Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Rising Demand for Home Ownership

The increasing demand for homeownership is a key driver in France’s loan market, particularly within the mortgage segment. According to recent projections, France’s household population is expected to rise by 1.7% by 2027, reaching 29.8 million, with single-parent households growing at the fastest pace. Urban centers like Paris, Lyon, and Bordeaux continue to witness strong real estate demand, driven by low-interest rates, government-backed loan programs, and rising confidence in real estate as a stable investment. Favorable loan conditions, such as lower borrowing costs and accessible mortgage terms, have made property purchases more attractive than renting for many citizens. The post-pandemic economic recovery has further improved consumer confidence, prompting increased interest in home buying. As a result, the strong appetite for real estate continues to propel mortgage lending and contribute to the expansion of France’s overall loan market.Key Market Challenges

Higher Interest Rates

Rising interest rates pose a significant challenge to the France loan market. As the European Central Bank implements rate hikes to combat inflation, borrowing becomes more expensive for individuals and businesses. For consumers, this leads to higher monthly repayments on mortgages, reducing affordability and deterring new home purchases. Similarly, costlier credit discourages consumer spending on big-ticket items, negatively impacting demand for personal loans. Businesses also experience increased financing costs, which can slow capital investment and operations expansion, reducing demand for commercial loans. Additionally, the broader economic impact of higher borrowing costs may lead to elevated default risks, placing further pressure on lenders and potentially slowing loan market growth.Key Market Trends

Rising Trend of Flexible Loan Terms

A notable trend in the France loan market is the increasing adoption of flexible loan terms, particularly in the mortgage sector. Lenders are offering more tailored financing options to meet the evolving needs of borrowers. Among these are “prêt modulable” or flexible mortgages, which offer fixed interest rates while allowing borrowers to adjust payment amounts based on financial circumstances. This flexibility enables better financial management, especially in a volatile economic environment.Borrowers can often pause or increase payments within predefined limits. Variable-rate and mixed mortgages are also becoming more popular, catering to borrowers with varying risk appetites and future income expectations. Additionally, specialized loan products such as interest-only mortgages and bridge loans are gaining traction, offering customized solutions for unique borrower needs. These evolving offerings highlight a market shift towards more borrower-centric lending models.

Key Market Players

- N26 Bank SE

- BNP Paribas Personal Finance

- LA BANQUE POSTALE

- Crédit Mutuel Home Loan SFH

- Handelsbanken

- CA Britline

- CA Auto Bank S.p.A.

- Toyota (GB) PLC

- Santander Consumer Finance SA

- Fransabank

Report Scope:

In this report, the France Loan Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below.France Loan Market, By Type:

- Secured Loan

- Unsecured Loan

France Loan Market, By Provider Type:

- Banks

- Non-Banking Financial Companies

- Others

France Loan Market, By Interest Rate:

- Fixed

- Floating

France Loan Market, By Tenure Period:

- Less Than 5 Years

- 5-10 Years

- 11-20 Years

- More than 20 Years

France Loan Market, By Region:

- Central France

- Northern France

- Western France

- Southern France

- Eastern France

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the France Loan Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- N26 Bank SE

- BNP Paribas Personal Finance

- LA BANQUE POSTALE

- Crédit Mutuel Home Loan SFH

- Handelsbanken

- CA Britline

- CA Auto Bank S.p.A.

- Toyota (GB) PLC

- Santander Consumer Finance SA

- Fransabank

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 82 |

| Published | April 2025 |

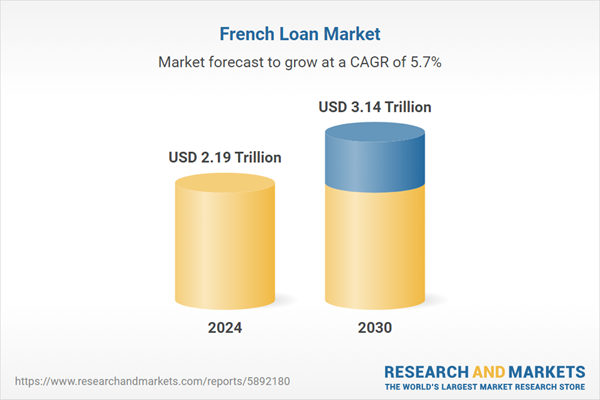

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 2.19 Trillion |

| Forecasted Market Value ( USD | $ 3.14 Trillion |

| Compound Annual Growth Rate | 5.6% |

| Regions Covered | France |

| No. of Companies Mentioned | 10 |