Speak directly to the analyst to clarify any post sales queries you may have.

A clear, strategic framing of land mobile radio systems that establishes scope, stakeholders, technology building blocks, and decision levers for modernization and resilience

The land mobile radio ecosystem remains a foundational element of critical communications across public safety, industrial operations, defense, and commercial services. This executive summary opens by framing the technical and operational contours of contemporary LMR deployments, highlighting how legacy analog systems coexist with evolving digital standards and network management paradigms. Stakeholders must evaluate not only device and infrastructure lifecycles but also interoperability, spectrum allocation, and long-term maintenance obligations that influence procurement and upgrade strategies.As the industry pivots toward digital voice and data integration, organizations face decisions around device types, base station architectures, and software stacks that support resilient communication under duress. Decision-makers require a clear view of how hardware, services, and software intersect to deliver mission-critical outcomes. This introduction sets the stage for a focused analysis by clarifying the scope of technologies, primary use cases, and the stakeholder groups-ranging from network operators to frontline responders-whose priorities will shape near-term investments and modernization roadmaps.

Finally, the introduction underscores the importance of aligning technical choices with governance, regulatory compliance, and long-term operational sustainability. By establishing a common vocabulary and outlining the core technical building blocks, this section prepares readers for the subsequent exploration of market dynamics, tariff impacts, segmentation intelligence, regional nuances, and strategic recommendations that support informed decision making.

How technological convergence, interoperability demands, and supply chain resilience are driving hybrid deployments and redefining procurement and lifecycle strategies in LMR

The landscape for land mobile radio is undergoing transformative shifts driven by technological convergence, increased expectations for data-rich communications, and a renewed focus on resilience. Digital systems have matured to offer secure, encrypted voice and low-latency data services, enabling capabilities such as telemetry, location tracking, and integrated incident management. Concurrently, advancements in network management software and radio application platforms are creating new possibilities for predictive maintenance, remote configuration, and performance optimization that reduce operational overhead.Interoperability has emerged as a central design criterion as agencies and enterprises demand cross-platform connectivity between legacy analog networks and modern digital standards. This has spurred a wave of hybrid deployments, where analog infrastructure is augmented with digital overlays and gateways to preserve investment while introducing modern functionality. In parallel, the proliferation of rugged handheld devices, in-vehicle applications, and sophisticated base stations is shifting procurement toward modular, upgradeable hardware that supports incremental capability enhancements.

Finally, supply chain considerations, cybersecurity imperatives, and the evolving regulatory environment are accelerating shifts in procurement strategies. Organizations increasingly prioritize vendors that demonstrate robust lifecycle support, transparent security practices, and flexible service contracts. As a result, the competitive landscape is favoring suppliers and integrators who can combine hardware expertise with software-driven value-adds and comprehensive services portfolios, enabling customers to navigate the transition without compromising operational continuity.

Tariff-driven supply chain adaptations and procurement strategies that are reshaping sourcing choices, regional manufacturing, and total cost assessments across the LMR value chain

Tariff adjustments and trade policy developments in the United States have introduced new variables into sourcing and supply chain strategies for land mobile radio ecosystem participants. Increased duties on certain electronic components and finished communications equipment have prompted buyer organizations and system integrators to reassess supplier footprints, procurement timelines, and inventory buffers. In response, many stakeholders have accelerated supplier diversification and reviewed component substitution strategies to mitigate exposure to tariff volatility.Consequently, organizations are placing greater emphasis on nearshoring and regional manufacturing partnerships to reduce transit times and tariff-related cost variability. Procurement teams are also renegotiating contract terms to include more flexible pricing and logistics clauses that account for tariff-induced lead time fluctuations. At the same time, original equipment manufacturers are reevaluating their bill of materials and supplier tiers to absorb or offset tariff impacts without compromising performance or regulatory compliance.

Moreover, tariffs have amplified the importance of total cost of ownership analyses that incorporate duties, compliance costs, and longer inventory cycles. Systems integrators and end-users are collaborating more closely to design procurement strategies that prioritize critical spares, compatibility across device generations, and software-driven capability extensions to prolong hardware useful life. In sum, tariff dynamics are reshaping procurement playbooks and accelerating a shift toward resilient supply chain architectures that balance cost, lead time, and continuity of service.

Comprehensive segmentation insights that connect component, device, technology, frequency, channel mode, functionality, and application distinctions to strategic product and service decisions

A nuanced segmentation approach is essential to understand where value is concentrated within land mobile radio systems and how technical and commercial choices drive outcomes. Based on Component, the market must be analyzed across Hardware, Services, and Software; Hardware further subdivides into Antennas, Receivers, and Transmitters; Services include Installation and Integration Services and Maintenance Services; Software comprises Network Management Software and Radio Application Software. These component distinctions reveal differing margin profiles, lifecycle cadences, and aftermarket opportunity sets, with services and software creating recurring revenue streams that complement one-time hardware sales.Device Type segmentation separates Base Stations, Handheld Devices, and In-Vehicle Applications, each presenting distinct performance requirements and environmental specifications. Base stations prioritize uptime and scalability, handheld devices focus on durability and ergonomic design, and in-vehicle units balance connectivity with vehicle-integrated power and antenna considerations. Technology Type segmentation contrasts Analog Systems with Digital Systems, where the latter is further categorized into DMR, NXDN, P25, and TETRA; this differentiation highlights the importance of standards compliance and upgradeability when planning network evolution.

Frequency Band segmentation segments across 200 MHz-512 MHz, 25 MHz-174 MHz, and 700 MHz & ABOVE, shaping propagation characteristics, coverage planning, and antenna design choices. Channel Mode delineation between Multi-Channel Mode and Single-Channel Mode impacts spectrum efficiency and network architecture decisions. Functionality segmentation across Data Communication, Location Tracking, Telemetry Services, and Voice Communication clarifies use-case prioritization, while Application segmentation spans Commercial, Industrial, Military & Defense, and Public Safety, with Public Safety further broken down into Emergency Services, Firefighting, and Law Enforcement-each application area imposes unique reliability, security, and regulatory demands that should inform product roadmaps and service-level commitments.

Regional dynamics and regulatory complexity that influence procurement, interoperability, and vendor selection across the Americas, Europe, Middle East & Africa, and Asia-Pacific markets

Regional dynamics play a pivotal role in shaping technology adoption, procurement strategies, and regulatory compliance across land mobile radio deployments. In the Americas, procurement decisions often emphasize rapid deployment, interoperability with legacy systems, and integration with public safety communications protocols, driving demand for robust maintenance agreements and upgrade paths. Infrastructure density and urbanization trends influence the balance between handheld device proliferation and base station investments, while cross-border interoperability concerns can affect equipment certification and deployment timing.In Europe, Middle East & Africa, regulatory heterogeneity and spectrum allocation variances create a mosaic of deployment models where local regulatory clarity and vendor certification often determine procurement timelines. Public safety agencies in this region prioritize standards-based digital systems and cross-agency operability, which elevates the importance of compliance expertise and multinational support structures. Furthermore, infrastructure investment cycles and the diversity of industrial and commercial application requirements necessitate flexible service offerings that accommodate widely varying operational needs.

Across Asia-Pacific, rapid urbanization, a large industrial base, and significant defense modernization programs drive demand for both ruggedized hardware and scalable software solutions. Governments and large enterprises in the region frequently emphasize indigenization and local manufacturing partnerships, affecting vendor selection and supply chain strategies. In all regions, local training, spare parts availability, and service-level responsiveness remain decisive factors for long-term supplier relationships, underscoring the need for tailored regional approaches that reconcile global standards with local operational realities.

How leading suppliers combine modular hardware, lifecycle services, and software-driven capabilities to secure long-term contracts and drive recurring revenue in mission-critical communications

Leading companies in the land mobile radio space differentiate through a combination of integrated hardware platforms, comprehensive service offerings, and evolving software ecosystems. Market-leading suppliers have invested heavily in modular hardware designs that enable field-upgradable capabilities and simplified logistics for spare parts. They have also cultivated systems integration expertise to support complex multi-vendor environments and to deliver turnkey deployments that meet stringent reliability standards for mission-critical users.On the services side, top-tier providers emphasize lifecycle management, offering proactive maintenance, training, and firmware update programs that extend equipment longevity and reduce total operational risk. Those with strong software capabilities are advancing network management and radio application suites that facilitate real-time monitoring, performance analytics, and secure communications. Partnerships between hardware vendors and software developers have become pivotal, enabling vendors to bundle services and software subscriptions that lock in recurring revenue and deepen customer relationships.

Competitive differentiation increasingly rests on security posture, compliance track record, and the ability to demonstrate high-availability architectures. Providers that invest in secure supply chains, transparent component sourcing, and rigorous software assurance practices position themselves favorably among public safety and defense customers. Overall, successful companies balance product innovation with strong service frameworks and robust channel ecosystems to meet diverse customer needs across sectors and geographies.

Actionable strategic priorities for vendors and operators to enhance interoperability, supply chain resilience, cybersecurity, and service-driven revenue models in LMR deployments

Industry leaders should adopt a set of actionable strategies to capitalize on the evolving LMR landscape and to mitigate operational and procurement risks. First, prioritize interoperability and upgrade pathways when specifying new systems to protect existing investments and to facilitate seamless integration with partner networks. Investing in modular hardware and software-centric architectures will allow organizations to extend asset lifecycles and to deploy targeted capability enhancements without wholesale replacements.Second, cultivate resilient supply chains by diversifying suppliers, establishing regional manufacturing partnerships, and maintaining strategic inventories of critical spares. This reduces exposure to tariff volatility and logistics disruptions while enabling rapid field repairs and replacements. Simultaneously, embed cybersecurity by design across both hardware and software components to meet heightened regulatory expectations and to protect mission-critical communications from evolving threats.

Third, develop service-oriented commercial models that combine installation, maintenance, and software subscriptions to create predictable, recurring revenue while delivering measurable uptime and performance guarantees to customers. Finally, invest in workforce training and partnership ecosystems that strengthen local service capabilities and accelerate deployment cycles. By executing on these priorities, industry leaders can both preserve operational continuity for customers and unlock new avenues for growth in adjacent applications and geographies.

A rigorous, evidence-driven methodology combining expert interviews, standards review, and capability mapping to validate technical claims and deployment realities in LMR systems

The research methodology underpinning this analysis integrates primary and secondary data sources, structured interviews with domain experts, and a rigorous review of technical standards and procurement practices. Primary inputs included confidential discussions with systems integrators, network operators, procurement leads, and end users across public safety, industrial, and defense sectors, which illuminated real-world constraints and prioritized use-case requirements. These insights were cross-referenced against vendor product literature, regulatory filings, and standards documentation to validate technical claims and interoperability assertions.Analytical techniques applied include qualitative trend analysis, capability mapping, and comparative assessment of product and service offerings to identify differentiation and lifecycle considerations. The methodology emphasizes triangulation of evidence to ensure findings are robust: vendor disclosures and published specifications were tested against field experiences and integrator feedback to surface practical deployment implications. Throughout the process, attention was given to regulatory contexts, supply chain dependencies, and software lifecycle management factors that materially affect procurement and operational decisions.

Limitations of the research are acknowledged, particularly where proprietary procurement data or classified defense procurement details are restricted. Nonetheless, the combined approach delivers a comprehensive, evidence-based perspective that supports strategic planning, vendor selection, and technology roadmapping for stakeholders seeking to modernize and sustain resilient land mobile radio communications.

A conclusive synthesis emphasizing interoperability, supply chain agility, and software-driven modernization as the decisive factors shaping resilient LMR strategies and investments

In conclusion, land mobile radio systems occupy a critical intersection between legacy communications architectures and modern, software-enabled capabilities. The imperative for interoperability, resilience, and lifecycle optimization will continue to drive hybrid deployment patterns where analog and digital systems coexist while migration strategies evolve. Organizations that align procurement with modular design principles, robust service contracts, and strong cybersecurity practices will be best positioned to maintain operational continuity while extracting greater value from networked voice and data services.Tariff dynamics and regional manufacturing trends have added urgency to supply chain and sourcing strategies, compelling both vendors and buyers to adopt more flexible contractual frameworks and localized production partnerships. Meanwhile, segmentation insights across components, device types, technologies, frequency bands, channel modes, functionalities, and applications provide a clear taxonomy for prioritizing investments and for aligning product roadmaps with end-user requirements. Together, these factors create a strategic landscape where disciplined planning, collaborative vendor relationships, and continuous capability upgrades will determine long-term success.

Ultimately, the path forward demands a pragmatic balance between preserving existing operational capabilities and embracing incremental modernization driven by software and service innovations. Stakeholders that act decisively to integrate these elements into procurement and deployment strategies will sustain mission-critical communications and unlock new operational efficiencies across public safety, industrial, defense, and commercial environments.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

19. China Land Mobile Radio Systems Market

Companies Mentioned

The key companies profiled in this Land Mobile Radio Systems market report include:- Airbus SE

- ANRITSU CORPORATION

- Applied Communications Services, Inc

- BCE Systems

- BK Technologies Corporation

- Cisco Systems, Inc.

- Codan Limited

- Damm Cellular Systems

- Hytera Communications Corporation Limited

- Icom Inc.

- JVCKENWOOD Corporation

- L3Harris Technologies, Inc.

- Leonardo S.p.A.

- Midland Radio Corporation

- Motorola Solutions, Inc.

- PierCon Solutions, LLC

- PowerTrunk, Inc.

- Samsung Electronics Co., Ltd.

- Sepura Limited

- Simoco Wireless Solutions Limited

- Tait International Limited

- TE Connectivity Corporation

- Thales Group

- Triple C Communications, Inc.

Table Information

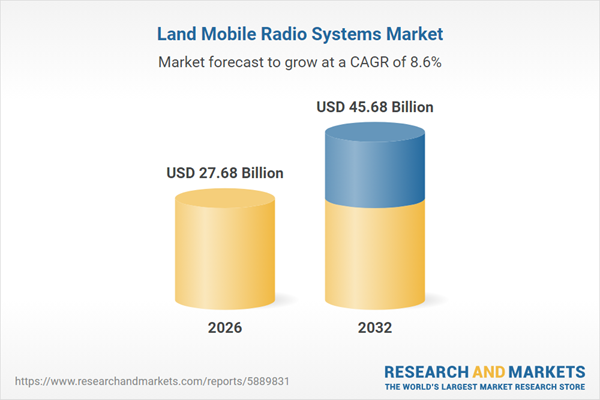

| Report Attribute | Details |

|---|---|

| No. of Pages | 182 |

| Published | January 2026 |

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 27.68 Billion |

| Forecasted Market Value ( USD | $ 45.68 Billion |

| Compound Annual Growth Rate | 8.6% |

| Regions Covered | Global |

| No. of Companies Mentioned | 25 |