Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Key Market Drivers

Government Initiatives and Public Health Campaigns

Government-backed efforts are playing a central role in expanding India’s feminine hygienic product market. Programs like the Menstrual Hygiene Scheme (MHS) and Suvidha, launched by the Ministry of Health and Family Welfare and the Ministry of Chemicals and Fertilizers respectively, are focused on improving access to affordable sanitary products for adolescent girls, especially in underserved regions.Suvidha’s distribution of oxo-biodegradable sanitary pads at subsidized rates through Jan Aushadhi Kendras has increased accessibility for economically weaker sections. These initiatives are bolstered by widespread public health campaigns aimed at eliminating the stigma surrounding menstruation. Additionally, improved sanitation infrastructure under programs like Swachh Bharat Abhiyan supports better menstrual hygiene practices. These combined efforts are not only expanding product reach but also contributing to increased education and awareness, particularly in rural India, thereby driving market growth.

Key Market Challenges

Cultural Taboos and Lack of Awareness in Rural Areas

Despite progress, deep-rooted social taboos and limited menstrual health awareness in rural regions continue to hinder the adoption of feminine hygiene products. In many communities, menstruation is viewed as a subject of shame, discouraging open dialogue and perpetuating misinformation. Girls in rural areas often skip school during their periods, and the use of unhygienic alternatives like cloth, ash, or hay remains prevalent due to lack of access and awareness. These stigmas restrict conversations around menstruation even within families, particularly where male members remain uninvolved or unaware. This environment makes it challenging for brands to educate potential consumers and expand into rural markets. Overcoming this challenge requires consistent community engagement, education campaigns, and culturally sensitive approaches to normalize menstrual health and break the silence surrounding it.Key Market Trends

Shift Toward Reusable and Sustainable Menstrual Products

An emerging trend in India’s feminine hygienic product market is the growing shift toward reusable and environmentally sustainable menstrual solutions. With increasing awareness about environmental degradation and plastic waste, consumers - especially in urban areas and among Gen Z and millennial segments - are opting for alternatives like menstrual cups, reusable cloth pads, and biodegradable sanitary napkins. These products are being promoted for both their eco-friendliness and long-term cost benefits. Brands like Saathi, Boondh, and Carmesi are responding to this demand with organic, chemical-free offerings. Moreover, many of these innovations are reaching rural populations through awareness campaigns and partnerships with government schemes. As sustainability becomes a stronger purchasing factor, the market is seeing innovation in materials and design, transforming menstrual care into a more environmentally conscious and accessible category.Key Market Players

- Procter & Gamble Hygiene & Health Care Limited

- Essity AB

- Johnson & Johnson Private Limited

- Kimberly Clark Corporation

- Hindustan Unilever Ltd.

- Redcliffe Hygiene Pvt. Ltd

- Edgewell Personal Care

- Unicharm India Private Limited

- Wet and Dry Personal Care Pvt. Ltd

- Tzmo SA

Report Scope:

In this report, the India Feminine Hygienic Product Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:India Feminine Hygienic Product Market, By Product Type:

- Sanitary Napkins/Pad

- Tampons

- Panty Liners

- Menstrual Cup

- Feminine Hygiene Wash

- Others

India Feminine Hygienic Product Market, By Distribution Channel:

- Supermarkets/Hypermarkets

- Drug Stores/Pharmacies

- Convenience Stores

- Online

- Others

India Feminine Hygienic Product Market, By Region:

- North

- South

- East

- West

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the India Feminine Hygienic Product Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Procter & Gamble Hygiene & Health Care Limited

- Essity AB

- Johnson & Johnson Private Limited

- Kimberly Clark Corporation

- Hindustan Uniliver Ltd.

- Redcliffe Hygiene Pvt. Ltd

- Edgewell Personal Care

- Unicharm India Private Limited

- Wet and Dry Personal Care Pvt. Ltd

- Tzmo SA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 80 |

| Published | July 2025 |

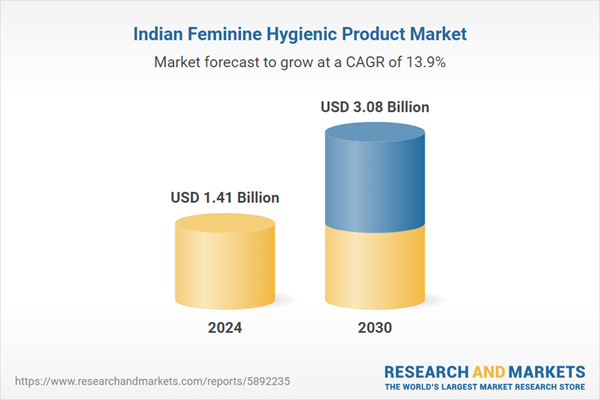

| Forecast Period | 2024 - 2030 |

| Estimated Market Value ( USD | $ 1.41 Billion |

| Forecasted Market Value ( USD | $ 3.08 Billion |

| Compound Annual Growth Rate | 13.9% |

| Regions Covered | India |

| No. of Companies Mentioned | 10 |