Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Technological enhancements like digital wireline tools, AI-driven data interpretation, and real-time monitoring are improving accuracy and safety. Additionally, growing emphasis on well integrity, especially in aging reservoirs, and expansion in emerging markets across Asia-Pacific, Latin America, and the Middle East, are contributing to market growth. Increasing regulatory pressure and the need for sustainable practices are further pushing the adoption of advanced, data-driven wireline solutions.

Key Market Drivers

Rising Global Energy Demand and Expansion of Oil & Gas Exploration Activities

Rising energy needs, particularly in fast-developing regions such as Asia-Pacific, Latin America, and Africa, are propelling oil and gas exploration efforts globally. The demand for hydrocarbon resources is fueling investments in both conventional and unconventional reserves, including shale, tight gas, and deepwater fields. Wireline services are vital throughout the lifecycle of a well - from initial formation evaluation and logging to intervention and completion. These services deliver critical downhole data including formation porosity, resistivity, and pressure, enabling better drilling and production decisions. Cased-hole services like pipe recovery, mechanical setting, and perforation further enhance reservoir output and operational efficiency. The growing reliance on such services highlights their indispensability in ensuring well performance and optimizing hydrocarbon extraction.Key Market Challenges

Market Volatility Due to Crude Oil Price Fluctuations

Volatility in crude oil prices presents a significant challenge to the wireline services market. Economic slowdowns, geopolitical tensions, and supply-demand imbalances often lead to sharp price swings, which directly affect capital expenditures in the oil and gas sector. During periods of low oil prices, exploration and production companies typically scale back operations, causing a decline in demand for wireline services. For example, downturns like those experienced during the 2014-2016 price crash and the 2020 pandemic led to widespread project delays and budget cuts. This scenario particularly strains smaller service providers who struggle with reduced contract volumes and competitive pricing. The cyclical nature of oil prices continues to pose risks to business stability and growth across the wireline segment.Key Market Trends

Integration of Digital Technologies and Data-Driven Wireline Services

A major trend reshaping the wireline services industry is the adoption of digital and real-time data technologies. With growing demand for operational efficiency and cost optimization, service providers are turning to advanced tools such as AI, IoT, and cloud-based analytics. Digital wireline solutions enable real-time acquisition and transmission of downhole data, empowering operators with instant insights into reservoir characteristics, well integrity, and formation conditions. These high-resolution telemetry systems improve decision-making and reduce operational delays. The integration of predictive analytics also supports proactive maintenance and performance optimization. As digital transformation gains momentum in the energy sector, it is expected to drive innovation and value creation across wireline operations.Key Market Players

- Schlumberger Limited

- Halliburton Company

- Baker Hughes Company

- Weatherford International plc

- National Oilwell Varco, Inc. (NOV)

- Superior Energy Services, Inc.

- Calfrac Well Services Ltd.

- Archer Limited

Report Scope:

In this report, the Global Wireline Services Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Wireline Services Market, By Service Type:

- Logging Services

- Completion Services

- Workover Services

- Fishing Services

Wireline Services Market, By Application:

- Onshore

- Offshore

Wireline Services Market, By Technology:

- Coiled Tubing

- Wireline Logging

- Cased Hole Logging

Wireline Services Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- Germany

- France

- United Kingdom

- Italy

- Spain

- Asia Pacific

- China

- India

- Japan

- South Korea

- Australia

- South America

- Brazil

- Colombia

- Argentina

- Middle East & Africa

- Saudi Arabia

- UAE

- South Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Wireline Services Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Schlumberger Limited

- Halliburton Company

- Baker Hughes Company

- Weatherford International plc

- National Oilwell Varco, Inc. (NOV)

- Superior Energy Services, Inc.

- Calfrac Well Services Ltd.

- Archer Limited

Table Information

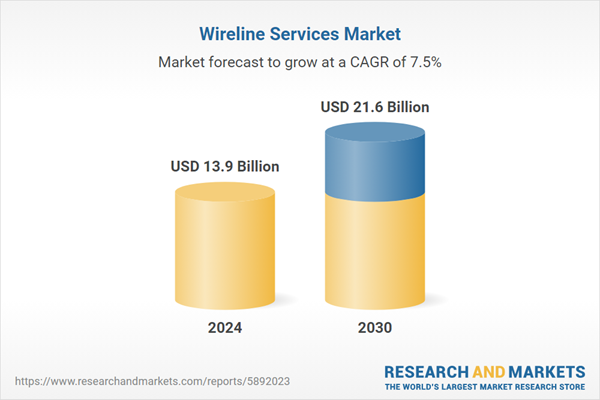

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | June 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 13.9 Billion |

| Forecasted Market Value ( USD | $ 21.6 Billion |

| Compound Annual Growth Rate | 7.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 8 |