Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Growing Demand for Plastic Additives in the Packaging Industry

The packaging industry is a prominent consumer of plastic additives in India. With the growth of e-commerce, organized retail, and the food and beverage sector, there is a surge in demand for innovative and sustainable packaging solutions. Plastic additives, such as barrier additives, UV stabilizers, and anti-fog additives, are utilized to enhance packaging performance, prolong shelf life, and maintain product quality. According to the Packaging Industry Association of India (PIAI), the India Packaging Market was valued at USD 50.5 billion in 2019 and is projected to reach USD 204.81 billion by 2025, exhibiting a CAGR of 26.7% from 2020 to 2025. The packaging industry is one of the high-growth sectors in India, growing at a rate of 22-25% annually and emerging as a preferred hub for packaging.Growing Demand for Plastic Additives in the Automotive Industry

The Indian automotive industry is witnessing significant growth, driven by factors such as rising income levels, changing demographics, and infrastructure development. According to the India Brand Equity Foundation (IBEF), the Indian automobile industry contributes almost 6.4% of India's GDP and 35% of manufacturing GDP, making it a leading employment provider. Plastic additives play a vital role in the production of lightweight and high-performance plastic components used in vehicles. Additives such as flame retardants, impact modifiers, and heat stabilizers ensure safety, durability, and cost-effectiveness in automotive applications. Additionally, with increasing emphasis on energy efficiency and environmental sustainability, there is growing demand for plastic additives that enable the production of energy-efficient products. The shift towards electric vehicles (EVs) in India has created new opportunities for plastic additives, which help enhance the performance and safety of EV components while reducing weight and increasing energy efficiency. According to the India Brand Equity Foundation (IBEF), the global electric vehicle (EV) market is developing at a rapid pace. Overall, electric vehicles reached a global share of 8.3% (including battery electric vehicles [BEVs] and plug-in hybrid electric vehicles [PHEVs]) in 2021, up from 4.2% in 2020, with 6.75 million vehicles on the road. This represents an increase of 108% since 2020.The growing demand for sustainable solutions is spurring the demand in India's plastic additives market. With increasing environmental concerns and stringent regulations on plastic waste management, there is a rising demand for sustainable plastics. Plastic additives, such as bio-based additives and biodegradable additives, are gaining traction as they offer enhanced biodegradability and reduced environmental impact. Plastics have become an integral part of modern life, offering convenience, versatility, and cost-effectiveness. However, the environmental consequences of plastic waste have become a significant global challenge. India, being one of the largest consumers of plastics, faces the task of addressing this issue while ensuring continued growth and development. As a result, the demand for sustainable solutions in the plastic additives market is gaining momentum. Government regulations and initiatives play a pivotal role in driving the demand for sustainable plastic additives. The Indian government has implemented regulations focusing on plastic waste management, extended producer responsibility, and the promotion of eco-friendly materials. These regulations have spurred the adoption of sustainable additives that enhance the biodegradability, recyclability, and composability of plastics. Moreover, increased environmental awareness among consumers is driving the demand for sustainable products, prompting manufacturers to develop and market eco-friendly plastic additives. One of the key areas of focus in the Indian plastic additives market is the development and adoption of bio-based additives and biodegradable additives. Bio-based additives are derived from renewable sources such as plant-based materials, agricultural waste, and algae. These additives offer improved environmental performance and can replace petroleum-based additives in various applications. Biodegradable additives, on the other hand, facilitate the breakdown of plastics into natural elements through biological processes, reducing their environmental impact.

Technological Advancements

Continuous advancements in technology and research have significantly contributed to the growth of the Indian plastic additives market. According to the Annual Report of the Central Pollution Control Board (CPCB) for the year 2019-20, India generated around 34.69 lakh tonnes per annum (TPA) of plastic waste. Manufacturers are investing in research and development to create innovative additives that offer improved performance properties, such as enhanced thermal stability, flame retardancy, and mechanical strength. The development of nanocomposites, antimicrobial additives, and conductive additives has opened up new possibilities for various industries. Additionally, the Indian government has implemented stringent regulations to address plastic waste management and environmental concerns. On August 12, 2021, the Ministry of Environment, Forestry, and Climate Change published the Plastics Waste Management (Amendment) Regulations 2021, which, starting from July 1, 2022, forbids the production, importation, stocking, distribution, sale, and use of certain single-use plastic products. These regulations push the industry towards more sustainable practices and the adoption of eco-friendly plastic additives. The demand for biodegradable additives, bio-based additives, and additives that improve recyclability has increased as companies strive to meet regulatory requirements and promote sustainability.Key Market Challenges:

Increase in Prices of Raw Materials

As global economic dynamics and supply chain disruptions impact the availability and cost of key inputs, the plastic additives market in India finds itself at a critical juncture. The plastic additives market in India heavily relies on imported raw materials, making it susceptible to global supply chain disruptions. Fluctuating geopolitical factors, trade tensions, and logistical challenges can lead to interruptions in the supply of critical inputs, causing a ripple effect throughout the entire value chain. The scarcity and unpredictability of raw materials contribute to price volatility and increased production costs. As global crude oil prices fluctuate, the cost of raw materials such as ethylene and propylene, which are utilized in the production of additives, also witnesses spikes. These cost escalations directly affect the pricing of plastic additives, thereby exerting pressure on profit margins for manufacturers. The surge in raw material costs exerts pressure on the profit margins of plastic additive manufacturers. Balancing the need to absorb some of these cost increases while remaining attractive to customers is a delicate balancing act that can impact long-term business sustainability.Lack of Consumer Awareness and Education

The absence of a comprehensive understanding among end-users about the role, benefits, and implications of plastic additives poses a multifaceted challenge that requires immediate attention and concerted efforts. The impact of plastic additives on various sectors is indisputable. However, a paradox arises as the majority of consumers remain largely unaware of their presence and significance. This lack of awareness has wide-ranging implications, posing numerous challenges that impede the growth and potential of the Indian plastic additives market. Products that could benefit immensely from plastic additives, such as automotive components requiring enhanced durability or packaging materials necessitating improved barrier properties, may not perform as desired due to the absence of suitable additives. Therefore, the limited awareness surrounding innovative plastic additives can suppress demand, subsequently impacting manufacturers' incentives to invest in research and development initiatives. As a result, the development of newer and more advanced additives may be hindered.Key Market Trends

Growing Efficiency in the Supply Chain

The proliferation of e-commerce and digital platforms is revolutionizing the way plastic additives are bought and sold. Online marketplaces provide a convenient channel for manufacturers, suppliers, and buyers to connect and transact. This digital transformation not only accelerates procurement but also offers transparency, real-time tracking, and simplified payment options, contributing to an efficient supply chain ecosystem. With a growing emphasis on sustainability, supply chain efficiency now encompasses environmentally friendly practices. Plastic additive manufacturers are embracing green logistics solutions, optimizing transportation routes, and adopting eco-friendly packaging. These efforts reduce the carbon footprint of the supply chain while aligning with global sustainability goals. Moreover, the integration of automation, robotics, and IoT technologies is enhancing warehousing and distribution operations. Smart warehouses equipped with automated picking and packing systems ensure faster order processing and minimize errors. Real-time tracking and monitoring enable efficient inventory management and order fulfillment, contributing to a leaner and more responsive supply chain.Segmental Insights

Type Insights

The plasticizers segment dominated the plastic additives market in 2022 and is expected to continue its expansion in the upcoming years. The growing population and urbanization in India have resulted in increased consumption of consumer goods, packaging materials, and infrastructure products. Plasticizers enable manufacturers to produce cost-effective, lightweight, and versatile items, catering to the rising demand across various sectors. With applications spanning industries such as packaging, automotive, construction, and consumer goods, plasticizers are invaluable in creating products that meet specific requirements, including softness, flexibility, and impact resistance.Application Insights

The packaging segment held the largest share in the plastic additives market in 2022 and is projected to continue its growth in the coming years. Factors such as urbanization, changing lifestyles, and a growing middle class have contributed to the increasing demand for packaged goods in India. This surge in consumption directly translates to a higher demand for plastic packaging materials, including films, containers, bottles, and more. Plastic additives play a crucial role in enhancing the performance, durability, and aesthetics of these packaging materials. Additives like UV stabilizers and antioxidants help prolong the shelf life of packaged goods by minimizing degradation caused by light, heat, and oxygen exposure.Regional Insights

The Western region has established itself as the leader in the Indian Plastic Additives market. The Western region of India is home to major industrial hubs, including Mumbai, Pune, Gujarat, and Maharashtra. These areas have a high concentration of manufacturing industries, including plastics, chemicals, automotive, packaging, and construction. The proximity of plastic additives manufacturers to these industrial clusters offers logistical advantages, leading to efficient supply chain operations and reduced transportation costs. Moreover, the Western region boasts well-developed ports and maritime infrastructure, facilitating the import and export of raw materials and finished products. This connectivity is especially beneficial for plastic additives manufacturers who rely on international suppliers for raw materials.Key Market Players

- BASF SE

- The Dow Chemical Company

- Akzo Nobel N.V.

- Clariant AG

- Synergy Poly Additives Pvt. Ltd.

- Nabaltec AG

- Flamingo Additives & Colourants LLP.

- Lanxess AG

- Songwon Industrial Co., Ltd.

- Albemarle Corporation

Report Scope:

In this report, the India Plastic Additives Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Plastic Additives Market, By Type:

- Plasticizers

- Stabilizers

- Flame Retardant's

- Impact Modifiers

India Plastic Additives Market, By Application:

- Packaging

- Automotive

- Construction

- Electrical

- Others

India Plastic Additives Market, By Region:

- North

- South

- West

- East

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Plastic Additives Market.Available Customizations:

India Plastic Additives Market report with the given market data, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- BASF SE

- The Dow Chemical Company

- Akzo Nobel N.V.

- Clariant AG

- Synergy Poly Additives Pvt. Ltd.

- Nabaltec AG

- Flamingo Additives & Colourants LLP.

- Lanxess AG

- Songwon Industrial Co., Ltd.

- Albemarle Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 77 |

| Published | September 2023 |

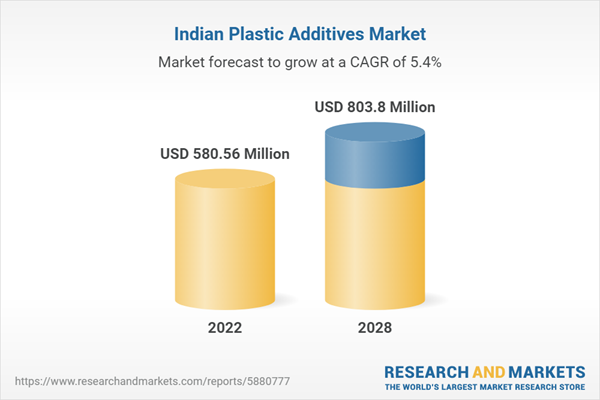

| Forecast Period | 2022 - 2028 |

| Estimated Market Value ( USD | $ 580.56 Million |

| Forecasted Market Value ( USD | $ 803.8 Million |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |