Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

Power tools that run on batteries include cordless saws, hammer drills, circular saws, impact wrenches, impact drivers, and other instruments. These tools work great for metalworking, welding, cutting, and other jobs. The shift to cordless power tools reveals a need for a more portable instrument that is easier to use.

Technology development has produced several tools and equipment that are utilized in a variety of industries. Due to the demand for efficiency, power tools are exceeding traditional hand tools in both the professional and residential markets. For instance, there is a lot of pressure on the construction industry to introduce cutting-edge products that minimize human labor. The market for power tools is benefiting from the boom in infrastructure and building, which will also drive future advancements.

Advances in Lithium-Ion Batteries

Lithium-Ion batteries are a common kind of battery for cordless power tools. Due to their size and lightweight, they can operate at maximum power for longer periods. Numerous improvements in batteries for greater backup capacity have been produced as a result of the growing demand for long-lasting battery life. As a result, Li-ion batteries now operate more efficiently and perform better. Improvements in energy density, charging speed, safety, and stability have also resulted from it. The preference for effective Li-ion batteries is growing for usage in electric vehicles (EVs) and e-communication devices, notwithstanding the 10% to 49% greater costs associated with replacing existing batteries with them. Nickel-Cadmium (NiCd) batteries are currently under stiff competition from cordless power tools powered by Li-ion batteries. Thus, it is expected to drive the growth of the global cordless power tools market.Growth in Do It Yourself (DIY) Activities

Most adults are engaged in creative and purposeful leisure activities in several of the developed economies of the US and Europe. Based on their interests, some consumers also spend money on home maintenance and renovation projects. The idea is also gaining ground in other places with growing economies. Consumers in the home market frequently engage in cost-effective and skill-improving repair and improvement projects. Additionally, DIY projects are available at supermarkets and other specialty stores, such as Home Depot, which stimulates the market for DIY items and increases demand for cordless power tools.Moreover, fixing cardboard, repairing auto lights, performing plumbing repairs, and patching a hole is among the most popular DIY projects done in homes. These tasks call for a kit that includes a cordless drill, screwdrivers, nut runners, and wrenches. The application of instruments, such as glue guns and heat guns is necessary for crafting projects including jewelry making, needle arts, sewing, cloth, and home décor. Drillers, impact wrenches, and saws may become more popular with most modest household tasks like woodworking and hardware work. Along with hand tools and ornamental tools, power tools are the most essential elements of DIY projects, which is why the majority of power tool providers could build and provide small, user-friendly battery-powered equipment. All of these factors encourage the use of cordless power tools, thus fueling the market's expansion globally.

Rising Use of Fastener

A fastener is a piece of hardware that is typically used to secure joints between two or more things. Industries like aerospace, building and construction, automotive, furniture, motors, and pumps are using fasteners more and more. Nails, screws, bolts, clamps, tapping screws, set screws, and studs are a few examples of common fasteners.Power tools are highly preferred and frequently used as assembly tools. Thus, the market for cordless power tools is driven by the development of the use of fastening tools. For instance, the industrial, nuts and screws can be fastened using impact drivers and cordless drills. Similar to automatic screw drive systems, some offer various setups that let users act appropriately.

Increasing Application of Electric Fastening Tools

Wind turbine installation involves a significant amount of use of electric fastening tools. These fastening tools are employed in tower maintenance and inspection procedures. A compression factor is chosen to maintain accuracy, and connections are torqued in accordance. Electric fastening tools are anticipated to be the ideal power tools for this industry because installation requires precise force. Growing installation capacity is expected to result in lucrative prospects for businesses in the cordless power tool industry.Easily Available Cheap Labor in Developing Economies to Hamper Growth

Cheap labor in the majority of developing economies, which are centered in APAC and Latin America, is one of the main issues impeding the expansion of cordless power tools. Low-wage manual labor is typically performed by unskilled people who use archaic instruments rather than modern ones. As these workers only utilize hammers and other basic tools, cordless power tools are not highly preferred or widely used in these nations. As a result, the majority of activities of US-based organizations have moved to China due to the availability of cheap labor. Vendors have extra difficulties since low-cost manual labor in nations like India, China, and Indonesia differs from how battery-operated power equipment operates.Thus, the above factors are expected to hinder the growth of the global cordless power tools market in the coming years.

Market Segmentation

The global cordless power tools market is segmented based on tool type, motor type, battery voltage, end user, and region. Based on tool type, the market is bifurcated into drilling and fastening tools, sawing and cutting tools, demolition tools, material removal tools, and routing tools. Based on motor type, the market is bifurcated into brushed motors and brushless motors. Based on battery voltage, the market is bifurcated into 12V, 18V, 20V, 40V, 40V, and above. Based on end user, the market is bifurcated into industrial, commercial, and residential. Based on region, the market is further bifurcated into North America, Asia-Pacific, Europe, South America, and the Middle East & Africa.Market players

The main players in the global cordless power tools market are Stanley Black & Decker, Inc., Robert Bosch GmbH, Techtronic Industries Company Limited, Makita Corporation, Hilti Corporation, Atlas Copco AB, Apex Tool Group, LLC., Ingersoll Rand Inc., Snap-on Incorporated, and Koki Holdings Co., Ltd.Report Scope:

In this report, the global cordless power tools market has been segmented into the following categories, in addition to the industry trends, which have also been detailed below:Cordless Power Tools Market, By Tool Type:

- Drilling and Fastening Tools

- Sawing and Cutting Tools

- Demolition Tools

- Material Removal Tools

- Routing Tools

Cordless Power Tools Market, By Motor Type:

- Brushed Motors

- Brushless Motors

Cordless Power Tools Market, By Battery Voltage:

- 12V

- 18V

- 20V

- 40V

- 40V and above

Cordless Power Tools Market, By Motor Type:

- Brushed Motors

- Brushless Motors

Cordless Power Tools Market, By Region:

- North America

- United States

- Canada

- Mexico

- Asia-Pacific

- India

- Japan

- South Korea

- Australia

- China

- Europe

- Germany

- United Kingdom

- France

- Italy

- Spain

- South America

- Brazil

- Argentina

- Colombia

- Middle East

- Saudi Arabia

- South Africa

- UAE

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the global cordless power tools market.Available Customizations:

With the given market data on the global cordless power tools market, the publisher offers customizations according to a company's specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Stanley Black & Decker, Inc.

- Robert Bosch GmbH

- Techtronic Industries Company Limited

- Makita Corporation

- Hilti Corporation

- Atlas Copco AB

- Apex Tool Group, LLC.

- Ingersoll Rand Inc.

- Snap-on Incorporated

- Koki Holdings Co., Ltd.

Table Information

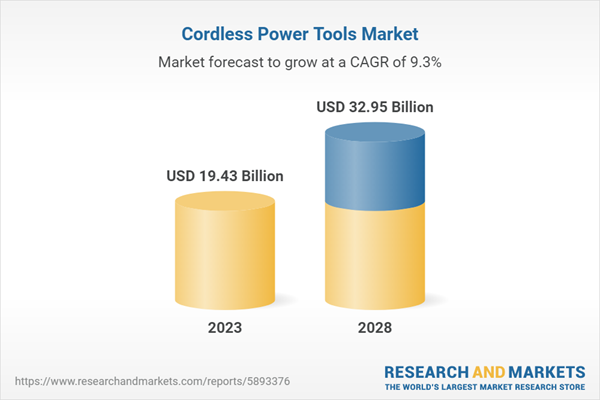

| Report Attribute | Details |

|---|---|

| No. of Pages | 179 |

| Published | October 2023 |

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 19.43 Billion |

| Forecasted Market Value ( USD | $ 32.95 Billion |

| Compound Annual Growth Rate | 9.2% |

| Regions Covered | Global |

| No. of Companies Mentioned | 10 |