Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Off-road vehicles cater to the recreational market, attracting enthusiasts engaged in activities like trail riding, rock crawling, and off-road racing. Technological advancements have played a pivotal role in shaping the off-road vehicle industry. Innovations such as advanced suspension systems, GPS navigation, and the emergence of electric off-road options have transformed the way these vehicles operate and perform. These advancements not only enhance the capabilities of off-road vehicles but also contribute to a more sustainable and eco-friendly approach.

Regulatory considerations have influenced the design and emissions standards of off-road vehicles, promoting the adoption of eco-friendly alternatives. Manufacturers are increasingly focusing on developing vehicles that are more fuel-efficient and emit lower emissions, aligning with the global push for sustainable practices. The global market landscape for off-road vehicles varies across different regions. North America, Europe, Asia-Pacific, and emerging markets each showcase unique demands and preferences for these vehicles.

Factors such as terrain conditions, infrastructure development, and economic growth contribute to the varying degrees of demand in each region. As the off-road vehicle market continues to evolve, challenges related to sustainability and responsible land use are being addressed through innovation. Manufacturers are actively exploring new technologies and solutions that minimize environmental impact while still maintaining high performance and durability. This constant drive for innovation creates a dynamic industry that strikes a balance between work and play in diverse terrains, ensuring the longevity and continued growth of the off-road vehicle market.

Key Market Drivers

Industrial Applications and Workforce Efficiency:

One of the primary drivers of the global Off-Road Vehicle market is the diverse range of industrial applications that necessitate reliable and robust off-road vehicles. Industries such as agriculture, construction, mining, forestry, and utilities require specialized vehicles capable of navigating challenging terrains. Off-road vehicles, such as all-terrain vehicles (ATVs) and utility task vehicles (UTVs), play a crucial role in improving workforce efficiency, enabling seamless material transport, equipment hauling, and site inspection in demanding environments.Adaptability to Rugged Terrain:

Off-road vehicles are specifically designed to tackle rugged terrains and adverse conditions. This adaptability is a key market driver, as these vehicles offer unmatched maneuverability and access to remote or inaccessible areas where conventional vehicles would struggle to operate effectively. Their ability to traverse unpaved roads, rocky landscapes, muddy trails, and uneven surfaces is vital for industries that operate in diverse geographical settings.Recreational Pursuits and Outdoor Lifestyle:

The recreational aspect of off-road vehicles is a significant driver of the market. Enthusiasts and adventure seekers engage in a variety of off-road activities, including trail riding, dune bashing, rock crawling, and desert racing. This recreational segment drives demand for vehicles such as dirt bikes, off-road trucks, dune buggies, and sport-oriented ATVs. The appeal of outdoor exploration, adrenaline-filled experiences, and community engagement in off-road events contributes to sustained market growth. For Instance, roughly USD 563 billion of the U.S. gross domestic product is attributed to the outdoor recreation economy.Technological Advancements and Innovation:

Technological advancements have played a transformative role in the off-road vehicle market. Manufacturers are incorporating advanced features such as improved suspension systems, electronic stability control, GPS navigation, and telematics. Moreover, the advent of electric off-road vehicles is reshaping the landscape, offering quieter operation, reduced emissions, and lower maintenance requirements compared to traditional internal combustion engines. The integration of smart technologies enhances performance, safety, and connectivity.For instance, In July 2023, Honda North Carolina Manufacturing (NCM) in Swepsonville achieved a significant milestone by producing its first FourTrax Rancher all-terrain vehicle (ATV). This event marked the beginning of a new chapter in North Carolina's powersports sector. NCM will be the sole manufacturer of Honda ATVs in North America, while Honda South Carolina Manufacturing (SCM) in Timmonsville, S.C., will remain the only facility in the world that produces Honda side-by-side vehicles. NCM will specialize in producing Honda FourTrax and TRX ATVs.

Versatile Utility in Different Sectors:

The versatility of off-road vehicles extends across a range of industries, driving their demand. In agriculture, ATVs and UTVs aid in tasks like crop monitoring, livestock management, and land preparation. Construction sites utilize off-road vehicles for transporting materials and navigating uneven terrain. Similarly, mining and forestry industries rely on these vehicles for efficient material handling and site exploration.Tourism and Adventure Travel:

Tourism and adventure travel play a role in boosting the off-road vehicle market, particularly in regions known for their natural landscapes and scenic trails. Off-road tours and guided expeditions attract tourists seeking unique and immersive experiences. These activities contribute to local economies and drive demand for rental services and off-road vehicle purchases.Growing Demand in Emerging Markets:

Emerging economies are witnessing rapid industrialization and infrastructural development, which drives the demand for off-road vehicles. As these economies progress, the need for construction, transportation, and resource exploration escalates, underscoring the importance of off-road vehicles in supporting these activities. The market growth in these regions presents new opportunities for manufacturers and suppliers.Government and Regulatory Initiatives:

Government policies and regulations related to environmental protection, safety standards, and emissions norms are shaping the off-road vehicle market. Stricter emissions requirements are influencing manufacturers to develop more fuel-efficient and environmentally friendly options. Additionally, regulatory compliance ensures safer operations and minimizes the negative impact of off-road vehicles on ecosystems.Customization and Personalization Trends:

Consumer preferences for personalized experiences are influencing the market, driving demand for customizable off-road vehicles. Manufacturers are offering a variety of accessories, configurations, and aftermarket options that allow users to tailor their vehicles according to their specific needs and preferences.Innovation in Design and Performance:

Manufacturers are constantly innovating to enhance the design, performance, and capabilities of off-road vehicles. These innovations include improvements in suspension systems for better ride comfort, advanced traction control for improved handling, and the integration of advanced materials to reduce weight without compromising durability.Key Market Challenges

Environmental Impact and Sustainability:

One of the primary challenges for the off-road vehicle market is the environmental impact of these vehicles on fragile ecosystems. Off-road vehicles can cause soil erosion, habitat disruption, and noise pollution in natural areas. Striking a balance between enjoying outdoor recreation and minimizing environmental harm requires responsible land use practices, compliance with regulations, and the development of eco-friendly vehicle technologies.Regulatory Compliance and Land Access:

Access to off-road trails and public lands is often subject to regulations and restrictions aimed at protecting natural habitats and preserving cultural heritage sites. Regulatory compliance is a challenge, as off-road enthusiasts must navigate a complex web of rules and permits that vary from region to region. Balancing the interests of recreational users with conservation efforts is a delicate task that requires cooperation among stakeholders.Safety Concerns and Operator Education:

Off-road vehicles can be inherently risky to operate, particularly in challenging terrains. Accidents related to rollovers, collisions, and inexperienced operators pose safety concerns. Ensuring proper operator education and training is crucial to mitigate these risks. However, achieving consistent and effective operator education across a diverse range of users can be challenging.Encroachment on Public Lands:

The increasing popularity of off-road activities has led to concerns about overcrowding in certain natural areas. Excessive vehicle traffic can lead to degradation of trails, soil erosion, and disruption of wildlife habitats. Managing visitor numbers while preserving the integrity of public lands presents a challenge for both conservationists and recreational users.Noise Pollution and Community Relations:

Off-road vehicles can generate significant noise levels, impacting the tranquility of natural areas and straining relations with nearby communities. Noise pollution not only disturbs wildlife but can also lead to conflicts between recreational users and local residents. Addressing noise-related concerns requires noise-reduction technologies and responsible riding practices.Technological Complexity and Affordability:

While technological advancements drive innovation in the off-road market, they also introduce complexity that may pose challenges for users. Sophisticated features like advanced suspension systems, GPS navigation, and electronic stability control can be overwhelming for some users, affecting user experience and potentially increasing the cost of ownership.Infrastructure Development and Maintenance:

Maintaining off-road trails and recreational areas requires infrastructure development and regular maintenance. Ensuring safe and well-maintained trails involves significant costs and logistical challenges. In regions with limited resources, maintaining a network of trails that cater to a diverse range of off-road vehicles can be particularly challenging.Changing Consumer Preferences:

Consumer preferences and demographics play a role in shaping the off-road market. As societal attitudes shift and preferences for outdoor activities evolve, the demand for off-road vehicles may experience fluctuations. Manufacturers need to stay attuned to these changes and adjust their product offerings accordingly.Economic Uncertainties and Market Volatility:

Economic downturns and market volatility can influence consumer spending patterns and purchasing decisions. In uncertain economic conditions, consumers may delay or reduce discretionary spending on recreational vehicles, affecting demand in the off-road market.Regulatory Barriers to Innovation:

Regulatory frameworks can either encourage or hinder innovation in the off-road vehicle market. Stricter emissions standards and safety regulations can impose barriers to the adoption of new technologies and design changes. Balancing safety and environmental considerations with innovation is a challenge for manufacturers and regulators alike.Key Market Trends

Electric Off-Road Vehicles

The rise of electric vehicles (EVs) is extending to the off-road market, driven by the push for sustainability and reduced emissions. Electric off-road vehicles offer quieter operation, lower maintenance requirements, and zero tailpipe emissions. Manufacturers are developing electric variants of popular off-road vehicles, including UTVs, ATVs, and dirt bikes. This trend aligns with global efforts to reduce carbon footprints and comply with stricter environmental regulations.Adventure Tourism and Recreation

The trend of adventure tourism and outdoor recreational pursuits is fueling demand for off-road vehicles. Enthusiasts seek unique experiences and are drawn to activities like trail riding, off-road racing, and overlanding. This trend is driving the popularity of off-road tours, guided expeditions, and off-road festivals, contributing to local economies and the growth of the off-road recreation sector.Connectivity and Smart Features

Off-road vehicles are becoming increasingly connected through integrated technologies such as GPS navigation, telematics, and smartphone integration. These features enhance navigation, communication, and safety, providing users with real-time data on trail conditions, weather forecasts, and emergency services. The integration of these smart features is enhancing the overall off-road experience.Customization and Personalization

Consumers are seeking personalized experiences, and this trend is extending to the off-road market. Manufacturers are offering a range of accessories, aftermarket options, and customization packages that allow users to tailor their vehicles to their preferences. Customization not only enhances the aesthetics but also addresses specific functional needs, contributing to a unique off-road experience.Autonomous and Semi-Autonomous Off-Road Vehicles

Similar to the automotive sector, autonomous and semi-autonomous technologies are making their way into the off-road market. Manufacturers are developing off-road vehicles equipped with sensors, cameras, and advanced software that enable autonomous navigation, obstacle detection, and route planning. These technologies are particularly relevant in sectors such as agriculture, where precision and efficiency are paramount.Sustainability and Eco-Friendly Practices

Environmental consciousness is influencing the off-road market, pushing manufacturers to develop eco-friendly vehicles and promote responsible riding practices. Sustainability features such as regenerative braking systems, eco-driving modes, and lightweight materials are being incorporated into off-road vehicles. Additionally, advocacy for "Leave No Trace" principles encourages users to minimize their impact on natural environments.Advanced Suspension and Terrain Management

Off-road vehicles are benefiting from advanced suspension technologies that enhance ride comfort and handling on challenging terrains. Adjustable suspension systems allow users to adapt their vehicles to different conditions, while terrain management systems optimize vehicle settings for specific surfaces such as sand, mud, and rocks.Ride-Sharing and Subscription Services

The trend of shared mobility is expanding to the off-road vehicle market through ride-sharing and subscription services. Some companies are offering off-road vehicles for rent, allowing enthusiasts to enjoy outdoor experiences without the commitment of ownership. This trend provides access to off-road vehicles to a wider range of users and supports the sharing economy.All-Terrain Electric Bicycles (e-bikes)

The popularity of electric bicycles is extending to off-road environments. Electric mountain bikes and all-terrain e-bikes enable riders to explore trails and terrains with assisted pedaling. These e-bikes cater to both recreational users and those seeking an eco-friendly mode of transportation in natural areas.Integration with Outdoor Lifestyle Brands

Collaborations between off-road vehicle manufacturers and outdoor lifestyle brands are becoming more prevalent. Partnerships with outdoor apparel, adventure gear, and camping equipment brands align with the interests of off-road enthusiasts, creating a holistic off-road experience that goes beyond the vehicles themselves.Segmental Insights

Vehicle Type Insights

The global off-road vehicle market showcased a dynamic landscape with All-Terrain Vehicles (ATVs) emerging as the fastest-growing segment compared to Utility Task Vehicles (UTVs). This growth trend highlights the evolving preferences and expanding applications of off-road vehicles across various sectors.All-Terrain Vehicles (ATVs) have seen a surge in popularity due to their versatility and suitability for a wide range of recreational and utility applications. ATVs are designed to handle a variety of terrains, from rugged trails to sandy dunes, making them a favorite choice among enthusiasts seeking adventure and outdoor experiences. Their agility, ease of maneuverability, and relatively lower cost compared to UTVs have contributed to their rapid growth. The advancements in ATV technology, such as improved suspension systems, enhanced safety features, and better fuel efficiency, have also fueled their increasing adoption. The recreational sector remains a major driver, with consumers drawn to ATVs for off-road racing, trail riding, and other outdoor activities. Additionally, the growing trend of adventure tourism and outdoor sports has further amplified the demand for ATVs.

Utility Task Vehicles (UTVs), while also experiencing growth, have not matched the pace of ATVs. UTVs are known for their larger size, greater payload capacity, and utility-focused features, making them ideal for applications such as agriculture, construction, and hunting. Their ability to transport passengers and cargo efficiently and their robust performance in challenging environments make them a valuable asset in various industries. However, the higher cost and larger footprint of UTVs can be limiting factors compared to the more affordable and compact ATVs. The UTV segment continues to grow steadily, driven by the increasing need for versatile and durable vehicles in work environments and recreational settings. Innovations in UTV technology, such as enhanced safety features and advanced navigation systems, have also contributed to their market expansion.

Both ATV and UTV segments are integral to the global off-road vehicle market, ATVs have demonstrated a faster growth trajectory in 2023. This is largely attributed to their affordability, versatility, and appeal to a broad range of consumers, including recreational riders and adventure enthusiasts. As the market continues to evolve, the dynamic between these two vehicle types will likely reflect broader trends in consumer preferences and technological advancements in the off-road vehicle sector.

Regional Insights

The global off-road vehicle market is segmented by region into North America, Europe & CIS, Asia-Pacific, South America, and the Middle East & Africa. In North America, the off-road vehicle market demonstrates robust growth, driven by a blend of recreational, utility, and adventure-seeking demands. The region's expansive natural landscapes, including national parks, forests, and off-road trails, fuel the high demand for various off-road vehicles such as ATVs, UTVs, and dirt bikes. This growth is further supported by a strong culture of outdoor recreation and sports, which encourages frequent use of off-road vehicles for activities ranging from trail riding to competitive racing.Additionally, North America's favorable economic conditions, including higher disposable incomes and a well-established infrastructure for vehicle maintenance and service, contribute to the market's expansion. The presence of a diverse consumer base seeking both recreational and practical off-road solutions enhances the market dynamics, while advancements in vehicle technology and safety features appeal to a growing demographic. Furthermore, the increasing popularity of off-road vehicle events and races, coupled with the rise in recreational tourism, strengthens the market’s resilience and potential for growth. Overall, North America's off-road vehicle market remains a vibrant and significant segment, supported by a combination of cultural enthusiasm, economic capacity, and evolving technological innovations.

Key Market Players

- Polaris Inc.

- Textron Inc.

- Honda Motor Co. Ltd.

- Kawasaki Heavy Industries Ltd.

- Yamaha Motor Corporation

- Deere & Company

- Bombardier Recreational Products Inc.

- Zhejiang CFMoto Power Co., Ltd.

- Suzuki Motor Corporation

- Arctic Cat Inc.

Report Scope:

In this report, the Global Off-Road Vehicle Market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:Off-Road Vehicle Market, By Vehicle Type:

- All-terrain Vehicle (ATV)

- Utility Task Vehicle (UTV)

Off-Road Vehicle Market, By Application Type:

- Sports

- Agricultural

- Other Applications

Off-Road Vehicle Market, Region:

- Asia-Pacific

- China

- India

- Japan

- Indonesia

- Thailand

- South Korea

- Australia

- Europe & CIS

- Germany

- Spain

- France

- Russia

- Italy

- United Kingdom

- Belgium

- North America

- United States

- Mexico

- Canada

- South America

- Brazil

- Argentina

- Colombia

- Middle East & Africa

- Turkey

- Iran

- Saudi Arabia

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Off-Road Vehicle Market.Available Customizations:

With the given market data, the publisher offers customizations according to a company's specific needs. The following customization options are available for the report.Company Information

- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Polaris Inc.

- Textron Inc.

- Honda Motor Co. Ltd.

- Kawasaki Heavy Industries Ltd.

- Yamaha Motor Corporation

- Deere & Company

- Bombardier Recreational Products Inc.

- Zhejiang Cfmoto Power Co., Ltd

- Suzuki Motor Corporation

- Arctic Cat Inc.

Table Information

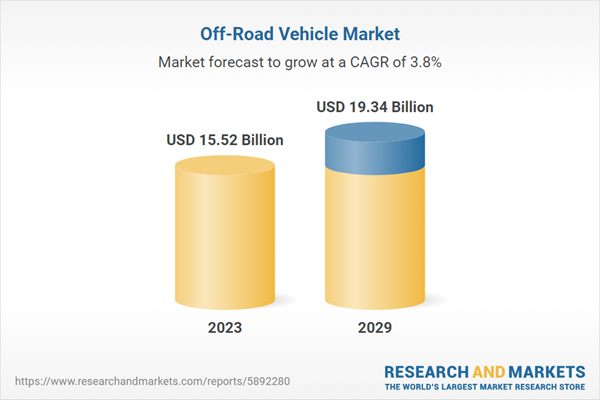

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | November 2024 |

| Forecast Period | 2023 - 2029 |

| Estimated Market Value ( USD | $ 15.52 Billion |

| Forecasted Market Value ( USD | $ 19.34 Billion |

| Compound Annual Growth Rate | 3.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |