Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Local manufacturers are also enhancing production capacity and innovation to meet rising domestic and international demand, positioning China at the forefront of the global transition to clean public transport. China’s exports of new energy buses (NEBs) surged by 28% in 2024, reaching 15,444 units over 3.5 meters in length, according to Chinabuses.org. Notably, 25% of these exports featured electrified drivetrains, qualifying as ‘New Energy’ vehicles, underscoring a strong global shift toward cleaner transport solutions.

Key Market Drivers

Strong Government Policies and Support

One of the most influential drivers of China’s electric bus market is the active role of the government in promoting clean and sustainable transportation. The Chinese government has implemented a wide range of supportive policies, including generous subsidies, tax incentives, and direct funding for electric bus production and procurement. These initiatives are part of broader national strategies such as the “New Energy Vehicle (NEV)” policy and the “Made in China 2025” plan, which aim to position the country as a global leader in electric mobility.In addition to financial support, the government mandates at both central and local levels have accelerated electric bus adoption. For example, cities with severe pollution issues - like Beijing, Shenzhen, and Guangzhou - have been directed to fully electrify their public transportation fleets. The introduction of city-level quotas and preferential treatment in public bidding processes for electric vehicles has further reinforced this push.

In 2023, the top ten cities contributed to 39% of battery electric bus sales and an even greater 53% of battery electric truck sales. Leading the transition were cities such as Shenzhen, Shanghai, Chengdu, and Beijing, propelled by local government policies and strategic initiatives focused on cutting urban pollution and aligning with China’s broader carbon neutrality targets. As a result, public transport operators are motivated to transition from diesel-powered buses to electric models.

Key Market Challenges

High Initial Investment and Financial Constraints

Despite long-term operational cost advantages, the high initial investment required for electric buses remains a major hurdle. Compared to conventional diesel buses, electric buses typically come with a significantly higher upfront cost - mainly due to expensive battery systems and the integration of advanced electric drivetrains. While government subsidies have helped to bridge the cost gap in recent years, the gradual reduction of these incentives has made it more difficult for smaller public and private operators to afford electric buses.Moreover, the costs associated with charging infrastructure - such as the installation of depot chargers, grid upgrades, and energy management systems - can add a considerable financial burden, especially for municipal authorities in less-developed regions. For rural or second- and third-tier cities with limited budgets, investing in electric buses and related infrastructure is often financially unfeasible without external funding or strong public-private partnerships. As government subsidies are scaled back, fleet operators may delay or reduce new electric bus purchases, which could slow down the overall market expansion.

Key Market Trends

Transition to Autonomous Electric Buses

One of the most transformative trends in China’s electric bus market is the increasing integration of autonomous driving technologies. As urban areas seek more efficient, safer, and cost-effective public transport systems, autonomous electric buses are emerging as a promising solution. Leading Chinese technology and automotive companies, such as Baidu, Yutong, and CRRC, are investing heavily in self-driving bus development, piloting autonomous shuttles in smart cities and closed-loop campuses. Over the past two decades, Yutong has sold more than 190,000 new-energy buses spanning battery-electric, diesel-electric hybrid, and hydrogen-powered models across domestic and international markets. In the first half of 2024 alone, exports exceeded 6,000 units, reflecting strong global demand and solidifying Yutong’s leadership in clean public transportation.Autonomous buses reduce the need for drivers, potentially lowering long-term operational costs and improving service consistency. Additionally, equipped with advanced sensors, AI, and vehicle-to-everything (V2X) communication systems, these buses can help ease traffic congestion and increase passenger safety. The trend is supported by government initiatives promoting smart city development and the adoption of intelligent transportation systems (ITS). As regulations evolve to accommodate autonomous operations, the market is likely to see wider deployment of self-driving electric buses in the coming years.

Key Market Players

- BYD Company Limited

- Ankai Automobile Co. Ltd

- Higer Bus Company Limited

- Dongfeng Motor Corporation

- Shenzhen Wuzhoulong Motors Co. Ltd

- Zhengzhou Yutong Group Co. Ltd.

- Zhongtong Bus Holding Co. Ltd.

- Yangzhou Yaxing Motor Coach Co. Ltd.

- King Long United Automotive Industry Co. Ltd.

Report Scope:

In this report, the China Electric Bus Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:China Electric Bus Market, By Application:

- Intercity

- Intracity

- Airport Bus

China Electric Bus Market, By Propulsion:

- Battery Electric Bus

- Hybrid Electric Bus

- Fuel Cell Electric Bus

China Electric Bus Market, By Length:

- 6 m - 8 m

- 9 m - 12 m

- Above 12 m

China Electric Bus Market, By Seating Capacity:

- Up to 30

- 31 - 40

- Above 40

China Electric Bus Market, By Region:

- East

- North-East

- South Central

- Southwest

- North

- North-West

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the China Electric Bus Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- BYD Company Limited

- Ankai Automobile Co. Ltd

- Higer Bus Company Limited

- Dongfeng Motor Corporation

- Shenzhen Wuzhoulong Motors Co. Ltd

- Zhengzhou Yutong Group Co. Ltd.

- Zhongtong Bus Holding Co. Ltd.

- Yangzhou Yaxing Motor Coach Co. Ltd.

- King Long United Automotive Industry Co. Ltd.

Table Information

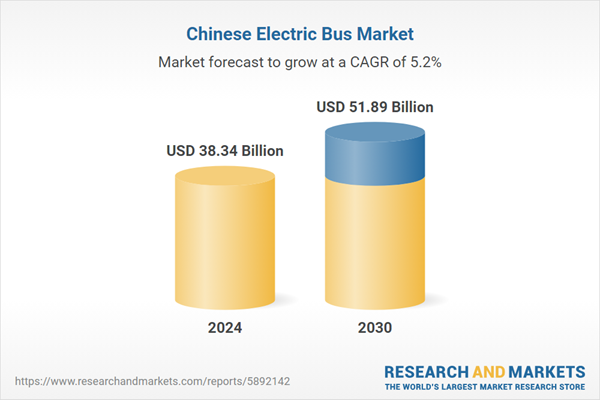

| Report Attribute | Details |

|---|---|

| No. of Pages | 80 |

| Published | August 2025 |

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 38.34 Billion |

| Forecasted Market Value ( USD | $ 51.89 Billion |

| Compound Annual Growth Rate | 5.2% |

| Regions Covered | China |

| No. of Companies Mentioned | 9 |