Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

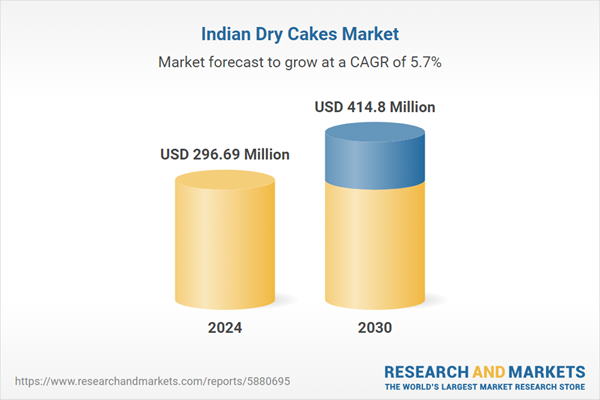

Urbanization, evolving consumer lifestyles, and a shift toward convenient, ready-to-eat products are key growth enablers. The emergence of modern retail and rapid expansion of e-commerce have further improved product accessibility and assortment. Manufacturers are increasingly innovating with new flavors, healthier formulations, and premium offerings to appeal to a broader demographic. As consumers become more experimental and health-aware, the dry cakes segment continues to expand across both urban and semi-urban markets.

Key Market Drivers

Growing Urbanization and Changing Consumer Lifestyles

Rapid urbanization, coupled with shifting lifestyle patterns, is a major catalyst for growth in the India Dry Cakes Market. In 2024, the urban population stood at 461 million and is growing steadily at 2.3% annually. By 2031, urban centers are expected to contribute 75% of India’s total income. This shift is leading to increased demand for convenient, on-the-go food options among working professionals and busy families. Dry cakes, which are ready-to-eat, easy to store, and suitable for snacking, have become a preferred choice for urban consumers. Their longer shelf life and portability make them ideal for lunch boxes, travel, and tea-time consumption. Moreover, rising disposable incomes and greater exposure to global bakery trends are encouraging consumers to try newer cake varieties, supporting market expansion beyond traditional preferences.Key Market Challenges

High Competition and Market Fragmentation

The India Dry Cakes Market faces considerable hurdles due to high competition and fragmentation. A diverse mix of local bakeries, regional brands, and large organized players compete across varied price and quality segments. Local bakeries, especially in smaller towns, often have loyal customer bases and price advantages, making it difficult for national brands to gain a foothold in these areas. Conversely, in urban markets, organized players face pressure from both domestic and international competitors, leading to continuous innovation and marketing spend. High price sensitivity among consumers also limits the ability to pass on cost increases, impacting profitability. Additionally, fragmented operations result in inconsistent quality standards and product offerings, hindering brand trust and repeat purchases.Key Market Trends

Increasing Health Consciousness and Demand for Functional Ingredients

A rising trend in the India Dry Cakes Market is the growing demand for healthier, functionally enhanced products. Consumers are increasingly opting for baked items that offer nutritional benefits in addition to taste. Ingredients such as oats, multigrains, flaxseeds, and chia seeds are being used to appeal to health-conscious consumers. The demand for products with low sugar, high fiber, and clean-label claims is on the rise, driven by increased awareness around lifestyle-related health issues. Furthermore, the market is witnessing an uptick in gluten-free, vegan, and keto-friendly cake variants to cater to evolving dietary preferences. This trend reflects the growing intersection of indulgence and nutrition, with brands offering products that balance taste with health benefits to capture a more discerning customer base.Key Market Players

- Britannia Industries Limited

- Monginis Foods Private Limited

- Parle Products Private Ltd.

- Bonn Nutrients Private Ltd.

- Elite Foods Pvt Limited

- Surya Food & Agro Ltd.

- Saj Food Products Private Limited

- Kitty Industries Pvt. Ltd.

- Anmol Industries Limited

- Oetker (India) Limited

Report Scope:

In this report, the India Dry Cakes Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Dry Cakes Market, By Product Type:

- Bar Cakes

- Muffins/Cupcakes

- Others

India Dry Cakes Market, By Pack Size:

- Upto 100g

- 100 to 250g

- Above 250g

India Dry Cakes Market, By Distribution Channel:

- Supermarkets/Hypermarkets

- Convenience Stores

- Online

- Others

India Dry Cakes Market, By Region:

- North

- South

- East

- West

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Dry Cakes Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Britannia Industries Limited

- Monginis Foods Private Limited

- Parle Products Private Ltd.

- Bonn Nutrients Private Ltd.

- Elite Foods Pvt Limited

- Surya Food & Agro Ltd.

- Saj Food Products Private Limited

- Kitty Industries Pvt. Ltd.

- Anmol Industries Limited

- Oetker (India) Limited

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 70 |

| Published | July 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 296.69 Million |

| Forecasted Market Value ( USD | $ 414.8 Million |

| Compound Annual Growth Rate | 5.7% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |