Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

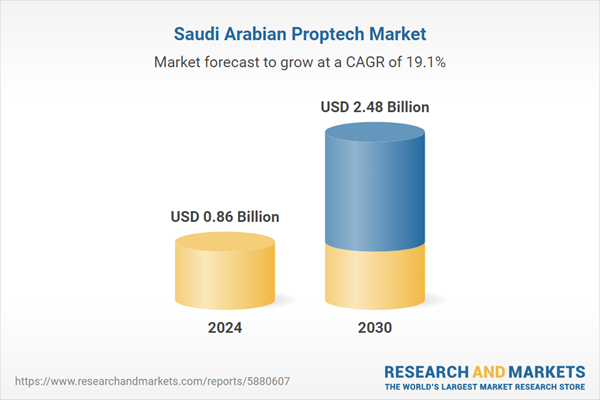

The PropTech market in Saudi Arabia is experiencing rapid growth, driven by the country’s ongoing digital transformation and its ambitious Vision 2030 goals. As the real estate sector continues to modernize, there is increasing adoption of technology-driven solutions that streamline property buying, selling, and management processes. The government’s commitment to building smart cities such as NEOM, The Line, and Qiddiya has significantly accelerated the demand for advanced property technologies, including Internet of Things (IoT), artificial intelligence (AI), and blockchain applications. These technologies are being used to enhance energy efficiency, automate building systems, and improve real-time property monitoring and analytics.

A strong regulatory push has also supported this momentum. Initiatives by real estate authorities have simplified ownership verification, digital transactions, and licensing processes. As a result, PropTech startups are emerging across the Kingdom, offering innovative solutions such as virtual property tours, digital contract platforms, and AI-driven valuation tools. These developments are transforming the customer experience by making property-related decisions more transparent, efficient, and accessible.

The PropTech market is particularly benefiting from increased investment in smart building systems, property management platforms, and digital marketplaces. These tools are helping property developers and real estate agencies manage portfolios more efficiently, reduce operational costs, and enhance tenant engagement. The rise of mobile-first platforms and virtual reality solutions is also changing how end users explore and select properties, with immersive virtual tours becoming a common feature.

Despite the optimistic outlook, the market faces challenges such as limited PropTech awareness among traditional real estate players, a shortage of specialized tech talent, and evolving regulatory landscapes. Overcoming these obstacles will require greater collaboration between the public and private sectors, as well as investments in education and skills development.

Saudi Arabia PropTech market is positioned for sustained expansion. With strong governmental support, a clear vision for urban modernization, and rising interest from global and local investors, the market is likely to become a key regional hub for property technology innovation in the years ahead.

Key Market Drivers

Smart-City and Giga-Project Expansion

Saudi Arabia’s aggressive rollout of smart cities and giga-projects has become a foundational driver of the PropTech sector. With over 13 giga-projects currently under construction, including landmark initiatives like NEOM, The Line, and Qiddiya, the demand for smart real estate technologies has surged across the country. The construction ecosystem includes more than 5,200 active projects, collectively valued at approximately USD819 billion.Residential development is also expanding rapidly, with over 660,000 new housing units in the pipeline, reflecting a 30% year-on-year increase in planned residential inventory. In Riyadh alone, the government has committed to delivering 100,000 new homes by the end of 2023 to accommodate urban expansion. Moreover, public infrastructure budgets continue to rise, with SAR1.25 trillion (roughly USD340 billion) allocated for urban development and modernization. These initiatives create the perfect foundation for PropTech applications such as Building Information Modeling (BIM), digital twin simulations, AI-based project tracking, and IoT-enabled facility management systems to be deployed on a national scale.

Key Market Challenges

Regulatory and Legal Complexities:

Saudi Arabia’s PropTech sector grapples with a regulatory environment still evolving to accommodate digital real estate solutions. Foreign investors face restrictive rules: property in Medina and Mecca remains off-limits, and non-Saudis must invest at least SAR 30 million (≈USD8 million) and secure special permits from the Ministry of Investment. Domestic entities encounter sprawling bureaucracy, often needing certified translations, local attestations, and compliance with both sharia and formal regulations. Saudi’s unwritten Sharia-based commercial laws - embedded in contract enforcement - mean damages often exclude profit losses, adding unpredictability to digital contract or token-based property platforms.Meanwhile, legal ambiguity surrounds digital asset ownership, token transfers, and blockchain contracts. With zero precedent for cross-jurisdictional validation of digital title deeds, PropTech firms face stiff barriers navigating legal recognition. The Real Estate Market digital platform, although heavily used with ~17,000 transactions and half a million users in its first week, still lacks uniform acceptance across all provinces, requiring ongoing legal harmonization. For any PropTech solution handling digital assets, physical deeds, or smart contracts, the cost of legal counsel and compliance can easily consume 10-15% of project budgets, slowing deployment.

Key Market Trends

Immersive Technology: VR, AR, and Digital Twins

Immersive technologies - virtual reality, augmented reality, and digital twins - are redefining the real estate experience in Saudi Arabia. VR/AR tools allow buyers and investors to remotely tour properties, explore design options, and visualize renovation outcomes, reducing travel costs and accelerating decision-making cycles. Digital twins - high-fidelity virtual replicas of buildings or entire neighborhoods - are increasingly deployed in smart-city contexts, enabling authorities to simulate traffic, utility usage, emergency response, and environmental scenarios . NEOM and other giga-projects use these technologies to visualize city-scale planning and refine infrastructure before physical deployment. Meanwhile, AR-infused on-site apps help contractors monitor construction progress, quality, and compliance. As hardware costs decline and connectivity improves (e.g., 5G), immersive PropTech solutions are expanding from niche pilot programs into mainstream applications across development, sales, and building operations.Key Market Players

- Zillow Group

- Redfin

- Opendoor Technologies

- Compass

- CoStar Group

- Matterport

- WeWork

- RealPage

- Reonomy

- HqO

Report Scope:

In this report, the Saudi Arabia Proptech Market has been segmented into the following categories, in addition to the Deployment trends which have also been detailed below:Saudi Arabia Proptech Market, By Solutions:

- Business Intelligence

- Facility Management

- Portfolio Management

- Real Estate Search

- Asset Management

- Enterprise Resource Planning

- Others

Saudi Arabia Proptech Market, By Type:

- Residential

- Non-Residential

Saudi Arabia Proptech Market, By Deployment:

- On-Premises

- Cloud

Saudi Arabia Proptech Market, By Region:

- Riyadh

- Makkah

- Madinah

- Eastern Province

- Asir

- Tabuk

- Rest of Saudi Arabia

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Saudi Arabia Proptech Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Zillow Group

- Redfin

- Opendoor Technologies

- Compass

- CoStar Group

- Matterport

- WeWork

- RealPage

- Reonomy

- HqO

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 70 |

| Published | September 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 0.86 Billion |

| Forecasted Market Value ( USD | $ 2.48 Billion |

| Compound Annual Growth Rate | 19.0% |

| Regions Covered | Saudi Arabia |

| No. of Companies Mentioned | 10 |