Speak directly to the analyst to clarify any post sales queries you may have.

Introduction to the Internet of Cars executive overview that frames strategic context, immediate imperatives, and stakeholder priorities for connected mobility

The Internet of Cars is reshaping how vehicles are designed, financed, operated, and experienced by end users. As vehicles become mobile data centers, the convergence of connectivity, software-defined functionality, and sensor-driven automation creates a new value stack. Strategic leaders must therefore reconcile legacy manufacturing rhythms with the rapid product iteration cycles typical of software-driven industries. This shift elevates cross-functional collaboration across engineering, cybersecurity, data science, and commercial teams.In this context, stakeholders face competing priorities: maintaining operational reliability while unlocking new revenue streams through services, protecting customer privacy and safety, and managing increasingly complex supplier ecosystems. The introduction of advanced connectivity layers and over-the-air update capabilities transforms product lifecycles and aftermarket interactions, requiring new governance models and contractual frameworks. Meanwhile, evolving regulatory expectations and public scrutiny around safety and data use necessitate proactive compliance planning.

This introduction frames the executive lens you should use when assessing opportunities and risks. It emphasizes the importance of end-to-end organizational alignment, the need to accelerate capability building in software and cloud operations, and the imperative to design commercial models that reflect continuous service delivery rather than one-time hardware sales. These realities set the stage for the strategic and operational analyses that follow.

Transformative shifts redefining vehicle ecosystems through software, data monetization, electrification and supply interplay, and mobility-as-a-service evolution

Today’s vehicle ecosystem is experiencing transformative shifts that alter competitive advantages and operational assumptions. The software-defined vehicle is moving value from hardware bill-of-materials to software platforms, data services, and syndicated mobility experiences. This reorientation compels incumbents to reevaluate product roadmaps and accelerate partnerships with cloud, semiconductor, and communications providers to retain relevance.Simultaneously, electrification and charging infrastructure expansion change vehicle use patterns and open new integration points for connectivity and energy management. The combination of electrified drivetrains and connected services creates synergies where vehicle telemetry informs energy optimization and vice versa, thereby broadening the addressable set of service offerings. At the same time, rising consumer expectations for seamless digital experiences push OEMs to adopt modern user experience paradigms and recurring revenue product models.

Regulatory regimes and safety standards are catching up to technological advances, reshaping compliance obligations for makers and suppliers and increasing the emphasis on validated software development lifecycles. Collectively, these shifts create an environment where agility, secure architecture, and platform thinking are decisive. Organizations that reconfigure around data, modular software platforms, and external ecosystems will be positioned to capture the upside of this structural change.

Assessing the cumulative effects of United States tariffs in 2025 on automotive supply chains, component sourcing, supplier strategies, and global trade routes

United States tariff actions in 2025 exert downstream pressure across global automotive supply chains, influencing sourcing decisions, component lead times, and supplier network resilience. Tariffs increase the marginal cost of imported components and subassemblies, altering comparative economics between sourcing regions. Procurement teams must therefore balance near-term cost increases against longer-term strategic shifts such as supplier diversification, nearshoring, and vertical integration strategies that can mitigate tariff exposure.Operationally, tariffs can lengthen time-to-repair and complicate logistics by redirecting freight flows and prompting requalification activities for alternative suppliers. Engineering organizations may need to validate substitute components, update compliance documentation, and adjust inventory strategies to ensure production continuity. For technology-dependent modules such as telematics units, sensors, and communications hardware, these disruptions have the potential to delay software and integration timelines if supply availability becomes constrained.

From a strategic vantage, tariffs amplify the value of supply chain transparency and scenario planning. Companies that invest in robust supplier risk assessment, multi-sourcing strategies, and flexible contract terms are better placed to absorb tariff shocks. Moreover, firms that accelerate local supplier development or reconfigure their bill-of-materials to prioritize modularity can limit the magnitude of tariff-driven impacts while preserving product roadmaps and customer commitments.

Segmentation insights pinpointing growth drivers and adoption patterns across services, connectivity technologies, applications, vehicle types, and end users

Understanding market opportunities requires granular segmentation analysis that ties product, technology, and customer dynamics to commercial strategy. Based on Services, market is studied across Infotainment, Navigation, Safety And Security, and Telematics, each of which follows distinct adoption curves, integration complexities, and monetization pathways. Infotainment and navigation increasingly converge on personalized ecosystems that depend on cloud services and recurring content agreements, while safety and security modules are driven by regulatory imperatives and certification regimes. Telematics sits at the intersection of operational analytics and connectivity, enabling fleet optimization and remote diagnostics.Based on Connectivity Technology, market is studied across Cellular, DSRC, Satellite, and Wi-Fi, and Cellular is further studied across 4G LTE, 5G, and 6G, which directly affects latency-sensitive applications and long-term architecture choices. The selection between these connectivity technologies shapes architecture decisions from antenna design through backend scaling and edge compute placement. Based on Application, market is studied across Autonomous Driving, Fleet Management, Predictive Maintenance, and Usage Based Insurance, revealing that application-specific data models and latency profiles drive differing priorities for onboard compute and cloud orchestration.

Based on Vehicle Type, market is studied across Heavy Commercial Vehicle, Light Commercial Vehicle, Passenger Vehicle, and Two Wheeler, with each vehicle type manifesting distinct telematics requirements, regulatory contexts, and service economics. Based on End User, market is studied across Aftermarket and Original Equipment Manufacturer, which delineates divergent distribution channels, warranty frameworks, and customer engagement models. Synthesizing these segmentation lenses helps executives target investments where technical feasibility, regulatory fit, and commercial potential converge.

Regional dynamics across the Americas, EMEA, and Asia-Pacific that shape regulation, infrastructure rollout, and adoption of connected vehicle technologies

Regional dynamics materially influence strategic priorities, regulatory risk, and infrastructure investment choices. In the Americas, enterprise fleets and connected insurance initiatives are driving demand for telematics and predictive maintenance, while regulatory focus on emissions and safety continues to shape hardware and software compliance roadmaps. The combination of mature digital payment ecosystems and high vehicle retention rates encourages subscription and usage-based services in select segments.EMEA presents a complex regulatory tapestry where harmonization efforts and stringent data protection standards elevate the importance of privacy-preserving architectures and localized data handling. Urban density and public transit integration in many EMEA markets also create unique interoperability requirements for connected vehicle services and intelligent transport systems. Infrastructure investment priorities in these markets include smart-city integrations and high-assurance communications channels for safety-critical applications.

Asia-Pacific spans markets with rapidly expanding connected vehicle fleets and aggressive adoption of smartphone-native user experiences. Emerging economies within the region emphasize cost-effective telematics solutions and scalable fleet management platforms, whereas advanced markets are deploying 5G-enabled services and piloting autonomous and mobility-as-a-service concepts. Taken together, these regional patterns underline the need for adaptive go-to-market approaches, localized compliance strategies, and differentiated product roadmaps aligned with regional infrastructure and regulatory realities.

Competitive landscape and company-level insights on partnerships, technology portfolios, and vertical integration strategies among automakers and technology firms

Company-level positioning in the Internet of Cars ecosystem is defined by the ability to assemble complementary capabilities across hardware, software, and cloud services. Leading firms are forming strategic partnerships with telecommunications providers, semiconductor suppliers, and cloud platforms to secure prioritized access to capacity, platform integrations, and co-development resources. Such alliances reduce time-to-market for integrated modules and enable coordinated go-to-market plays that bundle connectivity, analytics, and aftermarket services into differentiated value propositions.Competitive differentiation also stems from technology portfolios that balance proprietary software stacks with open-standard interoperability to support broader partner ecosystems. Firms that commit to modular architectures and standardized APIs find it easier to scale across vehicle platforms and regional markets. At the same time, vertical integration-owning select subsystems or in-house manufacturing-remains an attractive path for companies seeking tighter control over quality, cost, and intellectual property, particularly for safety-critical components.

Investment in cybersecurity, secure update mechanisms, and data governance is a defining factor in supplier selection and customer trust. Companies that demonstrate rigorous security practices and transparent data management find it easier to win enterprise fleet customers and secure long-term OEM partnerships. Collectively, these company-level strategies reveal a competitive landscape where cooperation and specialization coexist, with success determined by clarity of positioning and execution capability.

Practical recommendations for leaders to harness connectivity, fortify cybersecurity and data governance, and adapt business models to customer-centric services

Practical recommendations for leaders to harness connectivity, fortify cybersecurity and data governance, and adapt business models to customer-centric services provide a roadmap for translating strategy into execution. First, prioritize platform modularity by investing in software-defined architectures that separate application logic from hardware dependencies, enabling faster feature rollouts and simplified supplier integration. This approach reduces integration risk and shortens time-to-value for new services.Second, treat cybersecurity and data governance as strategic capabilities rather than compliance checkboxes. Implement secure-by-design practices, invest in over-the-air update infrastructure, and define data stewardship policies that clarify data ownership, consent mechanisms, and allowable use cases. These measures reduce systemic risk and build trust with regulators and customers alike.

Third, evolve commercial models toward recurring-revenue formats and service bundles that align incentives across OEMs, suppliers, and channel partners. Pilot subscription offers, telematics-as-a-service packages, and data monetization pilots with clear value propositions and measurable KPIs. Finally, strengthen supplier portfolio resilience through multi-sourcing strategies and regional supplier development to mitigate trade-related disruptions and maintain continuity across product lifecycles.

Research methodology outlining data sources, primary and secondary approaches, stakeholder interviews, and analytic frameworks that ensure study rigor

The research methodology underpinning this analysis combines multiple evidence streams and analytic approaches to ensure rigor and relevance. Primary research included structured interviews with industry executives, engineering leaders, procurement specialists, and regulatory advisors to capture practitioner perspectives on technology adoption, sourcing strategies, and operational constraints. Secondary research reviewed public regulations, standards documentation, technical white papers, and vendor documentation to validate technical assumptions and identify emergent trends.Analytic frameworks included scenario analysis to evaluate supply chain resilience under trade and tariff stress, triangulation across technology adoption signals to identify inflection points for connectivity layers, and qualitative synthesis of company strategies to map competitive positioning. Data integrity was maintained through cross-validation of interview findings with documented sources and attention to source provenance. Where possible, technical claims were corroborated with vendor specifications and regulatory texts.

This mixed-methods approach balances depth of insight with breadth of perspective, enabling a practical set of conclusions and recommendations that reflect both on-the-ground constraints and strategic trajectories. The methodology supports reproducibility and provides an audit trail for key assertions presented in the report.

Conclusion summarizing strategic imperatives and operational priorities organizations should adopt to lead in the evolving Internet of Cars ecosystem

The conclusion synthesizes the report’s central themes into a cohesive set of strategic imperatives that leaders should prioritize. Organizations must internalize that connectivity and software are now central to vehicle value propositions, which means that investments in platform capabilities, data governance, and cybersecurity are not optional but foundational. Firms that reorient engineering and commercial processes around continuous delivery and customer feedback loops will create more resilient and monetizable product portfolios.Operationally, supply chain transparency and supplier diversification are essential to mitigate geopolitical and tariff risks. Procurement and engineering teams should collaborate to design more modular bills-of-materials and adopt flexible sourcing contracts that allow for rapid substitution. At the same time, business leaders must explore new monetization pathways such as subscription services, telematics-driven offerings, and integrated mobility experiences while ensuring clear customer value and compliance with evolving privacy standards.

In short, leading in the Internet of Cars requires a balanced focus on technology, organizational design, and market-facing commercial models. Companies that move decisively to align these elements will unlock durable competitive advantage in a landscape defined by rapid technological change and shifting regulatory expectations.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China Internet of Cars Market

Companies Mentioned

The key companies profiled in this Internet of Cars market report include:- AT&T Inc.

- AUDI AG

- Bayerische Motoren Werke AG

- Cisco Systems, Inc.

- Eastern Peak

- General Motors Company

- Google LLC by Alphabet Inc.

- Intel Corporation

- International Business Machines Corporation

- Microsoft Corporation

- NXP Semiconductors N.V.

- Oracle Corporation

- Qualcomm Technologies, Inc.

- Robert Bosch GmbH

- Samsung Electronics Co., Ltd.

- SAP SE

- Tata Communications

- Telefonaktiebolaget LM Ericsson

- Texas Instruments Incorporated

- Thales Group

- Verizon

- Volkswagen AG

- Wipro Limited

Table Information

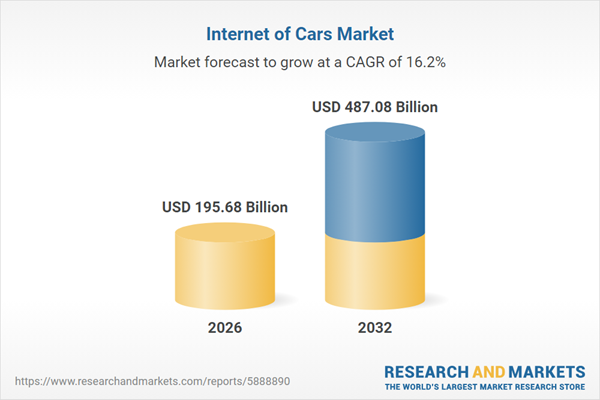

| Report Attribute | Details |

|---|---|

| No. of Pages | 197 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 195.68 Billion |

| Forecasted Market Value ( USD | $ 487.08 Billion |

| Compound Annual Growth Rate | 16.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 24 |