Speak directly to the analyst to clarify any post sales queries you may have.

10% Free customizationThis report comes with 10% free customization, enabling you to add data that meets your specific business needs.

The technique of using the wind to produce mechanical or electrical energy is known as wind power or wind energy. The kinetic energy of the wind is transformed into mechanical power by wind turbines. This mechanical energy can be used for certain activities (such as pumping water or grinding grain) or can be transformed into electricity by a generator.

South Africa Wind Energy Market: Drivers

Growing Investments in Deploying New Wind Farms

Growing investment in deploying new wind farm projects coupled with significant initiatives to mitigate carbon footprint boost the demand for wind energy in South Africa. South African government has issued stringent regulations and policies related to carbon emissions, which eventually promote the adoption of clean energy, including wind energy. For instance, in November 2021, the US joined Britain, France, Germany, and the European Union in a multi-billion-dollar partnership to help South Africa to achieve a quicker transition from coal to renewable energy, with an investment of USD 8.5 billion. A report published by the International Finance Corporation (IFC) shows that Africa has 59,000 GW of onshore and offshore wind potential to meet the continent's energy demand. Building new wind farms to utilize its vast wind resources will create demand for clean energy and critical infrastructure and help support thriving local economies alongside meeting the Sustainable Development Goals of the country.In January 2022, EDF Renewables had planned to develop the Phezukomoya Wind Energy Facility of 140 MW capacity in Northern Cape, South Africa, which is expected to start commissioning in April 2024. The project consists of 35 turbines with an investment of approximately USD 255 million. In March 2022, Chariot, an African energy company, and Total Eren, a French renewables developer, collaborated to develop a 430 MW solar and wind project for a mining company named Zambia. The construction of this project is likely to begin at the end of 2023. In addition, in January 2022, Brandvalley Wind Farm is a 140MW onshore wind power project which is expected to get commissioned in April 2024. As per the IFC report, Africa possesses a stunning onshore wind potential of almost 180,000 Terawatt hours (TWh) per annum. In addition, Algeria has the highest resource with a total potential of 7,700 Gigawatts (GW), which is equivalent to more than 11 times the current global installed wind capacity. Under the renewable independent power producer program, more than 6,000 MW of generation capacity has been allocated to bidders across wind and solar Energy in July 2021. Thus, a favorable government program, increasing investments in wind power projects, and reduced cost of wind energy have bolstered the adoption of wind energy, thereby driving the wind energy market growth in South Africa.

South Africa Wind Energy Market: Restraints

Slow-Paced Development of Wind Energy Projects

Despite the excellent wind resource potential, there is a slow rate of development of the wind energy sector in South Africa owing to an unstable political environment, corruption, mismanagement, and uncertainty in policies. The lack of a national regulatory framework and implementation of policies is resulting in several regulatory, legal, and institutional challenges for the wind energy industry in the country. Further, delays in projects, uncertainty regarding timings, and lack of financial support are the factors hampering the deployment of wind projects. Limited investments by the private sector in renewable energy technologies, owing to economic, political, social, and technological barriers further limit the expansion of these projects. Poverty, low literacy, limited technological readiness, and limited access to the electricity grid are the other factors hindering the establishment of renewable power projects. As per the World Bank's International Finance Corporation, the wind resource potential on the African continent alone is more than 59,000 GW. However, the country installed only 515 MW of new wind power capacity in 2020. As a result, according to the Global Wind Energy Council, Africa's existing wind power capacity barely represents 0.01% of its potential. Thus, the constraints impeding the growth of wind energy projects, delays in current projects, and a lack of financial backing are limiting the market for wind energy in South Africa.South Africa Wind Energy Market: Trends

Surge in Hub Height for Greater Exposure to Wind Speed

Wind energy is one of the fastest-growing segments of the renewable electricity generation industry. Cost reduction is anticipated to be a critical area of focus in the wind power industry to attain continued economic competitiveness. Due to the increased rotor diameters and hub heights that optimize energy prices, the size of the wind turbine has grown to boost the economic viability of producing wind energy. With larger buildings, the hub height rises, and with it the wind floating speed. As a result, the turbine receives more wind, which can generate power. Thus, turbine researchers, engineers, and designers are continuously working on pursuing strategies that could support the use of greater hub heights to make wind energy projects economically attractive.According to the National Renewable Energy Laboratory, the capacity of predicted power output has grown from around 2.2 MW per turbine in 2017 to 100 kW per turbine in the 1980s. Additionally, throughout these years, the hub height of commercial wind turbines went from 20 meters to 84 meters on average. Since the idea of height increment takes advantage of the fact that more energetic wind resources are accessible at greater heights above ground levels, higher hub heights are a popular trend among wind farm developers. Project developers can measure wind speeds and change hub heights to achieve maximum efficiency with the use of wind resource evaluation.

South Africa Wind Energy Market: Opportunities

Government Initiatives for Erecting New Wind Projects

The growing initiatives for erecting new wind projects hold potential growth opportunities for the wind energy market players. For instance, as per the Minister of Mineral Resources, the chosen 25 bidders accounted for 2.583 GW of capacity, divided into 1.608 GW of onshore wind and 975 MW of solar PV in November 2021. These allocated bidders are expected to start generating electricity from April 2024. In addition, two giant wind projects namely, Kangnas Wind Farm and Perdekraal East Wind Farm got connected to the country's national grid in August 2020 under its fourth window of Renewable Energy Industry Power Producer Procurement Programs. According to data from the Global Wind Energy Council (GWEC), South Africa has the most wind power capacity in the Middle East and North Africa, followed by Egypt and Morocco. Nevertheless, the country is heavily reliant on coal for producing energy, making it one of the top emitters of carbon dioxide across the world. The South African government has pledged to reach net-zero carbon dioxide emissions by 2050. In November 2021, the country received an investment worth USD 578.20 million from five of the G20 members intending to cut its GHG emissions and facilitate the transition away from coal-centric power generation. In addition, in March 2022, a Norwegian investment fund and a UK development finance institution committed investments worth USD 1.87 billion and 1.24 billion, respectively. Such investments by stakeholders from other countries also support the clean energy goals of South Africa, as they will help it create the pipeline of over 2.4 GW of new wind and solar projects. Thus, such supportive initiatives from the government for erecting new wind projects holds potential opportunity for the growth of the wind energy market.Market Segments

The South Africa wind energy market is segmented by location, component type, end-user, and region. Based on location, the market is segmented into onshore and offshore. Based on component type, the market is segmented into turbine, support structure, electrical infrastructure, and others. Based on end user, the market is segmented into industrial, residential, and commercial. Based on region, the market is segmented into Gauteng, KwaZulu-Natal, Western Cape, Eastern Cape, Mpumalanga, Limpopo, North West, Free State, and Northern Cape.Market Players

the South Africa wind energy market players include Vestas Southern Africa (Pty) Ltd, Enel Green Power S.p.A., Siemens Gamesa Renewable Energy, S.A., EDF South Africa, Nordex Energy South Africa Ltd., Mainstream Renewable Power Ltd, Eskom Holdings SOC Ltd, Hexicon AB, Juwi Renewable Energies (Pty) Ltd, and Acciona Energia SA.Report Scope:

In this report, the South Africa wind energy market has been segmented into the following categories, in addition to the industry trends which have also been detailed below:South Africa Wind Energy Market, By Location:

- Onshore

- Offshore

South Africa Wind Energy Market, By Component Type:

- Turbine

- Support Structure

- Electrical Infrastructure

- Others

South Africa Wind Energy Market, By End-User:

- Industrial

- Residential

- Commercial

South Africa Wind Energy Market, By Region:

- Gauteng

- KwaZulu-Natal

- Western Cape

- Eastern Cape

- Mpumalanga

- Limpopo

- North West

- Free State

- Northern Cape

Competitive Landscape

Company Profiles: Detailed analysis of the major companies present in the South Africa Wind Energy Market.Available Customizations:

South Africa Wind Energy Market with the given market data, the publisher offers customizations according to a company’s specific needs.This product will be delivered within 1-3 business days.

Table of Contents

Companies Mentioned

- Vestas Southern Africa (Pty) Ltd

- Enel Green Power S.p.A.

- Siemens Gamesa Renewable Energy, S.A.

- EDF South Africa

- Nordex Energy South Africa Ltd.

- Mainstream Renewable Power Ltd

- Eskom Holdings SOC Ltd

- Hexicon AB

- Juwi Renewable Energies (Pty) Ltd

- Acciona Energia SA

Table Information

| Report Attribute | Details |

|---|---|

| No. of Pages | 80 |

| Published | October 2023 |

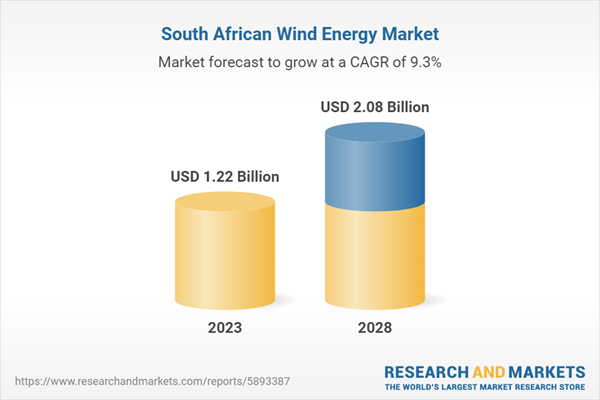

| Forecast Period | 2023 - 2028 |

| Estimated Market Value ( USD | $ 1.22 Billion |

| Forecasted Market Value ( USD | $ 2.08 Billion |

| Compound Annual Growth Rate | 9.3% |

| Regions Covered | South Africa |

| No. of Companies Mentioned | 10 |