Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

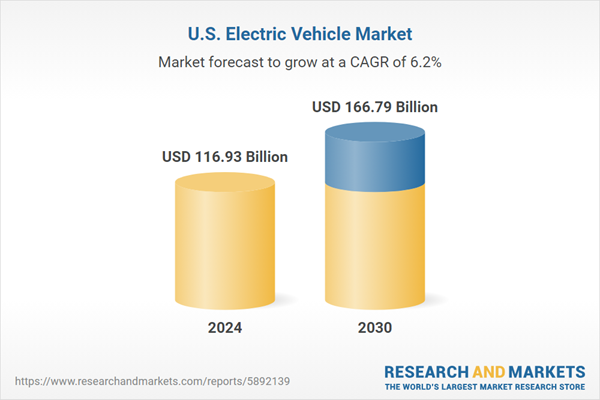

Automakers are diversifying their EV portfolios, while innovative startups continue to shape the commercial and passenger vehicle segments. Incentives under the Inflation Reduction Act and expansion of the EV charging infrastructure are accelerating adoption. Despite obstacles such as range anxiety, high initial costs, and policy uncertainties, the market is positioned for sustained growth as the U.S. moves toward emission reduction and greener mobility solutions.

Key Market Drivers

Government Policies and Incentives

Government support at both federal and state levels has emerged as a primary force behind the expansion of the U.S. electric vehicle market. The 2022 Inflation Reduction Act significantly enhanced EV adoption by introducing generous tax credits - up to USD 7,500 - for eligible new and used EV purchases, making them more accessible to consumers. The policy also incentivizes manufacturers to source materials domestically and assemble vehicles in North America, bolstering regional supply chains and production. Several states, including California and New York, complement federal efforts with additional benefits such as rebates, carpool lane access, and subsidies for residential charging stations. Furthermore, the Biden administration’s target of having EVs account for 50% of new car sales by 2030 reinforces a strong nationwide push. Regulatory measures, such as stricter emissions standards and fuel economy regulations, are also compelling automakers to speed up their electrification strategies.Key Market Challenges

High Upfront Costs and Affordability Issues

One of the primary hurdles in the U.S. electric vehicle market is the high initial cost of EVs compared to traditional internal combustion engine vehicles, mainly due to expensive battery components. While technological advancements and scaled production are gradually reducing costs, many models - particularly premium ones - remain financially inaccessible for a significant portion of consumers.Although federal and state-level incentives help mitigate some of the cost burden, eligibility requirements vary based on income levels, vehicle origin, and battery sourcing, limiting broad applicability. Some tax credits are contingent upon North American assembly and the use of domestic battery materials, narrowing the range of qualifying vehicles and causing confusion among buyers. Additionally, leasing and financing options for EVs are often less comprehensive than those for conventional vehicles. These financial and regulatory complexities, coupled with inflationary pressures, continue to pose a barrier to widespread EV adoption.

Key Market Trends

Growth of Affordable EV Models and Mainstream Adoption

An emerging trend in the U.S. electric vehicle market is the increasing focus on affordable EVs, signifying a transition from luxury to mass-market accessibility. While Tesla initially set the pace with premium models, brands like Chevrolet, Hyundai, Nissan, and Ford are now offering competitively priced EVs designed to attract a broader customer base.Models such as the Chevrolet Equinox EV, Hyundai Kona Electric, and Nissan Leaf are aimed at cost-conscious buyers seeking alternatives to gasoline-powered cars. According to a 2024 Consumer Reports survey, 71% of Americans showed some level of interest in EV ownership, reflecting growing public awareness and acceptance of environmentally friendly transport. With battery prices declining and supportive government policies in place, price parity with ICE vehicles is on the horizon. Entry-level EVs featuring modern safety technologies and connectivity are driving adoption beyond early adopters, especially among middle-income consumers, signaling a major shift toward mainstream usage.

Key Market Players

- Tesla Inc.

- Toyota United States Inc.

- General Motors of United States Company

- Ford Motor Company of United States Limited

- Nissan United States Inc.

- Hyundai Auto United States Corp.

- Honda United States Inc.

- FCA United States Inc.

- The Lion Electric Company

- NFI Group Inc

Report Scope:

In this report, the United States Electric Vehicle Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:United States Electric Vehicle Market, By Vehicle Type:

- Two Wheelers

- Passenger Cars

- Light Commercial Vehicle

- Medium & Heavy Commercial Vehicle

United States Electric Vehicle Market, By Propulsion:

- Battery Electric Vehicle

- Plug-In Hybrid Electric Vehicle

- Fuel Cell Electric Vehicle

United States Electric Vehicle Market, By Range:

- 0-50 Miles

- 51-150 Miles

- 151-200 Miles

- 201-400 Miles

- Above 400 Miles

United States Electric Vehicle Market, By Region:

- South

- West

- Northeast

- Midwest

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the United States Electric Vehicle Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Tesla Inc.

- Toyota United States Inc.

- General Motors of United States Company

- Ford Motor Company of United States Limited

- Nissan United States Inc.

- Hyundai Auto United States Corp.

- Honda United States Inc.

- FCA United States Inc.

- The Lion Electric Company

- NFI Group Inc

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 70 |

| Published | July 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 116.93 Billion |

| Forecasted Market Value ( USD | $ 166.79 Billion |

| Compound Annual Growth Rate | 6.1% |

| Regions Covered | United States |

| No. of Companies Mentioned | 10 |