Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Data protection is the process of safeguarding critical data against loss, theft, and corruption. Data protection is becoming increasingly important as data creation and storage continue to expand at previously unheard-of rates. Furthermore, downtime that may prevent access to critical information is not given much leeway. As a result, ensuring that data can be restored quickly after loss or corruption is a critical component of a data protection strategy. Data protection also entails protecting data from compromise and ensuring data privacy.

Data protection and recovery are in high demand, which is a key factor driving the India data protection market. This demand is being driven by the rising volume of data generated in businesses every day as well as the growing adoption of cloud computing by organizations. Other significant factors that are likely to drive growth of the global data protection market during the forecast period include increased organization awareness of data integrity and technological advancements in data protection systems and software. Personal data are now the primary source of energy for the world's expanding internet economy. Massive amounts of data are transported, stored, and acquired all over the world every day, enabling massive advances in computing and communication capability.

Much of the new online activity in the global information economy is now driven by personal data. Massive amounts of information are transmitted, stored, and gathered every day all over the world, allowing for massive advances in computing and communication power. In developing countries, mobile phone adoption and increased Internet connectivity have facilitated online social, economic, and financial activities. As more economic and social activities move online, there is a greater emphasis on data privacy and protection, particularly in the context of international trade, which aids market growth. Many businesses have adopted cloud computing, which has increased data management concerns.

Increase in Government Support and Laws Towards Data Protection Solutions

Government spending on security solutions is also expected to increase, which will create profitable market expansion opportunities during the forecast period. Growing concerns about cyber security are also anticipated. The goal of 2022 Digital Personal Data Protection Bill is to establish guidelines for the processing of digital personal data in a way that respects both individuals' rights to privacy protection and the necessity of processing personal data for those purposes, as well as for issues related to or incidental to those purposes. The Indian government has made cyber security a national policy priority, forming task forces and meeting with the US government (USG) to discuss cooperation, information sharing, and improving their cyber defense capability. Bilateral cooperation between India and the United States in cyber security is progressing well. The United States and India have held several official government-to-government bilateral joint Cyber Dialogues, the most recent of which was held in October 2019. The Cyber Dialogue is a forum for implementing the Framework for the India-US Cyber Relationship. It includes exchanging and discussing international cyber policies, comparing national cyber strategies, bolstering efforts to combat cybercrime, and fostering capacity and R&D, thereby promoting the development of cybersecurity and the digital economy. The Indian government has collaborated with the Data Security Council of India (DSCI) to establish a National Center of Excellence that will accelerate innovation in the Indian cybersecurity market, according to Ajay Sawhney, Secretary, Ministry of Electronics and Information Technology (MeitY). As India recovers from and adjusts to a post-COVID era, the government and businesses in India are expected to place an even greater emphasis on digitization and information technology, across all sectors.Increasing Unauthorized Access, Ransomware and Cyber-Attacks Driving Data Protection Market in India

With the increasing number of unauthorized access attempts, ransomware attacks, and other forms of cyber-attacks in India, the data protection market is experiencing significant growth. Organizations are realizing the importance of protecting their data from potential threats and are investing in data protection solutions to safeguard their critical information.In recent years, India has seen a surge in cybercrime incidents, and organizations of all sizes and types are vulnerable to these attacks. This has led to an increased demand for data protection solutions that can secure sensitive information and prevent unauthorized access.

The Indian government has also taken several initiatives to enhance cybersecurity in the country, such as launching the National Cyber Security Policy and establishing the National Critical Information Infrastructure Protection Centre. These measures have further fueled the growth of the data protection market in India.

Overall, the increasing incidents of cyber-attacks and the growing awareness of the importance of data protection are driving the demand for data protection solutions in India, making it a promising market for companies operating in this space.

Increasing Scalability of Security Offerings

Increasing scalability of security offerings is also driving the data protection market in India. With the proliferation of data and the growing number of cyber threats, organizations require flexible and scalable solutions to protect their data.Many data protection solutions now offer cloud-based services, which provide organizations with the scalability and flexibility needed to secure their data effectively. Cloud-based data protection solutions can be scaled up or down depending on the organization's needs, making them an attractive option for businesses of all sizes.

Additionally, advancements in technologies such as artificial intelligence and machine learning have also led to the development of more scalable data protection solutions. These technologies enable data protection solutions to automatically detect and respond to threats, providing organizations with real-time protection and enabling them to quickly scale their security offerings as needed.

Furthermore, as the data protection market in India continues to grow, many new players are entering the market with innovative solutions that are more scalable and cost-effective than traditional data protection solutions. This increased competition is driving further innovation in the market and making data protection solutions more accessible to organizations of all sizes.

Overall, the increasing scalability of security offerings is an important factor driving the growth of the data protection market in India, as it enables organizations to effectively protect their data in a rapidly evolving threat landscape.

Market Segmentation

India Data Protection market is segmented based on component, deployment mode, organization size, industry vertical, and region. Based on Component, the market can be segmented into Solutions and Services. By Deployment Mode, the market segmented into Cloud and On-Premise. Based on Organization Size, the market is further split into large organization and Small & Medium Organization. By Industry Vertical, the market can be segmented into Government and Defense, BFSI, Healthcare, IT & Telecom, Consumer Goods and Retail, Education, Media, and /Entertainment & Others. By Region, the market is segmented into East India, West India, North India, and South India.Market Players

Major market players in the India Data Protection market are DEKRA India Private Limited, eSec Forte Technologies Private Ltd., Dell Inc.-India, IBM Corporation- India, Hewlett Packard Enterprise Development LP-India, Skylark Information Technologies Private Limited, Kratikal Tech Pvt. Ltd., Quick Heal Technologies Limited, TAC Security, WeSecureApp and among others.Report Scope:

In this report, the India Data Protection market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Data Protection Market, By Component:

- Solutions

- Services

Data Protection Market, By Deployment Mode:

- Cloud

- On-Premises

Data Protection Market, By Organization Size:

- Large

- SMEs

Data Protection Market, By Industry Vertical:

- Government and Defense

- BFSI

- Healthcare

- IT & Telecom

- Consumer Goods and Retail

- Education

- Media and Entertainment

- Others

Data Protection Market, By Region:

- North India

- West India

- East India

- South India

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Data Protection Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company’s specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- DEKRA India Private Limited

- eSec Forte Technologies Private Ltd.

- Skylark Information Technologies Private Limited

- Kratikal Tech Pvt. Ltd.

- IBM Corporation- India

- Quick Heal Technologies Limited

- TAC Security

- WeSecureApp

- Dell Inc.-India

- Hewlett Packard Enterprise Development LP-India

Table Information

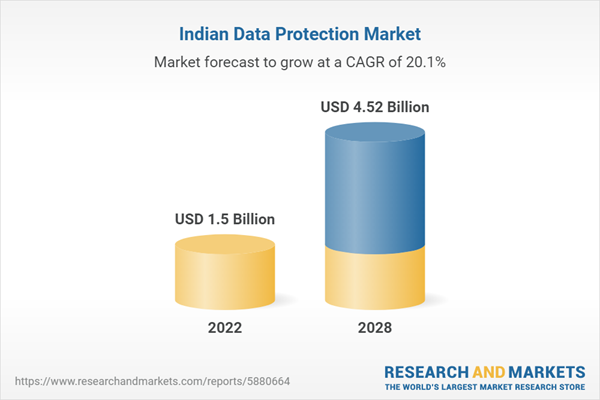

| Report Attribute | Details |

|---|---|

| No. of Pages | 85 |

| Published | September 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 1.5 Billion |

| Forecasted Market Value ( USD | $ 4.52 Billion |

| Compound Annual Growth Rate | 20.0% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |