Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Market momentum is being reinforced by shifting consumer preferences toward healthier lifestyles, Non-communicable diseases (NCDs) account for over 70% of all global deaths, with a significant share classified as premature occurring before the age of 70, growing incidence of lifestyle-related diseases, and increased adoption of clean-label ingredients.

In response, manufacturers are innovating product formulations and expanding their production capabilities to meet evolving market requirements. As the competitive landscape intensifies, industry players are strategically investing in capacity scaling, targeted product development, and geographic market penetration to strengthen their global footprint. Supported by favorable regulatory frameworks and rising demand from emerging economies, the global sorbitol market is well-positioned for long-term, sustainable growth.

Key Market Drivers

Growing Demand of Sorbitol in Food & Beverage Industry

The growing demand for sorbitol in the food and beverage industry is a major catalyst propelling the expansion of the Global Sorbitol Market. As consumer preferences shift toward healthier, low-sugar alternatives, food and beverage manufacturers are increasingly adopting sorbitol as a versatile and functional ingredient. This trend is being reinforced by heightened health awareness, regulatory pressure to reduce sugar content, and the rapid development of sugar-free product categories. Consumers are becoming more health-conscious, with greater emphasis on managing caloric intake, blood sugar levels, and weight control.This is particularly evident in the rising demand for sugar-free confectionery, beverages, chewing gum, baked goods, and dairy products, where sorbitol serves as an ideal sugar substitute. Its ability to deliver sweetness with fewer calories while maintaining taste and texture makes it a preferred choice for food product reformulation. The global rise in diabetes, obesity, and cardiovascular diseases has significantly influenced food choices. Cardiovascular diseases (CVDs) remain a critical global health challenge and are the leading cause of mortality worldwide.

In 2019, CVDs accounted for approximately 17.9 million deaths representing nearly 32% of all global fatalities. Notably, over 85% of these deaths were attributed to heart attacks and strokes, underscoring the severe impact of CVDs on public health systems and workforce productivity. As a low-glycemic index sweetener, sorbitol helps manufacturers create products tailored for diabetic and health-conscious consumers. This has led to its widespread use in the formulation of diabetic-friendly snacks, sugar-free drinks, and dietetic food products, contributing to sustained demand growth.

Beyond its role as a sweetener, sorbitol offers multiple functional benefits in food manufacturing. It acts as a humectant, stabilizer, and texturizer, helping retain moisture, extend shelf life, and improve mouthfeel in processed foods. Its chemical stability under heat and varying pH conditions further enhances its appeal in a wide range of food and beverage applications, making it especially suitable for industrial-scale production. Consumers are increasingly seeking clean-label products with transparent and natural ingredient lists. Sorbitol, which can be derived from natural glucose sources such as corn or wheat, aligns with this demand. Its natural origin and status as a recognized safe additive by global regulatory authorities (such as the FDA and EFSA) support its inclusion in health-forward product lines, particularly in premium and organic categories.

Key Market Challenges

Substitutional Threat from Other Sweeteners and Shortages of Commodities

Cost-effectiveness poses a significant challenge in the sorbitol market. Many food and beverage manufacturers are transitioning towards cost-effective alternative sweeteners like erythritol, xylitol, lactitol, and mannitol for baking and food processing. These alternatives offer the same functionality as sorbitol, prompting hotels, restaurants, and cafes (horeca) chains to purchase artificial sweeteners to achieve profitability while maintaining productivity. Furthermore, global price fluctuations and the Russia-Ukraine war have disrupted commodity imports and supply chains, resulting in a shortage crisis. Additionally, increased crude oil prices have impacted transportation and procurement costs, directly affecting sorbitol manufacturing.Key Market Trends

Technological Advancements in Production

Continuous research and development efforts are dedicated to enhancing sorbitol production processes. Utilizing advanced technologies enables manufacturers to optimize their production lines, resulting in improved efficiency and productivity. For example, the implementation of automated systems and control technologies enables better monitoring and regulation of the production process, ensuring consistent quality and higher yields. Technological advancements have significantly improved the quality and purity of sorbitol production. State-of-the-art equipment and innovative processes help minimize impurities and ensure the production of high-quality sorbitol.The use of advanced filtration techniques, precise temperature control, and purification methods contribute to the production of sorbitol with superior characteristics, meeting the stringent quality requirements of various industries. Advancements in production technologies also facilitate the scaling up of sorbitol production capacities. With the increasing demand for sorbitol across various applications, manufacturers are investing in advanced equipment and facilities to expand their production capabilities. This scalability enables them to meet the growing market demand while maintaining product quality and consistency.

Key Market Players

- American International Foods, Inc.

- Cargill Incorporated

- Gulshan Polyols Ltd.

- Merck KGaA

- Ecogreen Oleochemicals GmbH

- Qinhuangdao Lihua Starch Co., Ltd.

- Ingredion Incorporated

- Kasyap Sweeteners, Ltd.

- DuPont Inc.

- SPI Pharma, Inc.

Report Scope:

In this report, the Global Sorbitol Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Sorbitol Market, By Product Type:

- Liquid

- Crystal

Sorbitol Market, By Application:

- Oral Care

- Vitamin C

- Diabetic & Diabetic Food & Beverage

- Surfactant

- Others

Sorbitol Market, By End User:

- Personal Care

- Chemical

- Pharmaceutical

- Others

Sorbitol Market, By Region:

- North America

- United States

- Canada

- Mexico

- Europe

- France

- United Kingdom

- Italy

- Germany

- Spain

- Asia-Pacific

- China

- India

- Japan

- Australia

- South Korea

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- South Africa

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Sorbitol Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

Table of Contents

Companies Mentioned

- American International Foods, Inc.

- Cargill Incorporated

- Gulshan Polyols Ltd.

- Merck KGaA

- Ecogreen Oleochemicals GmbH

- Qinhuangdao Lihua Starch Co., Ltd.

- Ingredion Incorporated

- Kasyap Sweeteners, Ltd.

- DuPont Inc.

- SPI Pharma, Inc.

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 188 |

| Published | August 2025 |

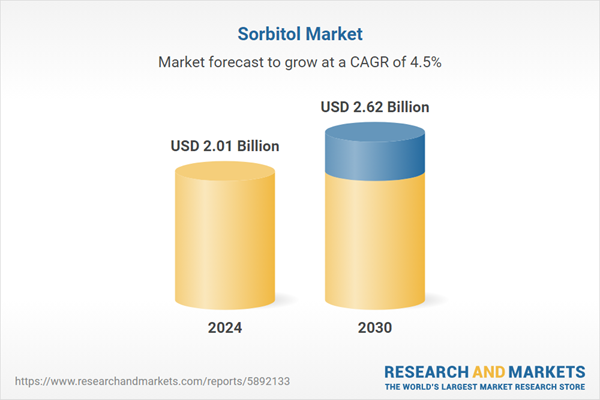

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.01 Billion |

| Forecasted Market Value ( USD | $ 2.62 Billion |

| Compound Annual Growth Rate | 4.5% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |