Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Market growth is primarily spurred by rising global energy needs and the significant development of power generation infrastructure, which requires dependable, continuous control systems. This demand is supported by strong performance in the energy sector; for instance, the World Nuclear Association reported that global nuclear reactors produced a record-breaking 2,667 TWh of electricity in 2024. This increase underscores the ongoing investment in essential facilities that depend on DCS architectures for stability, while the general trend toward industrial automation further propels market expansion.

However, the market encounters substantial obstacles related to cybersecurity. As industrial frameworks increasingly connect with external networks to facilitate data analytics, they become susceptible to malicious cyberattacks capable of halting vital production processes. The significant expense and technical difficulty involved in protecting both legacy and modern control environments against developing threats present a major hurdle to adoption. These security concerns have the potential to hinder the rapid implementation of DCS solutions across sensitive industry sectors.

Market Drivers

The rapid uptake of Industry 4.0 and the Industrial Internet of Things (IIoT) is transforming the Global Distributed Control Systems Market by necessitating enhanced connectivity and data integration. Contemporary DCS architectures are transitioning from standalone, proprietary loops into open, interoperable systems that process real-time data for predictive maintenance and process optimization. This digital evolution enables industrial operators to improve agility and decision-making, providing a compelling reason to modernize aging infrastructure. According to the '9th Annual State of Smart Manufacturing Report' published by Rockwell Automation in March 2024, 95% of manufacturers are currently utilizing or assessing smart manufacturing technologies, highlighting the essential nature of these advanced digital tools in competitive industrial settings.Concurrently, the resurgence of upstream and downstream operations in the oil and gas sector serves as a key driver for DCS implementation. As energy firms aim to maximize recovery from current assets and explore new reserves, they depend heavily on distributed control systems to guarantee operational safety and regulatory compliance within complex extraction procedures.

This requirement is supported by substantial capital investment; the International Energy Agency (IEA) stated in its 'World Energy Investment 2024' report from June 2024 that global upstream oil and gas investment is projected to rise by 7% to USD 570 billion in 2024. Additionally, growth in the broader process industry reinforces this trend, with the American Chemistry Council projecting a 2.2% increase in U.S. chemical output in 2024, signaling continued demand for automation across various verticals.

Market Challenges

Connecting Distributed Control Systems with wider enterprise networks exposes industrial sites to serious cybersecurity threats, presenting a significant hurdle to market expansion. As control components become increasingly interlinked to facilitate data analytics, they forfeit the security of traditional air gaps, rendering them susceptible to ransomware, espionage, and malicious interruptions. This vulnerability causes industrial decision-makers to pause modernization efforts, as they fear the operational advantages of advanced DCS solutions may not justify the risk of devastating financial and reputational harm. The substantial costs and technical intricacies involved in defending these environments against complex threats further deter investment, effectively decelerating adoption rates within critical infrastructure sectors.This caution is supported by recent industry statistics indicating a growing awareness of threats among operators. For example, the National Association of Manufacturers reported in 2024 that nearly 79% of surveyed manufacturing leaders anticipate a rise in cyberattacks over the upcoming year. This widespread expectation of security breaches prompts organizations to allocate capital towards defensive risk mitigation and compliance measures rather than expanding their control capabilities. As a result, the Global Distributed Control Systems Market experiences slowed momentum, with companies prioritizing operational stability over the integration of new, connected automation technologies.

Market Trends

The incorporation of Artificial Intelligence and Machine Learning Algorithms is fundamentally changing control strategies by allowing systems to forecast process deviations and optimize complex variables in ways traditional PID loops cannot. Industrial operators are increasingly integrating advanced AI models directly into distributed control layers to bolster operational resilience and facilitate autonomous decision-making in fluctuating environments. This transition marks a move from reactive monitoring to proactive, causal analysis, where algorithms detect the root causes of inefficiencies in real-time. As noted in Rockwell Automation's '10th Annual State of Smart Manufacturing Report' from June 2025, organizations investing in generative and causal AI rose by 12% year-over-year, indicating a maturing shift toward using these advanced technologies to address dynamic production challenges.At the same time, the emphasis on Sustainability and Energy Efficiency Optimization Modules has emerged as a key priority as manufacturers utilize DCS architectures to comply with strict decarbonization requirements. Modern control systems are increasingly equipped with integrated energy management software that monitors Scope 1 and Scope 2 emissions at the device level, enabling facilities to adjust power usage dynamically and reduce carbon footprints without impacting production. This trend evolves the DCS from a mere operational instrument into a central platform for environmental compliance and resource management. According to Schneider Electric's 'Q2 2025 Sustainability Impact Report' released in August 2025, the company's digital solutions have assisted customers in saving and avoiding a cumulative 734 million tonnes of CO2 emissions since 2018, highlighting the critical role of automation in reaching industrial net-zero goals.

Key Players Profiled in the Distributed Control Systems Market

- ABB Ltd.

- Siemens AG

- Emerson Electric Co.

- Honeywell International Inc.

- Schneider Electric SE

- Yokogawa Electric Corporation

- Rockwell Automation, Inc.

- General Electric Company (GE)

- Metso Corporation

- NovaTech Process Solutions

Report Scope

In this report, the Global Distributed Control Systems Market has been segmented into the following categories:Distributed Control Systems Market, by Component:

- Hardware

- Software

- Services

Distributed Control Systems Market, by Application:

- Continuous Process

- Batch-Oriented Process

Distributed Control Systems Market, by End-User Industry:

- Chemicals

- Paper & Pulp

- Food & Beverages

- Others

Distributed Control Systems Market, by Region:

- North America

- Europe

- Asia-Pacific

- South America

- Middle East & Africa

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the Global Distributed Control Systems Market.Available Customization

The analyst offers customization according to your specific needs. The following customization options are available for the report:- Detailed analysis and profiling of additional market players (up to five).

This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

The key players profiled in this Distributed Control Systems market report include:- ABB Ltd.

- Siemens AG

- Emerson Electric Co.

- Honeywell International Inc.

- Schneider Electric SE

- Yokogawa Electric Corporation

- Rockwell Automation, Inc.

- General Electric Company (GE)

- Metso Corporation

- NovaTech Process Solutions

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 180 |

| Published | January 2026 |

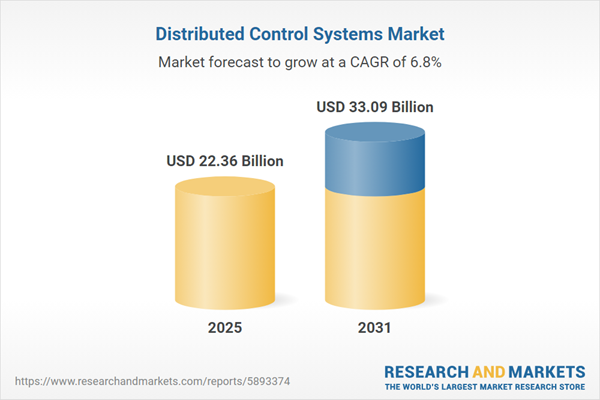

| Forecast Period | 2025 - 2031 |

| Estimated Market Value ( USD | $ 22.36 Billion |

| Forecasted Market Value ( USD | $ 33.09 Billion |

| Compound Annual Growth Rate | 6.7% |

| Regions Covered | Global |

| No. of Companies Mentioned | 11 |