Speak directly to the analyst to clarify any post sales queries you may have.

An incisive overview of how technological innovations regulatory pressures and evolving end-user needs are reshaping vacuum pump selection criteria

The global vacuum pump landscape has undergone a notable evolution as manufacturers, end users, and technology providers recalibrate to new operational paradigms. Innovations in pump design, materials science, and control electronics are converging with stricter environmental and safety regulations, leading to an accelerated emphasis on energy efficiency, lower lifecycle costs, and reduced emissions. At the same time, demand-side shifts driven by semiconductor fabrication, pharmaceutical manufacturing, and specialized laboratory workflows are increasing the need for precision, repeatability, and contamination control across vacuum systems.From an engineering perspective, modern vacuum pump solutions must balance throughput and ultimate vacuum levels with reliability and maintainability. This balance influences procurement decisions across sectors such as chemical processing, healthcare, and research facilities, where uptime and process integrity directly affect output quality and regulatory compliance. As manufacturers push for higher productivity and shorter time-to-market, procurement teams and plant engineers increasingly prioritize modular architectures and smart monitoring capabilities that enable predictive maintenance and remote diagnostics. Consequently, the market has become as much about integrated system performance and services as about the pumps themselves.

Key market shifts including decarbonization digitalization and contamination control that are driving fundamental redesigns in vacuum pump technologies and services

Several transformative shifts are actively redefining competitive dynamics and product roadmaps across the vacuum pump ecosystem. First, the transition toward oil-free and dry technologies is being driven by end users that require contamination-free process environments, particularly in electronics manufacturing and life sciences applications. This trend is prompting suppliers to reengineer sealing mechanisms and thermal management while maintaining throughput and service intervals.Second, digitalization is embedding intelligence into pump platforms through integrated sensors, IoT connectivity, and cloud-based analytics. These features change the nature of aftermarket services by enabling condition-based maintenance, remote troubleshooting, and firmware-driven performance optimization. Third, sustainability considerations are accelerating the adoption of energy-efficient motor drives and variable-speed control systems that reduce operational costs and align with corporate decarbonization goals. Fourth, materials and surface treatments that minimize outgassing and particulate generation are becoming critical for ultra-high vacuum and research-grade applications. Lastly, supply chain resilience and localized manufacturing are influencing sourcing strategies, leading to diversified supplier portfolios and increased emphasis on regional service networks. Together, these shifts are transforming not only product design but also commercial models and aftermarket value propositions.

How the 2025 tariff adjustments are reshaping procurement strategies sourcing footprints and total-cost-of-ownership calculations across the vacuum pump value chain

The tariff landscape introduced by the United States in 2025 has added a new layer of complexity to procurement, sourcing, and pricing strategies within the vacuum pump sector. Tariff adjustments affect imported components, finished units, and repair parts, prompting manufacturers and end users to reassess supplier footprints and inventory strategies. In response, several firms have accelerated nearshoring efforts to mitigate tariff exposure while maintaining delivery performance for critical equipment and service parts.Procurement teams have adapted by intensifying total-cost-of-ownership analyses that explicitly incorporate tariff contingencies, compliance costs, and potential delays in cross-border logistics. These considerations have increased the attractiveness of regional sourcing, long-term supplier agreements, and dual-sourcing strategies to limit single-vendor dependency. Repair and aftermarket service providers have adjusted spare parts inventories and introduced localization options for maintenance activities to shield customers from tariff-induced lead time variability. Regulators and trade advisors have also become integral to contract negotiations as buyers seek clarity on classification rules and potential exemptions. Ultimately, the tariff environment is shifting strategic emphasis toward resilience and flexibility, encouraging investments in local assembly, certification of alternate component sources, and contractual protections against sudden policy changes.

Comprehensive segmentation-driven insights linking pump types technologies industry use cases pressure classes and power ratings to specific design and service imperatives

Segmentation analysis reveals nuanced demand drivers across pump types, technologies, end-use industries, pressure ranges, operation stages, sealing approaches, power ratings, and application areas, each influencing product development and go-to-market strategies. When considering pump type, offerings such as Centrifugal, Diaphragm, Liquid Ring, Reciprocating, Rotary, Scroll, and Turbomolecular serve distinct performance envelopes and maintenance profiles, which necessitate tailored service models and spare parts strategies. Technology segmentation into Dry and Wet systems highlights trade-offs between contamination control and lubrication-management practices that affect lifecycle costs and regulatory compliance.End use industry segmentation across Automotive, Chemical & Petrochemical, Electronics, Food & Beverage, Healthcare & Medical, Oil & Gas, Pharmaceuticals, Power Generation, and Research & Labs underscores the importance of application-specific performance criteria, such as chemical resistance, cleanroom compatibility, and continuous-duty reliability. Pressure range distinctions-High Vacuum, Low Vacuum, Medium Vacuum, and Ultra High Vacuum-drive design considerations around sealing, materials selection, and pumping stages. Operation stage segmentation into Single Stage and Two Stage configurations correlates with the required ultimate pressure and efficiency for particular process steps. Sealing variants including Oil Free, Oil Sealed, and Water Sealed affect contamination risks and maintenance protocols. Power rating categories spanning Less Than 3 Kw, 3 To 15 Kw, 15 To 75 Kw, and Above 75 Kw correspond to scale-of-operation and integration needs with facility power infrastructure. Finally, application segmentation for Degassing, Distillation, Evacuation, Freeze Drying, Laboratory Applications, and Vacuum Packaging reveals specialized requirements for throughput, process repeatability, and end-product integrity. Integrating these segmentation lenses allows suppliers and buyers to articulate clearer value propositions and prioritize R&D investments for the segments with the most strategic relevance to their portfolios.

Regional demand contrasts and go-to-market imperatives across the Americas Europe Middle East and Africa and Asia-Pacific that affect product positioning and service delivery

Regional dynamics differ markedly across the Americas, Europe Middle East & Africa, and Asia-Pacific, each presenting distinct demand signals, regulatory environments, and supply chain characteristics that influence commercialization strategies. In the Americas, manufacturers and end users prioritize rapid service response, robust aftermarket networks, and compliance with environmental and safety regulations that emphasize emissions and energy efficiency. This market rewards suppliers who offer strong local support, modular service contracts, and retrofit capabilities that extend equipment life.Across Europe Middle East & Africa, stringent regulatory regimes, advanced manufacturing clusters, and specialized research institutions create demand for high-performance, contamination-controlled solutions and certification-ready equipment. In this region, sustainability mandates and energy efficiency standards shape procurement priorities and favor technologies that demonstrate measurable lifecycle benefits. In the Asia-Pacific region, diverse industrialization stages and aggressive capital investment in sectors such as electronics and pharmaceuticals drive demand for scalable, high-throughput systems as well as cost-competitive offerings. Local supply chains and regional manufacturing hubs enable rapid scale-up, while increasing local R&D investment supports innovation tailored to regional process requirements. Understanding these regional contrasts enables suppliers to calibrate distribution models, aftersales capabilities, and product roadmaps to match localized priorities and regulatory constraints.

How top manufacturers are converging engineering innovation and service-led business models to drive reliability performance and sustainable lifecycle economics

Leading companies are differentiating through combinations of engineering excellence, service ecosystems, and integrated digital capabilities that reduce downtime and optimize lifecycle costs. Strategic investments in R&D are focusing on materials, sealing technologies, and variable-speed drives that enhance efficiency and reliability. Market leaders are also expanding service portfolios to include predictive maintenance, condition monitoring, and subscription-based performance guarantees that align supplier incentives with customer uptime.Commercially, partnerships and selective acquisitions are consolidating domain expertise in niche technologies and regional service footprints. Companies that integrate supply chain transparency and traceability into their operations reduce vulnerability to external shocks while improving compliance with customer procurement requirements. Additionally, some manufacturers are piloting circular-economy initiatives that emphasize remanufacturing and parts recovery to meet sustainability objectives. Those that can present compelling total-cost-of-ownership propositions backed by strong service networks and digital analytics are increasingly viewed as preferred partners by sophisticated end users seeking predictable performance and lower operational risk.

High-impact recommendations for manufacturers and service providers to strengthen resilience accelerate product differentiation and unlock recurring revenue opportunities

Industry leaders should prioritize a coordinated set of strategic actions that reinforce resilience, sustainability, and customer-centricity across product and service offerings. First, accelerate development and commercialization of contamination-controlled and oil-free pump technologies for high-sensitivity applications while ensuring aftersales training and certification for service partners. Second, embed sensor suites and connectivity into new platforms to enable predictive maintenance, remote diagnostics, and data-driven service contracts that reduce unplanned downtime and enhance customer value.Third, reconfigure supply chains to mitigate tariff exposure and geopolitical risk by diversifying supplier bases and establishing localized assembly or repair hubs in key markets. Fourth, quantify and communicate lifecycle environmental benefits through standardized metrics that align with customer ESG goals and procurement requirements. Fifth, expand aftermarket and subscription offerings to create recurring revenue streams and strengthen long-term customer relationships. Finally, invest in targeted M&A or strategic partnerships to acquire niche capabilities in materials science, digital analytics, or regional service networks that accelerate time-to-market for differentiated solutions. Implementing these actions in an integrated manner will enable firms to capture value across design, operations, and commercial dimensions.

A transparent research methodology combining primary interviews secondary technical analysis segmentation frameworks and scenario testing to validate strategic implications

This study synthesizes primary and secondary research methodologies to ensure rigorous and reproducible insights for strategic decision-making. Primary research consisted of structured interviews and validation workshops with procurement managers, plant engineers, R&D leads, and senior executives across manufacturing, healthcare, and research institutions, which provided qualitative perspectives on performance priorities, procurement drivers, and aftermarket expectations. Secondary research involved a systematic review of technical literature, regulatory guidance, supplier technical white papers, and industry standards to contextualize performance requirements and compliance constraints.The analytical approach integrated a segmentation framework that examined pump type, technology, end-use industry, pressure range, operation stage, sealing method, power rating, and application area, enabling cross-sectional analysis of demand drivers and product fit. Triangulation protocols ensured consistency between interview findings and documented technical requirements, while scenario analysis explored the operational implications of tariff shifts and supply chain disruptions. Quality controls included peer review of key assumptions and source verification for all technical assertions. The methodology prioritizes transparency in data provenance and provides traceable logic from raw inputs to actionable implications, supporting confident strategic choices by market participants.

A strategic synthesis underscoring why innovation resilience and service integration will determine winners in the evolving vacuum pump ecosystem

In conclusion, the vacuum pump sector is entering a phase where product performance, digital enablement, sustainability, and supply chain resilience jointly determine competitive advantage. Advances in dry and oil-free technologies align with growing contamination control demands in electronics, pharmaceuticals, and laboratory settings, while digital monitoring and analytics are redefining service expectations and lifecycle management. Regional differences in regulation, industrial focus, and supply chain structure require suppliers to adopt differentiated commercialization strategies that match local priorities and service expectations.The tariff dynamics introduced in 2025 have sharpened focus on sourcing flexibility and total-cost-of-ownership analyses, accelerating nearshoring and inventory strategy adjustments. Companies that invest in integrated product-service models, prioritize energy-efficient designs, and expand regional service networks will be better positioned to capture long-term value. Strategic collaboration across engineering, supply chain, and commercial functions will be critical to convert technological capabilities into dependable customer outcomes. Overall, the market rewards firms that execute with precision on innovation, operational resilience, and demonstrable sustainability credentials.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

20. China Vacuum Pumps Market

Companies Mentioned

The key companies profiled in this Vacuum Pumps market report include:- Atlas Copco AB

- BECKER GmbH & Co. KG

- Busch Vacuum Solutions GmbH & Co. KG

- Ebara Corporation

- Edwards Limited

- EMTIVAC Engineering Pty. Ltd.

- Finetech Vacuum Pumps

- Flowserve Corporation

- Gardner Denver Holdings Inc.

- Gneuss Kunststofftechnik GmbH

- Graham Corporation

- Ingersoll Rand Inc.

- Leybold GmbH

- Pfeiffer Vacuum Technology AG

- ULVAC, Inc.

Table Information

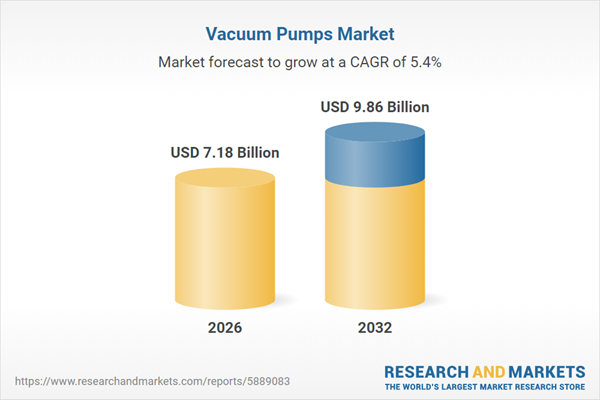

| Report Attribute | Details |

|---|---|

| No. of Pages | 194 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 7.18 Billion |

| Forecasted Market Value ( USD | $ 9.86 Billion |

| Compound Annual Growth Rate | 5.4% |

| Regions Covered | Global |

| No. of Companies Mentioned | 16 |