L.L.C.

- Wacker Chemicals MIDDLE EAST

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 88 |

| Published | September 2023 |

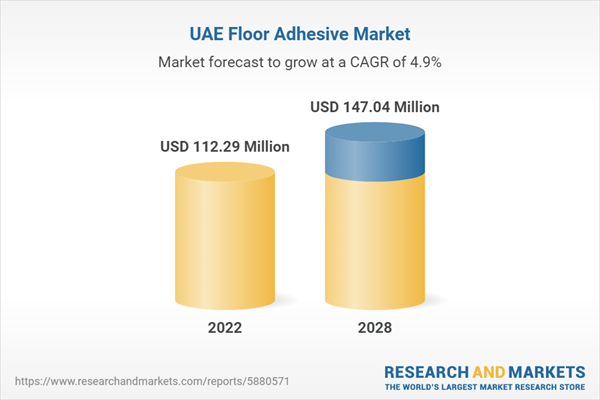

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 112.29 Million |

| Forecasted Market Value ( USD | $ 147.04 Million |

| Compound Annual Growth Rate | 4.8% |

| Regions Covered | United Arab Emirates |

| No. of Companies Mentioned | 10 |