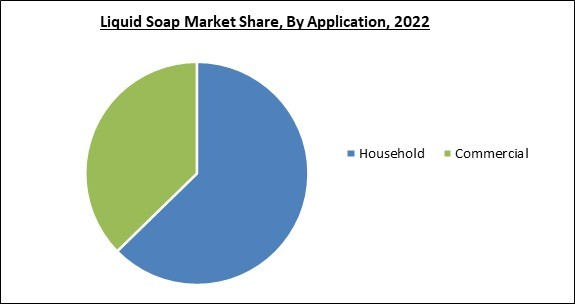

Contactless fittings are finding their way into domestic bathrooms and kitchens as a result of the pandemic. Hence, Household segment acquired $12,967.1 million revenue in the market in 2022. Members of the family are accustomed to cleaning their hands as soon as they enter the house. Because families wish to prevent bacteria and viruses from invading their home, the home bathroom or kitchen sink have abruptly become even more of a focal point. Hand washing eliminates germs on the hands, but if individuals use touch faucets and soap or sanitizer dispensers, the subsequent family member who touches that contaminated surface can unintentionally contract an infection. Some of the factors impacting the market are rising consciousness about health and hygiene, growing interest in natural and organic goods, and presence of toxic substances.

The market is anticipated to grow because of the increased awareness of sanitation and cleanliness among the world's population. Government agencies from many nations are taking the lead in encouraging people to maintain personal hygiene standards, such as maintaining hygienic conditions in public restrooms. In addition, rising hygiene consciousness in developing nations like Mexico, South Africa, Brazil, and India, among others, is anticipated to increase product demand. Hence, all increasing consciousness of hygiene among users will aid in the expansion of the market throughout the forecast period. The increasing global trend toward adopting organic products is aiding in product development. Due to their antibacterial characteristics, herbal ingredients like basil and neem (Azadirachta indica)-based products are becoming more and more popular in the market. As an illustration, certain liquid soap products now come with essential oils like rosemary, peppermint, or lavender. These distinctive scents offer not only a pleasurable experience but also extra advantages including relaxation, stress alleviation, and skin nourishment. Hence, such initiatives by players are probably going to help the market grow during the anticipated period.

However, businesses are being hampered by the use of hazardous compounds in soapy goods like parabens & triclosan, which are known to be bad for the skin. Additionally, a lot of packaging material, like plastic, is needed to ensure that the liquid form of soap does not leak. Corporations incur additional packing expenditures as a result, which raises the ultimate product cost. Additionally, compared to bar soap, the creation of liquid soap takes five times as many raw materials and components, as well as 20 times as much energy for packaging. Therefore, it is projected that all of the issues above will slow the growth of the market.

Product Type Outlook

By product type, the market is segmented into bath & body soaps, dish wash soaps, laundry soaps, and others. In 2022, bath and body soaps segment garnered the highest revenue share in the market. The adoption of sound hygiene habits, such as proper hand washing and general cleanliness at home and in hospitals, schools, and restaurants, is fostering the expansion of this segment. Furthermore, compared to solid bars, younger people are more likely to utilize liquid hand soaps & shower products. Due to the fact that bar soaps are frequently contaminated with germs, businesses advertise their products as "antiseptic liquid soaps" and "germ protecting liquid soaps" to encourage use, which is luring consumers and fostering market expansion.Application Outlook

Based on application, the market is bifurcated into household and commercial. The commercial segment recorded a significant revenue share in the market in 2022. The growing health consciousness amongst working professionals and the rising frequency of communicable infectious diseases are the major reasons why demand for organic liquid soap in the commercial segment is expanding. Additionally, there are a number of government initiatives and company standards for employee health and safety, which will likely fuel the use of liquid soaps.Distribution Channel Outlook

On the basis of distribution channel, the market is divided into supermarkets/hypermarkets, convenience stores, online sales channel, and others. The supermarkets/hypermarkets segment procured the highest revenue share in the market in 2022. A wide variety of liquid soap options are readily available in supermarkets and hypermarkets. The development of emerging economies is driving the expansion of supermarkets and hypermarkets. The demand for retail venues, like supermarkets and hypermarkets, develops as these economies develop, which in turn fuels the demand for liquid soap products.Regional Outlook

Region-wise, the market is analyzed across North America, Europe, Asia Pacific, LAMEA. In 2022, the North America region garnered the maximum revenue share in the market. The regional public is familiar with liquid soap and can easily get it in stores because it was originally introduced in the U.S. Additionally, due to disease outbreaks like SARS in 2003 and H1N1 influenza in 2009, people are increasingly mindful of sanitation. Numerous families with high earnings constantly seek the highest-quality goods, regardless of cost. The primary consumers of liquid soaps in these nations are the hotel and restaurant industries.The market research report covers the analysis of key stake holders of the market. Key companies profiled in the report include The Procter and Gamble Company, Kimberly-Clark Corporation, 3M Company (3M Health Information Systems), Henkel AG & Company, KGaA, Reckitt Benckiser Group PLC, Kao Corporation, Unilever PLC, The Colgate Palmolive Company, Lion Corporation, and Johnson & Johnson

Strategies Deployed in the Market

- Mar-2023: Unilever revealed the first Lifebuoy dishwash liquid in Indonesia. The Lifebuoy brand, which is well-known for its personal care products, is strengthened by this new product, which enters a completely new area. Additionally, it completes the current line of dishwashing products offered by our Sunlight brand, a market leader in the nation, with high-performance goods priced between mid-range and premium.

- Mar-2023: Kimberly-Clark Professional launched the ICON dispenser collection in the UK. This revolutionary restroom solution would introduce cleanliness and design that will change the game, as well as a new benchmark for dispensing performance and a human-centric experience, to deliver unrivaled confidence that goes beyond just dispensing paper towels. Three system solutions for hand towels, toilet paper, and skincare, including soap and sanitizer, are featured in the ICONTM portfolio.

- Dec-2022: Colgate-Palmolive entered into an agreement with NASA, an independent agency of the U.S. federal government responsible for the civil space program. The agreement is aimed to explore innovative solutions for oral health, personal care, and skin health which can be used by astronauts in space, but also the general public.

- Nov-2022: Reckitt joined hands with Essity, a global hygiene and health company. Essity's top professional hygiene brand Tork will combine its size and expertise with Reckitt's Sagrotan and Dettol brands, which are well-known to consumers.

- Jan-2021: Reckitt Benckiser partnered with Treebo Hotels, an Indian budget hotel chain. The partnership enables the company to help Treebo Hotels, utilize Dettol products for improving the cleanliness and hygienic conditions of the hotel.

- Mar-2020: Reckitt Benckiser formed a partnership with Jumia, the leading e-commerce platform in Africa. Through this partnership, the company would be able to offer liquid hand soap, soap bars, and disinfectants at affordable prices. Customers who are taking sanitary steps to stop the spread of the Coronavirus are placing an increasing demand on these products.

- Jan-2019: Kao Corporation unveiled Attack ZERO, a concentrated liquid laundry detergent. Attack ZERO is the first in a line of products made with Bio IOS, the greatest detergent base ever created particularly for Kao. It accomplishes "Three Zeros": "Zero stubborn stains," Zero musty odor," and "Zero detergent residue" and aims to revitalize clothing. It achieves the highest cleaning power in the history of Attack liquid laundry detergent.

Scope of the Study

Market Segments Covered in the Report:

By Product Type(Volume, Million Litres, USD Million, 2019-2030)

- Bath & Body Shops

- Dish Wash Shops

- Laundry Shops

- Others

By Application(Volume, Million Litres, USD Million, 2019-2030)

- Household

- Commercial

By Distribution Channel(Volume, Million Litres, USD Million, 2019-2030)

- Supermarkets/Hypermarkets

- Convenience Stores

- Online Sales Channel

- Others

By Geography(Volume, Million Litres, USD Million, 2019-2030)

- North America

- US

- Canada

- Mexico

- Rest of North America

- Europe

- Germany

- UK

- France

- Russia

- Spain

- Italy

- Rest of Europe

- Asia Pacific

- China

- Japan

- India

- South Korea

- Singapore

- Malaysia

- Rest of Asia Pacific

- LAMEA

- Brazil

- Argentina

- UAE

- Saudi Arabia

- South Africa

- Nigeria

- Rest of LAMEA

Key Market Players

List of Companies Profiled in the Report:

- The Procter and Gamble Company

- Kimberly-Clark Corporation

- 3M Company (3M Health Information Systems)

- Henkel AG & Company, KGaA

- Reckitt Benckiser Group PLC

- Kao Corporation

- Unilever PLC

- The Colgate Palmolive Company

- Lion Corporation

- Johnson & Johnson

Unique Offerings

- Exhaustive coverage

- The highest number of Market tables and figures

- Subscription-based model available

- Guaranteed best price

- Assured post sales research support with 10% customization free

Table of Contents

Companies Mentioned

- The Procter and Gamble Company

- Kimberly-Clark Corporation

- 3M Company (3M Health Information Systems)

- Henkel AG & Company, KGaA

- Reckitt Benckiser Group PLC

- Kao Corporation

- Unilever PLC

- The Colgate Palmolive Company

- Lion Corporation

- Johnson & Johnson