Speak directly to the analyst to clarify any post sales queries you may have.

A comprehensive orientation to ZDDP additives that clarifies technical functions, procurement considerations, and cross-functional trade-offs shaping strategic decisions

The zinc dialkyldithiophosphate (ZDDP) additives landscape stands at a pivotal juncture as stakeholders across lubricant formulation, equipment manufacturing, and industrial maintenance look to reconcile traditional performance expectations with evolving regulatory, environmental, and supply-chain realities. This executive summary provides a structured orientation for senior decision-makers by contextualizing ZDDP’s role as a multifunctional antiwear and antioxidant additive while underscoring the operational implications of recent policy shifts and technological developments. The purpose is to frame the competitive and operational considerations that technical and commercial leaders must weigh when setting product roadmaps, procurement strategies, and compliance roadmaps.Early in any strategic review, it is vital to recognize that ZDDP remains central to protecting mechanical interfaces under boundary lubrication conditions, particularly in high-load, high-temperature applications. At the same time, formulators are navigating trade-offs between achieving target antiwear performance and meeting evolving emissions and aftertreatment compatibility requirements. This duality necessitates a sophisticated understanding of interactions between ZDDP concentration, base oil chemistry, and downstream hardware sensitivities. As a result, technical teams and procurement leaders are increasingly collaborating to balance short-term reliability with medium-term shifts toward lower-metal or alternative chemistries.

Transitioning from technical function to commercial impact, product portfolios are being re-evaluated through lenses of sustainability, cost volatility, and the resilience of supply chains. Procurement professionals are integrating supplier diversification strategies and longer-term sourcing contracts to mitigate upstream disruptions, while R&D teams are accelerating efforts to adapt formulations without risking equipment life or warranty exposure. Taken together, these dynamics create an environment where coordinated cross-functional planning is no longer optional but essential for preserving both product performance and market access.

How regulatory scrutiny, formulation breakthroughs, and supply-chain modernization are jointly reshaping competitive dynamics and technical choices across the additives landscape

The ZDDP additives sector is undergoing transformative shifts driven by environmental policy evolution, new formulation science, and changing end-use priorities. Regulatory scrutiny over metal-containing additives in some jurisdictions has intensified, prompting formulators to examine dose optimization, alternative chemistries, and catalyst- and emissions-system compatibility. Concurrently, advances in lubricant additive technology, including synergistic packages and surface engineering approaches, are redefining how antiwear performance is achieved, enabling potential reductions in ZDDP concentration while preserving functionality under critical operating conditions.Meanwhile, supply chain modernization and digital traceability are altering procurement dynamics. Enhanced transparency in sourcing and raw-material provenance is increasingly demanded by OEMs and major fleets, which now require not only specification compliance but also evidence of sustainability credentials and supply-chain resilience. These demands incentivize manufacturers to invest in vertical integration, strategic partnerships, and nearshoring of critical intermediates. In parallel, customer expectations are shifting: end users are more focused on whole-life equipment costs, which elevates the importance of demonstrable antiwear performance and the avoidance of premature component failures.

Technological convergence is another key vector of change. The interaction of ZDDP with advanced base oils-particularly synthetic and bio-based platforms-is generating novel formulation paradigms. In addition, growth in electrified and hybrid drivetrains is altering lubricant requirements for certain vehicle segments, leading to differentiated additive strategies. Taken together, these factors are producing a more segmented market where technical differentiation, regulatory alignment, and supply-chain agility determine competitive positioning. Consequently, companies that align R&D, commercialization, and supply functions will be best placed to navigate the landscape’s accelerating pace of change.

Evaluating how US tariff measures have reshaped sourcing strategies, production footprints, and contractual approaches to preserve supply resilience and performance consistency

In 2025 the cumulative effects of tariffs implemented by the United States have materially influenced sourcing patterns, supplier negotiations, and downstream cost structures across the lubricants ecosystem. Tariff measures have acted as a catalyst for procurement teams to reassess international supplier exposure, leading to concentrated efforts to diversify raw-material origins and to secure redundancy in critical intermediate chemicals. As a result, supply chains have become more complex, with a heavier emphasis on regional suppliers and strategic inventories to mitigate the risk of sudden cross-border cost shifts.Operationally, manufacturers and formulators have responded by reconfiguring purchasing strategies. Some have pursued longer-term contracts that offer price stability and priority access to constrained feedstocks, while others have invested in local blending capacity to reduce tariff exposure on finished goods. These shifts have implications for working capital, as buffer inventories and local production ramp-ups require more capital deployment and logistical coordination. Importantly, the redistribution of sourcing has also affected lead times and batch variability, driving closer collaboration between procurement, production, and quality teams to maintain formulation consistency and performance standards.

On the commercial front, the tariff-driven cost reshuffle has intensified conversations with OEMs, fleet operators, and channel partners regarding pass-through mechanisms and value-sharing arrangements. Vendors must now clearly articulate the performance and total cost-of-ownership benefits of specific additive packages to justify any price adjustments. Moreover, the tariffs have accentuated the strategic importance of supplier relationships that offer technical support, collaborative problem-solving, and co-development options. As firms adapt, they are increasingly focused on contractual flexibility, scenario planning, and the creation of contingency playbooks that anticipate additional policy shifts or retaliatory measures. These measures collectively aim to preserve product reliability while maintaining commercial viability in an environment of elevated policy risk.

Segment-specific technical and commercial priorities that drive differentiated R&D, distribution strategies, and tailored additive formulations across distinct applications and customer cohorts

A nuanced segmentation lens reveals differentiated dynamics across applications, end users, base oil types, distribution channels, additive form factors, and zinc concentration levels, each influencing R&D prioritization, commercial outreach, and supply strategies. Across applications, engine oil continues to demand formulations that balance wear protection with emissions-system compatibility, whereas gear oil and transmission fluid applications require formulations optimized for shear stability and extreme-pressure performance. Grease and hydraulic fluid applications emphasize thickener and shear compatibility, and industrial oils used in manufacturing and power generation present unique thermal and oxidative stability requirements that drive specialized ZDDP dosing strategies.Examining end-user verticals highlights varying risk tolerances and performance priorities. Agriculture and construction sectors typically emphasize durability and field reliability under heavy loads and contamination risk, while automotive segments differentiate between commercial vehicle needs for high-load endurance and passenger vehicle demands for refined noise-vibration-harshness (NVH) characteristics and aftertreatment compatibility. Marine applications underscore corrosion protection and lubricant longevity in corrosive environments, whereas industrial end users prioritize predictable maintenance intervals and compatibility with equipment warranties. These distinctions shape product positioning and technical support models.

Base oil chemistry dramatically affects additive interaction and efficacy. Bio-based oils are driving interest where biodegradability and sustainability credentials matter, yet they introduce formulation challenges in oxidative stability that require complementary antioxidant strategies. Mineral oil platforms remain relevant for cost-sensitive applications, while synthetic oils-particularly ester chemistries, advanced Group III+ formulations, and PAO (polyalphaolefin) base stocks-enable higher-performance packages that can sometimes reduce additive dosages without compromising protection. Distribution channels play a parallel role in market access; aftermarket channels rely on off-highway retail and expanding online retail platforms for volume sales and technical education, whereas OEM pathways emphasize direct supply and tier-1 distributor relationships that align with warranty and specification compliance.

Regarding additive forms and zinc concentrations, liquid and powder formulations offer different advantages in handling, blending flexibility, and end-use dosing. High, medium, and low zinc concentration options respond to differing equipment sensitivities and regulatory thresholds, prompting formulators to create tiered product families and to provide clear technical guidance on application-specific dosing. Overall, segmentation-informed strategies enable targeted R&D investment and customized commercial approaches that respect the technical nuances of each application and customer cohort.

Contrasting regulatory pressures, procurement behaviors, and technology adoption trends across the Americas, Europe Middle East & Africa, and Asia-Pacific regions that shape localized strategies

Regional dynamics reveal strategic contrasts in regulatory environments, supply-chain architectures, and end-user demand profiles across the Americas, Europe, Middle East & Africa, and Asia-Pacific. In the Americas, industrial and automotive segments place a premium on rugged performance and aftermarket accessibility, with strong interest in solutions that support heavy-duty applications and fleet reliability. Procurement behaviors in this region emphasize supplier accountability and value-based contracting as purchasers seek to align maintenance economics with uptime objectives.In Europe, Middle East & Africa, regulatory frameworks and emissions pathways exert significant influence on formulation choices, creating an elevated focus on compatibility with advanced aftertreatment systems and life-cycle environmental performance. This region’s blend of mature automotive markets and diverse industrial end users encourages innovation in lower-metal additive strategies and in documentation practices that facilitate cross-border compliance. The Middle East’s industrial demand, driven by energy and petrochemical sectors, simultaneously requires robust thermal stability and corrosion resistance in lubricant solutions.

Asia-Pacific exhibits rapid technology adoption in both industrial and automotive sectors, and it is characterized by a broad spectrum of end-user sophistication. Large-scale manufacturing hubs and major vehicle markets stimulate high-volume demand for both conventional and advanced lubricant platforms, while growing local additive and base oil production capacity is shifting sourcing dynamics. Collectively, these regional patterns underscore the need for differentiated go-to-market approaches, regulatory intelligence capabilities, and localized technical support to ensure formulation acceptance and sustained product performance across diverse operating environments.

Why technical differentiation, supply-chain integration, and collaborative OEM partnerships are the defining factors for competitive advantage and long-term supplier selection

Competitive dynamics among key industry participants are increasingly defined by technical differentiation, supply-chain integration, and collaborative partnerships with OEMs and major end users. Leading players are investing in advanced formulation science and surface-interaction research to demonstrate reliable antiwear performance with optimized zinc dosing, while others concentrate on feedstock security and downstream blending capacity to reduce exposure to geopolitical and tariff-driven shocks. This dual focus on technical excellence and supply resilience is producing a tiered competitive landscape where specialty formulators, large-scale chemical producers, and niche technology providers coexist with regional blending houses that serve localized needs.Strategic partnerships and co-development agreements are becoming more commonplace as companies seek to de-risk technology transitions and accelerate time-to-market for new formulations. Equally, intellectual property management and technical validation services-such as laboratory performance characterization and field trial programs-are key differentiators that influence procurement decisions by OEMs and large fleet operators. In parallel, sustainability credentials and traceability initiatives are emerging as commercial levers: firms that can document responsible sourcing and reduced environmental footprints gain preference in supplier selection processes.

Finally, talent and capability investments matter. Firms that successfully integrate materials science expertise, regulatory affairs acumen, and customer-facing technical service teams achieve faster adoption curves and stronger long-term customer relationships. As a result, competitive advantage increasingly depends on the ability to blend R&D, operational excellence, and market intelligence into cohesive product and service propositions.

Practical and coordinated actions for leaders to bolster resilience, optimize formulations, and align commercial models with evolving regulatory and customer expectations

Industry leaders should pursue a set of coordinated actions that balance near-term operational resilience with medium-term strategic repositioning. First, invest in formulation R&D that targets dose-efficiency and synergistic additive systems to preserve antiwear performance while reducing reliance on single-chemical pathways. Concurrently, develop clear technical guidance and validation protocols to minimize warranty and compatibility risks when introducing reformulated products to OEMs and end users.Second, strengthen supply-chain resilience through deliberate diversification of raw-material sources, targeted nearshoring of blending capacity, and contingency inventory strategies. Contractual mechanisms that secure raw-material access-such as staggered purchase agreements and strategic supply partnerships-will reduce vulnerability to tariff volatility and geopolitical disruptions. Third, align commercial models with evolving customer expectations by offering performance-backed service packages, extended technical support, and transparent documentation of material provenance and environmental attributes. Doing so will help justify any price adjustments and reinforce the value proposition beyond the immediate commodity cost.

Fourth, enhance engagement with regulatory and standards bodies to anticipate policy shifts and to influence practical implementation measures. Active participation in standards development and cross-industry working groups will provide early visibility into compliance trends and enable proactive adaptation. Finally, build capability in market intelligence and scenario planning to operationalize responses to policy, technological, and supply-chain changes. These combined actions will position organizations to protect legacy performance characteristics while incrementally transitioning to more sustainable, lower-risk additive strategies.

A mixed-methods research framework combining technical literature synthesis, stakeholder interviews, and supply-chain mapping to produce operationally grounded insights

The research approach underpinning this analysis integrates qualitative technical review, stakeholder interviews, and supply-chain mapping to produce a comprehensive view of the ZDDP additives landscape. Technical review included systematic examination of peer-reviewed literature, patents, and industry white papers to understand mechanistic interactions between ZDDP chemistries and different base oil platforms. This literature synthesis informed assessment of formulation strategies and potential technical trade-offs when adjusting zinc concentrations or transitioning to alternative additive systems.Stakeholder engagement was central to capturing practical market dynamics. Interviews with formulators, procurement leads, technical service engineers, and maintenance managers provided insight into real-world performance priorities, procurement constraints, and the operational impact of tariffs and supply disruptions. In parallel, supply-chain mapping exercises traced material flows from raw-material producers through intermediates and blending houses to end-user channels, revealing points of concentration, lead-time sensitivities, and potential bottlenecks.

Finally, the methodology included comparative policy analysis to interpret the operational implications of tariff measures and regulatory frameworks across regions. Cross-validation between technical findings, stakeholder testimony, and supply-chain observations ensured that conclusions reflect both laboratory insights and field-level realities. This mixed-methods approach yields a robust, actionable foundation for strategic decision-making without relying on single-source assertions.

Convergent priorities for R&D, procurement, and market engagement that ensure performance continuity while enabling strategic transitions toward diversified and sustainable additive strategies

In summary, the ZDDP additives domain demands an integrated response that reconciles technical performance requirements with regulatory pressures and supply-chain realities. Technical teams must pursue dose-efficient and synergistic formulations that respect equipment longevity while responding to emissions and aftertreatment constraints. Procurement and commercial functions should prioritize supplier diversification, contractual flexibility, and value-based customer engagement to navigate tariff-driven and geopolitical risks.Looking ahead, success will hinge on organizations that can align R&D, operations, and market intelligence to deliver reliable, verifiable performance while progressively reducing exposure to single-source dependencies and regulatory friction. Building partnerships with OEMs and end users, investing in localized blending and quality control capabilities, and participating in policy and standards forums will collectively create the resilience and credibility required for long-term competitive advantage. These steps will enable firms to protect critical performance outcomes while transitioning toward more sustainable and diversified additive strategies.

Additional Product Information:

- Purchase of this report includes 1 year online access with quarterly updates.

- This report can be updated on request. Please contact our Customer Experience team using the Ask a Question widget on our website.

Table of Contents

7. Cumulative Impact of Artificial Intelligence 2025

17. China ZDDP Additives Market

Companies Mentioned

The key companies profiled in this ZDDP Additives market report include:- Afton Chemical Corporation

- BASF SE

- Chevron Oronite Company LLC

- Croda International Plc

- Dana Lubricants

- Desire Chemical Pvt. Ltd.

- Evonik Industries AG

- Huntsman International LLC

- Infineum International Limited

- LANXESS AG

- NewMarket Corporation

- Ruhani Industries

- The Lubrizol Corporation

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 199 |

| Published | January 2026 |

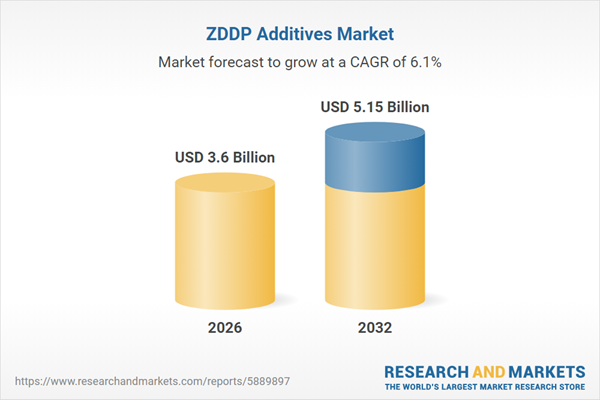

| Forecast Period | 2026 - 2032 |

| Estimated Market Value ( USD | $ 3.6 Billion |

| Forecasted Market Value ( USD | $ 5.15 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | Global |

| No. of Companies Mentioned | 14 |