Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Renowned for their chemical stability and adaptability, glass scintillators can be manufactured into various shapes, including large-area optical fibers, making them indispensable for radiation monitoring systems. A primary engine for this growth is the widening global nuclear energy infrastructure alongside the urgent necessity for durable neutron detection in homeland security. As reported by the World Nuclear Association, global nuclear reactors produced a record 2667 TWh of electricity in 2024, a milestone that directly intensifies the demand for reliable neutron flux monitoring tools within these plants.

Despite these positive indicators, the market faces a significant technical hurdle regarding the performance of glass matrices compared to crystalline substitutes. The primary impediment to wider market adoption is the intrinsically lower light yield of glass scintillators relative to single-crystal detectors, which results in compromised energy resolution. This physical constraint limits their effectiveness in applications demanding exact spectroscopic analysis. Consequently, end-users are frequently compelled to choose superior crystalline technologies for operations where high-fidelity spectral identification is a strict requirement.

Market Drivers

The growth of the glass scintillator market is largely fueled by the expansion of nuclear power infrastructure and stringent safety regulations, specifically due to the material's effectiveness in detecting neutrons within reactor settings. As nations strive to decarbonize their energy grids, the construction of new fission reactors and the continued operation of existing fleets demand advanced equipment for real-time flux monitoring and criticality safety. Glass scintillators, particularly those enriched with lithium-6, offer the necessary radiation hardness and thermal neutron sensitivity to perform reliably in these high-flux environments. Reinforcing this trend, the International Atomic Energy Agency's September 2025 report on energy estimates projects a high-case scenario where global nuclear electrical generating capacity reaches 992 gigawatts by 2050, effectively doubling current operational figures.Furthermore, the market is propelled by heightened demand for homeland security and border surveillance, as governments focus on intercepting illicit radiological materials at transit hubs and ports. Security agencies are increasingly adopting handheld identifiers and large-area radiation portal monitors that employ glass scintillators, favoring their durability and cost-effective scalability over scarce Helium-3 alternatives. The necessity for such measures is highlighted by persistent nuclear security threats; the International Atomic Energy Agency's February 2025 Incident and Trafficking Database Factsheet noted that member states reported 147 incidents of unauthorized or illegal activities involving radioactive material in 2024. This continuing threat landscape drives procurement across the detection sector, a trend reflected in industry financial performance, such as Mirion Technologies' report in November 2025 of $902 million in revenue for the preceding twelve months.

Market Challenges

A critical technical limitation impeding the glass scintillator market is the material's inherently lower light yield compared to crystalline alternatives, which restricts its penetration into high-performance sectors. This deficiency leads to inferior energy resolution, making glass matrices largely inadequate for applications that demand precise radioisotope identification and spectroscopic analysis. While glass serves well for gross counting, end-users in research and critical safety environments often need to differentiate between specific threats, background radiation, or benign medical isotopes. Since glass cannot supply the high-fidelity spectral data required for these distinctions, procurement choices frequently favor single-crystal detectors, effectively excluding glass scintillators from the industry's premium, high-margin segments.This gap in technical efficiency is especially damaging considering the vast infrastructure that requires advanced monitoring capabilities. According to the World Nuclear Association, the global count of operable nuclear reactors hit 440 in 2024. These complex facilities require sophisticated instrumentation for tasks such as environmental compliance, waste characterization, and fuel monitoring, all of which depend heavily on the superior energy resolution provided by crystalline technologies. As a result, despite the growing global nuclear footprint, glass scintillators' inability to satisfy strict spectroscopic specifications prevents them from securing a substantial portion of the instrumentation demand arising from these operational facilities.

Market Trends

The severe shortage of Helium-3 gas is precipitating a decisive technological transition toward Lithium-6 enriched glass scintillators as the leading alternative for thermal neutron detection in security infrastructure and portal monitors. This shift is motivated by the critical need for cost-effective, scalable deployment in border security networks, where supply constraints have made traditional gas-based systems unsustainable. Glass scintillators provide the essential moldability and ruggedness to supersede Helium-3 tubes while maintaining detection sensitivity in high-volume scanning portals. Federal funding priorities illustrate this procurement pivot; in its 'FY 2025 Budget Request' released in March 2024, the Department of Homeland Security allocated $138 million to the Countering Weapons of Mass Destruction Office to acquire and develop nuclear detection technologies, directly supporting the integration of alternative neutron sensing materials into national security frameworks.Concurrently, the oil and gas sector is increasingly utilizing robust glass scintillators for Logging While Drilling (LWD) and Measurement While Drilling (MWD) tools, capitalizing on the material's resilience against extreme vibration and heat in deep-well settings. As energy companies explore deeper, high-pressure reservoirs to optimize production, there is a surging demand for downhole sensors capable of maintaining spectroscopic performance under thermal stress, positioning glass matrices as a preferable solution over fragile crystalline options. This adoption is supported by renewed activity in the sector; the International Energy Agency's 'World Energy Investment 2024' report from June 2024 anticipated a 7% rise in global upstream oil and gas investment to USD 570 billion, representing a significant capital influx that drives the deployment of advanced, ruggedized logging instrumentation.

Key Players Profiled in the Glass Scintillator Market

- Rexon Components & TLD Systems Inc.

- Saint-Gobain Ceramics & Plastics, Inc.

- Nihon Kessho Kogaku Ltd.

- Hitachi Metals Ltd.

- Hamamatsu Photonics

- Epic Crystal Co. Ltd.

- Dynasil Corporation

- Food Machinery Corporation (FMC) Ltd.

- Albemarle Corporation

- Panasonic Corporation

Report Scope

In this report, the Global Glass Scintillator Market has been segmented into the following categories:Glass Scintillator Market, by Product:

- Natural Lithium

- Enriched Lithium

- Depleted Lithium

Glass Scintillator Market, by Type:

- ≤400nm

- >400nm

Glass Scintillator Market, by Application:

- Oil & Gas

- Nuclear Power Plant

Glass Scintillator Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Glass Scintillator Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Glass Scintillator market report include:- Rexon Components & TLD Systems Inc.

- Saint-Gobain Ceramics & Plastics, Inc.

- Nihon Kessho Kogaku Ltd.

- Hitachi Metals Ltd.

- Hamamatsu Photonics

- Epic Crystal Co. Ltd.

- Dynasil Corporation

- Food Machinery Corporation (FMC) Ltd.

- Albemarle Corporation

- Panasonic Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

| Forecast Period | 2025 - 2031 |

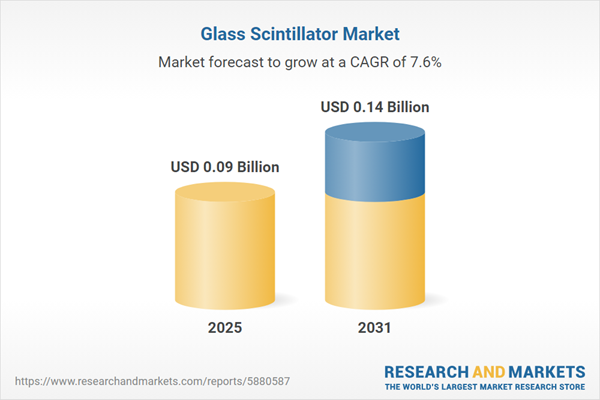

| Estimated Market Value ( USD | $ 0.09 Billion |

| Forecasted Market Value ( USD | $ 0.14 Billion |

| Compound Annual Growth Rate | 7.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |