Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Oil & gas exploration and production (E&P) activities are intricate processes that call for cutting-edge machinery. Oilfield service (OFS) providers give the oil and gas industry the required infrastructure, tools, intellectual property, and services they need to find, extract, and transport oil and gas to refineries, where it is eventually sold to consumers.

Rise in Investments in the Oil & Gas Sector to Drive the Market

Due to the increased investment in upstream activities across the region, it is anticipated that the oilfield services sector in the global market will display strong fundamentals, a well-built growth, and an increased activity during the forecast period. Saudi Aramco announced its expenditure on production in order to preserve its spare oil production capacity, strengthen its dominant position in the oil and gas sector, and pursue exploration and production projects focused on conventional and unconventional gas resources. The business has also emphasised its aspirations to increase natural gas production by double.Increasing Shale Gas Extraction to Drive Market Growth

Shale gas is a type of natural gas, trapped in shale formations. The limited permeability of the shale rock prevents the trapped gases from flowing into the well. But technological developments like directional drilling and hydraulic fracturing have increased shale gas production from such important sources. The oilfield needs a variety of tools and services for shale exploration. For instance, China has the greatest shale reserves, and the Sichuan Basin, which is near Chongqing, accounts for a sizeable portion of the country's production. With the aid of cutting-edge drilling instruments and procedures, the nation plans to increase its production to 30 billion cubic metres (bcm) per year, by 2020 and 80 to 100 billion cubic metres, per year by 2030.Rising Demand for Natural Gas

98 percent of the region's overall energy usage is made up of oil and natural gas. As a result, the Middle East's energy system is mostly dependent on the oil and gas industry. Although the Middle Eastern governments are working to diversify their energy sources and reduce their dependency on oil and gas, it is unlikely that this will happen anytime soon. Due to the benefits of its low carbon emissions, natural gas-based power generation is anticipated to see large investments as more Middle Eastern nations join the Paris Climate Accord. Due to increased attention being paid to the development of gas-based power infrastructure and the increased number of gas-based power generation projects planned in the Middle East, it is anticipated that domestic gas production will increase significantly. This will fuel the demand for oilfield services in the region.Increasing Production & Exploration Activities in Oil & Gas Industry to Favor Market Growth

Due to increased energy demand and profitable investment prospects in the oil and gas sector, production and exploration activities are expected to increase in the upcoming years. According to projections, a sizable portion of the world's total oil production will be conventional onshore oil. The DNV-GL Energy-Transition-Outlook predicts that in 2022, oil production would rise by 83 million barrels per day (Mbpd). Furthermore, by 2035, unconventional onshore oil production will have doubled to approximately 22 Mbpd, accounting for close to 30% of all world crude oil production. Therefore, it is anticipated and expected that rising production and exploration activities in global oil and gas industry will propel market expansion in the years to come.Market Segmentation

The Global Oil Field Service Market is divided into Service Type and Location of Deployment. Based on Service Type, the market is segmented into Drilling Services, Completion Services, Production and Intervention Services, and Other Services. Based on Location of Deployment, the market is divided into Onshore, offshore.Market Players

Major market players in the Global Oil Field Service Market are Schlumberger, Halliburton, Baker Hughes, Weir Oil and Gas, Emerson, National Oilwell Varco, Weatherford, AlMansoori Specialized Engineering, Saudi Aramco, Protiviti.Report Scope:

In this report, the Global Oil Field Service Market has been segmented into following categories, in addition to the industry trends which have also been detailed below:Oil Field Service Market, By Service Type:

- Drilling Services

- Completion Services

- Production and Intervention Services

- Other Services

Oil Field Service Market, By Location of Deployment:

- Onshore

- Offshore

Oil Field Service Market, By Region:

- North America

- Asia Pacific

- Europe

- MEA

- South America

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Oil Field Service Market.Available Customizations:

Global Oil Field Service Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Schlumberger (Texas, United States)

- Halliburton (Texas, United States)

- Baker Hughes (Texas, United States)

- Weir Oil and Gas (Glasgow, United Kingdom)

- Emerson (Missouri, United States)

- National Oilwell Varco (Texas, United States)

- Weatherford (Texas, United States)

- AlMansoori Specialized Engineering (Abu Dhabi, UAE)

- Saudi Aramco (Dhahran, Saudi Arabia)

- Protiviti (California, United States)

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 175 |

| Published | September 2023 |

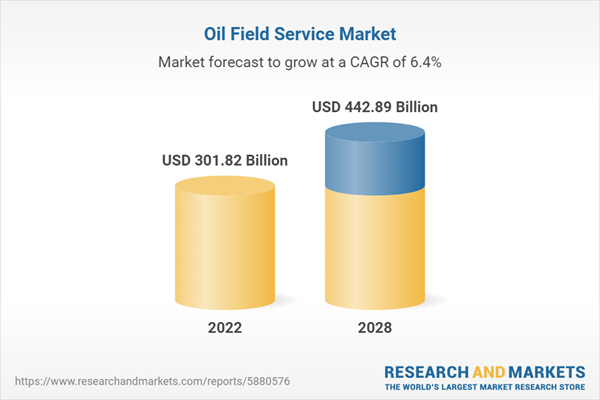

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 301.82 Billion |

| Forecasted Market Value ( USD | $ 442.89 Billion |

| Compound Annual Growth Rate | 6.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |