Speak directly to the analyst to clarify any post sales queries you may have.

Concrete bonding agents are essential to construction and infrastructure renewal, ensuring reliable project outcomes in both traditional and advanced building environments. Today’s decision-makers need up-to-date insight to navigate rapid shifts in materials technology and procurement strategies within the concrete bonding agents market.

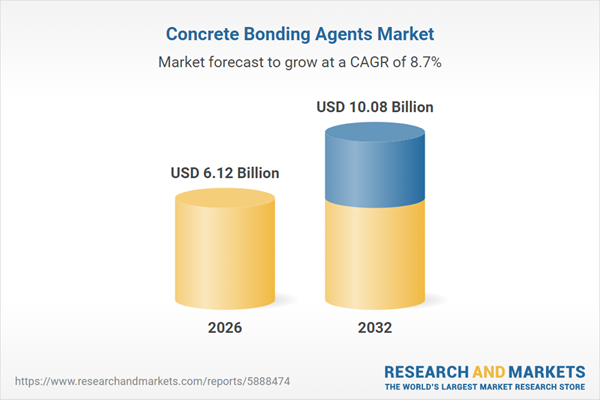

Market Snapshot: Concrete Bonding Agents Market Growth

The Concrete Bonding Agents Market expanded from USD 5.63 billion in 2025 to USD 6.12 billion in 2026. It is set to maintain momentum, advancing at a CAGR of 8.66% and projected to reach USD 10.08 billion by 2032. This upward trend highlights industry-wide adoption of innovative bonding solutions that respond to demands for durability and performance. Market growth is shaped by the integration of new adhesive technologies, evolving project scopes, and rising expectations for operational efficiency, which are driving stakeholders to prioritize adaptability in their decision-making processes.

Scope & Segmentation

- End-Use Applications: Rehabilitation and renovation efforts span commercial, industrial, infrastructure, and residential projects. Each segment presents distinct requirements, from rapid installation in high-traffic environments to long-term resilience in critical facilities.

- Technology Types: Polymeric and nano-enabled bonding agents are advancing both compatibility and lifecycle performance, helping substrates withstand extreme conditions and enabling tailored solutions that align with modern construction practices. This expansion of formulations supports a broad range of use cases across the industry.

- Distribution Channels: The market is served through both offline and online sales models. Technical sales teams offer on-site support and product specification, while digital platforms cater to standardized needs and enable rapid procurement for maintenance operations or retail orders.

- Regional Focus: In the Americas, the spotlight remains on robust solutions for aging infrastructure, while Europe, the Middle East & Africa navigate complex regulatory landscapes and adapt to climate pressures. Asia-Pacific continues to outpace with urbanization, requiring flexible supply chains and solutions for diverse project standards and timelines.

- Regulatory Considerations: Meeting shifting compliance requirements is critical. Stakeholders must adapt to evolving documentation needs and adhere to environmental standards distinct to each region to ensure uninterrupted supply and specification acceptance.

Key Takeaways: Strategic Insights for Concrete Bonding Agents

- Advanced bonding agents are increasingly chosen for both new construction and repairs, driven by stricter requirements for durability and lifecycle assurance.

- Innovation in chemistry, including the adoption of nanomaterials and tailored polymeric adds, is broadening solution performance and ensuring reliable adhesion in diverse on-site conditions.

- Procurement processes are evolving as organizations seek to mitigate supply risk by working with multiple suppliers and qualifying alternative materials for greater resilience.

- Manufacturers are boosting after-sales support, offering technical documentation and training resources that accelerate specification and installation for project teams.

- Distribution strategies are differentiated; offline networks deliver deep technical input and real-time jobsite support, while online models prioritize efficient delivery and access to standardized products for quick turnaround.

- Regional dynamics, including varying regulations and environmental factors, require ongoing customization and local technical support to guarantee consistent product performance and regulatory compliance.

Tariff Impact: Navigating Trade Uncertainty

Recent changes in tariff policy are prompting many stakeholders in the concrete bonding agents market to revise sourcing strategies, particularly for petrochemical intermediates and specialty resins. Import cost volatility is driving investment in domestic production, supplier diversification, and revised formulations to counteract tariff risks. This environment has led to enhanced scenario planning, flexible supply contracts, and increased diligence in supplier evaluation, ensuring continuity and performance under rapidly shifting regulatory and economic circumstances.

Methodology & Data Sources

This analysis employs a triangulated methodology, blending expert interviews, granular review of technical documents, and real-world project data. Certification and supplier claims are cross-referenced with field performance, while current policy and supply chain disruptions are factored into assessments of procurement and product availability.

Why This Report Matters

- Empowers leadership teams with integrated analysis of technology trends, procurement strategies, and regional market developments in the concrete bonding agents market.

- Delivers targeted guidance to strengthen R&D, sourcing, and implementation, minimizing operational and financial exposures across complex project environments.

Conclusion

As project requirements and regulatory frameworks evolve, concrete bonding agents continue to underpin resilient, efficient structures. Informed market insight and coordinated supply initiatives equip stakeholders to achieve dependable performance in any construction context.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

15. China Concrete Bonding Agents Market

Companies Mentioned

The key companies profiled in this Concrete Bonding Agents market report include:- Adherebonds Coats Pvt. Ltd.

- Aero Conchem LLP

- Algitech Chemicals

- BASF SE

- Chembond Chemicals Limited

- Compagnie de Saint-Gobain S.A.

- Dow Chemical Company

- DuraBuild

- Euclid Chemical Company

- Fosroc International Limited

- GCP Applied Technologies Inc.

- Krishna Conchem Products Pvt. Ltd.

- Larsen & Toubro Limited

- Magicrete Building Solutions Pvt. Ltd.

- Mapei S.p.A

- Normet Group

- QUIKRETE

- RadheKrishna Chemical Company

- Resikon Construction Chemicals by Anuvi Chemicals

- Sika AG

- TK Products Construction Coatings

- W. R. Meadows, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 197 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 6.12 Billion |

| Forecasted Market Value ( USD | $ 10.08 Billion |

| Compound Annual Growth Rate | 8.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 23 |