Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Rising Birth Rates

The global population is continually expanding, resulting in a growing number of births worldwide. This demographic trend has led to an increased demand for baby care products, such as diapers, baby wipes, baby food, and skincare items.Increasing Disposable Incomes

As economies develop and household incomes rise, consumers have more purchasing power to invest in high-quality baby care products. Higher disposable incomes enable parents to prioritize their child's well-being and choose premium and organic baby care products.Shifting Parenting Patterns

Changing lifestyles and cultural shifts have influenced parenting patterns. Modern parents are more aware of the importance of investing in their child's health and development. They seek products that promote safety, convenience, and overall well-being, driving the demand for specialized baby care products.Growing Awareness of Health and Safety

Parents are increasingly concerned about the safety and well-being of their babies. This awareness has prompted them to choose baby care products that are hypoallergenic, free from harmful chemicals, and dermatologically tested. The emphasis on health and safety has fueled the demand for organic, eco-friendly, and non-toxic baby care products.Growing Middle-Class Population

The expanding middle-class population in developing countries has significantly contributed to the growth of the baby care products market. As more families move into the middle-income bracket, they have the means to afford higher-quality products for their children.Increasing Urbanization

Rapid urbanization across the globe has had a profound impact on consumer behavior. Urban dwellers often lead busy lifestyles, leading to a demand for convenient and time-saving baby care products. Urbanization has also heightened awareness about the availability and importance of specialized baby care products.Government Initiatives and Regulations

Government initiatives aimed at improving infant health and welfare have had a positive impact on the baby care products market. Regulatory bodies enforce safety standards, leading to the development of safer and more reliable products. Government campaigns promoting breastfeeding and nutrition have also influenced the demand for related baby care products.Key Market Challenges

Regulatory Compliance

One of the key challenges in the baby care products market lies in adhering to stringent regulatory standards imposed by various government bodies. These regulations are essential for ensuring the safety and quality of the products, but they also necessitate significant investments in research, testing, and compliance procedures. Meeting these regulatory requirements can be time-consuming and costly, particularly for smaller companies or startups operating in the market.Product Safety Concerns

Baby care products are specifically designed for delicate and sensitive skin, making product safety of utmost importance. Issues such as allergic reactions, skin irritations, or the presence of harmful ingredients can severely damage a brand's reputation and result in legal liabilities. Manufacturers must continuously monitor and test their products to ensure compliance with rigorous safety standards and avoid any potential harm to babies.Intense Competition

The global baby care products market is highly competitive, with numerous established players and new entrants vying for market share. This intense competition puts pressure on manufacturers to consistently innovate, differentiate their products, and offer competitive pricing to attract consumers. Smaller brands may face challenges in competing with well-established companies that have larger marketing budgets and enjoy greater brand recognition.Supply Chain Disruptions

Disruptions in the supply chain can significantly impact the baby care products market. Factors such as raw material shortages, transportation disruptions, or trade restrictions can lead to production delays, increased costs, and an inability to meet customer demand. Manufacturers must establish robust supply chain management systems to mitigate these risks and ensure a steady flow of products to the market.Pricing Pressures

Price sensitivity is a significant challenge in the baby care products market. Consumers, particularly in emerging economies, are often price-conscious and seek affordable options. Manufacturers face the challenge of balancing product quality, safety, and affordability to cater to a wide range of consumers. Maintaining competitive pricing while maintaining product standards and profitability can be a delicate balancing act for companies operating in this market.Online Competition

The rise of e-commerce has transformed the retail landscape, including the baby care products market. Online platforms offer convenience, a wide product selection, and competitive pricing, attracting a growing number of consumers. Traditional brick-and-mortar retailers may struggle to compete with online giants, leading to challenges in distribution and market reach.Key Market Trends

Product Innovation and Advancements

The baby care products market has witnessed significant innovation in recent years. Manufacturers are introducing advanced features and technologies in diapers, such as superior absorbency, leak protection, and skin-friendly materials. Similarly, there have been advancements in baby food formulations, with a focus on natural and organic ingredients. Technology and innovation also play a significant role in shaping the baby care products market. Advancements in technology have led to the development of smart baby monitors, wearable devices, and mobile applications that provide real-time health monitoring, sleep tracking, and other valuable insights. These technological innovations offer convenience, peace of mind, and enhanced care for both parents and their little ones.E-commerce and Online Retailing

The ease and convenience of online shopping have transformed the baby care products market. E-commerce platforms provide a wide range of options, competitive pricing, and doorstep delivery, making it convenient for parents to purchase baby care products. Online channels also offer access to a larger variety of niche and international brands.Parental Influence and Peer Recommendations

Parents are increasingly relying on recommendations from peers, influencers, and online parenting communities when choosing baby care products. Positive reviews and testimonials play a significant role in shaping consumer preferences and driving product sales.Increasing Demand for Organic & Natural Products

One prominent trend in the global baby care products market is the increasing demand for organic and natural products. Parents are becoming more conscious about the ingredients used in baby care products and are opting for safer and more environmentally friendly options. Organic baby care products, free from harmful chemicals and synthetic additives, have gained popularity as they are considered gentler on a baby's delicate skin.Growing Popularity of Personalized Baby Care Products

Parents are seeking customized solutions that cater to their specific needs and preferences. Personalization offers a unique and tailored experience, allowing parents to choose products based on factors such as skin sensitivity, age, and individual requirements. This trend reflects the growing consumer desire for personalized and individualized experiences across various industries.Increasing demand of Social media & online platforms

Social media and online platforms have also played a significant role in shaping the trends in the baby care products market. Parents are turning to social media influencers, parenting blogs, and online reviews to gather information and make informed purchasing decisions. This trend has made digital marketing and influencer collaborations crucial for brands to reach and engage with their target audience effectively.Segmental Insights

Product Insights

Baby toiletries/hair care accounted for the majority of revenue share in 2022, and is expected to maintain its dominance throughout the forecast period. Baby shampoos, conditioners, washes, and wipes are widely used for infants' skincare needs due to their frequent application. These products offer instant hydration, refreshed skin, and hassle-free solutions for addressing dryness, infections, and diaper rashes. Body washes have gained popularity globally, especially in the Asia Pacific and North America regions, driven by the rising population and increasing consumer preference for baby care products for their infants.The skin care segment is projected to exhibit the fastest rate during the forecast period. This segment comprises various moisturizers, face creams, powders, and massage oils. InAge Grouped parents are increasingly inclined to choose products with antioxidant, anti-bacterial, and antifungal properties, which are particularly beneficial for sensitive skin.

Distribution Channel Insights

During the forecast period, the hypermarket and supermarket segments garnered the largest share of revenue in the market. These stores offer consumers notable advantages, including a wide range of choices, competitive prices, and prominent visibility of international brands. Consequently, they serve as a suitable platform for all customer groups seeking to purchase baby care products. Furthermore, the specialty store segment is expected to exhibit the highest compound annual growth rate (CAGR) throughout the forecast period. Customers often opt to purchase baby products from these stores due to the convenience of the purchasing process, the extensive store network, and the opportunity to procure the same items regularly. Additionally, these stores capitalize on the growing popularity of niche products, such as organic, natural, and herbal items.The online segment is anticipated to observe significant growth from 2022 to 2028. Online sales of baby care products are projected to experience considerable expansion during the forecast period. Prominent e-commerce giants, including Amazon and Walmart, stand as the leading online retailers of baby care products.

Regional Insights

The Asia Pacific region accounted for the largest market share and is projected to experience the most rapid growth during the forecast period. Similarly, according to the UN report, India's population currently stands at 1.37 billion and is expected to increase by over 270 million by 2050. These indicators will drive the adoption of baby care products in the region.In Central and South America, the expansion rate is anticipated to be the highest during the forecast period. Manufacturers in this region are actively developing baby care products that incorporate a blend of natural and organic ingredients, aiming to reach new customer demographics.

North America is expected to witness significant growth throughout the forecast period. The presence of well-established product manufacturers such as Unilever, Kimberly-Clark (KCWW), and Johnson & Johnson Consumer Inc., along with the growing infrastructure facilities for retailers, will contribute to the demand for baby care products.

Key Market Players

- Beiersdorf

- California Baby

- Unilever

- Johnson & Johnson

- Procter & Gamble (P&G)

- The Himalaya Drug Company

- Citta World

- Kimberly-Clark (KCWW)

- Honasa Consumer Pvt. Ltd.

- Sebapharma GmbH & Co. KG

Report Scope:

In this report, the global baby care products market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Global Baby Care Products Market, By Product:

- Skin Care

- Toiletries

- Hair Care

- Food & Beverages

- Others

Global Baby Care Products Market, By Age Group:

- 0-12 Months

- 13-24 Months

- 24-48 Months

Global Baby Care Products Market, By Sales Channel:

- Supermarkets/Hypermarkets

- Specialty Stores

- Pharmacies/Drugstores

- Online

- Others

Global Baby Care Products Market, By Region:

- North America

- Europe

- South America

- Middle East & Africa

- Asia Pacific

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the global baby care products market.Available Customizations:

Global Baby Care Products Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Beiersdorf

- California Baby

- Unilever

- Johnson & Johnson

- Procter & Gamble (P&G)

- The Himalaya Drug Company

- Citta World

- Kimberly-Clark (KCWW)

- Honasa Consumer Pvt. Ltd.

- Sebapharma GmbH & Co. KG

Table Information

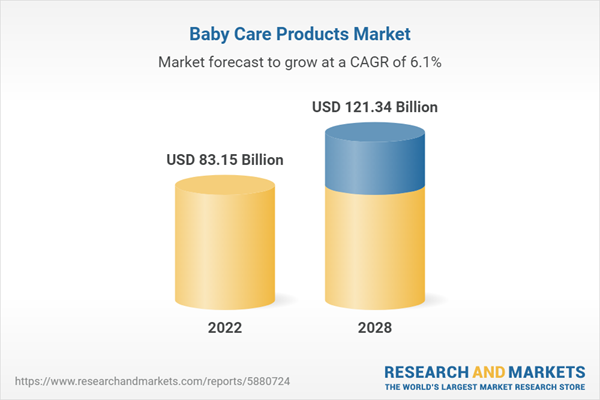

| Report Attribute | Details |

|---|---|

| No. of Pages | 190 |

| Published | September 2023 |

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 83.15 Billion |

| Forecasted Market Value ( USD | $ 121.34 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |