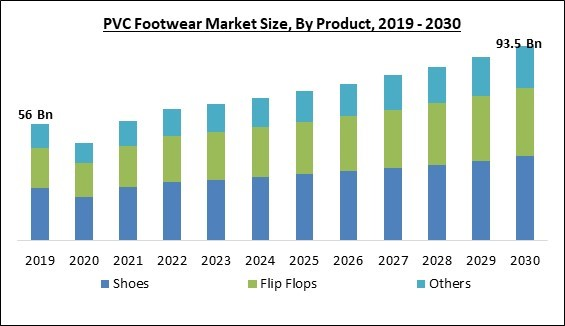

In the context of footwear, the affordability of PVC-based shoes and sandals has positioned them as a go-to option for most consumers, making them a driving force in the market. Consequently, the Shoes segment is anticipated to capture approximately 2/4th share of the market by 2030. Moreover, in emerging economies, where the majority of the population may not have the financial means to invest in expensive footwear, PVC shoes and sandals represent an affordable, entry-level option. PVC footwear manufacturers have seized this opportunity to cater to a rising middle class with changing lifestyle needs and aspirations. Some of the factors impacting the market are surging Demand for PVC Footwear Due to Growing E-commerce Sector, rapidly changing fashion trends, and health and safety issues.

The rise in mobile device use has resulted in the expansion of eCommerce to acquire items such as flip-flops. Many businesses provide diverse merchandise and round-the-clock customer support with technical aid. In addition, they provide various payment alternatives, including online banking, credit cards, cash on delivery (COD), and other payment service providers, to ensure secure and safe online transactions for customers. Furthermore, the increasing expenditure on fashion accessories due to the growing impact of social media is driving the demand for flip-flops. Hence, the growth of e-commerce channels has also surged the demand for footwear like flip-flops, boosting market growth. PVC footwear has become a fashion statement in some markets due to its unique and futuristic appearance. It has gained popularity in fashion circles, driven by trends and celebrity endorsements. When PVC footwear aligns with current fashion trends, it becomes more appealing to consumers who want to stay stylish and trendy. Since celebrities and fashion influencers play a pivotal role in shaping fashion trends, it can significantly boost demand as fans seek to emulate their style. Therefore, the changing fashion trends, along with the widespread acceptance of PVC footwear, will accelerate the market's growth in the coming years.

However, Health and safety issues associated with PVC (polyvinyl chloride) footwear represent a significant restraint for the industry. As a material, PVC often contains various chemicals, including phthalates, lead, and cadmium, which can pose risks to human health and safety. One of the primary concerns is the potential for chemical exposure through direct contact with PVC footwear. Prolonged or frequent contact with these chemicals, which can leach out of the footwear, may lead to skin irritations, allergies, or more severe health issues. Therefore, health and safety concerns may hamper the growth of the market during the forecast period.

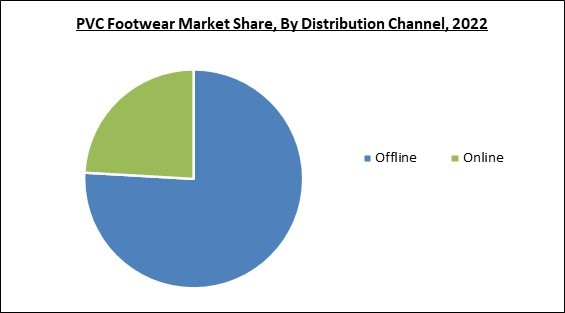

Distribution Channel Outlook

By distribution channel, the market is divided into offline and online. In 2022, the offline segment accounted for the largest revenue share in the market. PVC footwear is commonly sold in shoe, department, discount, and specialty shops. These stores carry a variety of PVC shoe brands and designs, which customers can try on and purchase in person. The offline distribution of PVC footwear relies heavily on wholesalers and distributors. They purchase large quantities of PVC footwear directly from manufacturers and distribute them to retailers. Wholesalers serve as intermediaries, allowing retailers to stock a vast selection of PVC footwear options.Product Type Outlook

On the basis of the product, the market is segmented into shoes, flip flops, and others. The flip flops segment accounted for a considerable revenue share in the market in 2022. PVC flip-flops are a popular choice of footwear, particularly during warm weather or casual occasions. These flip-flops are created from PVC, a durable and water-resistant synthetic plastic material. Flip-flops made from PVC are lightweight and comfortable. They are resistant to the damaging effects of exposure to moisture. The water-resistant properties of PVC make flip-flops ideal for beach excursions, poolside lounging, and any other water-based activity. They are available in a variety of hues, fashions, and patterns.Regional Outlook

Based on region, the market is analyzed across North America, Europe, Asia Pacific, and LAMEA. The Asia Pacific region registered the highest revenue share in the market in 2022. People in numerous Asian nations, including India, China, and Japan, engage in outdoor activities such as beach excursions, hiking, and informal gatherings. PVC-made footwear, such as sandals and flip-flops, provides comfort and functionality for these activities. PVC footwear is typically less expensive than footwear manufactured from other materials, such as leather or high-end synthetic fabrics. This makes the product accessible to consumers of all income levels, including those with lesser disposable incomes.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include Dr. Martens plc, Decathlon S.A. (Asociacion Familiale Mulliez) (Oxelo), VKC Group, Alpargatas S.A. (Havaianas), BATA CORPORATION, Grendene S.A., Liberty shoes ltd. (Liberty Group), Khadim India Ltd., Ajanta shoes India Pvt. Ltd., and VF Corporation

Scope of the Study

By Product

- Shoes

- Flip Flops

- Others

By Distribution Channel

- Offline

- Online

By Geography

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- Dr. Martens plc

- Decathlon S.A. (Asociacion Familiale Mulliez) (Oxelo)

- VKC Group

- Alpargatas S.A. (Havaianas)

- BATA CORPORATION

- Grendene S.A.

- Liberty shoes ltd. (Liberty Group)

- Khadim India Ltd.

- Ajanta shoes India Pvt. Ltd.

- VF Corporation

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- Dr. Martens plc

- Decathlon S.A. (Asociacion Familiale Mulliez) (Oxelo)

- VKC Group

- Alpargatas S.A. (Havaianas)

- BATA CORPORATION

- Grendene S.A.

- Liberty shoes ltd. (Liberty Group)

- Khadim India Ltd.

- Ajanta shoes India Pvt. Ltd.

- VF Corporation